Bid-ask spread components on the foreign exchange market: The

... major in Finance. The subject was chosen because it had so many different elements in it which could provide me with the necessary variation during the whole period I worked on it and because I have a general interest in financial topics. After more than a year of hard work, it still is interesting. ...

... major in Finance. The subject was chosen because it had so many different elements in it which could provide me with the necessary variation during the whole period I worked on it and because I have a general interest in financial topics. After more than a year of hard work, it still is interesting. ...

Regional monetary integration in the member states of the Gulf

... overall largely similar in terms of economic structures and face common challenges; secondly, most of their economies are largely based on oil and gas, and are rather open towards the rest of the world; thirdly, while exports of oil and gas mainly go to Asia, a considerable proportion of imports ste ...

... overall largely similar in terms of economic structures and face common challenges; secondly, most of their economies are largely based on oil and gas, and are rather open towards the rest of the world; thirdly, while exports of oil and gas mainly go to Asia, a considerable proportion of imports ste ...

The Currency Market and its Satellites

... Also US traders still do this; so they use unnatural one for e.g. CHF but natural quote for GBP etc ...

... Also US traders still do this; so they use unnatural one for e.g. CHF but natural quote for GBP etc ...

Currency internationalisation and exchange rate dynamics in

... internationalisation using Brazil as a case study. It develops an alternative analytical framework for exchange rate determination in emerging markets based on PostKeynesian economic thought. Drawing on several strands of Post-Keynesian economic theory, the critical realist ontological claim of deep ...

... internationalisation using Brazil as a case study. It develops an alternative analytical framework for exchange rate determination in emerging markets based on PostKeynesian economic thought. Drawing on several strands of Post-Keynesian economic theory, the critical realist ontological claim of deep ...

MultiFractality in Foreign Currency Markets

... evolution of the market efficiency theory during its first two decades and skillfully cites numerous studies that offer empirical support as well as empirical rejection of the EMH. In this paper we conduct an empirical investigation of the return behavior of five foreign currencies in order to dete ...

... evolution of the market efficiency theory during its first two decades and skillfully cites numerous studies that offer empirical support as well as empirical rejection of the EMH. In this paper we conduct an empirical investigation of the return behavior of five foreign currencies in order to dete ...

central bank interventions, communication and interest rate policy in

... In addition to the broad country coverage, our contribution to the literature is threefold. First, we scrutinize the role of central bank communication and interest rate news and study how they can reinforce the effect of actual interventions. Second, we do not only analyze the effectiveness of FX i ...

... In addition to the broad country coverage, our contribution to the literature is threefold. First, we scrutinize the role of central bank communication and interest rate news and study how they can reinforce the effect of actual interventions. Second, we do not only analyze the effectiveness of FX i ...

Mundell`s International Economics: Adaptations and Debates

... that built upon the subject that I had worked on, and he produced a paper that is still worth reading today by students. (Fleming [1978, xix]) Fleming is somewhat more inclined to see his own work as being a useful construct: The essay in Chapter 9, written in 1962, was inspired by a feeling that th ...

... that built upon the subject that I had worked on, and he produced a paper that is still worth reading today by students. (Fleming [1978, xix]) Fleming is somewhat more inclined to see his own work as being a useful construct: The essay in Chapter 9, written in 1962, was inspired by a feeling that th ...

Consistency of two major data sources for

... empirical investigations of money demand or market efficiency, due to peso problems (see, e.g., Flood and Garber, 1980 and 1983; LaHaye, 1985; Casella, 1989). A second issue of interest is whether the US dollar/German reichsmark quotations during the later stages of the German hyperinflation were n ...

... empirical investigations of money demand or market efficiency, due to peso problems (see, e.g., Flood and Garber, 1980 and 1983; LaHaye, 1985; Casella, 1989). A second issue of interest is whether the US dollar/German reichsmark quotations during the later stages of the German hyperinflation were n ...

Arbitrage in the foreign exchange market

... cornerstone riskless no-arbitrage condition in the FX market. The LOP for lending and borrowing services requires that the domestic lending (borrowing) interest rate should be the same as the foreign lending (borrowing) interest rate when the latter is adjusted to fully hedge for exchange rate risk. ...

... cornerstone riskless no-arbitrage condition in the FX market. The LOP for lending and borrowing services requires that the domestic lending (borrowing) interest rate should be the same as the foreign lending (borrowing) interest rate when the latter is adjusted to fully hedge for exchange rate risk. ...

Exchange Rate Predictability in a Changing World

... their interaction with exchange rates change over time. In light of this, we estimate timevarying parameter Taylor rules and examine their predictive content in a framework that also allows for the parameters of the forecasting regression to change over time.4 In a major break with the earlier non-l ...

... their interaction with exchange rates change over time. In light of this, we estimate timevarying parameter Taylor rules and examine their predictive content in a framework that also allows for the parameters of the forecasting regression to change over time.4 In a major break with the earlier non-l ...

as a PDF

... (RNDs) is over-the-counter (OTC) data from a large international bank. This consitutes the third major departure from the work by Galati and Melick (2002) who use exchange-traded options. Our choice is motivated by recent research suggesting that due to different quotation practices, the use of mark ...

