* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 10

Expenditures in the United States federal budget wikipedia , lookup

Present value wikipedia , lookup

Private equity secondary market wikipedia , lookup

Syndicated loan wikipedia , lookup

Shadow banking system wikipedia , lookup

Stock trader wikipedia , lookup

Interest rate wikipedia , lookup

Financialization wikipedia , lookup

Stock selection criterion wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Public finance wikipedia , lookup

Credit rationing wikipedia , lookup

Investment fund wikipedia , lookup

Investment management wikipedia , lookup

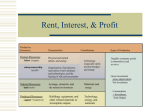

Econ 2301 Macroeconomics Dr. Jacobson Mr. (Coach) Stuckey Chapter 10 Savings Investment Spending and the Financial System National Savings What is it? National Savings is the total income in the economy that remains after paying for consumption and government purchases. The portion of the nation’s income that is not consumed. Equation for National Savings S=Y-C-G GDP Y=C+I+G S=I S=National Savings, Y=GDP, C=Consumption, G=Government Purchases, I=Investment Savings=Investment Savings has to equal investments for the economy as a whole, but not for every individual. The bond market, stock market, banks, mutual funds and other financial markets take the nation’s savings and direct it to the nation’s investment. National Savings Represents resources available for investment to do things like replace old factories and equipment, or to buy more and better capital goods. Plays a major role in our nation’s longterm economic growth and future living standards. Higher savings and investment contribute to increased productivity and stronger economic growth. The United States net national savings is less than 1% of the GDP The net national savings rate has not been this low since the Great Depression. Positivity of National Savings Savings is the main source of funds available for domestic investment in new capital goods. Ways to Higher National Savings Tax Reforms Budget Deficit Social Security Tax Reforms Make the tax code simpler, more fair, and to further promote savings, and job creation Reduce the bias against savings and investment inherent in the current system. Budget Deficit Create a plan to reduce the deficit over time relative to the size of the economy. Restrain government spending growth Social Security Reform Restoring Social Security to sustainable solvency and increasing saving are intertwined national goals. The way in which Social Security is reformed will influence both the magnitude and timing of any increase in national savings. Negativity of National Savings National savings has been in the red in past years. The net national savings rate has not been this low since the Great Depression. Things are not looking too good for the future either. National debt sky high, savings not. Fear and obsession regarding consumer spending continues, the fact is that the beginning of the 21st century has not been troubled with excessive savings, but by a serious dearth in savings. Consequences of Negative Savings Negative savings rate implies a negative trade balance. American households are whittling down their wealth. Negative national savings means that the nation is not accumulating capital How Many of You Would Like to Either Start Your Own Business or Take Over a Family Business? Lack of Money or Not Enough Money is the Cause of Most Start-up Businesses Going Broke. Many People Have Great Ideas and Even Great Products That Can Not Make a Go of It. Why? Usually Implementation! Implementation Usually Means Money or Lack thereof. Where Can One Go To Get the Necessary Capital? Places to Get Capital Money From Friends. Mortgage Your House. Relatives. Sell Assets. Banks. Venture Capitalists. Sell Stock. Find Investors. In the Last Chapter We Looked at the Various Ways for a Country to Increase its Production. When People Start New Businesses Can Not That Increase a Nations GDP? In this Chapter We are Going to Explore the Various Methods Nations, Companies and Individuals Use to Either Raise Capital or Invest. In Short: What is the Engine Driving Production With the Needed Capital? In the Last Chapter We Saw How Savings and Investment Are Key Ingredients to Long Term Economic Growth. In an Economy There Are: Savers- People Who Spend Less Then They Earn. Borrowers- People Who Spend More Than They Earn. The Financial System Is the Various Institutions That Brings Savers and Borrowers Together. The Financial SystemThe Group of Institutions in The Economy That Help to Match One Person’s Savings With Another Person’s Investment. How Does the Financial System Work? Financial Institutions Can Be Grouped Into Two Categories: 1. Financial Markets, and 2. Financial Intermediaries. 