* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download 6.5 Loan Portfolio

Present value wikipedia , lookup

Negative gearing wikipedia , lookup

Federal takeover of Fannie Mae and Freddie Mac wikipedia , lookup

Private equity secondary market wikipedia , lookup

Systemic risk wikipedia , lookup

Investment fund wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Business valuation wikipedia , lookup

Syndicated loan wikipedia , lookup

Financial economics wikipedia , lookup

Investment management wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Securitization wikipedia , lookup

This report contains statements concerning expectations, planned synergies, growth estimates, forecasts

and future strategies related to Banco do Brasil and its subsidiaries, associated companies and affiliates.

Although these statements reflect management's current beliefs, they involve imprecisions and risks that

are difficult to predict, and actual results and events may differ from those anticipated and discussed

herein. These expectations depend materially on market conditions, Brazil’s economic performance and

developments in the banking industry and international markets. Banco do Brasil does not assume any

responsibility to update the estimates contained in this report.

This report contains tables and charts that present financial figures rounded to the nearest million of

Brazilian real. The rounding method used complies with Regulation 886/66 issued by Fundação IBGE: if

the last digit is equal to or greater than 5, the last remaining digit is increased by one unit; and if the last

digit is less than 5, it is discarded and the digit before it is maintained. Variations, in both nominal and

percentage terms, were calculated using numbers in units.

Summary

Summary ............................................................................................................................................. 2

Index of Tables .................................................................................................................................... 4

Index of Figures................................................................................................................................... 7

Presentation ........................................................................................................................................ 9

Summary of Results .......................................................................................................................... 10

1 - Economic Environment ............................................................................................................... 23

2 - BB Securities............................................................................................................................... 29

2.1 Shares...................................................................................................................................... 29

2.2 Warrants .................................................................................................................................. 34

2.3 Stock Performance .................................................................................................................. 35

3 - Corporate Governance ............................................................................................................... 39

4 - Key Statistics............................................................................................................................... 43

5 - Summarized Financial Statements ............................................................................................. 45

5.1 Summarized Balance Sheet .................................................................................................... 45

5.2 Summarized Income Statement – BR GAAP .......................................................................... 47

5.3 Income Statement with Reallocations ..................................................................................... 48

5.3.1 Details of Reallocations ....................................................................................................49

6 - Balance Sheet Analysis .............................................................................................................. 53

6.1 Breakdown ............................................................................................................................... 53

6.2 Analysis of Assets.................................................................................................................... 54

6.3 Securities Portfolio................................................................................................................... 55

6.4 Tax Credits .............................................................................................................................. 56

6.5 Loan Portfolio........................................................................................................................... 57

6.5.1 Individual Customer Loan Portfolio ...................................................................................59

6.5.2 Business Loan Portfolio ....................................................................................................61

6.5.3 Agribusiness Loan Portfolio ..............................................................................................64

6.6 Analysis of Liabilities................................................................................................................ 75

6.7 Liquidity Analysis ..................................................................................................................... 77

6.8 Deposits and Money Market Funding...................................................................................... 78

6.8.1 Foreign Borrowing ............................................................................................................79

7 - Analysis of Results...................................................................................................................... 80

7.1 Net Interest Income ................................................................................................................. 80

7.2 Analysis of Investments ........................................................................................................... 84

7.3 Analysis of Funding ................................................................................................................. 88

7.4 Analysis of Volume and Spread .............................................................................................. 90

7.5 Provision for Credit Risk .......................................................................................................... 92

7.5.1 Retail Loan Portfolio ..........................................................................................................96

7.5.2 SMEs Loan Portfolio .......................................................................................................100

7.5.3 Commercial Loan Portfolio ..............................................................................................101

7.5.4 Agribusiness Loan Portfolio ............................................................................................102

7.5.5 Foreign Trade Loan Portfolio ..........................................................................................106

7.5.6 Foreign Loan Portfolio and Others ..................................................................................107

7.6 Fee Income............................................................................................................................ 108

7.6.1 Revenues from Checking Account Fees .........................................................................109

7.6.2 Asset Management .........................................................................................................110

7.6.3 Cards...............................................................................................................................112

7.6.4 Collection ........................................................................................................................114

7.7 Administrative Expenses ...................................................................................................... .115

7.7.1 Personnel Expenses .......................................................................................................116

7.7.2 Other Administrative Expenses .......................................................................................117

7.7.3 Distribution Network ........................................................................................................118

7.7.4 Automated Channels.......................................................................................................121

7.7.5 Productivity – Coverage Ratios……………………………………………………………….123

7.7.6 Operating Income……………………………………………………………………………… 126

7.8 Net Value Added.................................................................................................................... 129

8 - Risk Management ..................................................................................................................... 130

8.1 Risk Management.................................................................................................................. 130

8.1.1 Market Risk .....................................................................................................................130

8.1.2 Liquidity Risk ...................................................................................................................140

8.1.3 Credit Risk .......................................................................................................................142

8.1.4 Operating Risk ................................................................................................................146

8.2 Capital Structure .................................................................................................................... 148

8.2.1 Shareholders’ Equity .......................................................................................................148

8.2.2 Regulatory Capital ...........................................................................................................149

8.2.3 Economic Capital ............................................................................................................154

9 - Social and Environmental Performance ................................................................................... 156

9.1 Employee Relations............................................................................................................... 157

9.2 Eco-efficiency ........................................................................................................................ 161

9.3 Social Environmental focused Business................................................................................ 164

9.4 Investor Market Recognition .................................................................................................. 168

10 - Strategic Investments ............................................................................................................... 169

10.1

Information ..................................................................................................................... 169

10.2

Income from Insurance, Pension and Savings Bonds ................................................... 170

10.3

Strategic Development................................................................................................... 178

10.3.1 Banco Votorantim ......................................................................................................178

10.3.2 Performance in the State of São Paulo .....................................................................184

10.3.3 Internationalization………………………………………………………………………....186

10.3.4 Business in Progress .................................................................................................188

11 - Financial Statements ................................................................................................................ 190

11.1

Summarized Balance Sheet .......................................................................................... 190

11.2

Summarized Income Statement..................................................................................... 192

11.3

Income Statement with Reallocations............................................................................ 193

Index of Tables

Table 1. Main Equity Items ........................................................................................................................11

Table 2. Loan portfolio (Conglomerate).....................................................................................................11

Table 3. Income statement with reallocations – Main lines.......................................................................13