... (RNDs) is over-the-counter (OTC) data from a large international bank. This consitutes the third major departure from the work by Galati and Melick (2002) who use exchange-traded options. Our choice is motivated by recent research suggesting that due to different quotation practices, the use of mark ...

Dreher ge08 6483485 en

... avoid the emergence of major macroeconomic imbalances. IMF policy advice is thus geared toward creating an economic environment in which the emergence of a currency crisis is unlikely. In this context one can also argue that markets see IMF programs as “seal of approval” for the country’s economic p ...

... avoid the emergence of major macroeconomic imbalances. IMF policy advice is thus geared toward creating an economic environment in which the emergence of a currency crisis is unlikely. In this context one can also argue that markets see IMF programs as “seal of approval” for the country’s economic p ...

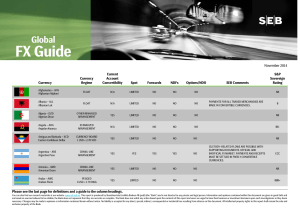

EM Currency Handbook 2014

... from strengthening demand in the US and Europe. Beyond Asia, Central Europe is emerging from a period of painful deleveraging and is poised to see activity accelerate. Reforms in Mexico will leave it better placed to benefit from US recovery. Growth in Chile, Colombia, and Peru, will remain robust. ...

... from strengthening demand in the US and Europe. Beyond Asia, Central Europe is emerging from a period of painful deleveraging and is poised to see activity accelerate. Reforms in Mexico will leave it better placed to benefit from US recovery. Growth in Chile, Colombia, and Peru, will remain robust. ...

Monetary policy background to the gold transactions of the Swiss

... This paper attempts to describe the monetary policy background to the gold transactions of the Swiss National Bank (SNB) in the Second World War. The Independent Commission of Experts Switzerland – Second World War (ICE) addressed the general problem of the SNB gold transactions in the Second World ...

... This paper attempts to describe the monetary policy background to the gold transactions of the Swiss National Bank (SNB) in the Second World War. The Independent Commission of Experts Switzerland – Second World War (ICE) addressed the general problem of the SNB gold transactions in the Second World ...

Macroeconomic Policy Responses to Financial

... main motives lead us to focus on these countries. Firstly, relative to other emerging economies, emerging Europe experienced the largest output drops during the global financial crisis. Secondly, while many emerging countries have reduced their level of liability dollarization since 2000, emerging E ...

... main motives lead us to focus on these countries. Firstly, relative to other emerging economies, emerging Europe experienced the largest output drops during the global financial crisis. Secondly, while many emerging countries have reduced their level of liability dollarization since 2000, emerging E ...

NBER WORKING PAPER SERIES WHAT DOES FUTURES

... interest has more forecasting power than the forward discount, which is a leading predictor of exchange rates in international finance. Similarly, rising bond market interest, which signals higher economic activity and rising inflation expectations, predicts low bond returns. Finally, rising stock mar ...

... interest has more forecasting power than the forward discount, which is a leading predictor of exchange rates in international finance. Similarly, rising bond market interest, which signals higher economic activity and rising inflation expectations, predicts low bond returns. Finally, rising stock mar ...

Australian Government Foreign Exchange Risk Management

... in the exchange rate between the Australian dollar and other currencies. Under the Australian Government’s financial framework, GGS entities are responsible for their financial management, including the foreign exchange risk of their entity. For the purposes of this policy, ‘hedging’ includes any ar ...

... in the exchange rate between the Australian dollar and other currencies. Under the Australian Government’s financial framework, GGS entities are responsible for their financial management, including the foreign exchange risk of their entity. For the purposes of this policy, ‘hedging’ includes any ar ...

The Politics of Monetary Leadership and

... since the creation of the EMS in the late 1970s, two currencies, the British pound sterling and Italian lira, left the system. Additionally, the Portuguese escudo and Spanish peseta were pressured to devalue involuntarily. Continued speculative pressures against EMS currencies through the end of 199 ...

... since the creation of the EMS in the late 1970s, two currencies, the British pound sterling and Italian lira, left the system. Additionally, the Portuguese escudo and Spanish peseta were pressured to devalue involuntarily. Continued speculative pressures against EMS currencies through the end of 199 ...

A Flop And A debAcle: InsIde the IMF`s GlobAl RebAlAncInG Acts

... how suspenseful the meeting actually was — and how discordant. ...

... how suspenseful the meeting actually was — and how discordant. ...

Currency

A currency (from Middle English: curraunt, ""in circulation"", from Latin: currens, -entis) in the most specific use of the word refers to money in any form when in actual use or circulation as a medium of exchange, especially circulating banknotes and coins. A more general definition is that a currency is a system of money (monetary units) in common use, especially in a nation. Under this definition, British pounds, U.S. dollars, and European euros are examples of currency. These various currencies are stores of value, and are traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are defined by governments, and each type has limited boundaries of acceptance.Other definitions of the term ""currency"" are discussed in their respective synonymous articles banknote, coin, and money. The latter definition, pertaining to the currency systems of nations, is the topic of this article. Currencies can be classified into two monetary systems: fiat money and commodity money, depending on what guarantees the value (the economy at large vs. the government's physical metal reserves). Some currencies are legal tender in certain jurisdictions, which means they cannot be refused as payment for debt. Others are simply traded for their economic value. Digital currency arose with the popularity of computers and the Internet.