* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 13 Irreversibility risk and uncertainty

Media coverage of global warming wikipedia , lookup

Citizens' Climate Lobby wikipedia , lookup

Public opinion on global warming wikipedia , lookup

Stern Review wikipedia , lookup

Surveys of scientists' views on climate change wikipedia , lookup

Climate change, industry and society wikipedia , lookup

Climate change and poverty wikipedia , lookup

IPCC Fourth Assessment Report wikipedia , lookup

Effects of global warming on humans wikipedia , lookup

Effects of global warming on Australia wikipedia , lookup

Chapter 13 Irreversibility risk and uncertainty

13.1 Individual decision making in the face of risk

13.2 Option price and option value

13.3 Risk and irreversibility

13.4 Environmental cost-benefit analysis revisited

13.5 Decision theory: choices under uncertainty

13.6 A safe minimum standard of conservation

In this chapter

you will learn about the difference between risk and uncertainty

find out how risk affects environmental decision making and have the concepts of

option value and option price explained

see how irreversibility affects environmental decision making and learn about

quasi-option value

consider decision making in the face of uncertainty

be introduced to the safe minimum standard and the precautionary principle

learn how environmental performance bonds could work

Risk and uncertainty

Risk – where all possible consequences of a decision can be completely enumerated

and probabilities assigned to each possible ‘state of the world’, ‘state of nature’,

‘state’

Uncertainty – where where all possible consequences of a decision can be

enumerated, but probabilities cannot be assigned

Radical uncertainty - where all possible consequences of a decision cannot be

enumerated

Risk/uncertainty distinction not always made in economics

Lack of objective probabilities (gambling, insurance) sometimes dealt with by

assigning subjective probabilities

In many environmental contexts, probabilities are assigned on the basis of modelling

– urban air pollution, nuclear accidents

The climate change problem exemplifies radical uncertainty

The St Petersburg paradox

A fair coin will be tossed repeatedly until it lands tail up. If it falls head up at the first toss, the gambler

gets £1. If it falls head up at the second toss, the gambler gets £2, at the third toss £4, at the fourth £8, and so

on. Tossing continues until the coin falls tail up. How much would somebody be willing to pay for such a

gamble?

The answer might appear to be ‘an infinite amount’ because the expected monetary value of the gamble is

infinite. The expected value is the sum of the probability-weighted possible outcomes, which in this case is

the infinite series

(0.5 1) (0.52 2) (0.53 4) (0.54 8)

... 0.5 0.5 0.5 0.5 ...

which has an infinite sum. That anybody would be prepared to pay a very large amount of money for such

a gamble violates everyday experience, and the example is known as the Bernoulli, or St Petersburg, paradox.

The paradox can be resolved by assuming that individuals assess gambles in terms of expected utility,

rather than expected monetary value, and that the utility function exhibits diminishing marginal utility. The

relevant outcome is then the infinite series

0.5U (1) 0.52U (2) 0.53U (4) 0.54U (8) ...

which has a finite sum, so long as there is some upper limit to U, which is what diminishing marginal

utility implies.

In economics, the basic approach to the analysis of individual behaviour in any kind of risky situation is

to assume the maximisation of expected utility and diminishing marginal utility.

Basic concepts for risk analysis 1

Expected value

Expected utility

Risk neutrality, aversion, preference

Certainty equivalence

Cost of risk bearing

The expected value of gamble with income outcomes Y1 and Y2 probabilities p1 and p2 is

E[Y ] p1Y1 (1 p1 )Y2

(13.1)

The expected utility of the gamble is

E[U ] p1U (Y1 ) (1 p1 )U (Y2 )

(13.2)

The certainty equivalent of the gamble is the value for Y that solves

U (Y ) E[U ]

The cost of risk bearing is the difference between the expected value of the gamble and its

certainty equivalent

Basic concepts for risk analysis 2

For U = Ya, 0<a<1, expected utility is

E[U ] p1Y1a (1 p1 )Ya2

(13.3)

and the certainty equivalent is the solution for Y in

Ya p1Y1a (1 p1 )Y2a

(13.4)

Y** is the expected value of the gamble

Y* is the certainty equivalent of the gamble

For U=Ya, 0<a<1, Y* < Y**

This individual is risk averse and

CORB = Y** - Y*

(13.5)

For a = 1, get risk neutrality

For risk preference arc ADEB would lie below

straight line ACB, with ∂U/∂Y > 0 and

∂2U/∂Y2 > 0

Option price and option value 1

Consider an individual and a national park wilderness area.

