* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Mirae Asset Securities (USA) Inc.

Survey

Document related concepts

Peer-to-peer lending wikipedia , lookup

Systemic risk wikipedia , lookup

Investment fund wikipedia , lookup

Financialization wikipedia , lookup

Collateralized debt obligation wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Financial economics wikipedia , lookup

Investment management wikipedia , lookup

Short (finance) wikipedia , lookup

Credit rating agencies and the subprime crisis wikipedia , lookup

Financial Crisis Inquiry Commission wikipedia , lookup

Auction rate security wikipedia , lookup

Amman Stock Exchange wikipedia , lookup

Securitization wikipedia , lookup

Transcript

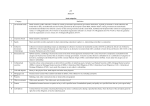

Mirae Asset Securities (USA) Inc. “BUILDING A GLOBAL FOOTPRINT THROUGH REPO, SECURITIES L ENDING, PRIME BROKERAGE, AND CORRESPONDENT CLEARING BUSINESSES” Contents 1. Firm 2. Opportunity 3. Strategic Plan 4. New Businesses 5. Corporate Structure 6. Management Bios MIRAE ASSET SECURITIES (USA) INC. DAEWOO SECURITIES (AMERICA) INC. 2 2 Firm ▪ Mirae Asset Securities (USA) Inc. is ultimately owned by Mirae Asset Financial Group. ▪ The parent firm is in the process of completing the acquisition of Mirae’s current parent (Mirae Asset Daewoo Co., Ltd.). ▪ Mirae Asset Financial Group is headquartered in Seoul, South Korea. ▪ As of June 30, 2016, Mirae Asset Financial Group had: ◦ Assets under management of $92 billion ◦ Wealth management-related assets of $193 billion ◦ Insurance services operations with $27 billion of assets ◦ Broker-dealer affiliates totaling $6 billion of capital ▪ The firm has a global presence with offices in 15 markets, including the US, UK, China, India, Australia, Singapore, Hong Kong and Brazil. ▪ Mirae Asset Daewoo Co., Ltd. is publicly traded on the KOSPI (KRX: 006800) is rated Baa2 long term by Moody’s. ▪ We have successfully completed FINRA’s CMA process to become self-clearing. ▪ To capitalize itself to conduct the new businesses, the parent made an equity capital infusion into the U.S. subsidiary of $250 million in December 2016. MIRAE ASSET SECURITIES (USA) INC. 3 Opportunity ▪ The global financial crisis caused several leading U.S.-based investment banks to be reconstituted as bank holding companies to receive governmental bailout protection. ▪ These firms became subject to expanded regulatory oversight and must directly adhere to Basel III and Dodd Frank. ▪ These has impacted the Repo, Securities Lending, Prime Brokerage and Correspondent Clearing activities of these firms by: Requiring higher levels of equity, thus limiting access to their balance sheet by sophisticated professional investors; Rendering less liquid and balance sheet-intensive strategies more difficult to support: - Clients therefore have been instructed to modify their strategies to suit their ROA/ROE targets; - Hold cash elsewhere and/or leave. Placing restrictions on proprietary trading. MIRAE ASSET SECURITIES (USA) INC. 4 Strategic Plan ▪ Mirae Securities (USA) plans to develop a leading institutional capital markets platform to service professional investors with complex needs, who supply/use capital globally. This will require the firm to become self-clearing. ▪ These professional investors will include: Central Banks Hedge Funds Sovereign Wealth Funds Broker-dealers Insurance Companies Proprietary Traders Pension Funds Family Offices Endowments Investment Advisers ▪ We will target professional investors that/whose: ◦ Typically transact in highly rated and liquid securities ◦ Impact on our balance sheet/liquidity is understood/manageable ◦ Customer needs are consistent with our operational framework and compliance/risk profiles ◦ Best industry practices will be implemented for all aspects of the new businesses. MIRAE ASSET SECURITIES (USA) INC. 5 New Businesses ▪ To support the complex needs of professional