Table 4. Main Indicators of Income/Expenses ..........................................................................................13

Table 5. NII by business line .....................................................................................................................14

Table 6. Net Interest Margin......................................................................................................................15

Table 7. Loan Portfolio Quality Indicators .................................................................................................16

Table 8. Expenses with Allowance for Loan Losses vs Portfolio ..............................................................16

Table 9. Insurance, Pension Plans and Savings Bonds Income...............................................................17

Table 10. Administrative expenses – Pro forma Comparison ...................................................................18

Table 11. One-off items .............................................................................................................................20

Table 12. Guidance 2010 ..........................................................................................................................22

Table 13. Main Macroeconomic Indicators................................................................................................28

Table 14. Shareholders quantity after and before the Public Offering .....................................................30

Table 15. Ownership Structure.................................................................................................................31

Table 16. Distribution of Dividends/Interest on Own Capital.....................................................................31

Table 17. Shareholders by Range of Shares Owned................................................................................32

Table 18. Breakdown of the Warrant Holders ...........................................................................................34

Table 19. Series "C" Warrants...................................................................................................................34

Table 20. Expected Dilution of Capital ......................................................................................................34

Table 21. Key Statistics .............................................................................................................................43

Table 22. Summarized Balance Sheet – Assets .......................................................................................45

Table 23. Summarized Balance Sheet – Liabilities ...................................................................................46

Table 24. Summarized Income Statement – BR GAAP............................................................................47

Table 25. Income Statement with Reallocations .......................................................................................48

Table 26. Reallocations - Other Operating Income/Expenses ..................................................................50

Table 27. Previ – adjustments ...................................................................................................................51

Table 28. Tax Effects and Statutory Profit Sharing on One-off Items .......................................................52

Table 29. Breakdown of Assets.................................................................................................................54

Table 30. Securities Portfolio by Category ................................................................................................55

Table 31. Securities Portfolio by Maturities – Market Value......................................................................55

Table 32. Breakdown of Tax Credits .........................................................................................................56

Table 33. Acquired Portfolios and Interbank Deposits with Credit Guarantee..........................................57

Table 34. Loan Portfolio ............................................................................................................................58

Table 35. Individuals’ Loan Portfolio .........................................................................................................60

Table 36. Business Loan Portfolio.............................................................................................................61

Table 37. Private Securities – Business....................................................................................................62

Table 38. ACC/ACE Average Volume per Contract..................................................................................62

Table 39. SME Credit Products.................................................................................................................63

Table 40. Exports ......................................................................................................................................65

Table 41. Brazil’s Participation in World Agribusiness ..............................................................................65

Table 42. Agribusiness Loan Portfolio by Region .....................................................................................66

Table 43. Agribusiness Loan Portfolio by Purpose ...................................................................................67

Table 44. Agribusiness Loan Portfolio by Product ....................................................................................68

Table 45. Agribusiness Loan Portfolio by Financed Item..........................................................................68

Table 46. Funds Released for the 09/10 Crop by Customer Size ............................................................68

Table 47. Agribusiness Portfolio by Size...................................................................................................69

Table 48. Equalizable Funds from Agribusiness Portfolio.........................................................................71

Table 49. 2009/2010 Crop Plan ................................................................................................................73

Table 50. Defrayal – Transaction Profile ...................................................................................................73

Table 51. Liabilities....................................................................................................................................75

Table 52. Sources and Uses .....................................................................................................................76

Table 53. Liquidity Balance .......................................................................................................................77

Table 54. Deposits and Money Market Funding .......................................................................................78

Table 55. Foreign Borrowing .....................................................................................................................79

Table 56. Overseas Issues........................................................................................................................79

Table 57. Net Interest Income ...................................................................................................................80

Table 58. Analysis of Volume (Earning Assets) and Quarterly Spread – 1Q10 and 2Q10.......................81

Table 59. Margin, Net of Interest and Profit Margin ..................................................................................83

Table 60. Revenues from Loans Net of Exchange Impact (Res. 2,770)...................................................84

Table 61. NIM ............................................................................................................................................85

Table 62. Securities Income......................................................................................................................86

Table 63. Avg Balance of the BS accounts and onfo. on interest rates – Earning assets (quarterly) ......87

Table 64. Avg Balance of the BS accounts and info. on interest rates – Earning Assets (half-yearly) ....87

Table 65. Avg. Balances of the BS accounts and info. on int. rates – Int. Bearing Liabilities (quarterly) .88

Table 66. Avg. Bal of the BS accounts and info. on int. rates – Int. Bearing Liabilities (half-yearly) ........89

Table 67. Int. increase and decrease (Inc. and Exp.) due to changes in Vol and Rates (quarterly).........90

Table 68. Int. increase and decrease (Inc. and Exp.) due to changes in Vol and Rates (half-yearly) ......91

Table 69. Net Financial Margin .................................................................................................................92

Table 70. Allowance for Loan Losses Expenses over Portfolio ................................................................92

Table 71. Loan Portfolio by Level of Risk..................................................................................................94

Table 72. Delinquency Ratio .....................................................................................................................94

Table 73. Average Portfolio Risk...............................................................................................................95

Table 74. Retail Loan Portfolio by Level of Risk .......................................................................................96

Table 75. Changes in the Allowance – Retail ...........................................................................................97

Table 76. Small and Micro Enterprise Loan Portfolio..............................................................................100

Table 77. Changes in the Allowance – SMEs .........................................................................................100

Table 78. Commercial Loan Portfolio by Level of Risk ...........................................................................101

Table 79. Changes in the Allowance - Commercial ................................................................................101

Table 80. Agribusiness Loan Portfolio by Level of Risk ..........................................................................102

Table 81. Changes in the Allowance – Agribusiness ..............................................................................102

Table 82. Portfolio with and without Roll Over – Agribusiness................................................................103

Table 83. Agribusiness Portfolio Rates ...................................................................................................104

Table 84. Foreign Trade Loan Portfolio by Level Risk ............................................................................106

Table 85. Changes in Allowance – Foreign Trade ..................................................................................106

Table 86. Foreign Loan Portfolio by Risk Level ......................................................................................107

Table 87. Other Transactions Portfolio – Banco Nossa Caixa and Banco Votorantim (50%) ................107

Table 88. Fee Income..............................................................................................................................108

Table 89. Investment Funds and Managed Portfolios by Customer .......................................................111

