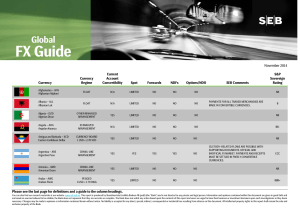

Global FX Guide

... You can also find our research materials at our website: www.mb.seb.se. This report is produced by Skandinaviska Enskilda Banken AB (publ) (the "Bank") and is not directed to any private and legal person. Information and opinions contained within this document are given in good faith and are based o ...

... You can also find our research materials at our website: www.mb.seb.se. This report is produced by Skandinaviska Enskilda Banken AB (publ) (the "Bank") and is not directed to any private and legal person. Information and opinions contained within this document are given in good faith and are based o ...

Vote of confidence in the promise of ASEAN www.pwc.com/apec The ASEAN cut

... ongoing negotiations to promote free trade and economic integration between economies and trade blocs did not seem to impress as many business leaders in the 7 APEC economies in ASEAN, a signal to governments that they do not foresee the red tapes and policy hindrances which still persist in limitin ...

... ongoing negotiations to promote free trade and economic integration between economies and trade blocs did not seem to impress as many business leaders in the 7 APEC economies in ASEAN, a signal to governments that they do not foresee the red tapes and policy hindrances which still persist in limitin ...

CD1. European Economy. Basic editions. 44/1990. One market, one

... negotiate new Treaty provisions that will lay the constitutional foundations of economic and monetary union (EMU). The European Council has agreed that the new Treaty provisions should be drawn up, ratified by all Member States and available for use before I January 1993. It has also decided that a ...

... negotiate new Treaty provisions that will lay the constitutional foundations of economic and monetary union (EMU). The European Council has agreed that the new Treaty provisions should be drawn up, ratified by all Member States and available for use before I January 1993. It has also decided that a ...

Currency internationalisation and exchange rate dynamics in

... relationship with short-term capital flows over recent years. In addition, the econometric results present evidence that despite different structural characteristics, the Brazilian Real exhibits a strong co-movement with other internationally traded currencies, confirming the currency‘s internationa ...

... relationship with short-term capital flows over recent years. In addition, the econometric results present evidence that despite different structural characteristics, the Brazilian Real exhibits a strong co-movement with other internationally traded currencies, confirming the currency‘s internationa ...

Exchange Rate Predictability in a Changing World

... and with a diagonal covariance matrix Q. Putting together equations (1) and (3) results in a state-space model, where (1) is the measurement equation and (3) the transition equation. We use Bayesian methods to estimate the parameters of the state-space model. While the use of the Kalman filter with ...

... and with a diagonal covariance matrix Q. Putting together equations (1) and (3) results in a state-space model, where (1) is the measurement equation and (3) the transition equation. We use Bayesian methods to estimate the parameters of the state-space model. While the use of the Kalman filter with ...

mmi11 Sturm 15004126 en

... governments overcome temporary balance of payments problems, its role in the world economy has changed remarkably due to historical events of economic and political nature (see for instance Boughton, 2004). There have been different epochs in the history of the IMF, but – at least – two structural c ...

... governments overcome temporary balance of payments problems, its role in the world economy has changed remarkably due to historical events of economic and political nature (see for instance Boughton, 2004). There have been different epochs in the history of the IMF, but – at least – two structural c ...

Arbitrage in the foreign exchange market

... costs.3 The move to electronic trading platforms in the 1990s, however, has made it possible to obtain long data samples of real-time quotations for rigorous empirical work. The move itself provides a motivation for a fresh analysis of arbitrage opportunities because of changes in trading practices ...

... costs.3 The move to electronic trading platforms in the 1990s, however, has made it possible to obtain long data samples of real-time quotations for rigorous empirical work. The move itself provides a motivation for a fresh analysis of arbitrage opportunities because of changes in trading practices ...

Equilibrium Real Exchange Rate, Misalignment, and Export

... After the crisis, real exchange rate undervaluation was evident in many Asian countries such as People’s Republic of China (PRC), Malaysia, and Thailand. This study also shows that real exchange rate misalignment could have a negative impact on export performance in developing Asia. With its implica ...

