* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download DAINAM Securities

Private equity secondary market wikipedia , lookup

Securitization wikipedia , lookup

Business valuation wikipedia , lookup

United States housing bubble wikipedia , lookup

Financial economics wikipedia , lookup

Market (economics) wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Short (finance) wikipedia , lookup

Interbank lending market wikipedia , lookup

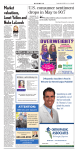

DAINAM Securities Weekly market report from 11/05/2015 to 15/05/2015 WEEKLY MARKET REPORT DAINAM SECURITIES JOINT STOCK COMPANY From 11/05/2015 to 15/05/2015 RECOMMENDATIONS FOR THE WEEK FROM 11TO 15/05/2015 Market may continue to correct. Investors should continue watching the market and not increase weights of stock in portfolio. Market is lack of supportive macroeconomics information. Rather, the signal that candlesticks of 7 and 8/May created a positive gap that need to be filled mentions a mounting selling pressure. We expect that VNIndex will retest the 540 point supporting level. NEWS REVIEW FOR THE WEEK FROM 04-08/05/2015 INTERNATIONAL NEWS Oil prices plummet after reaching 5 month peak. Copywright @ DNSE Oil prices plummeted Thursday as concerns persisted that demand is not strong enough to ease the supply glut. Oil prices hit 2015 peak on Wednesday amid the first drawdown in U.S. crude inventories since January, before settling off its high as investors and traders moved to take profits on a multi-week rally. Wednesday's rise came after the U.S. Energy Information Administration said crude stockpiles fell 3.9 million barrels last week, the first drop in four months. The drawback was more than double that projected by industry group American Page | 1 DAINAM Securities Weekly market report from 11/05/2015 to 15/05/2015 Petroleum Institute. A Reuter’s poll of analysts had estimated U.S. crude stocks to rise last week for a record 17th week in a row. On 07/05, sweet crude for June delivery moved down 1.99 U.S. dollars to settle at 58.94 dollars a barrel on the New York Mercantile Exchange. In London, Brent North Sea crude for June delivery, the global benchmark, lost 2.23 dollars to close at 65. 54 dollars a barrel. Table 1: Oil price from04to08/05/2015 Source: Nasdaq.com It’s hard to imagine a better situation for the Russian economy (CNBC) Copywright @ DNSE The Russian economy is recovering after the crisis thanks to a range of factors, and it is difficult to imagine a better situation:Interest rates have decreased, oil prices are moving towards a positive trend and tensions with neighboring Ukraine are easing. Russia could not dream of a better possible combination to recover its economy, writes CNBC. Joseph Dayan, head of markets at BCS Financial, commenting on the situation on the Russian markets for CNBC, noted the ruble’s growth and stated that he thought that it was linked to a Page | 2 DAINAM Securities Weekly market report from 11/05/2015 to 15/05/2015 positive rally in oil prices.Also, Russia Central Bank earlier lowered key interest rates to 12.5%, amid a recovery of the Russian ruble, indicating that inflation in the country has already peaked. Thus, CNBC maintains that there are clear signs of stabilization for this country. Euro nations losing patience with Greece Copywright @ DNSE Euro zone leaders will tell Greece that time and patience are running out for its leftist-led government to implement agreed reforms to avert looming cash crunch that could force it out of the single currency.Greece has been kept from bankruptcy by two international bailouts but now risks running out of money within weeks if it does not receive more funds.Greek banks reported the largest deposit withdrawals in a month, a sign savers are worried about the outlook for the country's finances and institutions. Two EU/IMF bailouts totaling €240 billion have kept Greece from bankruptcy since 2010 but its economy has shrunk by 25%, partly due to austerity measures imposed by the lenders. It risks running out of cash without more aid or permission to issue more short-term debt. Page | 3 DAINAM Securities Weekly market report from 11/05/2015 to 15/05/2015 DOMESTIC NEWS Stock market highlights Last week experienced decrease in points of both exchanges, especially the first day after holiday, when Vn-Index lost more than 17 points, the highest level since beginning of 2015. Over the week, Vn-Index decreased by 2%, from 565.8 points to 554.5 points, while HNX-Index fell by 2.77% from 82.58 to 80.29 points only. Liquidity showed little improvements on HOSE while decreased slightly on HNX. On HOSE, there were 85.5 million stocks traded, equivalent to 1.25 trillion, increased by 18.33% in volume and 3.85% in value. Mean while, liquidity on HNX was 41 million