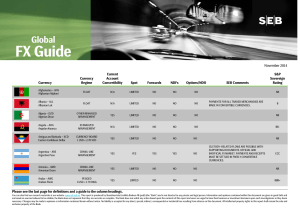

Global FX Guide

... Please see the last page for definitions and a guide to the column headings. You can also find our research materials at our website: www.mb.seb.se. This report is produced by Skandinaviska Enskilda Banken AB (publ) (the "Bank") and is not directed to any private and legal person. Information and op ...

... Please see the last page for definitions and a guide to the column headings. You can also find our research materials at our website: www.mb.seb.se. This report is produced by Skandinaviska Enskilda Banken AB (publ) (the "Bank") and is not directed to any private and legal person. Information and op ...

What triggers prolonged inflation regimes? A - ECB

... for the economy, periods of high or hyper-in ation are seen to have negative repercussions which could cripple an economy as they lead to uncertainty, shorter planning horizons and possibly even a diversion of resources away from production. As a result, for policy makers, it is important to keep in ...

... for the economy, periods of high or hyper-in ation are seen to have negative repercussions which could cripple an economy as they lead to uncertainty, shorter planning horizons and possibly even a diversion of resources away from production. As a result, for policy makers, it is important to keep in ...

Cover page for the project report â 2 semester, BP 2:

... challenged this authority. The most famous and discussed example is the cryptographic currency called Bitcoin. This currency is based on a system where the act of a payment itself is purely peer to peer. The act of transaction is thus not owned by anyone as the system does not have to go through a t ...

... challenged this authority. The most famous and discussed example is the cryptographic currency called Bitcoin. This currency is based on a system where the act of a payment itself is purely peer to peer. The act of transaction is thus not owned by anyone as the system does not have to go through a t ...

Arbitrage in the foreign exchange market

... short-term arbitrage opportunities to arise, inviting traders to exploit them, and hence be quickly eliminated. Also, microstructure theory shows how price differences may occur for identical assets in markets that are less than fully centralized, segmented or with an imperfect degree of transparenc ...

... short-term arbitrage opportunities to arise, inviting traders to exploit them, and hence be quickly eliminated. Also, microstructure theory shows how price differences may occur for identical assets in markets that are less than fully centralized, segmented or with an imperfect degree of transparenc ...

The Swiss National Bank 1907 – 2007

... One hundred years have passed since the Swiss National Bank first opened its doors for business on 20 June 1907. In looking back over the SNB’s history, we are picking up the thread of the last three anniversary publications – those of 1932, 1957 and 1982. This time, however, we are not only prese ...

... One hundred years have passed since the Swiss National Bank first opened its doors for business on 20 June 1907. In looking back over the SNB’s history, we are picking up the thread of the last three anniversary publications – those of 1932, 1957 and 1982. This time, however, we are not only prese ...

Monetary Analysis: Tools and Applications

... monitoring of financial innovation as this may affect the fundamental relationship between money and prices. To implement this more detailed assessment, monetary analysis undertaken at the ECB is not limited solely to the analysis of M3. The main components and counterparts of M3 in the balance shee ...

... monitoring of financial innovation as this may affect the fundamental relationship between money and prices. To implement this more detailed assessment, monetary analysis undertaken at the ECB is not limited solely to the analysis of M3. The main components and counterparts of M3 in the balance shee ...

Currency internationalisation and exchange rate dynamics in

... with yields on domestic financial assets and a currency‘s liquidity premium, which depends on an exogenously given liquidity preference and market participants‘ perceptions about a country‘s ability to meet its outstanding external obligations. The emphasis on expectations in short-term financial ma ...

... with yields on domestic financial assets and a currency‘s liquidity premium, which depends on an exogenously given liquidity preference and market participants‘ perceptions about a country‘s ability to meet its outstanding external obligations. The emphasis on expectations in short-term financial ma ...

Monetary Policy without Central Bank Money: A Swiss Perspective

... The SNB was clearly aware of the pitfalls in monetary targeting. As to the first difficulty, instability in money demand has not been a major problem in Switzerland. While high-frequency movements are often hard to explain, in the longer run, Swiss money demand, on the whole, has been stably related ...

... The SNB was clearly aware of the pitfalls in monetary targeting. As to the first difficulty, instability in money demand has not been a major problem in Switzerland. While high-frequency movements are often hard to explain, in the longer run, Swiss money demand, on the whole, has been stably related ...