... After the crisis, real exchange rate undervaluation was evident in many Asian countries such as People’s Republic of China (PRC), Malaysia, and Thailand. This study also shows that real exchange rate misalignment could have a negative impact on export performance in developing Asia. With its implica ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... tested the intertemporal model using data for a group of developing countries. They argue that, overall, their results adequately capture the most important features of modern optimizing models of the current account. Numerical simulations based on the intertemporal approach sketched above suggest t ...

... tested the intertemporal model using data for a group of developing countries. They argue that, overall, their results adequately capture the most important features of modern optimizing models of the current account. Numerical simulations based on the intertemporal approach sketched above suggest t ...

ppt_montreal_crise

... phased and growth-friendly plans to deliver fiscal sustainability […]. Those countries with serious fiscal challenges need to accelerate the pace of consolidation. […] We agreed the financial sector should make a fair and substantial contribution towards paying for any burdens associated with govern ...

... phased and growth-friendly plans to deliver fiscal sustainability […]. Those countries with serious fiscal challenges need to accelerate the pace of consolidation. […] We agreed the financial sector should make a fair and substantial contribution towards paying for any burdens associated with govern ...

IMF Reform Is Waiting on the United States

... has been a bipartisan and nonpartisan topic. The US administration has proposed to redress the previous failure to enact the IMF quota and governance reform legislation by incorporating it in legislation before the US Congress providing $1 billion in loan guarantees for Ukraine.1 The IMF provision i ...

... has been a bipartisan and nonpartisan topic. The US administration has proposed to redress the previous failure to enact the IMF quota and governance reform legislation by incorporating it in legislation before the US Congress providing $1 billion in loan guarantees for Ukraine.1 The IMF provision i ...

EM Currency Handbook 2014

... from strengthening demand in the US and Europe. Beyond Asia, Central Europe is emerging from a period of painful deleveraging and is poised to see activity accelerate. Reforms in Mexico will leave it better placed to benefit from US recovery. Growth in Chile, Colombia, and Peru, will remain robust. ...

... from strengthening demand in the US and Europe. Beyond Asia, Central Europe is emerging from a period of painful deleveraging and is poised to see activity accelerate. Reforms in Mexico will leave it better placed to benefit from US recovery. Growth in Chile, Colombia, and Peru, will remain robust. ...

Do loans harm?

... nothing but empty promises” (Camdessus, 1990, cited in Vreeland, 2002). Today, developing countries have a number of programs available1 and reducing poverty is among the IMF's official aims (IMF 2009). Among the few empirical studies available on the effect of the IMF on inequality - scarce mainly ...

... nothing but empty promises” (Camdessus, 1990, cited in Vreeland, 2002). Today, developing countries have a number of programs available1 and reducing poverty is among the IMF's official aims (IMF 2009). Among the few empirical studies available on the effect of the IMF on inequality - scarce mainly ...

Chapter VIII (pdf format)

... Now, suppose that a U.S. multinational has a subsidiary with positive cash flows in EUR and another subsidiary has negative cash flows in GBP. The U.S. multinational knows that there is very high and positive correlation between these two currencies. The U.S. multinational will take this correlation ...

... Now, suppose that a U.S. multinational has a subsidiary with positive cash flows in EUR and another subsidiary has negative cash flows in GBP. The U.S. multinational knows that there is very high and positive correlation between these two currencies. The U.S. multinational will take this correlation ...

International Monetary Fund Annual Report 1973

... fruition of the negotiations on international monetary reform. It is possible, however, to take stock of the profound changes in the exchange system that have come to be reflected in current practice. By the beginning of 1972, the system had changed from one in which most countries maintained the ex ...

... fruition of the negotiations on international monetary reform. It is possible, however, to take stock of the profound changes in the exchange system that have come to be reflected in current practice. By the beginning of 1972, the system had changed from one in which most countries maintained the ex ...

International Reserves - Independent Evaluation Office (IEO)

... symptom of problems rather than the underlying causes, and it did not appear to be different from the longerstanding concerns about risks from global imbalances. Many country officials also felt that the IMF should have placed greater emphasis on other developments relating to the evolution and stab ...