A – available, the park is open

N – the park is closed

U(A) –utility for income YA, park open

and wants to visit

U(N) – utility for income YA, park closed

and wants to visit.

p1 – probability of N, 1-p1 of A

NCA as p1 varies

Y** is the expected value of the outcome

Y* is the certainty equivalent

Option price and option value 2

YA – Y** is the expected value of the

individual’s compensating surplus, E[CS].

YA – Y* is option price, OP, the maximum that

the individual would be willing to pay for an

option that guaranteed access to an open park.

For Figure 13.2 U function, risk aversion, Y**

> Y* has OP > E[CS].

OP = E[CS] + OV

(13.6)

with OV, option value, positive.

With risk neutrality, NCA and arc NA coincide

and OV would be zero.

Option value is a risk aversion premium

E[CS] understates the benefit of keeping the park open as risk averse

individuals would be willing to pay a premium to avoid risk

Option price and option value 3

Risk also attaches to whether the individual wants to visit

The weather determines whether or not the individual wants to visit on a

given weekend – fine wants to go, not otherwise.

With park open for free WTP for entry on a fine weekend is £10

Probability of fine weather 0.5

E[CS] = £5.

Individual told park might be closed next weekend, and offered ticket

guaranteeing access. With no risk aversion, ticket is worth E[CS], £5.

If the risk averse individual, in order to avoid risk of wanting to go but

not being able to get in, is WTP £6 then option price is £6 and option

value is £1.

Risk and irreversibility

For a risk averse individual, option price exceeds expected compensating surplus by

option value.

If social decision making adopts consumer sovereignty, given observed actual risk

aversion, option price should be used in ECBA.

With respect to wilderness development this implies that the level of net development

benefits required to justify development needs to be greater than in a world where the

future is certain.

There are arguments that work in the same direction – require larger net development

benefits to justify development – that do not require the risk aversion assumption.

These use imperfect knowledge of the future and irreversibility.

Wilderness development ( also nuclear power ) can reasonably be regarded as

irreversible, given the timescales typically involved in any regeneration.

The decision not to develop is reversible.

Identification of maximum net benefit

A is flow of wilderness services,

decreasing with extent of

development.

Costs and benefits are functions of

A

A* - wilderness service flow that

corresponds to allocative efficiency

A* can be represented as

MC(A) = MB(A)

Maximum NB(A)

MNB(A) = 0

Irreversibility – future known

1 is now. 2 is the future

Future net benefits in present value terms

Following Krutilla-Fisher arguments, future

MNB2 higher than MNB1 for given A

Without irreversibility get A2NI > A1NI

With irreversibility A2 cannot be larger than A1

Myopia would mean A1NI and A’2

It means period 1 gain abc, period 2 loss

edhi.

Taking account of irreversibility would

mean A1I and A2I – ab = de.

Cost of irreversibility in period 1 is abc

Cost of irreversibility in period 2 is def

Irreversibility in a risky world

At start of period 1 can assign probabilities p to

MNB21 and q = (1 – p) to MNB22.

Working with the expected value for period 2

leads to A1IR and A2IR

Adding risk to irreversibility leads to lower A –

more development – than irreversibility alone

But, to less development than if irreversibility

were ignored.

Quasi-option value 1

Where there is the prospect of improved information ‘the expected benefits of an irreversible

decision should be adjusted to reflect the loss of options that it entails’ Arrow and Fisher

Even if the decision maker is risk-neutral

The size of the adjustment is quasi-option value

All or nothing development to simplify.

Decision to be taken at start of period 1 when period 1 conditions fully known and period 2

outcomes listed and probabilities attached. At the end of period 1, complete knowledge about

period 2 will become available

The decision at the start of period 1 is whether to permit development

Table 13.1 Two – period development/preservation options

Option

Period 1

Period 2

Return

1

D

D

R1 = (Bd1 – Cd1) + Bd2

D – development

P – preservation

Ri – return to option i

Bpt – preservation benefits

2

P

D

R2 = Bp1 + (Bd2 – Cd2)

3

P

P

R3 = Bp1 + Bp2

Bdt – development

benefits

Cdt – development costs

4

D

P

Is infeasible

period 2 costs and benefits

as present values

Quasi-option value 2

The return to proceeding immediately with development is

R d R1 ( Bd 1 Cd 1 ) Bd 2

(13.20)

The return to the decision to preserve at the start of period 1 is

R p Bp1 max{Bp 2 ,( Bd 2 Cd 2 )}

(13.21)

Suppose for moment that decision maker had complete knowledge at start of period 1.

