* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Morgan Stanley Global Fixed Income Strategy

Survey

Document related concepts

Leveraged buyout wikipedia , lookup

Early history of private equity wikipedia , lookup

Stock trader wikipedia , lookup

International investment agreement wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Financial Crisis Inquiry Commission wikipedia , lookup

Socially responsible investing wikipedia , lookup

Fixed-income attribution wikipedia , lookup

Securitization wikipedia , lookup

Hedge (finance) wikipedia , lookup

Systemic risk wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Transcript

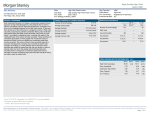

INVESTMENT MANAGEMENT STRATEGY PROFILE | 2015 Morgan Stanley Global Fixed Income Strategy The Morgan Stanley Global Fixed Income Strategy is a value-oriented fixed-income strategy that seeks attractive total returns from income and price appreciation by investing in a globally diversified portfolio of multi-currency debt issued by government and non-government issuers. To help achieve this objective, the strategy combines a top-down macroeconomic assessment, to determine optimal beta1 positioning for the portfolio, with rigorous bottom-up fundamental analysis and active currency management (where appropriate). Strategy at a Glance Inception Benchmark November 1989 3 Sector weight4 Investment Philosophy Dependent on client objectives. Available benchmarks include Citigroup World Government Bond Index, JPM Global Government Bond Index, Barclays Global Aggregate Index and Citi World BIG Index Active positions limited to 10% Security weight4 Positions in a single corporate issuer limited to 0.5-1.0% of the portfolio. Non-government issuers to 5%. The investment team believes that market participants may often mis-value a bond issuer’s default risk, resulting in bond prices that fail to reflect the true credit profile of an issuer. However, the team believes that the market, over time, will re-value the bond prices of high-quality issuers based on an improving credit profile, thereby offering investors in undervalued issuers the opportunity to potentially exploit these pricing inefficiencies and earn superior returns over the long term. Typical number of holdings5 100–150 Available vehicles Separately managed account The team believes that successful portfolio management depends on four factors: • A value-driven process: The team contends that securities should be evaluated for their total return over the entire market cycle, and not just for yield generation. The team seeks to identify undervalued securities in which the potential for price appreciation, combined with an attractive yield, can provide a superior total return. • Forward-looking credit analysis: Some bonds, in particular corporate bonds, can benefit from exposure to additional risks associated with their individual credit risk, business risk and sector risk. These additional risk factors create an ideal environment for portfolio managers to add value, and thus identifying situations where the market is overvaluing or undervaluing those risks is an integral part of the team’s fundamental credit analysis process. • Broad diversification2 to reduce portfolio risk: The team believes successful risk management is based on five key elements: sector and security diversification, overall portfolio credit risk, liquidity, market risk, and duration and volatility management. • A global approach: Given that many global players issue different tranches of debt denominated in different currencies, the team takes a global approach to investing, comparing issuers from around the world. In addition, the team believes value can be added through active interest-rate and country management. The team’s research demonstrates that countries eta is a measure of the volatility, or systematic B risk, of a security or a portfolio in comparison to the market as a whole. 2 Diversification does not protect you against a loss in a particular market; however it allows you to spread that risk across various asset classes. 3 A comparison to this index is provided for informational purposes only; the index is subject to change. The portfolio manager retains discretion in regards to the strategy’s particular investments. Benchmarks may be customised for separately managed accounts. 4 Weightings provided are a typical range, not a maximum number. The portfolio may exceed this from time to time. 5 T he number of holdings provided is a typical range not a maximum number. The portfolio may exceed this from time to time due to market conditions and outstanding trades. 