* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download 26 - Ohio State University

Monetary policy wikipedia , lookup

Global financial system wikipedia , lookup

Real bills doctrine wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

Balance of payments wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Exchange rate wikipedia , lookup

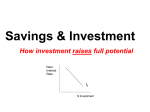

Hypothetical Market Adjustment to Great Leap Forward How would the GLF have worked in a market economy? •Initiating event might have been •Increased Govt expenditure for “defense”—promote steel production in remote locations •Technology advance increasing profitability of small steel manufacturing, use of scrap steel, etc. •Use the standard macro model to work through the impact of these initiating events. Copyright © 2004 South-Western SAVING AND INVESTMENT IN THE NATIONAL INCOME ACCOUNTS • Recall that GDP is both total income in an economy and total expenditure on the economy’s output of goods and services: Y = C + I + G + NX (NFI) Copyright © 2004 South-Western Some Important Relationships • Now, subtract C and G from both sides of the equation: Y – C – G =I + NFI • The left side of the equation is the total income in the economy after paying for consumption and government purchases and is called national saving, or just saving (S). Copyright © 2004 South-Western Summary • National saving, or saving, can be expressed: S = I+NFI S=Y–C–G S = (Y – T – C) + (T – G)= NFI + I S = Private Saving + Public Saving Copyright © 2004 South-Western The Market for Loanable Funds S = I + NFI At the equilibrium interest rate, the amount that people want to save plus what the government saves exactly balances the desired quantities of investment and net foreign investment. Copyright © 2004 South-Western The Market for Loanable Funds Real Interest Rate Supply of loanable funds (from national saving) Equilibrium real interest rate Demand for loanable funds (for domestic investment and net foreign investment) Equilibrium quantity Quantity of Loanable Funds Copyright © 2004 South-Western How Net Foreign Investment Depends on the Interest rate... Real Interest Rate Net foreign investment is negative. 0 Net foreign investment is positive. Net Foreign Investment Copyright © 2004 South-Western The Market for Foreign-Currency Exchange... Real Exchange Rate Supply of dollars (from net foreign investment) Equilibrium real exchange rate Demand for dollars (for net exports) Equilibrium quantity Quantity of Dollars Exchanged into Foreign Currency The Real Equilibrium in an Open Economy Real Interest Rate (a) The Market for Loanable Funds (b) Net Foreign Investment Real Supply Interest Rate r1 r1 Net foreign investment, NFI Demand Quantity of Loanable Funds Net Foreign Investment Real Exchange Rate Supply E1 Demand Quantity of Dollars (c) The Market for Foreign-Currency Exchange The Effects of Financing GLF with a Government Budget Deficit Real Interest Rate (a) The Market for Loanable Funds S2 (b) Net Foreign Investment Real Interest Rate r2 S1 B r2 3. ...which in turn reduces net foreign investment. A r1 r1 Demand 1. A budget deficit reduces the supply of loanable funds... 2. ...which increases the real interest... NFI Quantity of Loanable Funds Net Foreign Investment Real Exchange Rate E2 5. …which causes the real exchange rate to appreciate. E1 S2 S1 4. The decrease in net foreign investment reduces the supply of dollars to be exchanged into foreign currency… Demand Quantity of Dollars (c) The Market for Foreign-Currency Exchange An Increase in the Profitability of Backyard Steel Furnaces Real Interest Rate r2 r1 (a) The Market for Loanable Funds (b) Net Foreign Investment (China) Real Supply Interest Rate D2 r1 Net foreign investment, NFI Demand Quantity of Loanable Funds Net Foreign Investment Real Exchange Rate Supply E2 E1 Demand Quantity of Dollars (c) The Market for Foreign-Currency Exchange What Actually Happened • Backyard steel production and other projects were not profitable. • Therefore, it was necessary to finance them through government procurement. • In an open economy, this wasteful government expenditure might (temporarily) have been financed by investment from abroad. This at least temporarily would have reduced starvation, but would have paved the way for a future financial crisis if the foreign debt couldn’t be repayed.