* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download interest rates

Non-monetary economy wikipedia , lookup

Monetary policy wikipedia , lookup

Business cycle wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Real bills doctrine wikipedia , lookup

Exchange rate wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Early 1980s recession wikipedia , lookup

Quantitative easing wikipedia , lookup

Helicopter money wikipedia , lookup

Austrian business cycle theory wikipedia , lookup

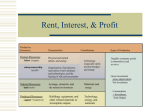

+ Money & Loanable Funds Markets C-4 Students will pose recommendations for the FED to enact in the face of a recessionary period of economic performance + Meanwhile, in Russia… Russia’s Central Bank increased interest rates from 10.5% to 17% yesterday…why? How? + First and Foremost… Interest rates move together, short term or long term, if the key interest rate (federal funds rate) increases, so do ALL other interest rates, and vice versa Interests rates in an economy = the “price” of money in an economy Money Market illustrates NOMINAL interest rates vs quantity of $ in the short run Loanable Funds Market illustrates REAL interest rates vs quantity of loanable funds in the long run We are examining how the FED will manipulate M1 in the US’s economy and how these manipulations of the money supply will affect interest rates (which are all the same) and ultimately GDP…we’ll get there + Money Market (Liquidity Preference Model of Int. Rts.) MD = downward sloping Opportunity cost of holding money in an economy MS = vertical line N. Int. Rts = opportunity cost; quantity of money demanded NOMINAL!!! .. O ie E FED directly controls the quantity of money in an economy; only be “x” amount of M1 at a time E = intersection of MS and MD identifies interest rates in economy . L Q *If our economy is ever at disequilibrium in the money market, natural forces will work to move it back to ie + Right denotes an increase in the quantity of money demanded at all interest rates and vice versa Change in Aggregate Price Level: if goods/services in an economy cost more, people need to hold more money ( MD ) 1. 2. Shifts in Money Demand Curve Opposite is also true Change in Real GDP: if economy produces more goods/services (increase in GDP) households need to hold more money to be able to buy ( MD )* Change in Technology: ATMs, credit and debit cards have made holding cash less important ( MD ) IN MS i2 i1 i3 MD3 MD1 Q Rule: MD = Int. Rts. MD = Int. Rts MD2 + Loanable Funds Market Bringing savers (loan issuers/lenders) and borrowers (firms) together Using REAL interest rates on our Y-axis—real interest drives investment spending, not nominal interest • LF Demand (Investment) = at Int. Rts quantity of loans demanded by firms • LF Supply (Savings) = Int. Rts quantity of loans supplied • LF Equilibrium = quantity of loans demanded equals quantity of loans supplied @ Re Or, the quantity of loans savers want to lend is equal to the quantity of funds firms want to borrow Re . Qe E + Shifts of the LF Demand Curve (Investment) 1. Change in perceived business opportunities: if a firm thinks the rate of return on investment spending will change, there may be an increase or decrease in desired investment (demand for loans) at all interest rates Ex: Internet expansion in 1990s 2. Changes in Gov’t Borrowing: If a gov’t runs a deficit and must finance additional spending with borrowed funds (loans) desired investment will increase at all interest rates Ex: US gov’t in 2003 paid off a lump sum of debt valued at $416 B…money was borrowed from savers (US and foreign) ***Remember: when Int. rts rise there will be a decrease in economic growth (crowding out) + Shifts of the LF Supply Curve (Savings) 1. Changes in private savings behavior: if people are spending more money, for whatever reason, we assume they are saving less ( LF Supply). If people spend less and save more, like in a recession ( LF Supply). Think wealth effect! 2. Changes in capital inflows: if a nation experiences a period of greater foreign investment, like the US in recent history prior to 2008 ( LF Supply). If a nation experiences a period of great capital outflows, perhaps during an economic collapse ( LF Supply) ***Remember: Investment = savings! When people have more money to save, they deposit more money in banks, banks can then loan more funds… + 2 Models Come Together: Interest Rates in the Short Run Money market drives changes in the interest rate that the loanable funds market mirrors 1. Assume FED increases MS(MS = Int. Rts) 2. Fall in interest rates in money market leads to an GDP ( Investment). This GDP = savings (multiplier theory tells us that with this increase in income, more money will be spent and more will be save than prior to the GDP). 3. savings = supply of loanable funds (LF Supply = savings). This savings results in a in Int. Rts ***This change in interest rates in BOTH models is the exact same!!! The interest rates are directly proportional to one another! + 2 Models Come Together: Interest Rates in the Short Run + 2 Models Come Together: Interest Rates in the Long Run In long run changes in the money market will not affect interest rates! In the long run, an in MS will Int. Rts; however in long run, aggregate price level will rise proportionally with the decrease in interest rates. When aggregate price level rises, people need to hold more money to purchase goods/services, increasing demand for money. Rightward shift of MS and MD will lead us to the same interest rate we began with in the money market + 2 Models Come Together: Interest Rates in the Long Run In the loanable funds market: 1. The increase in MS reduces interest rates and increases Real GDP. 2. In long run, just like with our classical theory on AD/AS, Real GDP will fall back to pre-MS shift levels from increase in wages and other input costs (back to LREQ) 3. Ultimately, in our market for loanable funds, we arrive back at our initial equilibrium level of interest rates and equilibrium quantity of loanable funds + 2 Models Come Together: Interest Rates in the Long Run + So, what about Russia? How did their Central Bank increase their equivalent to our “federal funds rate” to 17%? In the SR, how does this affect interest rates in the loanable funds market? In the LR, how does this affect interest rates in the loanable funds market? For tomorrow: how does the FED expand or contract MS? How do changes in MS affect the investment demand curve?