Table 90. Investment Funds and Managed Portfolios by Type...............................................................111

Table 91. Global Card Revenue..............................................................................................................113

Table 92. Commercial Income ................................................................................................................115

Table 93. Personnel Expenses ...............................................................................................................116

Table 94. Other Administrative Expenses ...............................................................................................117

Table 95. Distribution Network ................................................................................................................118

Table 96. Wholesale Pillar Branches ......................................................................................................119

Table 97. Distribution Network Abroad....................................................................................................120

Table 98. Coverage Ratios – without extraordinary items ......................................................................123

Table 99. Cost Income Ratio – without extraordinary items....................................................................124

Table 100. Operating Income..................................................................................................................126

Table 101. Accumulated Amortization.....................................................................................................127

Table 102. Intangible ...............................................................................................................................128

Table 103. Net Value Added ...................................................................................................................129

Table 104. Balance in Foreign Currency.................................................................................................132

Table 105. Consolidated BB VaR............................................................................................................135

Table 106. Foreign Network’s VaR .........................................................................................................136

Table 107. International Trading Portfolio’s VaR ....................................................................................137

Table 108. Domestic Trading Portfolio’s VaR .........................................................................................138

Table 109. Repricing Profile of Interest Rates – 06/30/2010 ..................................................................139

Table 110. Extended Loan Portfolio ........................................................................................................144

Table 111. Concentration of the Loan Portfolio of the 100 Largest Borrowers .......................................144

Table 112. Concentration of the Loan Portfolio of the 100 Largest Borrowers % in relation to RE ........145

Table 113. Concentration of the Loan Portfolio by Macrossector ...........................................................145

Table 114. Monitoring Operational Losses..............................................................................................147

Table 115. Shareholders’ Equity .............................................................................................................148

Table 116. BIS Ratio – Economic-Financial Conglomerate ....................................................................150

Table 117. Main accounts of the PEPR quota (Economic-Financial Conglomerate)..............................151

Table 118. RRE for Market Risk by Risk Factor .....................................................................................151

Table 119. Allocated Capital for Operational Risk by Line of Business ..................................................151

Table 120. Changes in Composition of BIS Ratio ...................................................................................152

Table 121. Fixed Asset Ratio ..................................................................................................................153

Table 122. Economic Capital ..................................................................................................................154

Table 123. Distribution of Economic Capital in the Loan Portfolio ..........................................................154

Table 124. VaR by Risk Factor ...............................................................................................................155

Table 125. Distribution of Economic Capital for Operating Risk, by Loss Event Category.....................155

Table 126. Scholarships Granted............................................................................................................158

Table 127. Employees Training – Annual Flow.......................................................................................159

Table 128. Quarterly Average Expenses per Employee (Income Statement with Reallocations) ..........160

Table 129. Expenses with Statutory Profit Sharing.................................................................................160

Table 130. Employee Turnover ...............................................................................................................160

Table 131. Use of Water..........................................................................................................................161

Table 132. Use of Paper..........................................................................................................................161

Table 133. Sustainable Regional Development (DRS) ...........................................................................164

Table 134. Microcredit Operations ..........................................................................................................165

Table 135. RSA Loans - Other Programs ...............................................................................................166

Table 136. Investment Funds with RSA criteria ......................................................................................166

Table 137. Complaints Registered in the Central Bank of Brazil ............................................................167

Table 138. Interests in the Capital of Companies ...................................................................................169

Table 139. Insurance, Pension Plans and Savings Bondsans................................................................171

Table 140. Insurance Income Statement by Line of Business ................................................................172

Table 141. Consolidated Insurance Ratio ...............................................................................................174

Table 142. Insurance Ratio by Segment .................................................................................................175

Table 143. Operating Highlights of the Insurance Group........................................................................177

Table 144. Banco Votorantim – Income Statement with Reallocations Highlights .................................179

Table 145. Banco Votorantim – Reallocations (Fee Income)..................................................................180

Table 146. Banco Votorantim – Reallocations (Mark-to-Market - MKT) .................................................180

Table 147. Banco Votorantim – Reallocations (Currencies Fluctuation) ................................................180

Table 148. Banco Votorantim – Equity Highlights ...................................................................................182

Table 149. Banco Votorantim – Loan Portfolio by Level of Risk .............................................................182

Table 150. Banco Votorantim – Delinquency Ratios...............................................................................183

Table 151. Banco Votorantim – Vehicle Loan Portfolio...........................................................................183

Table 152. Banco Votorantim – Operating and Structural Highlights .....................................................183

Table 153. Banco Votorantim – Ratios Highlights...................................................................................183

Table 154. Deposits in the State of São Paulo .......................................................................................184

Table 155. Loan Operations in the State of São Paulo...........................................................................185

Table 156. Banco Patagonia – Income of Statement Highlights.............................................................187

Table 157. Banco Patagonia – Equity Highlights ....................................................................................187

Table 158. Banco Patagonia – Operating and Structural Highlights.......................................................187

Table 159. Banco Patagonia – Returns, Capital and Loan Ratios..........................................................187

Table 160. Review of the Corporate Structure ........................................................................................189

Table 161. Balance Sheet – Assets ........................................................................................................190

Table 162. Balance Sheet – Liabilities ....................................................................................................191

Table 163. Summarized Corporate Law Income Statement ...................................................................192

Table 164. Income Statement with Reallocation .....................................................................................193

Index of Figures

Figure 1. Income (R$ million) and ROE (%)..............................................................................................10

Figure 2. BIS Ratio ....................................................................................................................................19

Figure 3. Dollar/Euro Ratio ........................................................................................................................23

Figure 4. Brazil Risk and Exchange Rate..................................................................................................24

Figure 5. Industrial Production Index.........................................................................................................24

Figure 6. Installed Capacity Usage Index – NUCI.....................................................................................25

Figure 7. Unemployment Rate (% of the Economically Active Population) ..............................................25

Figure 8. Brazilian Economy Volume of Credit Growth.............................................................................26

Figure 9. Price Index - IPCA......................................................................................................................27

Figure 10. Selic Evolution..........................................................................................................................27

Figure 11. Public Offering Breakdown.......................................................................................................29

Figure 12. Geographic localization of Institutional Investors.....................................................................30

Figure 13. Total Free Float Breakdown.....................................................................................................32

Figure 14. Equity Held by Foreign Investors .............................................................................................33

Figure 15. BB Shares vs. Ibovespa...........................................................................................................35