Decision would be to develop if Rd>Rp, Rd – Rp>0, which from 13.20 and 13.21 is

( Bd 1 Cd 1 ) Bd 2 Bp1 max{Bp 2 ,( Bd 2 Cd 2 )} 0

(13.22)

which can be written

N1 Bd 2 max{B p 2 , ( Bd 2 Cd 2 )} 0

(13.23)

with N1 = (Bd1 – Cd1) – Bp1, that which would actually be known at the start of period 1

The other terms in (13.23) could not be known at the start of period 1, so it is not an operational

decision rule.

But, by assumption the decision maker does at the start of period 1 know the possible outcomes for

Bd2, Bp2 and (Bd2 – Cd2) and can attach probabilities.

Question - ? use the rule develop at start of period 1 if

N1 E[ Bd 2 ] max{E[ B p 2 ], E[( Bd 2 Cd 2 )]} 0

(13.24)

Quasi-option value 3

Answer – no, using this rule would ignore the fact that full information will become

available at the start of period 2. The decision maker does not have full information at

the start of period 1, but she does know the possibilities and probabilities.

The proper decision rule is go ahead with development at the start of period 1 if

N1 E[ Bd 2 ] E[max{B p 2 , ( Bd 2 Cd 2 )}] 0

(13.25)

Whereas in 13.24 the decision maker uses the maximum of of the expected values

of period 2 preservation and development benefits, in 13.25 she uses the

expectation of the maximum of period 2 preservation benefits and net development

benefits.

The left hand side of 13.25 will be larger than the left hand side of 13.24, so the

former, ie 13.25, is a harder test to pass at the start of period 1.

The difference between the left hand sides of 13.25 and 13.24 is quasi-option

value.

Quasi-option value is the amount by which a net benefit assessment which simply

replaces outcomes by their expectations should be reduced, given irreversibility, to

reflect the pay-off to keeping options open by not developing until more

information about future conditions is available.

Quasi-option value – a numerical example

Two possible period 2 situations, A and B, are differentiated only by what preservation benefits

in the future will turnout to be.

For A and B, (Bd2 – Cd2) = 6

For A Bp2 = 10, for B Bp2 = 5

pA = pB = 0.5

Then, for 13.24 the third term on the lhs is.

max{E[ Bp2 ], E[( Bd2 Cd2 )]} max{[(0.5 10)

(0.5 5)],[(0.5 6) (0.5 6)]}

A where Bp2 ( Bd2 Cd2 ), Bp2 10, p A 0.5

B where Bp2 ( Bd2 Cd2 ),( Bd2 Cd2 ) 6, p B 0.5

Hence

max{7.5,6} 7.5

so the development gets the go-ahead if

N1 E[ Bd2 ] 7.5 0

For 13.25 we have two possible outcomes

(13.26)

E[max{Bp2 ,( Bd2 Cd2 )}] (0.5 10) (0.5 6)

8

and following this decision rule, the

development gets the go-ahead if

N1 E[ Bd2 ] 8 0

(13.27)

Suppose N1 + E[Bd2] = 7.75. Then, using 13.24/13.26 development would be decided on at the

start of period 1, while using 13.25/13.27 the decision would be to preserve in period 1. The test

based on 13.25 is harder to pass than the 13.24-based test.

The 13.25 test adds a premium to the 13.24 test – Quasi-option value which is 0.5 here.

Quasi-option value 4

Positive quasi-option value is a general result – Arrow and Fisher 1974

If, as in the numerical example

E[Bp2] > E[(Bd2 – Cd2)]

then 13.24 becomes

N1 E[ Bd 2 ] E[ Bp2 ] 0

(13.28)

Now consider max{Bp2, (Bd2 – Cd2)} from 13.26, which is either Bp2 or

a larger number.So long as decision maker entertains the possibility that

(Bd2 – Cd2) > Bp2, E[max{Bp2, (Bd2 – Cd2)}] will be greater than E[Bp2]

and 13.25 which is

N1 E[ Bd 2 ] E[max{Bp2 , ( Bd 2 Cd 2 )}] 0

will be a harder test to pass than 13.28, with

E[max{Bp2 , ( Bd 2 Cd 2 )}] E[ Bp2 ] QOV

where QOV stands for Quasi-option value

Environmental cost-benefit analysis revisited 1

How should ECBA take account of risk? For risk neutrality instead of

T

T

NPV {B(D)t C (D)}e dt {B(P)t }e rt dt

rt

0

0

use

T

T

{E[ B(P)]t }e rt dt

E[NPV] {E[ B(D)]t E[C (D)]t }e rt dt

(13.29)

