* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Anthrax Vaccine Program - Corporate-ir

Poliomyelitis wikipedia , lookup

Onchocerciasis wikipedia , lookup

Hepatitis B wikipedia , lookup

Orthohantavirus wikipedia , lookup

Typhoid fever wikipedia , lookup

Meningococcal disease wikipedia , lookup

Eradication of infectious diseases wikipedia , lookup

Steven Hatfill wikipedia , lookup

Cysticercosis wikipedia , lookup

Bioterrorism wikipedia , lookup

Human cytomegalovirus wikipedia , lookup

Whooping cough wikipedia , lookup

Neisseria meningitidis wikipedia , lookup

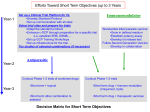

Vijay B. Samant President and Chief Executive Officer UBS Global Life Sciences Conference September 24, 2003 Safe Harbor This presentation contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in the forwardlooking statements, including whether any product candidates will be shown to be safe and efficacious in clinical trials and the risks set forth in the company’s filings with the Securities and Exchange Commission. Actual results may differ materially from those projected. These forward-looking statements represent the company’s judgment as of the date of this presentation. The company disclaims, however, any intent or obligation to update these forward-looking statements. Vical Investment Highlights • Vaccine company – patented non-viral DNA • delivery technology Broad product pipeline: 3 independent, 7 partnered programs • Phase II product: melanoma • Infectious disease vaccine programs: CMV, anthrax • Key partnerships: • • Merck, Merial, Aventis, Corautus Genetics, NIH Extensive vaccine expertise Strong cash position - $98 million Vical’s Strategy • Develop new vaccines using patented non-viral • • • • DNA delivery technology Focus in-house on infectious disease targets • No current vaccine • Obtain proof of efficacy in small trials Outlicense targets requiring major resources Advance Allovectin-7® lead cancer product Leverage vaccine manufacturing expertise Product Pipeline OTHER INFECTIOUS DISEASES PRECLINICAL PHASE I PHASE II DNA Vaccine CMV Vical DNA Vaccine ANTHRAX Vical HIV Vaccine AIDS Animal Health UNDISCLOSED Malaria Vaccine MALARIA DNA Vaccine WEST NILE Vical / VRC DNA Vaccine EBOLA Allovectin-7® MELANOMA VEGF-2 ANGIOGENESIS (CAD) Corautus Growth Factor ANGIOGENESIS (PAD) Aventis Pharma Merck Merial Vical / US Navy Vical / VRC Vical Allovectin-7® for Melanoma • Plasmid DNA containing two genes • HLA-B7 and 2-microglobulin • Triggers rejection of tumor • Restores immune recognition of tumors • Formulated with DMRIE/DOPE • Pro-inflammatory • Stage III or IV melanoma • Potential use for earlier-stage disease • Potential application for other solid tumors Allovectin-7® High-Dose Phase II Trial • Multi-center, single arm study • Completed enrollment of 127 high-dose patients • Similar patient population to low-dose (10 µg) • • • Phase II trial Dose escalation (up to 2000 µg) Multi-tumor injections (up to 5 lesions/patient) Interim results from March 2003 • First 91 high-dose patients • Response rate: 13% • Excellent safety and tolerability • Encouraging survival ® Allovectin-7 Status • Data maturing for high-dose trial • 60 of first 91 patients: still alive in March • 11 of 12 responders: still alive in July • 7 of 12 responders: disease had not progressed in July • Median duration of response: 6.4 months in July • Continued excellent safety and tolerability • <2% of patients with Grade 3 adverse events • Review mature data with FDA in 7-9 months Infectious Disease Vaccine Development Timelines Conventional vaccines Chicken pox vaccine – Varivax HPV Rotavirus MMRV “combination vaccines” Pentavalent “combination vaccines” FluMist Approval years 33 (1962-1995) 14 (1992-2006) 15 (1992-2007) 18 (1989-2007) 12 (1991-2003) 27 (1976-2003) DNA vaccines Rapid synthesis/preclinical testing of vaccine Simpler process scale-up issues Streamlined bio-analytical testing plan No advantage in clinical timelines Integration of clinical/mfg. consistency lots Potential reduction in size of safety database Construction/startup of mfg. facilities Potential years saved 4-6 3-5 3-5 0 2-4 1-3 3-5 NIH Vaccine Research Center Key Partner in DNA Vaccines • Established production orders • Ebola • West Nile Virus • HIV • New large-scale manufacturing agreement • Option for additional vaccine targets • Investment in infrastructure CMV Vaccine Program • About CMV • Herpes virus – infects 50-85% in the US by age 40 • High risk groups • Current therapy inadequate • NO vaccine available • Advantages of Vical’s vaccine • Ability to harness antibody and T-cell responses • Non-infective - a MUST for immunosuppressed patients • Proof of efficacy in transplant patients • Small clinical trials CMV Vaccine Strategy • Tiered approach for clinical development • Rapid advancement - transplant indication • Substantial downstream commercial potential - universal indication • Focus on transplant patients • Trial Design • Vaccinate donor to boost immunity • 4 and 2 weeks prior to transplant • Vaccinate recipient to provide further boost • 4 - 6 weeks after transplant • Monitor for signs of disease CMV Vaccine Status • Expert advisory panel in place • Development pathway defined • • • • • • • Consensus with FDA IP freedom to operate Basic constructs defined and manufactured Preclinical trials started Phase I by year-end Proof of efficacy trial size defined Key clinical centers selected Anthrax Vaccine Program • About anthrax • Caused by toxins from spore-forming Bacillus anthracis • Treated with antibiotics (i.e. Cipro) • Vaccine is antibody-mediated • Bivalent plasmid DNA vaccine • Animal Rule: opportunity for rapid approval • Concept to clinic in 24 months Anthrax Vaccine Strategy • Target effectiveness equivalent to • • • • licensed vaccine Potential to improve cross-protection Reduced number of doses vs. licensed vaccine • Shorter time to protection Manufacturing well-characterized product Stockpiling advantage due to stability Rabbit Challenge Results Anthrax Vaccine Program Group # Alive/ # Challenged Letx Neut Titer (Range) Mortality Range (Days) PA DNA - 3 injections 8/8 2,560-20,480 All Alive PA DNA - 2 injections 8/8 640-1,280 All Alive PA DNA - 3 injections DMRIE/DOPE 8/8 1,280-10,240 All Alive PA + LF DNA - 3 injections 8/8 2,560-5,120 All Alive LF DNA - 3 injections 5/9 320-1,280 Days 4-7 AVA - 2 injections 4/4 640-2,560 All Alive Vector Controls 0/5 0 Days 2-3 Naïve Rabbits 0/12 ND Days 2-4 All DNA vaccines formulated with Vaxfectin except for one DMRIE/DOPE group. Anthrax Spore Challenge Dose: 50-250 LD50. Anthrax Vaccine Status • Proof of concept completed in mice • Challenge study completed in rabbits • • • • • • Demonstrated 100% protection Pre-IND meeting with FDA in December 2002 Manufactured initial clinical vaccine supplies Phase I by year-end Government funding of development Agreement - approval based on Animal Rule External Collaborations • Merck • HIV, cancer • $23 million received to date • Merial • Animal health vaccines • $7 million received to date • NIH • Ebola, West Nile Virus, HIV • $7 million in grants to date External Collaborations • Aventis Pharma • Angiogenesis - PAD • $1.5 million received to date • Corautus Genetics • Angiogenesis - CAD • Minority ownership • U.S. Navy • Malaria • $5 million received to date Nearly $40 million in revenues to date from collaborations Financial Information (in millions, except per share data) Revenues Expenses Write-down of investment Loss from operations Net investment income1 Net loss Net loss per share Cash, cash equivalents and marketable securities 2Q03 $ 0.6 8.1 0.5 (7.5) 0.5 $ (6.9) $ (0.34) 2Q02 1H03 1H02 $ 2.4 $ 1.5 $ 4.0 8.4 16.2 16.1 0.5 (6.0) (15.2) (12.2) 1.0 1.2 1.9 $ (5.0) (13.9) $ (10.2) $ (0.25) $ (0.69) $ (0.51) $ 98 $ 123 Management Depth of Vaccine Expertise Vijay Samant President and CEO Merck David Kaslow, M.D. Chief Scientific Officer Merck, NIH Alain Rolland, Pharm.D., Ph.D. Valentis, Ciba-Geigy Product Development Tom Evans, M.D. Clinical Development UC - Davis Milestones Launch CMV and anthrax vaccine development programs Manufacturing agreement with NIH Encouraging Allovectin-7® interim data at ASCO $5.7 million SBIR grant for anthrax vaccine program Extension of Merck agreement to cancer Multiple patent issuances - U.S. and Europe • Presentations at scientific conferences • • • • ICAAC • World Vaccine Congress Start Phase I study of anthrax vaccine (4Q03) Start Phase I study of CMV vaccine (4Q03) Startup of new manufacturing facility (1Q04) Full Allovectin-7® high-dose cohort data (2Q04) Vical Investment Summary • Vaccine company – patented non-viral DNA • delivery technology Broad product pipeline: 3 independent, 7 partnered programs • Phase II product: melanoma • Infectious disease vaccine programs: CMV, anthrax • Key partnerships: • • Merck, Merial, Aventis, Corautus Genetics, NIH Extensive vaccine expertise Strong cash position - $98 million