Figure 16. BBAS3 Stock in Ibovespa ........................................................................................................36

Figure 17. Average daily financial trading volume – BBAS3.....................................................................36

Figure 18. Average daily trading volume – BBAS3 ...................................................................................37

Figure 19. Market Ratios ...........................................................................................................................38

Figure 20. Committees, Subcommittees and Commissions - Strategic Level ..........................................40

Figure 21. Earning Assets vs. Interest Bearing Liabilities .........................................................................53

Figure 22. Breakdown of Assets ...............................................................................................................54

Figure 23. Agribusiness Participation in the GDP and in the Labor Market..............................................64

Figure 24. Trade Balance (FOB) ...............................................................................................................65

Figure 25. Production vs. Planted Area.....................................................................................................66

Figure 26. Agribusiness Loan Portfolio by Customer................................................................................69

Figure 27. Agribusiness Loan Portfolio by Funding Sources ....................................................................70

Figure 28. Equalization Revenues and Weighting Factor .........................................................................71

Figure 29. Agricultural Insurance and Proagro .........................................................................................72

Figure 30. Evolution of Operations Contracted with Risk Mitigators .........................................................73

Figure 31. Ratio Price/Cost of Soybean and Maize ..................................................................................74

Figure 32. Liquidity Balance ......................................................................................................................77

Figure 33. Market Share of BB Funding....................................................................................................78

Figure 34. NIM Evolution ...........................................................................................................................82

Figure 35. Securities Portfolio by Index (Multiple Bank) ...........................................................................86

Figure 36. Allowances Breakdown ............................................................................................................93

Figure 37. Overdue above 15 and 90 days ...............................................................................................95

Figure 38. Allowance/Past Due Loans + 90 days – BB x BI (%)...............................................................95

Figure 39. Quarterly Vintage .....................................................................................................................98

Figure 40. Annual Vintage .........................................................................................................................98

Figure 41. Annual Vintage – Vehicle Loan Portfolio – Arena I ..................................................................99

Figure 42. Annual Vintage – Vehicle Loan Portfolio – Arena II .................................................................99

Figure 43. Stratified Agribusiness Portfolio .............................................................................................105

Figure 44. Checking Account Base .........................................................................................................109

Figure 45. Asset Management ................................................................................................................110

Figure 46. Credit and Debit Cards...........................................................................................................112

Figure 47. Card Revenue ........................................................................................................................113

Figure 48. BB Billings Volume.................................................................................................................114

Figure 49. Business vs. Expenses ..........................................................................................................115

Figure 50. Changes in Workforce............................................................................................................116

Figure 51. Total Distribution Network ......................................................................................................119

Figure 52. Automated Teller Machines ...................................................................................................121

Figure 53. Customer Access Options – % ..............................................................................................122

Figure 54. Coverage Rations – whitout extraordinary items – % ............................................................123

Figure 55. Cost Income Ratio – without extraordinary items ..................................................................124

Figure 56. Other Productivity Ratios .......................................................................................................125

Figure 57. Changes in Foreign Exchange Exposure ..............................................................................133

Figure 58. Composition of Banco do Brasil’s assets and liabilities in the country. .................................133

Figure 59. Net Position ............................................................................................................................134

Figure 60. Consolidated BB VaR ............................................................................................................134

Figure 61. Consolidated of the Foreign Network’s VaR ..........................................................................135

Figure 62. VaR of the International Trading Portfolio..............................................................................137

Figure 63. VaR of the Domestic Trading Portfolio...................................................................................138

Figure 64. Reserve Liquidity – National Treasury ...................................................................................140

Figure 65. Reserve Liquidity – Foreign Currency....................................................................................141

Figure 66. DRL Index ..............................................................................................................................141

Figure 67. Measuring and management instruments..............................................................................142

Figure 68. BIS Ratio – Economic-Financial Conglomerate.....................................................................152

Figure 69. Employees Age ......................................................................................................................157

Figure 70. Employees by Length of Service............................................................................................157

Figure 71. Level of Education..................................................................................................................159

Figure 72. Transactions without Use of Paper ........................................................................................162

Figure 73. Toner Consumption – in units ................................................................................................163

Figure 74. PRONAF Portfolio/Proger Rural (R$ million) .........................................................................165

Figure 75. Share of BBAS3 in ISE, ITAG, and IGC ................................................................................168

Figure 76. Change of the Insurance Ratio ..............................................................................................174

Figure 77. Combined Ratio .....................................................................................................................176

Presentation

This Management Discussion and Analysis (MD&A) presents the economic and financial situation of

Banco do Brasil (BB). Geared towards market analysts, stockholders and investors, this quarterly report

addresses topics such as the economic environment and BB's stock performance, corporate

governance practices and risk management. The capital structure and results are analyzed separately.

Moreover, in conformity with the "Triple Bottom Line" concept, the report also presents the Social and

Environmental Performance indicators of Banco do Brasil (Chapter 9) in order to demonstrate the value

these initiatives generate for our shareholders and other stakeholders.

Readers will also find eight tables presenting the historical data series for the period from the

Summarized Balance Sheet, Summarized Corporate Law Income Statement, Income Statement with

Reallocations, Analytical Spread, and other information on profitability, productivity, loan portfolio quality,

capital structure, capital markets and structural data.

According to Paragraph 55 of CVM Resolution 371/2000, Banco do Brasil has decided to adopt, as of

year-end 2009 and on, in consistent and recurring basis, a faster recognition of the actuarial gains and

losses related to Previ Benefit Plan I (Plan I of Previ).

Henceforth, PREVI income will be regarded as recurring and the income arising from surpluses will be

recognized on a quarterly basis. In order to allow comparability of results in the first quarter of 2010 with

previous fiscal years, PREVI income will be segregated in a specific line of the Statement of Income with

Reallocations.

Considering the strategic transactions relevance announced as of the second half of 2008 (acquisitions,

mergers and partnerships), main information details related to the companies associated with business

in course and to transactions already executed is presented in this report, evidencing the transactions

impact on BB's results and producing a (pro forma) simulation of how the Bank's main indicators would

be like if all the companies were consolidated.

Note also that as of 1Q09, all financial statements and management analyses developed are based on

an "Economic Financial Consolidation" view, which provides for the consolidation of all the companies

belonging to the economic group. Prior to this period, the MD&A report featured the consolidation of

financial companies only. For comparability, we inform that the 2008 results presented were prepared

using the same method.

