* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download 1 AC411 Solution E8-9 Preliminary computations of fair value

History of private equity and venture capital wikipedia , lookup

Internal rate of return wikipedia , lookup

Short (finance) wikipedia , lookup

Private equity wikipedia , lookup

Private money investing wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

International investment agreement wikipedia , lookup

Private equity secondary market wikipedia , lookup

Investment management wikipedia , lookup

Investment banking wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Capital gains tax in Australia wikipedia , lookup

Leveraged buyout wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

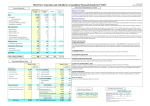

AC411 Solution E8-9 Preliminary computations of fair value — book value differentials: April 1, 2009 acquisition Cost of 4,000 shares (20% interest) $ 64,000 Implied total fair value of Sum ($64,000 / 20%) $320,000 Book value of Sum on april 1 acquisition date: Beginning stockholders’ equity $280,000 20,000 Add: Income for 3 months ($80,000 × ¼ year) Stockholders’ equity April 1 300,000 Goodwill $ 20,000 July 1, 2010 acquisition Cost of 8,000 shares (40% interest) Implied total fair value of Sum ($164,000 / 40%) Book value on July 1 acquisition date: Beginning stockholders’ equity Add: Income for 6 months ($80,000 × 1/2 year) Less: Dividends May 1 Stockholders’ equity July 1 Goodwill (amount is unchanged by this transaction) 1 2 3 4 $164,000 $410,000 $360,000 40,000 (10,000) 390,000 $ 20,000 Income from Sum 2009 Income from Sum for 2009 ($80,000 × 20% × 3/4 year) $ 12,000 2010 Income from Sum for 2010 20% share of reported income ($80,000 × 20%) 40% share of reported income ($80,000 × 40% × 1/2 year) Income from Sum $ 16,000 16,000 $ 32,000 Noncontrolling interest December 31, 2010 (($420,000 book value + $20,000 goodwill)× 40%) $176,000 Preacquisition income (does not appear in come statement) Sum income Time before acquisition Percent acquired in 2010 Preacquisition income ($80,000 × .5 × .4) $ 80,000 1/2 40% $ 16,000 Investment balance at December 31, 2010 Cost of 20% investment Income from Sum for 2009 Cost of 40% investment Income from Sum for 2010 Less: Dividends ($2,000 + $6,000) Investment in Sum $ 64,000 12,000 164,000 32,000 (8,000) $264,000 Check: Share of Sum’s December 31, 2010 equity ($420,000 × 60%) Add: 60% of $20,000 Goodwill Investment in Sum $252,000 12,000 $264,000 1 Solution E8-10 Preliminary computations Investment cost July 1, 2010 $675,000 Implied total fair value of Sandridge ($675,000 / 90%) Less: Book value of Sandridge at acquisition: Equity of Sandridge Mines December 31, 2009 Add: Income for 1/2 year Equity of Sandridge Mines July 1, 2010 Excess (book value = underlying equity) $750,000 1 $700,000 50,000 750,000 0 Investment income from Sandridge Mines Income from Sandridge — 2010 ($100,000 × 1/2 year × 90%) Income from Sandridge — 2011: January 1 to July 1 ($80,000 × 1/2 year × 90%) July 1 to December 31 ($80,000 × 1/2 year × 80%) $ 45,000 $ 36,000 32,000 $ 68,000 Investment in Sandridge Mines Cost July 1, 2010 Add: Income from Sandridge — 2010 Less: Dividends paid in December ($50,000 × 90%) $675,000 45,000 (45,000) Investment balance December 31, 2010 675,000 Less: Book value of 1/9 interest sold on July 1, 2011a Add: Income from Sandridge — 2011 Less: Dividends paid in December ($30,000 × 80%) a (79,000) 68,000 (24,000) Investment balance December 31, 2011 $640,000 Sale of 10% interest July 1, 2011: Equity of Sandridge Mines December 31, 2009 Add: Income less dividends — 2010 Add: Income for 1/2 year — 2011 Equity of Sandridge Mines July 1, 2011 Interest sold $700,000 50,000 40,000 790,000 10% Underlying equity of interest sold $ 79,000 Gain on sale of 1/9 interest ($85,000 proceeds - $79,000) $ Since Piccolo maintains a controlling interest, the gain is not recorded, but shown as an adjustment to additional paid-in capital. 