investors, Mirae Securities (USA) seeks to enter the following low risk businesses: Repo Securities Lending Prime Brokerage Correspondent Clearing Agency Execution Corporate Access ▪ Mirae Securities (USA)’s edges include: ◦ We are not a bank; ◦ Possess a strong balance sheet; ◦ Are backed by a strong, well respected parent; ◦ A seasoned and well connected management team; ◦ Leading-edge systems. DAEWOO SECURITIES (AMERICA) INC. MIRAE ASSET SECURITIES (USA) INC. 6 Corporate Structure MIRAE ASSET SECURITIES (USA) INC. 7 Management Team Bios Richard J. Misiano ◦ Role: Head Trader Fixed Income Sales and Trading, Head of Fixed Income Finance and Correspondent Clearing ◦ Years of Experience: 21 Years (1995) ◦ Primary Expertise: Fixed Income sales and trading ◦ Firm History: Industrial and Commercial Bank of China’s Financial Services; ING Financial Markets LLC; Commerzbank Capital Markets; Westdeutsche Landesbank; UBS AG; Warburg Dillon Read, LLC; Citicorp Securities Inc. ◦ Licenses: Series 7, 63, 24 Robert E. Akeson ◦ Role: Chief Operating Officer(Operations & Risk/Credit)/Co-head Equities Prime Brokerage and Clearing; ◦ Years of Experience: 36 Years (1980) ◦ Primary Expertise: Firm and risk management, Prime Brokerage and Correspondent Clearing; ◦ Firm History: Industrial and Commercial Bank of China’s Financial Services; Neuberger Berman; Morgan Stanley; ADP (“Broadridge Solutions”) ◦ Licenses: Series 7, 9, 10, 63, 24, 79, 99 Peter F. Volino ◦ Role: Co-head Group; Head Trader Equities Securities Lending and Finance ◦ Years of Experience: 30 Years (1986) ◦ Expertise: Securities Lending and Equity Finance ◦ Firm History: Industrial and Commercial Bank of China’s Financial Services: Wedbush Securities; Cantor Fitzgerald & Co; TD Securities USA Inc.; Fidelity Investments; Nomura Securities; First Marathon America, Inc.; and A.G. Edwards & Sons ◦ Licenses: Series 7, 63, 99 MIRAE ASSET SECURITIES (USA) INC. DAEWOO SECURITIES (AMERICA) INC. 8 NEW BUSINESS ACTION PLAN 2016-2017 Management Team Bios (continued) Hyoseok Chae ◦ Role: President ◦ Years of Experience: 17 Years (1999) ◦ Primary Expertise: Equity Sales, Equity Finance and Marketing ◦ Firm History: Daewoo Securities and Daewoo Securities (America) Inc. ◦ Licenses: Series 7, 24 Sanghyun Bae ◦ Role: Chief Financial & Compliance Officer ◦ Years of Experience: 22 Years (1994) ◦ Primary Expertise: Compliance and financial and operations management ◦ Firm History: Newedge, Merrill Lynch, Citi Bank; Korea Long Term Credit Bank ◦ Licenses: Series 7, 24, 27, 55, 65, 99 MIRAE ASSET SECURITIES (USA) INC. DAEWOO SECURITIES (AMERICA) INC. 9 NEW BUSINESS ACTION 9 PLAN 2016-2017 Management Team Bios (continued) Brandon E. Angus ◦ Role: Chief Technology Officer ◦ Years of Experience: 20 Years (1996) ◦ Primary Expertise: Technology, Product Development, Prime Brokerage and Correspondent Clearing ◦ Firm History: : Industrial and Commercial Bank of China’s Financial Services; Pershing LLC; Jefferies & Co.; Neuberger Berman; Charles Schwab Lou De Simone ◦ Role: Head of Operations ◦ Years of Experience: 35 years (1981) ◦ Expertise: Operations Equities, options, Margin Credit and Risk. Prime Brokerage, Institutional Credit and Correspondent Clearing ◦ Firm History: Industrial and Commercial Bank of China, Jefferies and Co., Banc of America Securities, ING, Neuberger Berman and Morgan Stanley ◦ Licenses: Series 99 Peter A. Marrinan ◦ Role: Chief Risk Officer and Credit Officer ◦ Years of Experience: 29 Years (1987) ◦ Expertise: Credit analysis, correspondent clearing, prime brokerage and risk management ◦ Firm History: Convergex Group, Apex Clearing Corp., Broadridge Financial Solutions, Inc., Bear Stearns & Co., Morgan Stanley & Co. ◦ Licenses: Series 99 MIRAE ASSET SECURITIES (USA) INC. DAEWOO SECURITIES (AMERICA) INC. 10 NEW BUSINESS ACTION10 PLAN 2016-2017 End of Document Mirae Asset Securities (USA) Inc. 810 7th Avenue New York, NY, 10019