At the end of the report we present the Financial Statements and accompanying notes for the quarter

under analysis.

ON-LINE ACCESS

This Management Discussion and Analysis is also available on Banco do Brasil’s Investor Relations

website. More information about the Bank can also be accessed there, such as: corporate governance,

news, frequently asked questions, a download center with versions of this report for Adobe® Reader®

software. The website also makes available general information, balance sheet analyses, complete

financial statements, and historical data series in Excel, presentations to the market, the Social and

Environment Responsibility Report, the Social Balance Sheet and transcripts of the quarterly earnings

conference calls.

LINKS

Banco do Brasil S.A.

Investor Relations

9 - Banco do Brasil – MD&A 2Q10

bb.com.br

bb.com.br/ri

Summary of Results

Net Income surpasses R$ 5 billion in the first half

Banco do Brasil reported a net income of R$ 5,076 million in the first half, up 26.5% from the same

period of 2009. The result represents annualized return on average equity of 28.7%. Excluding one-off

items, recurring net income was R$ 4,383 million, up 34.9% from the amount recorded in 1H09, and

corresponding to a recurring return on equity of 24.6%.

Considering only the second quarter, the net income was R$ 2,725 million, presenting growth of 15.9%

from 1Q10 and 16.1% from the same prior-year period. The ROE of the quarter was 31.5%. On

recurring basis, net income of the period was R$ 2,327 million, a growth of 13.2% from the previous

quarter and 34.8% in relation to 2Q09. The annualized return on equity was 26.5%.

56.8

33.2

23.8

28.7

28.0

26.2

31.5

27.4

24.6

26.5

23.7

21.6

23.1

22.5

24.2

22.0

4,014 4,383

4,155

1,5231,665

1Q09

2,348

1,7641,979 1,819

1,727

2Q09

3Q09

Recurring Net Income

4Q09

Net Income

5,076

2,0562,351

1Q10

2,725 3,250

2,327

2Q10

ROAE - %

1H09

1H10

Recurring ROAE - %

Figure 1. Income (R$ million) and ROE (%)

Banco do Brasil kept its payout policy of paying 40% of its net income to shareholders. In the quarter,

BB allocated R$565 million to dividends and R$ 525 million to interest on own capital.

10 - Banco do Brasil – MD&A 2Q10

♦ BB consolidates leadership in the financial system with R$ 756 billion in

assets

Banco do Brasil reached R$ 755,706 million in total assets at the end of June, growth of 26.2% in

relation to June 2009 and 4.3% in relation to the previous quarter. The growth of loans and of the

securities portfolio deserves special emphasis in the quarter.

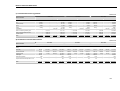

Table 1. Main Equity Items

Chg. %

R$ million

Jun/09

M ar /10

Jun/10

On Jun/09 On M ar /10

Total A ssets

598,839

724,881

755,706

26.2

Loan Portf olio

252,485

305,551

326,522

29.3

6.9

Securities

109,564

119,364

132,249

20.7

10.8

Short-term Interbank Operations

132,438

152,595

132,543

0.1

(13.1)

Deposits

310,846

342,624

343,961

10.7

0.4

Demand Deposits

49,075

54,973

59,025

20.3

7.4

Savings Deposits

69,011

78,719

81,541

18.2

3.6

Interbank Deposits

7,459

10,749

10,436

39.9

(2.9)

185,072

197,934

192,715

4.1

(2.6)

101,508

32,360

157,866

37,646

166,603

39,332

64.1

21.5

5.5

4.5

Time Deposits

Money Market Borrow ing

Shareholder’s Equity

4.3

♦ Loan Portfolio reaches R$ 350 billion

The loan portfolio, based on an amplified concept that includes the guarantees given and private

securities in the portfolio, attained R$ 349,761 million, growth of 6.8% in the quarter and 41.1% in the

year.

The classified loan portfolio (in accordance with CMN Resolution 2682) reached R$ 326,522 million,

recording growth of 29.3% in 12 months and 6.9% in the quarter. The domestic loan portfolio grew

28.2% in the year and 6.6% from 1Q10. Banco do Brasil’s share of the domestic market began to rise

again and reached 20.1%.

The growth in 12 months was benefited by the proportionate consolidation of Banco Votorantim loans,

since 3Q09. However, even using a pro forma comparison basis that simulates the consolidation of BV

as of June, the domestic loan portfolio would record growth of 18.8% in twelve months. All the portfolios

exhibit growth in line with the projections provided by BB to the market.

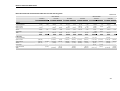

Table 2. Loan portfolio (Conglomerate)

Chg. %

R$ million

Loan Por tfolio

Br azil

Individuals

Payroll Loan

A uto Loans

Businesses

Jun/09

M ar /10

Jun/10

On Jun/09 On M ar /10

252,485

305,551

326,522

29.3

239,418

288,044

307,018

28.2

68,467

95,092

101,122

47.7

6.3

29,533

38,550

40,476

37.1

5.0

6.9

6.6

8,180

21,037

22,774

178.4

8.3

103,351

128,080

135,575

31.2

5.9

SME

39,493

45,215

47,382

20.0

4.8

Other

63,858

82,865

88,193

38.1

6.4

67,600

13,068

64,872

17,507

70,321

19,504

4.0

8.4

49.3

11.4

A gribusiness

Abroad

11 - Banco do Brasil – MD&A 2Q10

♦ Consumer credit surpasses R$ 100 billion

At the end of 2Q10, loans to individuals amounted to R$ 101,122 million, an increase of 47.7% in the

year and of 6.3% in the quarter. Among the most relevant lines of credit, special emphasis is placed on

the growth of payroll loans and of vehicle financing operations, which continue to exhibit expressive

expansion, both in the quarterly comparison and in twelve months. Consumer credit maintained its

relative share at 31% of the total portfolio.

The business portfolio, which represents 41.5% of BB's total portfolio, amounted to R$ 135,575 million in

June 2010, recording growth of 31.2% in the last twelve months and of 5.9% over the previous quarter.

Both in the quarterly comparison and in twelve months, growth was concentrated in operations with

medium and large companies (middle and corporate segments).

The greater growth among loan portfolios in the quarter was observed in the agribusiness and foreign

portfolios, which grew respectively 8.4% and 11.4%. The agribusiness loans performance was

leveraged mainly by the "Trading and Processing of Agricultural and Stockbreeding Products"

operations, which recorded growth of 44.5%, and "BNDES/Finame Rural", with expansion of 17.5%. In

twelve months, the agribusiness portfolio recorded a growth of 4%.