6,000 2 2 Noncontrolling interest share Noncontrolling interest share — 2010: ($100,000 income × 10% interest) $ 10,000 Noncontrolling interest share — 2011: ($80,000 × 1/2 year × 10%) + ($80,000 × 1/2 year × 20%) $ 12,000 Noncontrolling interest December 31, 2010 Equity of Sandridge Mines January 1 Add: Income less dividends for 2010 Equity of Sandridge Mines December 31 Noncontrolling interest percentage $700,000 50,000 750,000 10% Noncontrolling interest December 31 Noncontrolling interest December 31, 2011 Equity of Sandridge Mines January 1 Add: Income less dividends for 2011 Equity of Sandridge Mines December 31 Noncontrolling interest percentage Noncontrolling interest December 31 $ 75,000 $750,000 50,000 800,000 20% $160,000 Solution E8-11 Preliminary computations: Investment cost January 1, 2010 Implied total fair value of Sanyo ($690,000 / 75%) Book value of Sanyo Excess fair value over book value = Goodwill 1 690,000 $ 920,000 (800,000) $ 120,000 Underlying book value December 31, 2010 $1,000,000 equity × 75% 2 $ $ 750,000 $ 690,000 Percentage ownership before purchase of additional shares 30,000 shares owned/40,000 shares outstanding = 75% interest Percentage ownership after purchase of additional shares 40,000 shares owned/50,000 shares outstanding = 80% interest 3 Investment in Sanyo balance January 3, 2011 Investment cost January 1, 2009 Add: Share of Sanyo’s income less dividends for 2009 ($200,000 × 75%) Investment in Sanyo December 31, 2009 Add: Additional investment — January 3, 2011 (10,000 shares × $30) Investment in Sanyo balance January 3, 2011 150,000 840,000 300,000 $1,140,000 3 4 Percentage ownership if shares sold to outside entities 30,000 shares owned/50,000 shares outstanding = 60% interest 5 Investment in Sanyo balance January 3, 2011 Investment in Sanyo December 31, 2009 (see 3 above) Add: Increase in book value from change in ownership interest: Book value after additional 10,000 shares were issued ($1,300,000 equity × 60%) Book value before additional 10,000 shares were issued ($1,000,000 equity × 75%) Investment in Sanyo balance - January 3, 2011 $ 840,000 $ 30,000 870,000 $780,000 (750,000) Solution E8-12 Preliminary computations: Cost of additional investment (2,000 shares × $80) $160,000 Implied total fair value of Saton $160,000 / (2,000/12,000) Less: Book value of Saton after issuance Excess fair value over book value $960,000 710,000 $250,000 January 2, 2010 Investment in Saton 160,000 Cash 160,000 To record purchase of additional 2,000 shares of Saton. December 2010 Cash 50,000 Investment in Saton 50,000 To record receipt of dividends ($60,000 × 10,000/12,000 shares). December 31, 2010 Investment in Saton 75,000 Income from Saton To record income from Saton($90,000 × 10,000/12,000). 