... symptom of problems rather than the underlying causes, and it did not appear to be different from the longerstanding concerns about risks from global imbalances. Many country officials also felt that the IMF should have placed greater emphasis on other developments relating to the evolution and stab ...

as a PDF

... jump the bandwagon and bid up the exchange rate. Along this line of reasoning, an intervention would generally be followed by increased volatility in the exchange rate. Reflecting these considerations, Galati and Melick (2002) argue that foreign exchange interventions could more recently have been a ...

... jump the bandwagon and bid up the exchange rate. Along this line of reasoning, an intervention would generally be followed by increased volatility in the exchange rate. Reflecting these considerations, Galati and Melick (2002) argue that foreign exchange interventions could more recently have been a ...

World Economic Outlook: Crisis and Recovery, April 2009

... since the start of the crisis will total $2.7 trillion, compared with an estimate of $2.2 trillion in the January 2009 GFSR Update. Including assets originated in other mature market economies, total write-downs could reach $4 trillion over the next two years, approximately two-thirds of which may b ...

... since the start of the crisis will total $2.7 trillion, compared with an estimate of $2.2 trillion in the January 2009 GFSR Update. Including assets originated in other mature market economies, total write-downs could reach $4 trillion over the next two years, approximately two-thirds of which may b ...

DOES THE CURRENT ACCOUNT MATTER?* By Sebastian Edwards University of California, Los Angeles

... domestic savings – are also analyzed. Throughout the paper I am interested on whether there is evidence supporting the idea that there are costs involved in running “very large” deficits. Moreover, I investigate the nature of these potential costs, including whether they are particularly high in the ...

... domestic savings – are also analyzed. Throughout the paper I am interested on whether there is evidence supporting the idea that there are costs involved in running “very large” deficits. Moreover, I investigate the nature of these potential costs, including whether they are particularly high in the ...

On the Receiving End? External Conditions and Emerging

... on impact. On average, in the medium term, external shocks—stemming from external demand, financing costs, and terms of trade—explain about half of the variance in emerging market economies’ growth rates. The incidence of external shocks varies across economies, with stronger growth in advanced econ ...

... on impact. On average, in the medium term, external shocks—stemming from external demand, financing costs, and terms of trade—explain about half of the variance in emerging market economies’ growth rates. The incidence of external shocks varies across economies, with stronger growth in advanced econ ...

Robert Barro and Jong-Wha Lee IMF Programs: Who Is Chosen and What Are the Effects? (Second IMF Research Conference).

... analogous variables for other important countries, such as France, Germany and the United Kingdom, but find no additional effects.) We find that, as an international organization influenced by the dominating power of the United States, the IMF apparently takes politics into account when making decis ...

... analogous variables for other important countries, such as France, Germany and the United Kingdom, but find no additional effects.) We find that, as an international organization influenced by the dominating power of the United States, the IMF apparently takes politics into account when making decis ...

The International Monetary Fund: 70 Years of Reinvention

... cross border finance, as well as global factors such as international interest rates, primary commodity prices, and global saving patterns. We also consider how the situations to which the IMF responds to has changed over time, from the early focus on currency problems to the more engulfing challeng ...

... cross border finance, as well as global factors such as international interest rates, primary commodity prices, and global saving patterns. We also consider how the situations to which the IMF responds to has changed over time, from the early focus on currency problems to the more engulfing challeng ...

The Bitcoin Revolution

... on August 7, 2014, by the coinometrics.com web site. These magnitudes are $57.3 million and $16,518 million, so the implied ratio is 0.00345. Alternatively, in terms of stocks, rather than transactions, the M1 measure of the U.S. money supply (currency plus demand deposits) is currently about $2,835 ...

... on August 7, 2014, by the coinometrics.com web site. These magnitudes are $57.3 million and $16,518 million, so the implied ratio is 0.00345. Alternatively, in terms of stocks, rather than transactions, the M1 measure of the U.S. money supply (currency plus demand deposits) is currently about $2,835 ...

![Robert Barro and Jong-Wha Lee IMF Programs: Who Is Chosen and What Are the Effects? (Second IMF Research Conference). <![if !supportLineBreakNewLine]> <![endif]>](http://s1.studyres.com/store/data/008826433_1-04df42b714a3eee241ab8d529ca237e6-300x300.png)