0

0

However, individuals are risk averse and if this is to be reflected in ECBA, it should use

T

T

T

0

0

NPV* {E[ B(D)]t E[C (D)]t }e rt dt {E[ B(P)]t }e rt dt CORBt e rt dt

0

(13.30)

for the test, where CORBt is the cost of risk bearing at time t.

It is sometimes suggested that risk can be dealt with Tby using expected values and an a higher discount rate:

T

NPV** {E[ B(D)]t E[C (D)]t }e ( r b )t dt

0

{E[ B(P)]t }e ( r b )tdt

(13.31)

0

where b is the ‘risk premium’. This implies that the cost of risk bearing is decreasing exponentially with time

T

NPV** {E[ B(D)]t E[C (D)]t }{CORBe }e dt

0

bt

rt

T

{E[ B(P)]t }{CORBe bt }e rt dt

0

which is not generally the case. CORBt should be estimated over the project lifetime and used as in 13.30.

Environmental cost-benefit analysis revisited 2

Environmental services are typically public goods, so that the risk spreading argument cannot be

used to exclude consideration of CORBt. ECBA that does not ignore risk should use either13.30 with

E[B(P)]t replaced by E[CS]t and CORBt replaced by OVt, that is

T

NPV* {E[ B(D)]t E[C (D)]t }e rt dt

0

T

T

{E[CS]t }e dt OVt e rt dt

rt

0

(13.32)

0

or replace both E[B(P)]t and CORBt with OPt and use

T

NPV* {E[ B(D)]t E[C (D)]t }e dt

0

rt

T

OPt e rt dt

0

(13.33)

where CS is compensating surplus, OV is option value, and OP is option price.

Putting numbers to option values and quasi-option values is difficult. Often judgemental

allowance is made and sensitivity analysis conducted.

Decision theory: choices under uncertainty 1

A game against nature

Table 13.2 A pay-off matrix

C

Two strategies

D

E

A - Preservation

B - Development

A Conserve the

wilderness area as a

national park

B Allow the mine to be

developed

120

50

10

Three states of nature

C – High Preservation Benefit

5

30

140

Low return to mine

D – Intermediate Preservation and

development

E – Low Preservation Benefit

High return to development

Decision theory: choices under uncertainty 2

Table 13.2 A pay-off matrix

A Conserve

the wilderness

area as a

national park

B Allow the

mine to be

developed

C

D

E

bad worst outcome – is A

120

50

10

Maximax – select the best of the best

outcomes – is B

5

30

140

Table 13.3 A regret matrix

C

Maximin - select the strategy with the least-

D

E

Minimax regret – form the regret matrix

with entries that are the difference between the

actual pay-off and what it would have been

under the best strategy for the given state of

nature – minimax on regret by selecting for the

lowest of the largest regret - outcome is B

Subjective probability assignment –

A

0

0

130

B

115

20

0

on basis of principle of insufficient reason assign

equal probabilities to each outcome and select

for largest expected value pay-off – outcome is

A for 60 (B is 58.33)

A safe minimum standard of conservation

Table 13.4 A regret matrix for the

possibility of species extinction

F

U

A

130

0

B

0

z

Radical uncertainty – cannot list all possible outcomes

If mine goes ahead, possibly unique, plant population will

be destroyed. Project includes attempted re-establishment

of plant population at new location. With no previous

experience. No way of assigning probability of success to

possible prevention of species extinction.

F – state of nature favourable, relocation successful

U – state of nature unfavourable, relocation

unsuccessful

A - do not develop

z is an unknown number.

B – develop

Safe minimum standard - use minimax regret assuming z large enough to make A the right

strategy. Because species extinction involves an irreversible reduction in the stock of potentially useful

resources, of unknown future value. There are two kinds of ignorance

Regarding future preferences, needs and technologies

About the characteristics of existing species as they relate to future circumstances

Presume z is large enough to make A – do not develop – the correct strategy with minimax regret

A modified safe minimum standard

SMS is a very conservative rule. Any project that entailed the possibility of species extinction

would get stopped. However large, current gains would be foregone for possible avoided future

costs, presumed larger.