75,000 Solution P8-4 Entries on Panama’s books to reflect the change in ownership interest: Option 1 Panama sells 30,000 shares of Shenandoah Cash 1,500 Investment in Shenandoah 870 Additional paid-in capital 630 To record sale of 30,000 shares at $50 per share. No gain or loss is recognized since parent maintains a controlling interest. Option 2 Shenandoah issues and sells 40,000 shares to the public Investment in Shenandoah Additional paid-in capital 630 630 To record adjustment in ownership computed as follows: 4 Book value after sale of 40,000 shares ($12,440 × 75%) Book value before sale of 40,000 shares ($10,440 × 5/6) Increase in book value of investment from sale $9,330 (8,700) $ 630 Option 3 Shenandoah reissues 40,000 shares of treasury stock Investment in Shenandoah 630 Additional paid-in capital 630 To record adjustment in ownership computed the same as 2 above. Consolidated Stockholders’ Equity at January 1, 2010 Common stock Additional paid-in capital Retained earnings Noncontrolling interesta Total stockholders’ equity a Option 1 Option 2 Option 3 $10,000 3,630 7,000 2,610 $23,240 $10,000 3,630 7,000 3,110 $23,740 $10,000 3,630 7,000 3,110 $23,740 Noncontrolling interest under option 1: $10,440 × 25% Noncontrolling interest under options 2 and 3: $12,440 × 25% P8-7 >>(Solution P8-6)] 1 Investment in Stake December 31, 2010 Investment in Stake January 2, 2009 $ 98,000 Increase for 2009 ($30,000 retained earnings increase × 70%) 21,000 Purchase of additional 20% interest June 30, 2010 37,000 Increase 2010: 24,000 ($30,000 × 1/2 year × 70%) + ($30,000 × 1/2 year × 90%) (9,000) Dividends 2010: ($10,000 × 90%) Investment in Stake December 31, 2010 $171,000 2 Goodwill December 31, 2010 January 2, 2009 purchase: Cost of 70% interest Implied fair value of Stake ($98,000 / 70%) Less: Book value of Stake Goodwill June 30, 2010 purchase: Cost of 20% interest Implied fair value of Stake ($37,000 / 20%) Less: Book value of Stake Goodwill - December 31, 2010 3 Consolidated net income Sales Cost of sales Expenses Consolidated net income Noncontrolling interest share * Controlling share of net income $ 98,000 $140,000 120,000 $ 20,000 $ 37,000 $185,000 165,000 $ 20,000 $600,000 (400,000) (70,000) 130,000 6,000 $124,000 5 * 4 5 Noncontrolling share is 10% for full year plus 20% for ½ year. Alternative: Post’s reported income = Controlling share of net income Consolidated retained earnings December 31, 2010 Beginning retained earnings Add: Controlling share of Consolidated net income — 2010 Less: Dividends Consolidated retained earnings — ending Alternative solution: Post’s reported ending retained earnings = Consolidated retained earnings — ending $124,000 $200,000 124,000 (64,000) $260,000 $260,000 Noncontrolling interest December 31, 2010 Equity of Stake December 31, 2010 Goodwill Fair value of Stake Noncontrolling interest percentage Noncontrolling interest December 31, 2010 $170,000 20,000 $190,000 10% $ 19,000 Solution P9-1 Pida Corporation and Subsidiaries Schedule to Compute Consolidated Net Income and Noncontrolling Interest Share for the year 2009 Separate income (loss) Pida $500,000 Staley $300,000 Less: Unrealized profit Separate realized income (loss) Allocate Bean’s loss 70% to Staley Bean $(20,000) (20,000) 500,000 300,000 130,000 (14,000) Allocate Axel’s income 60% to Staley Patent Allocate Staley’s income 90% to Pida Patent Axel $150,000 78,000 (12,000) 352,000 316,800 (40,000) (20,000) 14,000 (78,000) (316,800) Controlling share of net income $776,800 Noncontrolling interest income $ 35,200 $ 52,000 $ (6,000) Check: Income allocated: $776,800 consolidated net income + $35,200 noncontrolling interest share in Staley + $52,000 noncontrolling interest share in Axel $6,000 noncontrolling interest share (loss) in Bean = $858,000 Income to allocate: $500,000 Pida income + $300,000 Staley income + $130,000 realized income of Axel - $20,000 loss of Bean - $52,000 patent = $858,000 Controlling share of