12 - Banco do Brasil – MD&A 2Q10

♦ Recurring income reflects improvement in the operating efficiency

Recurring income in 1H10 registered growth of 34.9% from the same period of 2009, with an emphasis

on the net interest income, which presented expansion of 21.6%.

In 2Q10 the recurring income presented growth of 13.2% from the previous quarter and of 34.8% in

relation to that observed in the same period of 2009. During the quarter, special emphasis is placed on

the growth of service fees and on the control of administrative expenses, which were accompanied by a

decrease in expenses with allowance for loan losses (reflecting an improvement in the quality of the

portfolio and reduction of delinquency rates). The net interest income continues growing, although at a

slower pace than that observed in the previous quarters.

The table below, extracted from the income statement with reallocations, presents the main highlights of

the period. The breakdown of reallocations can be seen in Section 5.3.1 of this Management Discussion

& Analysis.

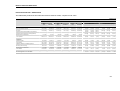

Table 3. Income statement with reallocations – Main lines

Quarterly Flow

R$ million

Financial Interm ediation Incom e

Loan operations + Leasing

Securities

Financial Interm ediation Expenses

Net Interest Incom e

2Q09

1Q10

Chg. %

2Q10

Half-yearly Flow

On 2Q09 On 1Q10

1H09

1H10

Chg. %

On 1H09

16,037

18,562

19,512

21.7

5.1

31,297

38,075

21.7

10,281

12,721

13,195

28.3

3.7

19,370

25,916

33.8

5,644

5,195

(0.4)

(7.9)

10,945

10,839

(1.0)

(9,205) (10,052)

33.1

9.2 (15,825) (19,257)

21.7

21.6

5,215

(7,550)

8,487

9,357

9,461

11.5

1.1

15,472

18,817

(3,172)

(3,026)

(2,871)

(9.5)

(5.1)

(5,663)

(5,897)

4.1

5,316

6,331

6,590

24.0

4.1

9,809

12,920

31.7

3,436

Income f/ Insurance, Pension Plans and Savings Bonds 471

Contribution Margin

8,417

3,634

3,954

15.1

8.8

6,379

7,588

19.0

440

468

(0.6)

6.3

775

909

17.3

9,567

10,103

20.0

5.6

15,539

19,670

26.6

Allow ance for Loan Losses

Net Financial Margin

Fee income

Administrative expenses

(4,892)

(5,300)

(5,471)

11.8

3.2

(8,823) (10,771)

22.1

Personnel Expenses

(2,613)

(2,851)

(2,937)

12.4

3.0

(4,742)

(5,788)

22.0

Other Administrative Expenses

(2,279)

(2,449)

(2,534)

11.2

3.5

(4,080)

(4,983)

22.1

3,518

4,241

4,598

30.7

8.4

6,667

8,839

32.6

(152)

(238)

35

-

-

(247)

(203)

(18.0)

107

(212)

(274)

-

29.4

5

(485)

-

(740)

(379)

(491)

(33.6)

29.6

(1,294)

(870)

(32.8)

41.5

Com m ercial Incom e

Legal Claims

Labor Law suits

OtherOperating Income

Incom e Before Taxes

2,744

3,415

3,884

41.6

13.7

5,157

7,299

Income and Social Contribution Taxes

(771)

(1,053)

(1,194)

54.9

13.4

(1,459)

(2,247)

54.0

Corporate Profit Sharing

(220)

1,727

(307)

2,056

(363)

2,327

64.7

34.8

18.2

13.2

(423)

3,250

(670)

4,383

58.4

34.9

Recurring Net Incom e

Table 4. Main Indicators of Income/Expenses

Indicator s - %

2Q09

1Q10

2Q10

Global Spread¹

7.3

6.5

Ex pens es w ith A llow anc e f or Loan Los ses ov er Portf olio²

4.2

4.5

4.1

Ef f iciency Ratio³

42.3

44.3

42.7

Rec urring Return on Equity ¹

23.7

30.6

24.2

33.9

26.5

33.9

Ef f ectiv e Rate of Tax

6.5

(1) Annualized Indicators.

(2) Expenses with Allowance for Loan Losses in the last 12 months divided by the average portfolio in the same period.

(3) Extraordinary effects excluded.

13 - Banco do Brasil – MD&A 2Q10

♦ Net Interest Income continues expanding

The net interest income of Banco do Brasil reached R$ 18,817 million in the first half, which represents

an increase of 21.6% from 1H09. The performance reflects the growth of assets, especially of the loan

portfolio, in addition to Nossa Caixa (BNC) and Votorantim (BV) acquisition.

In 2Q10 the NII recorded growth of 1.1% over the previous quarter and of 11.5% over the same period

of 2009. The change over the previous quarter results from business expansion, especially the loan

portfolio. However, this growth was limited by the behavior of the net interest margin, as will be detailed

further on.

The table below presents the breakdown of the net interest income. The contribution of the loan portfolio

in its main lines is highlighted, and it also segregates the amounts corresponding to income from the

written-offs recovery and those related to remunerated compulsory deposits. The “Other” item,

comprised mainly of treasury income resulting from transactions with securities, derivatives and foreign

exchange, completes the composition of the NII.

The changes promoted by the Central Bank in the compulsory deposit rules produced two different

impacts on the financial statements of BB for 2Q10. On one hand there was decrease of liquidity, as a

result of the rise in rates, which reduces the resources available for more profitable investments. On the

other hand, there was a change in the form of collection, which implied migration of resources from the

securities portfolio to compulsory deposits. These movements explain the growth observed on the

"Remunerated Compulsory" line of the table below, and are better detailed in chapter 7.1 of the MD&A.