The Currency Market and its Satellites

... The HC/FC Convention (—ours) The FC/HC Convention Bid and Ask Primary and Cross Rates Inverting bid and asks Major Markets for Foreign Exchange How Exchange Markets Work Markets by Location and by Currency Markets by Delivery Date The Law Of One Price in Spot Mkts ...

... The HC/FC Convention (—ours) The FC/HC Convention Bid and Ask Primary and Cross Rates Inverting bid and asks Major Markets for Foreign Exchange How Exchange Markets Work Markets by Location and by Currency Markets by Delivery Date The Law Of One Price in Spot Mkts ...

Macroeconomics, 10e, Global Edition (Parkin) Chapter 26 The

... 19) An increase in the value of a domestic currency in terms of other currencies is known as A) an appreciation. B) a depreciation. C) a flexible exchange rate. D) a term not given in the above answers. Answer: A Topic: The Exchange Rate, Currency Appreciation Skill: Recognition Question history: P ...

... 19) An increase in the value of a domestic currency in terms of other currencies is known as A) an appreciation. B) a depreciation. C) a flexible exchange rate. D) a term not given in the above answers. Answer: A Topic: The Exchange Rate, Currency Appreciation Skill: Recognition Question history: P ...

CD1. European Economy. Basic editions. 44/1990. One market, one

... negotiate new Treaty provisions that will lay the constitutional foundations of economic and monetary union (EMU). The European Council has agreed that the new Treaty provisions should be drawn up, ratified by all Member States and available for use before I January 1993. It has also decided that a ...

... negotiate new Treaty provisions that will lay the constitutional foundations of economic and monetary union (EMU). The European Council has agreed that the new Treaty provisions should be drawn up, ratified by all Member States and available for use before I January 1993. It has also decided that a ...

EM Currency Handbook 2014

... major risk factor into the New Year, but forward rates have already moved to Deutsche Bank’s 10Y yield forecast (3.25%). Moreover, EMFX is starting the year with better valuation, and – while EM growth will likely remain diverse – many countries are likely on the cusp of an upturn. This is particula ...

... major risk factor into the New Year, but forward rates have already moved to Deutsche Bank’s 10Y yield forecast (3.25%). Moreover, EMFX is starting the year with better valuation, and – while EM growth will likely remain diverse – many countries are likely on the cusp of an upturn. This is particula ...

Chapter 4 Involuntary Excess Liquidity and the Effectiveness of

... in the high in‡ation environment, ensured negative real interest rates on Treasury bills. Finally, the room for maneuver for the central bank was curtailed by exchange rate in‡exibility until 1999. Figure 4 also suggests that high excess liquidity has been associated with high and volatile in‡ation ...

... in the high in‡ation environment, ensured negative real interest rates on Treasury bills. Finally, the room for maneuver for the central bank was curtailed by exchange rate in‡exibility until 1999. Figure 4 also suggests that high excess liquidity has been associated with high and volatile in‡ation ...

International Monetary Review

... economies, many developing countries have already faced a fall in exports, experienced speculative capital flows replacing more stable FDI, and Trade Financing choking up. The faltering prospects for export-oriented countries that are dependent on the OECD, especially those with a relatively disadva ...

... economies, many developing countries have already faced a fall in exports, experienced speculative capital flows replacing more stable FDI, and Trade Financing choking up. The faltering prospects for export-oriented countries that are dependent on the OECD, especially those with a relatively disadva ...

Currency Boards for Developing Countries

... sound currency is one that is stable, credible, and fully convertible. Stability means that current annual inflation is relatively low, usually in single digits. Credibility means that the issuer creates confidence that it will keep future inflation low. Full convertibility means that the currency c ...

... sound currency is one that is stable, credible, and fully convertible. Stability means that current annual inflation is relatively low, usually in single digits. Credibility means that the issuer creates confidence that it will keep future inflation low. Full convertibility means that the currency c ...

currency boards for developing countries

... sound currency is one that is stable, credible, and fully convertible. Stability means that current annual inflation is relatively low, usually in single digits. Credibility means that the issuer creates confidence that it will keep future inflation low. Full convertibility means that the currency c ...

... sound currency is one that is stable, credible, and fully convertible. Stability means that current annual inflation is relatively low, usually in single digits. Credibility means that the issuer creates confidence that it will keep future inflation low. Full convertibility means that the currency c ...