1. Financial Markets Financial Markets Are the (Financial) Institutions Through Which Savers Can Directly Provide Funds to Borrows. The Two Most Important Financial Markets in the U.S. Economy Are the Bond Market and the Stock Market. A BondIs a Certificate of Indebtedness That Specifies the Obligations of the Borrower To the Holder of the Bond. In Simplest Terms A Bond Can Be Considered A Loan. It is Usually Issued by Either a Corporation or The Government. Bonds: Because They Are A Loan (or IOU) They “Usually” Do Not Include Ownership or a Right to Share in Growth or Profits. However, Some Are Convertible to Stock or May Include Options To Convert. Bonds Usually Have A Date of Maturity and a Rate of Interest. However This May Take A Wide Variety of Forms. For Example: Bonds May Be Paid Off Early If The Issuer Exercises A Previously Included Option . They May Not Even Pay Interest But Simply Discount the Face Amount of the Bond. Some Corporate Bonds May Be Issued With Options to Purchase Shares of Stock at a Set Price, or They May Be Convertible Into Shares of Common or Preferred Stock. Bonds Are Rated According to Their Credit Risk. Government Bonds Are Considered Less Risky and Therefore Usually Pay a Lower Interest. Government BondsMay Be Issued By Federal, State or Local Governments and May Also Have Any Interest Paid as Being Tax Exempt. Important Note: Bonds May Go Into Default, Wherein the Owner May Get Either a Partial Payment or Nothing. The Second Type of Financial Market is Called the Stock Market. Stock Represents Partial Ownership in a Company and Therefore Has a Claim to the Profits The Company Makes or a Share of the Proceeds When and If the Company is Sold. The Sale of Stock to Raise Money is Called Equity Finance. The Sale of a Bond to Raise Money is Called Debt Finance. Shares of Stock May Be Sold Through Either a Private Offering (Limited). Or a Public Offering and Traded on One of the Many Exchanges. Stock Prices The Price of A Share of Stock is Determined By Supply and Demand. It is Influenced By Expectations, Profits and the Overall Economy. Bonds Vs. Stocks Bonds Usually Are Paid Interest Plus a Return of the Face Amount of the Bond. Stock Prices Vary As Does the Company’s Profits And the Market. There is No Guarantee of A Return of Investment. 2. Financial Intermediaries The Second Category Besides Financial Markets is Called Financial Intermediaries That Are Financial Institutions Through Which Savers Can Indirectly Provide Funds to Borrowers. Financial Intermediaries Two of the Most Important Financial Intermediaries Are Banks and Mutual Funds. Other Financial Intermediaries Savings Banks. Savings and Loan. Life-Insurance-Companies. Pension Funds. Money Market Funds. Credit Unions. Banks Banks Are Financial Intermediaries Who Take Deposits From People who Want to Save and Use These Deposits to Make Loans to People who Want to Borrow. BanksTake the Savers Deposits and Pay Them an Interest and Then Charge the Borrowers A Higher Interest on Their Loans. Banks Also Facilitate Trading By Establishing a Medium of Exchange By Making Money Available. A Mutual Fund Is an Institution That Sells Shares to the Public and Uses the Proceeds to Buy a Selection, or Portfolio, of Various Types of Stocks, Bonds, or Both Stocks and Bonds. The Shareholder of a Mutual Fund Accepts the Risks and Returns Associated With the Portfolio. Like Common Stock the Shareholder Benefits When the Value Increases and Suffers a Loss When the Value Decreases. Two Advantages of Mutual Funds Over Common Stock Diversification- Mutual Funds Typically Have a Variety of Stocks in Their Portfolio. 2. They are Managed By Professionals Who Are Experts in Their Field and Able to Concentrate Their Efforts. 1. Mutual Funds Also Allow a Small Investor to Buy a Number of Different Stocks That They May Otherwise Not Be Able to Afford. Let Us Again Look At Our Formula For The GDP That Included Both The Total Income and Expenditures Within the Borders of The United States. You Will (I Hope) Remember That: GDP (Y) = Consumption (C) + Investment (I) + Government (G) + Net Export (NX) Now Let Us Say (For Current Purposes) That We Have a Completely Closed Economy Where There Are No Exports or Imports. We Know This Is Not Realistic But Humor Me. From Your High School Math Days You Will Remember That This Can Be Changed To Read: I=Y–C–G In Other Words I = Y – C – G Means the Income That is Left After Paying for Consumption and Government Purchases. This Amount is Called National Savings (or Savings) and Is Denoted as S. Therefore, S=I Or Savings Equals Investment. National Saving The Total Income In the Economy That Remains After Paying for Consumption and Government Purchases. Let Us Now Let T Denote the Amount the Government Collects From Households in Taxes Minus the Amount It Pays Back to Households in the Form of Transfer Payments. Note: This is Necessary Because As You Will Recall Transfer Payments Are Not Included In the GDP and Therefore We Must Account For Them In the Amount the Government Collects in Taxes. We Can Now Rewrite Our Equation as: S = (Y – T – C) + (T – G) This Equation Separates National Savings Into Two Pieces: Private Savings (Y – T – C) and Public Savings (T – G) Private Saving Y–T–C The Income That Households Have Left After Paying for Taxes and Consumption. Public Saving T–G The Tax Revenue That The Government Has Left After Paying For Its Spending. Budget Surplus An Excess of Tax Revenue Over Government Spending. Budget Deficit A Shortfall of Tax Revenue From Government Spending. Please Pay Attention: as This May Be Hard to Grasp. Important Note: Although in the Accounting