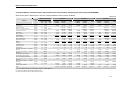

Table 5. NII by business line

Quarterly Flow

R$ million

2Q09

1Q10

Chg. %

2Q10

On 2Q09

On 1Q10

Half-yearly Flow

Chg. %

1H09

On 1H09

1H10

Net Interest Incom e

8,487

9,357

9,461

11.5

1.1

15,472

18,817

21.6

Loan Operations

5,826

6,924

6,904

18.5

(0.3)

10,744

13,829

28.7

Individuals

3,097

3,926

3,967

28.1

1.0

5,412

7,893

45.8

Businesses

1,827

2,052

1,927

5.5

(6.1)

3,514

3,979

13.2

902

946

1,010

12.1

6.8

1,818

1,957

7.6

2,662

2,432

2,556

(4.0)

5.1

4,728

4,989

5.5

213

274

917

330.5

234.7

389

1,192

206.6

531

1,918

631

1,528

757

882

42.7

(54.0)

20.1

(42.3)

887

3,452

1,388

2,410

56.4

(30.2)

Agribusiness

Other

Remunerated Compulsory

Recovery of Write-offs

Other

The net interest margin (NIM) was 6.4% in the first half, a 50 basis points decrease in relation to the

same period of previous year. In the quarter, the net interest margin was 6.5%, keeping the same level

observed in the previous quarter and a decrease of 80 basis points in relation to 2Q09.

The behavior of the NIM in 2Q10 is direct associated to the decrease in the spread on loans operations,

which was of 9.7%, recording decrease of 20 basis points in comparison with the 1Q10 and of 70 basis

points from the same period of 2009.

In the quarter, the 80 basis points downslide in spread on loans contracted by individuals and 50 basis

points in the business portfolio occurred due to mix changes, increasing the relative share of operations

with lower risk and therefore lower spread. In the individuals portfolio, there was an increased share of

payroll loans in the total portfolio. In the business portfolio, there was a faster growing in the operations

with medium and large companies. Furthermore, a larger share of loans for micro and small companies

have been contracted with the guarantee of the FGO.

The perception that the NIM oscillation is caused by mix changes in the portfolios, with greater shares of

lower risk transactions, is supported by the indicator " Risk Adjusted NIM ", calculated based on the ratio

of net financial margin and earning assets. Besides the net interest income, the risk-adjusted NIM

14 - Banco do Brasil – MD&A 2Q10

considers allowance for loan losses expenses. The indicator ended the 2Q10 in 4.5%, the same level

observed in 2Q09 and a 10 basis points increase over the previous quarter.

Table 6. Net Interest Margin

%

2Q09

L o an Op e r atio n s

Indiv iduals

1Q10

2Q10

1H09

1H10

10.4

9.9

9.7

10.0

9.7

21.2

18.2

17.4

20.4

17.4

Bus ines s es

7.5

6.7

6.2

7.3

6.4

A gribus ines s

5.5

5.6

6.0

5.6

5.8

Oth e r

Ne t In te r e s t M ar g in (NIM )

Ris k A d ju s te d NIM

15 - Banco do Brasil – MD&A 2Q10

4.4

3.3

3.4

3.0

3.3

7.3

4.5

6.5

4.4

6.5

4.5

6.9

4.4

6.4

4.4

♦ Loan default decrease sharply and approaches the pre-crisis level

Default intensified the downtrend during the quarter and approached the levels observed in 2008. All the

main delay ratios presented significant improvement. The ratio between operations past due 90 days

and the loan portfolio ended the quarter at 2.7%, down 40 basis points in the quarter and 60 basis points

in relation to June 2009. This is the lowest level of the historical series since December 2008.

Transactions past due 60 days represent 3.1% of the portfolio at the end of June. This percentage is 50

basis points lower than that recorded in March and 70 basis points below that verified in June 2009.

Table 7. Loan Portfolio Quality Indicators

%

Jun/09

M ar /10

Jun/10

A llow ance/Loan Portf olio

7.0

6.0

5.5

Past due loans + 60 days /Total Portf olio (% )

3.8

3.6

3.1

Past due loans + 90 days /Total Portf olio (% )

3.3

3.1

2.7

A llow ance/Pas t Due Loans + 60 day s

187.2

167.4

176.1

A llow ance/Pas t Due Loans + 90 day s

214.0

5.9

194.7

5.1

203.9

5.0

7.2

4.4

6.7

4.0

6.2

3.7

A verage Risk BB

A verage Risk – Banking Industry

Trans ac tions ov erdue + 90 day s/Total Portf olio – Banking Industry

In line with the improvement observed in the portfolio quality, there was a decrease in expenses with

allowance for loan losses. Expenses reached R$ 2,871 million in the quarter, which represents a

downslide of 5.1% in comparison to the previous quarter and of 9.5% against expenses observed in

2Q09. The indicator that measures the ratio between expenses with allowance for loan losses

cumulative in twelve months and the average loan portfolio of the same period ended 2Q10 at 4.1%,

against 4.5% in the previous quarter and 4.2% in 2Q09.

Table 8. Expenses with Allowance for Loan Losses vs Portfolio

R$ million

2Q09

1Q10

2Q10

(A ) A llow ance f or Loan Losses - Quarterly

(3,172)

(3,026)

(2,871)

(B) A llow ance f or Loan Losses - 12 Months

(9,241)

(12,164)

(11,864)

(C) Loan Portf olio

252,485

305,551

326,522

(E) A verage Portf olio – 3 Months

246,363

219,071

304,936

269,466

316,005

287,413

1.3

4.2

1.0

4.5

0.9

4.1

(E) A verage Portf olio – 12 Months

Expenses over Portf olio (A /D) - %

Expenses over Portf olio (B/E) - %

In spite of the improvement in the default ratios and the noticeable improvement in the economic and

business environment, Banco do Brasil kept its policy of prudence regarding the allowance for loan

losses and the percentage of portfolio coverage. The balance of allowance for loan losses ended the

quarter at R$ 18,088 million, which provides coverage of 204% of operations past due 90 days.

In the quarter, there was reduction of R$ 833 million in the balance of additional allowance for loan

losses. The change in the period is due to the following factors:

•

Reversion of nearly R$ 332 million in addition allowance for Rural operations. This accounting was

treated as an one-off item in the recurring net income for the quarter. Additional details can be seen

in chapter 7.5 of this MD&A.

16 - Banco do Brasil – MD&A 2Q10

•

The remaining changes are merely related to additional allowance balance reclassification to

required allowances and are not considered as reversion of provisioned amounts. For further details

see chapter 7.5.

♦ Fee Income presents robust growth

Fee income totaled R$ 7,588 million in 1H10, an increase of 19.0% from 1H09. Considering only 2Q10,

these revenues reached R$ 3,954 million, up 8.8% over the previous quarter and 15.1% versus the

same period of 2009.