JUNE, 1969 FEDERAL RESERVE BANK OF BOSTON SAMUELSON TOBIN

... Now, since other speakers have to speak, I can’t review all these mountains of evidence, but let me just mention what some of the types of evidence are. First-and I’ve heard several tapes dealing with this-take particular incidents in American history. In 1919, for example, we came out of World War ...

... Now, since other speakers have to speak, I can’t review all these mountains of evidence, but let me just mention what some of the types of evidence are. First-and I’ve heard several tapes dealing with this-take particular incidents in American history. In 1919, for example, we came out of World War ...

The Future of Money

... might replace the physical with the digital and concerns about the implications of these technologies for central banks. Those discussions have provided reassuring conclusions regarding the implications of new technologies for the effective pursuit of macroeconomic policy. However, such a technology ...

... might replace the physical with the digital and concerns about the implications of these technologies for central banks. Those discussions have provided reassuring conclusions regarding the implications of new technologies for the effective pursuit of macroeconomic policy. However, such a technology ...

NBER WORKING PAPER SERIES

... In this study, we analyze the role played by international reserves on the short and intermediaterun REER dynamics generated by a CTOT shock. We also test the degree to which international reserves and the choice of exchange rate regime mitigates REER volatility associated with given CTOT shocks. Sp ...

... In this study, we analyze the role played by international reserves on the short and intermediaterun REER dynamics generated by a CTOT shock. We also test the degree to which international reserves and the choice of exchange rate regime mitigates REER volatility associated with given CTOT shocks. Sp ...

Foreign Monetary Policy and Firms` Default Risk

... The first strand of research related to our paper is those studies analyzing monetary policy e↵ects on firms using market based information. Recently, there is an increasing attention on the e↵ects of monetary policy on the liability side of firms and on financial markets. As it has been suggested b ...

... The first strand of research related to our paper is those studies analyzing monetary policy e↵ects on firms using market based information. Recently, there is an increasing attention on the e↵ects of monetary policy on the liability side of firms and on financial markets. As it has been suggested b ...

Mundell`s International Economics: Adaptations and Debates

... macromodel during the sixties, a period of massive upheaval in the subject. The present paper looks at these two great economists in an unorthodox way. We consider their contributions in light of the contrast in the extent to which revisions were made to their works as they were reprinted in an adap ...

... macromodel during the sixties, a period of massive upheaval in the subject. The present paper looks at these two great economists in an unorthodox way. We consider their contributions in light of the contrast in the extent to which revisions were made to their works as they were reprinted in an adap ...

The Swiss National Bank in Brief

... in a redistribution of income and wealth. The SNB ensures price stability by using its monetary policy operations to influence the interest rate environment and align it with the prevailing economic situation. Interest rate reductions lower credit costs, which leads to growing demand for loans and t ...

... in a redistribution of income and wealth. The SNB ensures price stability by using its monetary policy operations to influence the interest rate environment and align it with the prevailing economic situation. Interest rate reductions lower credit costs, which leads to growing demand for loans and t ...

NBER WORKING PAPER SERIES EXTERNAL ADJUSTMENT AND THE GLOBAL CRISIS

... to a significant extent. In this paper, we analyze the ongoing process of external adjustment in advanced economies and emerging markets. We find that countries whose pre-crisis current account balances were in excess of what could be explained by standard economic fundamentals have experienced the ...

... to a significant extent. In this paper, we analyze the ongoing process of external adjustment in advanced economies and emerging markets. We find that countries whose pre-crisis current account balances were in excess of what could be explained by standard economic fundamentals have experienced the ...

CHAPTER VI CURRENCY RISK MANAGEMENT: FUTURES AND

... brokers can be located anywhere and deal with each other over the phone. To reverse a position, one has to make a separate additional forward contract. Reversing a forward contract is not common. Ninety percent of all contracts result in the seller making delivery of the underlying currency. Forward ...

... brokers can be located anywhere and deal with each other over the phone. To reverse a position, one has to make a separate additional forward contract. Reversing a forward contract is not common. Ninety percent of all contracts result in the seller making delivery of the underlying currency. Forward ...

Trade and Development Report 2007

... Over the past five years, the expansion of the world economy and trade has served as an engine of growth for many developing countries and helped to support progress to the Millennium Development Goals. Even the poorest countries have been able to reap benefits from sustained growth of the world eco ...

... Over the past five years, the expansion of the world economy and trade has served as an engine of growth for many developing countries and helped to support progress to the Millennium Development Goals. Even the poorest countries have been able to reap benefits from sustained growth of the world eco ...