consolidated net income: $500,000 - $40,000 + 90%($300,000 - $12,000) + (90% × 60% × $130,000) - (90% × 70% × $20,000) = $776,800 6 P9-3 Working paper entries a Income from Skill 27,000 Dividend income 10,000 Dividends 28,000 Investment in Skill 9,000 To eliminate income from Skill, dividend income, and 90% of Skill’s dividends, and return the investment in Skill account to the beginning-of-the-period balance under the equity basis. b 200,000 Capital stock — Skill 200,000 Retained earnings — Skill Goodwill 50,000 Investment in Skill 405,000 45,000 Noncontrolling interest — beginning To eliminate reciprocal investment and equity accounts, and enter beginning-of-the-period patent and noncontrolling interest. c Treasury stock 80,000 Investment in Prill To reclassify investment in Prill to treasury stock. d 80,000 Noncontrolling Interest Share 3,000 Dividends 2,000 Noncontrolling Interest 1,000 To record noncontrolling interest share of subsidiary income and dividends. Treasury Stock approach Prill Company and Subsidiary Consolidation Working Papers for the year ended December 31, 2011 Prill Income Statement Sales Income from Skill Dividend income Cost of sales Expenses $ 400,000 27,000 $ 177,000 Retained Earnings Retained earnings — Prill $ 300,000 100,000 10,000 50,000* 30,000* 177,000 Dividends 100,000* $ 30,000 $ 200,000 Consolidated Statements $ a a 500,000 27,000 10,000 250,000* 80,000* 170,000 d Retained earnings — Skill Net income (Controlling share in Consol. Column) Retained earnings December 31 $ 200,000* 50,000* Consolidated NI Noncontrolling share Controlling share of NI Adjustments and Eliminations Skill 90% 3,000 3,000* $ 167,000 $ 300,000 b 200,000 30,000 167,000 $ 377,000 20,000* $ 210,000 a d 28,000 2,000 90,000* $ 377,000 7 Balance Sheet Other assets Investment in Skill 90% $ 486,000 414,000 $ Investment in Prill 10% Goodwill Liabilities Capital stock Retained earnings 420,000 $ 906,000 50,000 956,000 a 9,000 b 405,000 c 80,000 80,000 b 50,000 $ 900,000 $ 500,000 $ $ 123,000 400,000 $ 90,000 200,000 $ $ 377,000 900,000 $ b 200,000 210,000 500,000 Noncontrolling interest January 1 Noncontrolling interest December 31 Treasury stock c b 45,000 d 1,000 46,000 80,000 $ * 213,000 400,000 377,000 80,000* 956,000 Deduct Solution P9-4 1 Affiliation diagram 80% Swift 2 Parish 20% 50% Tolbert 10% Income allocation Definitions P = Parish’s income on a consolidated basis S = Swift’s income on a consolidated basis T = Tolbert’s income on a consolidated basis Equations P = $200,000 + .8S + .5T S = $100,000 + .2T T = $50,000 + .1S Solve for S S = $100,000 + .2($50,000 + .1S) S = $110,000 + .02S .98S = $110,000 S = $112,244.90 or $112,245 Compute T T = $50,000 + .1($112,244.90) T = $50,000 + $11,224.49 T = $61,224.49 or $61,224 Compute P P = $200,000 + .8($112,244.90) + .5($61,224.49) P = $320,408.16 or $320,408 Income allocation Consolidated net income = P = Noncontrolling interest share in Swift ($112,245 × .1) Noncontrolling interest share in Tolbert ($61,224 × .3) $320,408 11,225 18,367 $350,000 8 3 P, S, and T are as defined in part 2. Equation P = ($200,000 - $20,000) + .8S + .5T S = $100,000 + .2T T = ($50,000 - $10,000) + .1S Solve for S S = $100,000 + .2($40,000 + .1S) S = $108,000 + .02S S = $110,204.08 Compute T T = $40,000 + .1($110,204.08) T = $51,020.41 Compute P P = $180,000 + .8($110,204) + .5($51,020.41) P = $293,673.48 Income allocation Consolidated net income = P = $293,673.48 11,020.40 Noncontrolling interest share in Swift ($110,204.08 × 10%) 15,306.12 Noncontrolling interest share in Tolbert ($51,020.41 × 30%) $320,000.00 Solution P10-1 1 2 3 4 [Preferred stock] (amounts in thousands) Undervaluation of the building from Parrella’s investment in Stanley Cost of 180,000 shares of common stock $3,600 Implied total fair value ($3,600 / 90%) Less: Book value Stockholders equity $4,150 1,150 Less: Preferred equity (10,000 × $115)* Common equity Excess fair value = Goodwill * Preferred equity at liq. Pref. (!0,000 × $105) + Div. in arrears ($100,000) $4,000 Income from Stanley Stanley’s reported income Less: Preferred dividend for 2009 Stanley’s adjusted income to common 90% of Stanley’s adjusted income Noncontrolling interest share for 2009 Income allocable to preferred Stanley’s adjusted income Noncontrol. common interest share (10%) Noncontrolling interest share $ ( $ 3,000 $1,000 500 100) 400 $ 360 $ 100 $ $ 40 140 $400 Noncontrolling interest December 31, 2009 Total stockholders’ equity ($4,150,000 + $500,000 net income $400,000 dividends) $4,250 Less: Preferred equity (No div. in 1,050 × 100% arrears) Common equity – book value $3,200 $1,050 9 Plus Unamortized fair value at 12/31 Common equity at fair value Noncontrolling interest December 31 5 1,000 $4,200 × 10% Investment in Stanley December 31, 2009 Investment cost Add: Income from Stanley Less: Dividends ($400,000 - $100,000 preferred dividends in arrears - $100,000 current preferred dividends) × 90% Investment in Stanley December 31 Check: Equity of common ($3,200,000 × 90%) Undepreciated excess ($1,000,000 × 90%) Investment in Stanley December 31 Solution P10-2 420 $1,470 $3,600 360 (180) $3,780 $2,880 900 $3,780 [Preferred stock] Preliminary computations Stockholders’ equity July 1, 2009 $900,000 - ($46,000 income × 1/2 year) Less: Preferred equity July 1, 2009 Par value with call premium Dividend arrearage — 2008 ($200,000 × 9%) Dividend arrearage — 2009 ($200,000 × 9% × 1/2 year) Common equity July 1, 2009 $877,000 $210,000 18,000 9,000 237,000 $640,000 Cost of 90% interest in Starky’s common stock $630,000 Implied total fair value ($630,000 / 90%) Book value of common equity Goodwill $700,000 (640,000) $ 60,000 Cost of 80% interest in Starky’s preferred stock Book value acquired ($237,000 × 80%) Book value over cost of preferred $175,000 (189,600) $(14,600) 1 2 Investment account balances at December 31, 2009 Common Investment cost $630,000 Adjust preferred to book value and recognize a constructive retirement Income to preferred ($18,000 × 1/2 year × 80%) 12,600 Income to common ($28,000 × 1/2 year × 90%) Investment balances December 31 $642,600 Preferred $175,000 14,600 7,200 $196,800 Consolidated balance sheet working paper entries 9% preferred stock, $100 par 200,000 46,000 Retained earnings — Starky 196,800 Investment in Starky — preferred 49,200 Noncontrolling interest — preferred To eliminate reciprocal preferred equity and investment balances and enter noncontrolling interest. The preferred stockholders’ claim on Starky’s retained earnings consists of $18 per share preferred dividends in arrears plus a $5 per share call premium. Computations: Investment in Starky 10 preferred = $123 × 1,600 shares. Noncontrolling interest — preferred = $123 × 400 shares. Capital stock, $10 par — Starky Paid-in capital in excess of par — Starky Retained earnings — Starky Goodwill Investment in Starky — common Noncontrolling interest — common 500,000 40,000 114,000 60,000 642,600 71,400 To eliminate reciprocal common equity and investment amounts and enter goodwill and noncontrolling interest in common. NOTE: Noncontrolling interest includes 10% of Goodwill. 11