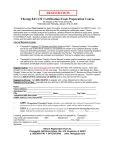

* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Sample title for chapter 1

Financialization wikipedia , lookup

Internal rate of return wikipedia , lookup

Securitization wikipedia , lookup

Investment management wikipedia , lookup

Beta (finance) wikipedia , lookup

Investment fund wikipedia , lookup

Business valuation wikipedia , lookup

Moral hazard wikipedia , lookup

Financial economics wikipedia , lookup

Modern portfolio theory wikipedia , lookup

13 Risk and Capital Budgeting Chapter McGraw-Hill/Irwin Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved. Chapter Outline • Concept of risk based on uncertainties. • Investors and their averseness to risk. • Investors expected higher rate of return on risky projects. • Simulation models and decision trees. • Consequences of risky projects both individually and for the firm as a whole. 13-2 Evaluation and Management of Risk • Price of a stock is largely influenced by the amount of risk. • Ideal situation for a firm is to achieve an approximate mix between profitability and risk. • The challenge lies in determining an appropriate position on the risk-return scale. 13-3 Definition of Risk in Capital Budgeting • Risk is defined in terms of variability of possible outcomes from a given investment. • Risk is measured not only in terms of losses but also in terms of uncertainty. 13-4 Variability and Risk 13-5 The Concept of Risk-Averse • Based on the assumption that - most investors and managers are risk averse. – Preference: relative certainty as opposed to uncertainty. – Expectation: higher value or return for risky investments. 13-6 Actual Measurement of Risk • Basic statistical devices used. – Expected value: D = ∑ DP – Standard deviation: σ = ∑ (D – D)2 P – Co-efficient of Variation: (V) = σ D 13-7 Profitability Distribution with Differing Degrees of Risk 13-8 Profitability Distribution with Differing Degrees of Risk (cont’d) 13-9 Betas for Five-Year Period (Ending January 2006) 13-10 Risk and the Capital Budgeting Process • Informed investors and managers need to decide between: – Investments that produce ‘certain’ returns. – Investments that produces an expected value of return, apart from having a high coefficient of variation. 13-11 Risk-Adjusted Discount Rate • Using different discount rates for proposals with different risk levels. – Investment with normal amount of risk may be discounted at the cost of capital. – Investments carrying greater than normal risk will be discounted at a higher rate and so on. • Risk is assumed to be measured by the coefficient of variation (V). 13-12 Relationship of Risk to Discount Rate 13-13 Increasing Risk over Time • Accurate forecasting becomes more obscure farther out in time. • Unexpected events: – Create a higher standard of deviation in cash flows. – Increase the risk associated with long-lived projects. • Using progressively higher discount rates to compensate for risk tends to penalize late flows more than early flows. 13-14 Qualitative Measures • Setting up of risk classes based on qualitative considerations. 13-15 Risk Categories and Associated Discount Rates 13-16 Example: Risk-adjusted Discount Rate • Assumption (Table 13-4): – An investment calls for an addition to the normal product line and is assigned a discount rate of 10%. – Another investment represents a new product in a foreign market and must carry a 20% discount rate to adjust for a large risk component. – First investment is the only acceptable alternative. 13-17 Capital Budgeting Analysis 13-18 Capital Budgeting Decision Adjusted for Risk 13-19 Simulation Models • Help in dealing with uncertainties involved in forecasting the outcome of capital budgeting projects or other decisions. – Computers enable the simulation of various economic and financial outcomes, using a number of variables. • A Monte Carlo simulation model uses random variable for inputs. 13-20 Simulation Models (cont’d) – Rely on repetition of the same random process as many as several hundred times. – Have the ability to test various combinations of events. – Are used to test possible changes in variable conditions included in the process. – Are driven by sales forecasts, with the assumption to derive income statements and balance sheets. – Generate probability acceptance curves for capital budgeting decisions. 13-21 Simulation of Flow Chart 13-22 Decision Trees • Helps in laying out a sequence of decisions that can be made. • Presents a tabular or graphical comparison between investment choices. • Provides an important analytical process. 13-23 Decision Trees (cont’d) • Assuming that a firm is considering two choices: – Expanding the production for sale to end users. – Entering the highly competitive personal computer market using the firm’s technology. • Cost of both projects is $60 million, with different net present value (NPV) and risk. • Project A: high likelihood of positive rate of return and the long-run growth is a reasonable expectation. • Project B: stiff competition may result in loss of more money or higher profit if sales are high. 13-24 Decision Trees (cont’d) 13-25 The Portfolio Effect • Considers the impact of a given investment on the overall risk of the firm. – A firm may plan to invest in the building products industry carrying a high degree of risk. • The overall risk exposure of that firm might diminish. • The investing firm could alter cyclical fluctuations inherent in its business and reduce overall risk exposure. • Thus, standard deviation for the entire company has been reduced. 13-26 Portfolio Risk • Changes in overall risk of a firm depends on its relationship with other investments. – Highly correlated investments - do not really diversify away risk. – Negatively correlated investments provide a high degree of risk reduction. – Uncorrelated investments provide some overall reduction in portfolio risk. 13-27 Coefficient of Correlation • Represents extent of correlation among projects. – A measure that may take on values anywhere from -1 to +1. • More likely measure case is a measure between -.2 negative correlation and +.3 positive correlation. • Risk can be reduced by: – Combining risky assets with low or negatively correlated assets. 13-28 Rates of Return for Conglomerate, Inc., and Two Merger Candidates 13-29 Evaluation of Combinations • Choosing between the variable points or combinations – should meet two primary objectives: – Achieve the highest possible return at a given risk level. – Provide the lowest possible risk at a given return level. • After developing the best risk-return line efficient frontier: – Determine the position of the firm on that line. 13-30 Risk-Return Trade-Off 13-31 The Share Price Effect • When a firm takes unnecessary or undesirable risk: – Higher discount rate and a lower valuation may have to assigned to the stock in the market. • Higher profits, resulting from risky ventures, could however, have an opposite result. – The overall valuation of a firm might decrease with an increase in coefficient of variation, or beta. 13-32