Comparing with the 1H09, the performance was benefited from the consolidation of incomes of Banco

Votorantim (BV), which acquisition of interest was completed at the end of September 2009, and by the

incomes provided by Banco Nossa, which were accounted for 2009 results only since April. However,

even using a pro forma basis of comparison, which considers the consolidation of BV and BNC

throughout the 2009 year, the fee income of the conglomerate would have recorded expansion of 12.3%

comparing 2Q10 and 2Q09 and 10.8% comparing 1H10 and 1H09. The performance of the first half is

higher than the fee income Guidance growth provided by BB to the market (7% to 10%).

The loan and checking account fees grew respectively 34.3% and 12.6% over 1Q10. There was no

repricing or creation of new fees in the period. This good performance was possible due to business

expansion and adoption of measures with the purpose of improving the receivable fees management,

enhancing charging effectiveness.

Insurance, pension and savings bonds business were the highlight among fee income and recorded

growth of 79.2% in the quarter and 62.2% in comparison with 2Q09. Besides fee incomes, insurance

operations also generated net income of R$ 468 million in the quarter, 0.6% lower than in the same

quarter of 2009 but 6.3% higher than that recorded in 1Q10. In the first half, the net income from

insurance operations reached R$ 909 million, growth of 17.3% over that observed in the same prior-year

period.

Table 9. Insurance, Pension Plans and Savings Bonds Income

Quarterly Flow

R$ million

Fee Incom e

2Q09

1Q10

Chg. %

2Q10

On 2Q09

On 1Q10

Half-yearly Flow

Chg. %

1H09

On 1H09

1H10

3,436

3,634

3,954

15.1

8.8

6,379

7,588

19.0

Account Fees

863

875

985

14.1

12.6

1,587

1,861

17.2

Credit / Debit Cards

571

712

727

27.3

2.1

1,140

1,439

26.2

Investment Fund Management Fees

506

537

575

13.5

7.1

952

1,112

16.8

Loan Fees

344

307

413

19.8

34.3

654

720

10.0

Collections

284

288

302

6.5

4.9

541

591

9.2

Insurance, Pension Plans and Savings Bonds

117

106

190

62.2

79.2

187

296

58.3

Billings

120

143

141

18.0

(1.1)

230

284

23.2

Interbank

122

130

137

12.1

5.2

241

267

10.5

Capital Market Fees

138

106

98

(28.5)

(7.1)

180

204

13.8

371

Insurance, Pension Plans and Savings Bonds Incom

471

e

430

440

386

468

4.0

(0.6)

(10.4)

6.3

667

775

816

909

22.3

17.3

Other

17 - Banco do Brasil – MD&A 2Q10

♦ Expenses control surpasses estimates: administrative expenses below the

Guidance

Administrative Expenses, which include personnel expenses and other administrative expenses,

amounted to R$ 10,771 million in the 1H10, an increase of 22.1% over the same prior-year period. In

2Q10 administrative expenses reached R$ 5,471 million, 3.2% higher than that observed in the previous

quarter, with growth of 3.0% in personnel expenses and 3.5% in other administrative expenses.

As is the case of fee income, the comparison with 1H09 and 2Q09 is impaired by the consolidation of

Nossa Caixa (since 2Q09) and Votorantim (since 4Q09). The table below was prepared for this reason

and contains a pro forma basis of comparison for the periods of 2009, simulating the consolidation of the

banks acquired throughout the whole year. The table also segregates expenses incurred by BB + BNC,

from those incurred by the other associated and subsidiary companies, which present differentiated

growth dynamics.

In the pro forma comparison, also used for the 2010 Guidance monitoring, BB's expenses in 1H10

presented growth of 9.1% over the same period of 2009, percentage below the estimates range that

appears in projections provided to the market.

Considering only BB + BNC (Multiple Bank) expenses, administrative expenses of the first half are up

8.2% from 1H09. In the quarterly comparison the expenses expansion was 1.6% from 1Q10 and 6.2%

from 2Q09.

•

The performance, both in the quarterly and half-yearly comparison, resulted of an intense effort to

control expenses. This is proven by the Multiple Bank other administrative expenses performance

that grew only 6.1% in the comparison between 1H10 and 1H09. This percentage is low, given the

effect of inflation on service agreements and the organic growth of operations.

Once the other conglomerate companies operate in segments with a fast pace of growth, or in sectors in

which BB is structuring/restructuring its activities, they exhibited slightly stronger growth in their

expenses.

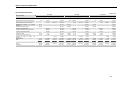

Table 10. Administrative expenses – Pro forma Comparison

Quar te r ly Flow

Chg. %

R$ million

2Q09

1Q10

2Q10

BB + BNC ¹

Personnel Ex pens es

(4,650)

(2,529)

(4,859)

(2,688)

(4,937)

(2,751)

Other A dministrative Expenses

(2,120)

(2,171)

(2,186)

(444)

(441)

(534)

Personnel Ex pens es

(159)

(163)

(186)

Other A dministrative Expenses

(285)

(278)

(348)

(5,094)

(2,688)

(2,405)

(5,300)

(2,851)

(2,449)

(5,471)

(2,937)

(2,534)

Othe r Affiliate d Com panie s ²

BB Cons olidate d

Personnel Ex pens es

Other A dministrative Expenses

(1)

(2)

Half-ye ar ly Flow

On 2Q09 On 1Q10

Chg. %

1H09

1H10

1.6

2.4

(9,051)

(4,944)

(9,796)

(5,439)

3.1

0.7

(4,107)

(4,357)

6.1

20.4

21.1

(826)

(976)

18.1

16.8

14.1

(295)

(349)

18.1

22.4

25.3

(531)

(627)

18.1

7.4

9.2

5.4

3.2

3.0

3.5

(9,877)

(5,239)

(4,638)

(10,771)

(5,788)

(4,983)

9.1

10.5

7.5

6.2

8.8

On 1H09

8.2

10.0

"BB + BNC" line includes branches in the country and abroad, BESC BI, BBDTVM, BB Leasing, Banco Popular and the foreign subsidiaries.

"Other Companies" line includes non-financial associated/subsidiary companies and Banco Votorantim.

18 - Banco do Brasil – MD&A 2Q10

♦ BIS ratio supports expansion of operations

Banco do Brasil's capital ratio (K) ended June 2010 at 12.8, a 90 basis points decrease over March

2010. The BIS ratio presented indicates an excess of reference equity of R$ 8,685 millions, allowing for

an increase of up to R$ 79 billion in credit assets, considering a 100% weighting.