* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download investments for the new “normal”Finance

Survey

Document related concepts

Private equity wikipedia , lookup

Private money investing wikipedia , lookup

Quantitative easing wikipedia , lookup

Private equity secondary market wikipedia , lookup

Socially responsible investing wikipedia , lookup

Investment banking wikipedia , lookup

International investment agreement wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

International monetary systems wikipedia , lookup

Transcript

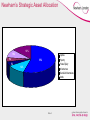

Local Government Pension Scheme investment strategies – investments for the new “normal”Finance Roy Nolan The New Normal? Economic environment for schemes where low interest rates, higher inflation and lower investment returns in developed economies depress schemes’ real asset performance while keeping their liabilities high (PwC) Slide 2 Newham’s Strategic Asset Allocation 13% 10% 5% 5% Equities Property Private Equity Infrastructure Diversifed Alternatives Bonds 55% 12% Slide 3 LAPF Investment Magazine 2012 • June – Newham ranked 1st of 107 authorities for investment income growth in year ended 31/03/2011 • December - Newham ranked 7th of 107 authorities, with three year average investment income growth of 22.53% (three year average investment income growth ) Slide 4 Everything’s Rosie? Slide 5 Speaking of Liabilities…… 2007 2013 Active Members 7,180 6,381 11% Deferred 4,016 6,799 69% Pensioners 5,709 6,574 15% Slide 6 Percentage Change Active Members Profile 74% of active members are over 40: Age Group Percentage of Active Members 20-29 8% 30-39 18% 40-49 34% 50-59 33% 60+ 7% Slide 7 Are we in the new normal? Asset prices are rallying… • • • All developed economy indices are up sharply from mid-2012 Nikkei up over 50% since November Bond yields continue to track downwards everywhere – not just in developed economies Slide 8 …on paper only QE • The equity rally is mostly about the debasement of paper money through QE: all real assets (including gold) have increased in cash value – because cash is losing value Slide 9 Rally bought with monetary policy… • • • Policy rates at all-time lows Central bank balance sheets (cumulated QE) at all-time highs Combined impact: unparalleled monetary stimulus Slide 10 …but fundamentals remain weak • • Real fixed investment returns very low now thanks to the credit boom of the last decade Private banks in developed economies supplied that credit, and are now sitting on large stocks of potentially bad assets. Slide 11 Caution: zombies everywhere… • The result of weak fundamentals and massively supportive monetary policy is creeping zombification of advanced economies. • At old-normal monetary policy settings, these zombies would be financially dead. New-normal monetary policy keeps them alive, and gradually infecting the rest of the economy, locking us into the new normal. • Zombies do not stay at home watching TV. They like to get out and about… Slide 12 …except in the US • • Bad assets in the US banking sector have largely been written off (zombies have been slain), so the US economy is poised for growth Not so in the UK (or elsewhere in the developed world) Slide 13 What to avoid in the new normal? • Missing the QE inspired rally in all asset prices: likely to be lots more QE now that Japan has entered the “ugly currency race”. Some yields could go negative. • Being trapped in low or negative real portfolio returns after that. • Ideally, go overweight in assets that participate in the QE rally but have a chance of generating positive real returns in the long run. US and EM equities fit the bill. Slide 14 Macro matters, but is difficult • • Outperformance has come not just from diversification but from macro views, in spite of the fact that consensus macro forecasts have been dreadful Vital to think not just about the mean but also (more importantly) the risks to the macro outlook Slide 15 Looking ahead • • New-normal returns mean a huge increase in sponsor payments into the typical Local Government Pension Scheme, according to Fathom’s model Correspondingly huge benefits to improving on those returns Slide 16