A modified SMS would adopt the strategy that ensures survival of the species provided that it

does not entail socially unacceptably large current costs.

How to determine what is currently ‘socially unacceptable’?

A modified SMS can be applied to target setting for pollution policy – set standards according

to efficiency criteria subject to SMS constraints – accord efficiency a lower priority than

conservation except where the two conflict, provided that the opportunity costs of conservation

are not excessive.

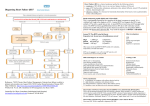

Box 13.1 Stern climate change review 1

Economic activity

Emissions

Sinks

Concentrations

A schematic representation of the

structure of the enhanced

greenhouse effect.

Dotted lines represent feedback

effects. Examples – methane

release, weakened carbon sinks.

Our knowledge of all of the links is

highly imperfect.

Climate

Biosphere

Humans

Figure 13.6 The enhanced greenhouse effect

The climate change problem is

characterised by uncertainty

Box 13.1 Stern climate change review 2

The 1992 United Nations Framework Convention on Climate Change adopted a Safe Minimum Standard

approach to the problem. Article 2, Objectives, states that:

The ultimate objective of this Convention and any related legal

instruments that the Conference of the Parties may adopt is to

achieve, in accordance with the relevant provisions of the

Convention, stabilization of greenhouse gas concentrations in the

atmosphere at a level that would prevent dangerous anthropogenic

interference with the climate system.

This is actually a modified SMS in that Article 2 goes on to say that this is subject to enabling 'economic

development to proceed in a sustainable manner'.

The role of uncertainty is explicitly recognised in Article 3, Principles, where it is stated that

3. The Parties should take precautionary measures to anticipate,

prevent or minimize the causes of climate change and mitigate its

adverse effects. Where there are threats of serious or irreversible

damage, lack of full scientific certainty should not be used as a

reason for postponing such measures, .........

The EU also adopts a precautionary approach, and it has operationalised it as meaning that the change in

global average temperature should not be more than 2oC above the pre-industrial level. A number of NGOs

have endorsed this objective. (It was endorsed at the Copenhagen UNFCC COP December 2009)

Box 13.1 Stern climate change review 3

The review notes the distinction between risk and uncertainty, and that the fact of

the latter suggests a precautionary approach to decision making, which is different

from risk aversion.

In its formal analysis of the costs of climate change the review actually uses the

standard expected utility framework with risk aversion. An integrated assessment

model, IAM, projects global GDP under business as usual with and without the

effects of climate change. The difference gives a trajectory of GDP loss on account

of climate change, which is converted to utility and expressed in BGE loss terms as

per Box 3.1 here.

For each climatic parameter, Stern constructed a subjective probability distribution.

For a given scenario IAM run 1000 times with climatic parameters drawn

randomly from their distributions. So, for each scenario get 1000 BGE losses,

reported as means across 1000 runs together with 5th and 95th percentiles.

Box 13.1 Stern climate change review 4

Table 13.4 Losses on BAU across six scenarios

Scenario

BGE equivalents: % loss in current consumption

Climate

Economic

Baseline

Climate

High

Climate

5th percentile

Mean

95th percentile

Market impacts

0.3

2.1

5.9

Market impacts

+ risk of

catastrophes

0.6

5.0

12.3

Market impacts

+ risk of

catastrophes

+ non-market

impacts

2.2

10.9

27.4

Market impacts

0.3

2.5

7.5

Market impacts

+ risk of

catastrophes

0.9

6.9

16.5

Market impacts

+ risk of

catastrophes

+ non-market

impacts

2.7

14.4

32.6

High climate IAM includes

feedbacks from methane release

and weakened carbon sinks as

temperature increases.

Utility discount rate 0.01

Elasticity of marginal utility of

consumption 1

Box 13.1 Stern climate change review 5

Mitigation costs

Bottom-up: 1% of of GDP (range –1 to 3.5%) for cutting to 75% of current

level by 2050 – consistent with stabilisation at 550 ppm CO2e.

Top-down: 1% of GDP (+/- 3%) for an emissions trajectory leading to

stabilisation around 500-550 ppm CO2e.

Target setting in terms of concentrations.

Stern does not try to optimise. Looks ( chapter 13) at dis-aggregated impacts and costs,

and supports with IAM scenario results.