units, equivalent to 454 billion, fell slightly by 0.14% in volume and 11.96% in value compared to last week performance. Retail fuel prices increase The domestic retail prices of oil and petroleum went up at 9pm of May 5 in the wake of increasing global fuel prices. Following a joint decision issued by the Ministries of Industry and Trade and Finance, petrol and oil retailers have increased the price of Ron92 and Ron95 by nearly 2,000 VND to 19,200 VND per litre. While the prices of diesel and mazut remain unchanged, kerosene has become cheaper by 258 VND per litre. The two ministries also emphasized that the Tuesday price increases had been carefully calculated, so they would not greatly affect local businesses and consumers. State Bank raises inter-bank VND/USD rate by 1 percent The State Bank of Vietnam raised the inter-bank average exchange rate between the VND and USD by 1 percent early on May 7, from 21,458VND to 21,673VND per one USD.Banks may set their rate within a range of +/- 1 percent of the SBV-set interbank average rate.This is the second time this year the SBV has adjusted the inter-bank rate. The first Copywright @ DNSE Page | 4 DAINAM Securities Weekly market report from 11/05/2015 to 15/05/2015 time was on January 7, also with an increase of 1 percent.The SBV said the adjustment is made to counter negative impacts from the international market in line with its policy set for this year, which aims to keep fluctuation in the exchange rate at not more than 2 percent.The bank added that the rising exchange rate over recent days was due to psychological reasons and market expectations, while was still within the band set by the central bank. Looking ahead, the SBV will continue to apply synchronous policy tools and measures to keep the exchange rate and market stable on the new price level. It will closely monitor the international and domestic markets as well as macroeconomic and monetary forecasts in order to make timely response. FOREIGN INVESTOR ACTIVITIES 250 200 150 100 HOSE HNX 50 0 4.05 5.05 6.05 7.05 8.05 -50 20.04 21.04 22.04 23.04 24.04 -100 Net buy 508 billion on HOSE. Net buy 68.6 billion on HNX. Copywright @ DNSE Last week, foreign investors continued to net buy more than 580 billion on the market, creating 5 consecutive weeks of net buying. On HOSE, this group of investors net bought Page | 5 DAINAM Securities Weekly market report from 11/05/2015 to 15/05/2015 strongly on 04/05 and 06/05, when the market downed significantly with the value of 211 and 213 billion respectively. Over the week, foreign investors net bought more than 508 billion. Most interested stocks this week were HHS, CTG, VCB, KBS and SSI while most sold stocks were VIC, HPG, DXG, HAG and TDC. On HNX, they net bought more than 68 billion and net sold only on 06/05. Significant net buy stocks were HUT, SHB, PVS, PLC and SD5 while PVS, IVS, PVX, VNT and VE9 are sold at highest volume. TECHNICAL ANALYSIS The market sharply fluctuated in the early week between 4 – 8/May and maintained sideway situation on the rest of trading sessions. Liquidity focused mostly on some stocks that have large influence on VNIndex and the market and the support level of 540 points was still held tigh.VNIndex experienced a pull-back after touching lower Bollingerband at 539 points. Copywright @ DNSE Page | 6 DAINAM Securities Weekly market report from 11/05/2015 to 15/05/2015 However, warning systems now still show an adjustment possibility in the short-term. In particular, daily candlesticks indicated that selling pressure mounted as bodies of candlesticks reached the MA25 line. Meanwhile, MACD remains under Zero zone; RSI, MFI were 46.09 and 45.05 respectively, showing that cash flow has no clear direction. Rather, the signal that candlesticks of 7 and 8/May created a positive gap that need to be filled mentions a mounting selling pressure. We expect that VNIndex will retest the 540 point supporting level. For more information, please contact: Statement of Disclaimer - Phuong My Hang Pham Department of Analysis Email: [email protected] Phone: (04) 7304 7304 (ext201) DAINAM Securities joint stock company Head office: 12A Floor, Centre buldingHapulico Complex, Number 01 Nguyen HuyTuong, Thanh Xuan, Ha Noi. Tel: (04) 7304 7304 Fax: (04) 73 073 073 Website: www.dnse.com.vn Copywright @ DNSE Information contained on this report based on the resources that DNSE believed as accurate at the time, but maybe updated, amended or superseded by subsequent disclosures, or may be outdated and inaccurate over time. DNSE does not undertake any obligation to insure the accuracy, updating of these information. - Recommendations on this report are subjective views of analysts. Investors using this report as source of reference take full responsibility for their investment decisions. Page | 7