Savings = Investment For a Nation, That Does Not Have to Be True For an Individual. Example: If you Earn More Than You Spend On Consumption and Put Your Money in a Bank or Some Other Vehicle Such as Stocks or Bonds Hoping to Get a Return on Your Money. You Are NOT “Investing” as Defined By the GDP as You Are Not Buying Buildings or Equipment. How Does Savings = Investment? The Saving = Investment Comes in Where The Bank or Proceeds From the Stocks or Bonds May Go to Buy Buildings and Equipment. In Short: Macroeconomists Are Stealing the Word “Investment” From What You and I Use it For and Changing The Meaning. Market for Loanable Funds The Market in Which Those Who Want to Save Supply Funds and Those Who Want to Borrow to Invest Demand Funds. The Market For Loanable Funds: For Simplicity, If We Say That the Economy Has Only One Financial Market for Savers and Borrowers to go to; to Either Deposit Funds or Get Loans. Of Course This is Not True as There Are Many Different Markets As We Have Just Seen, Such as; Banks, Stocks, Bonds, Mutual Funds, Etc. The Term Loanable Funds Refers to All Income That People Have Chosen to Save and Lend Out; Rather Than Use for Their Own Consumption. In the Market of Loanable Funds There is Only One Interest Rate, Which Is Both The Return to Savings and The Cost of Borrowing. Market For Loanable Funds Interest Rate Supply ------------------------ 5% 0 $1,200 Demand Loanable Funds (In Billions of Dollars) Savings Is the Source Of The Supply of Loanable Funds. Investment is the Source of the Demand For Loanable Funds. A Higher Interest Rate Would Encourage Saving (Thereby Increasing the Quantity of Loanable Funds Supplied) and Discourage Borrowing For Investment (Thereby Decreasing the Quantity of Loanable Funds Demanded). Likewise a Lower Interest Rate Would Discourage Saving (Thereby Decreasing the Quantity of Loanable Funds Supplied) and Encourage Borrowing For Investment (Thereby Increasing the Quantity of Loanable Funds Demanded). Market For Loanable Funds Interest Rate Surplus -------------------------- ------------------------ 5% Supply Shortage 0 $1,200 Demand Loanable Funds (In Billions of Dollars) Problem? The United States Has a Lower Saving Rate Than Many of the Other Nations In the World. In 1999 Percentage of GDP Saved: (Source McConnell) Country Saved India 20% China 42 Japan 30 Germany 23 United States 15 Note: Many Very Poor Countries Such as Chad, Ghana, Madagascar and Uganda Have a Negative Savings Rate or in the 0-6% Range as the People Are to Poor to Save. So What If Anything Should or Can a Government Do to Affect the Savings Rate of the United States. First : The Government Can Reform its Tax Laws to Encourage Greater Savings, The Result Would Be Lower Interest Rates and Greater Investment. Policy 1: Savings Incentives If the Government Allows a Person to Shelter Some of Their Saving From Taxation. Example: IRA, Bonds. Tax Incentives Tax Incentives For Savings Increase the Supply of Loanable Funds. 2. The Increase in the Supply of Loanable Funds, Reduces the Equilibrium Interest Rate. 3. The Increase in the Supply of Loanable Funds, Raises the Equilibrium Quantity of Loanable Funds. 1. Market For Loanable Funds Interest Supply Rate S1 4% ------------------------------------ 0 ----------------- -------------------------- ------------------------ 5% $1,200 $1,600 Supply S2 Demand Loanable Funds (In Billions of Dollars) Policy 2: Investment Incentives Investment Tax Credit Gives a Tax Advantage to Any Firm Building a Factory or Buying a New Piece of Equipment. If a Reform of the Tax Laws Encouraged Greater Investment, Through a Vehicle Such as An Investment Tax Credit, The Result Would Be Higher Interest Rates and Greater Savings. An Investment Tax Credit 1. An Investment Tax Credit Increases the Demand For Loanable Funds. 2. An Increased Demand for Loanable Funds Raises the Equilibrium Interest Rate 3. An Increased Demand for Loanable Funds Raises the Equilibrium Quantity of Loanable Funds. Market For Loanable Funds Interest Rate Supply 5% -------------------------- 0 -------------------------------- --------------------------------- ------------------------ 6% $1,200 $1,400 D2 Demand D1 Demand Loanable Funds (In Billions of Dollars) Policy 3: Government Budget Deficits and Surpluses. Governments Finance Budget Deficits By Borrowing in the Bond Market, and the Accumulation of Past Government Borrowing is Called Government Debt. A Government Budget Deficit A Budget Deficit Decreases the Supply of Loanable Funds. 2. The Decrease in Loanable Funds Raises the Equilibrium Interest Rate. 3. The Decrease in Loanable Funds Reduces the Equilibrium Quantity of Loanable Funds. 1. Market For Loanable Funds Interest S2 Supply Rate S1 Supply 5% -------------------------- 0 ------------------------ ----------------- ------------------------------- 6% $800 $1,200 D1 Demand Loanable Funds (In Billions of Dollars) Figure 5 The U.S. Government Debt Percent of GDP 120 World War II 100 80 60 Revolutionary War Civil War World War I 40 20 0 1790 1810 1830 1850 1870 1890 1910 1930 1950 1970 1990 2010 Questions ? Quick Write If You Were President of the United States, What Would You Do About the Savings Problem In the U.S.?