* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download PART I: PARSIFAL SCHEDULING

Competition (companies) wikipedia , lookup

International status and usage of the euro wikipedia , lookup

Foreign exchange market wikipedia , lookup

Bretton Woods system wikipedia , lookup

Purchasing power parity wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

International monetary systems wikipedia , lookup

Fixed exchange-rate system wikipedia , lookup

Currency War of 2009–11 wikipedia , lookup

Reserve currency wikipedia , lookup

Exchange rate wikipedia , lookup

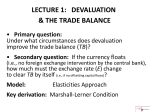

CHAPTER 15 EXCHANGE-RATE ADJUSTMENTS AND THE BALANCE OF PAYMENTS CHAPTER OVERVIEW This chapter considers exchange-rate adjustments and the balance of payments. The chapter notes that currency depreciation (devaluation) can affect a nation’s trade position through its impact on relative prices, incomes, and purchasing power of money balances. The chapter first considers the situation where all of a firm’s inputs are acquired domestically and their costs are denominated in the domestic currency. As a result, an appreciation in the domestic currency’s exchange value increases a firm’s costs by the same proportion, in terms of the foreign currency. Next, the chapter considers the situation where manufacturers obtain inputs from abroad whose costs are denominated in terms of a foreign currency. As foreign-currency-denominated costs become a larger portion of a producer’s total costs, an appreciation of the domestic currency’s exchange value leads to a smaller increase in the foreign-currency cost of the firm’s output and a larger decrease in the domestic cost of the firm’s output— compared to the cost changes that occur when all input costs are denominated in the domestic currency. The chapter emphasizes the elasticities approach to depreciation. According to this approach, currency depreciation leads to the greatest improvement in a country’s trade position when demand elasticities are high. The time path of currency depreciation can be explained in terms of the J-curve effect and the extent to which exchange-rate changes lead to changes in import prices and export prices is explained by the pass-through effect. Finally, the chapter notes the importance of the absorption approach to devaluation. According to this view, a devaluation may initially stimulate a nation’s exports and production of import-competing goods. But this will promote excess domestic spending unless real output can be expanded or domestic absorption reduced. The result would be a return to a payments deficit. After completing the chapter, students should be able to: Discuss how currency depreciation (devaluation) affects a nation’s trade position through its impact on relative prices, incomes, and purchasing power of money balances. Explain how the J-curve effect relates to the time path of currency depreciation. Discuss the significance of currency pass through for exchange rate changes. Describe the absorption approach to currency devaluation. 47 48 Instructor’s Manual for International Economics, 8e BRIEF ANSWERS TO STUDY QUESTIONS 1. Currency devaluation affects a country’s trade balance via its impact on relative prices (elasticities approach), spending behavior (absorption approach), and the purchasing power of money balances (monetary approach). 2. See Question 1. 3. The Marshall-Lerner condition refers to the elasticities approach to devaluation. It suggests that devaluation works best at improving a country’s trade balance when demand elasticities are high (i.e., the sum of the domestic demand elasticity for imports plus the foreign demand elasticity for exports exceeds one). Empirical studies suggest that demand elasticities for most countries are quite high. 4. The J-curve effect implies that due to time lags between the response of goods traded to relative price changes (e.g., recognition lags), currency devaluation will have a more pronounced effect on a country’s trade balance over the longer run. 5. The extent to which changing currency values lead to changes in import and export prices is known as the pass-through relationship. Pass-through is important since buyers have incentives to alter their purchases of foreign goods only to the extent that the prices of these goods change in terms of their domestic currency following a change in the exchange rate. 6. The absorption approach concludes that currency devaluation best improves the trade balance when the country faces a trade deficit along with domestic unemployment. 7. The monetary approach suggests currency devaluation affects the domestic price level and the purchasing power of money balances, which lead to changes in domestic expenditures and the level of imports. 8. The 50 percent dollar appreciation results in a 50 percent increase in the firm’s production cost in terms of the peso. 9. The 50 percent dollar appreciation results in a less-than 50 percent increase in the firm’s production cost in terms of the peso. 10. a. b. c. Export quantity 1000, 1300, 1030 Import quantity 150, 120, 147 Export price $3000, $3000, $3000 Export receipts $3 million, $3.9 million, $3.09 million Import price $20,000, $22,000, $22,000 Import payments $3 million, $2.64 million, $3.234 million Trade balance $0, $1.26 million, -$144,000 The dollar depreciation improves (worsens) the U.S. trade balance when the sum of the exportdemand elasticity and the import-demand elasticity are greater (less) than 1.0. Because the sum of the export-demand elasticity and the import-demand elasticity are less than 1.0, the U.S. trade balance will worsen. Chapter 15: Exchange-Rate Adjustments and the Balance of Payments 49 SUGGESTIONS FOR FURTHER READINGS Das, D. The Yen Appreciation and the International Economy. New York: New York University Press, 1993. Einzig, P. Leads and Lags: The Main Cause of Devaluation. New York: St. Martin’s Press, 1968. Glick, R., and R. Moreno. “The Pass-Through Effect on U.S. Imports.” Federal Reserve Bank of San Francisco, Weekly Letter, 12 December 1986. Guillermo, C. Money, Exchange Rates, and Output. Cambridge, MA: MIT Press, 1996. Hickok, S. “Japanese Trade Balance Adjustment to Yen Appreciation.” Federal Reserve Bank of New York, Quarterly Review, Autumn 1989. Mann, C.L. “Prices, Profit Margins, and Exchange Rates.” Federal Reserve Bulletin, June 1986. Meade, E. “Exchange Rates, Adjustments, and the J-Curve.” Federal Reserve Bulletin, October 1988. Solomon, R Money on the Move: The Revolution in International Finance Since 1980. Princeton, NJ: Princeton University Press, 1999. Whitt, J.A., et al. “The Dollar and Prices: An Empirical Analysis.” Federal Reserve Bank of Atlanta, Economic Review, October 1986.