‘the stabilisation goal should lie within the range 450-500 ppm CO2e’

‘550 ppm CO2e would be a dangerous place to be, with substantial risks of very

unpleasant outcome’

aiming below 450 CO2e ‘would impose very high adjustment costs in the near term for

relatively small gains, and might not even be feasible’

Stern argument is based a modified safe minimum standard – a target of 550 ppm CO2e

is affordable and would avoid the worst that can be envisaged. A target of 450 ppm

CO2e would be safer, but would cost a lot more, and may already be infeasible.

The precautionary principle

The precautionary principle is closely related to the modified safe minimum standard and is

gaining widespread acceptance, at the governmental and intergovernmental levels, as a concept

that should inform environmental policy. Statements of the precautionary principle have been

made by a number of governments, by individuals, and as part of inter-national agreements. Thus,

for example, Principle 15 of the June 1992 Rio Declaration is that:

In order to protect the environment, the precautionary approach shall be widely applied by States

according to their capabilities. Where there are threats of serious or irreversible damage, lack of full scientific

certainty shall not be used as a reason for postponing cost-effective measures to prevent environmental

degradation.

Like the SMS, the precautionary principle can be taken as saying that there is a presumption

against going ahead with projects that have serious irreversible environmental consequences,

unless it can be shown that not to go ahead would involve unacceptable costs. The question

which arises is whether there are any policy instruments that are consistent with this approach to

irreversibility and uncertainty, which could constitute a feasible means for its implementation in

such a way as to avoid an outcome that simply prohibits such projects.

Environmental performance bonds 1

Environmental performance bonds have been suggested as a response to the problem of devising a means

of project appraisal which takes on board the ideas behind the SMS and the precautionary principle.

Some firm which wishes to undertake a project involving major technological innovation, so that there is

no past experience according to which probabilities can be assigned to all possible outcomes. In so far as

genuine novelty is involved, there is radical uncertainty in that not all of the possible outcomes can be

anticipated. An example of such a project would have been the construction of the first nuclear power plant.

Assume an environmental protection agency (EPA) without permission from which the firm cannot go

ahead with the project. The EPA takes independent expert advice on the project, and comes to a view about

the worst conceivable environmental outcome of the project’s going ahead. Approval of the project is then

conditional on the firm depositing with the EPA (‘posting’) a bond of $x, where this is the estimate of the

social cost of the worst conceivable outcome.

The bond is fully or partially returned to the firm at the end of the project’s lifetime (defined by the

longest-lasting conceived consequence of the project, not by the date at which it ceases to produce output)

according to the damage actually occurring over the lifetime.

If there is no damage the firm gets back $x, plus some proportion of the interest. The withheld proportion

of the interest is to cover EPA administration costs and to finance EPA research.

If the damage actually occurring is $y, the firm gets back $x – $y, with appropriate interest adjustment.

For $x equal to or greater than $y, the firm gets nothing back, forfeiting the full value of the bond.

Environmental performance bonds 2

The advantages claimed for such an instrument are in terms of the incentives it creates for the firm to

undertake research to investigate environmental impact and means to reduce it, as well as in terms of

stopping projects.

Suppose that the EPA decides on $x as the size of the bond, and that the firm assesses lifetime project net

returns to it as $(x – 1), and accepts that $x is the appropriate estimate of actual damage to arise. Then it will

not wish to go ahead with the project. If, however, the firm took the view that actual damage would be $(x –

2) or less, it would wish to go ahead with the project. The firm has, then, an incentive to itself assess the

damage that the project could cause, and to research means to reduce that damage.

If it does undertake the project it has an ongoing incentive to seek damage-minimising methods of

operation, so as to increase the eventual size of the sum returned to it, $x – $y.

At the end of the project’s lifetime, the burden of proof as to the magnitude of actual damage would rest

with the firm. The presumption would be that the bond was not returnable. It would be up to the firm to

convince the EPA that actual damage was less than $x if it wished to get any of its money back. This would

generate incentives for the firm to monitor damage in convincing ways, as well as to research means to

minimise damage.

In the event that damage up to the amount of the bond, $x, occurred, society would have received

compensation. If damage in excess of $x had occurred, society would not receive full compensation.

$x is to be set at the largest amount of damage seen as conceivable by the EPA at the outset. A socially

responsible EPA would take a cautious view of the available evidence, implying a high figure for $x, so that

society would not find itself uncompensated.