1 MORGAN STANLEY GLOBAL FIXED INCOME STRATEGY with high real interest rates and steep yield curves have historically offered attractive bond returns, thereby providing active managers with the opportunity to add value through interest-rate and country management.6 The team also contends that a value-based approach towards currency management can help generate superior fixedincome returns. Where currency management is permitted by the client, the team assesses relative value using exchangerate and interest rate valuation models. The team takes currency positions (i.e., purchasing undervalued currencies, overweighting higher yielding currencies and purchasing currencies of countries with strong growth prospects) that reflect these value signals. Investment Process The Global Fixed Income strategy combines a top-down assessment of the global bond universe with rigorous bottomup fundamental analysis: • Macro analysis: The process begins with a top-down value assessment of the bond universe, including a consideration of macroeconomic conditions, the corporate earnings environment and relative valuations. The team examines swap spreads as a proxy for the liquidity premium embedded within corporate spreads, and assesses factors such as leverage and asset volatility (which drive both equity volatility and default spreads) as an indicator of future default expectations. to assess the suitability of the issuer’s capital structure for the risk entailed in the issuer’s business. The team’s forward-looking proprietary cash flow models enable them to understand the likely future financial profile. The group also seeks to understand management’s intentions, in terms of business development and capital structure, and ability to execute. • Valuation analysis: The team then conducts a relative valuation assessment on potential investment candidates. Using default data and average risk premia, the team derives a fair value spread for each bond that is compared to the market spread to determine a bond’s under/overvaluation. • Portfolio construction: A portfolio based on specific client guidelines is constructed, with sector allocation driven primarily from bottom-up security selection (subject to the team’s risk management guidelines). Integral to the team’s portfolio construction process is the measurement and monitoring of market risk, duration and volatility, and credit risk through the use of proprietary risk measures and proprietary models. The team actively manages spread duration with a target range of +/- two years versus the benchmark, with portfolio duration targeted at +/- one year around the benchmark. Display 1: Top-down macro analysis integrated with rigorous fundamental analysis helps provide optimal portfolio positioning •Screening: The team applies a unique combination of quantitative and qualitative filters to identify bond issuers that meet its investment criteria in terms of competitive position, franchise value and management quality. The team uses a proprietary quantitative model, Distance-to-Default, to calculate how far an issuer is from theoretical default. Plotting this metric against a bond’s yield spread allows the team to identify bonds offering potential attractive rewards relative to their associated risk. • Credit analysis: The team focuses on financial risk, business risk and management ability/intentions. When analyzing business risk, the team assesses an issuer’s competitive position, its diversification and growth potential, the value of its franchise and the flexibility of its business model in terms of the variability of its cost structure. Financial risk involves an examination of a issuer’s financial statements 6 Past performance is no guarantee of future results. 2 Top-Down Value Assessment Risk Management Client’s Objectives, Guidelines and Benchmark Quantitative Screen Fundamental Analysis This diagram represents how the portfolio management team generally implements its investment process under normal market conditions. STRATEGY PROFILE | 2015 Competitive Advantages Investment Team7 • Combined quantitative and qualitative investment approach: The team’s investment approach integrates strong The Global Fixed Income strategy is managed by Michael Kushma, Christian Roth, Richard Ford, Federico Kaune and Yoshinobu Kou, with the support of the Global Fixed Income team. The team also leverages the research and resources of the Credit, Interest-Rate, Mortgage, Emerging Markets Debt and the Fixed Income Portfolio Specialist teams. qualitative analysis with robust quantitative valuation tools at every stage of the investment process, providing a dynamic credit management process. • Extensive experience: Morgan Stanley Investment Management’s (MSIM) Global Fixed Income team has invested in fixed-income assets since 1975. • Global research: An emphasis on a team-based approach to research and investment allows investors to benefit from the combined insight and expertise of MSIM’s global fixed-income team. Approximately 80 percent of MSIM’s research is generated in-house, and this is supplemented by Morgan Stanley sell-side and third-party research. 7 Team members may change from time to time without notice. 3 For Business and Professional Investors and May Not Be Used with the General Public This financial promotion was issued and approved in the UK by Morgan Stanley Investment Management Limited, 25 Cabot Square, Canary Wharf, London E14 4QA, authorized and regulated by the Financial Conduct Authority, for distribution to Professional Clients or Eligible Counterparties only and must not be relied upon or acted upon by Retail Clients (each as defined in the UK Financial Conduct Authority’s rules). This document has been issued by Morgan Stanley Asia Limited for use in Hong Kong and shall only be made available to “professional investors” as defined under the Securities and Futures Ordinance of Hong Kong (Cap 571). The contents of this document have not been reviewed nor approved by any regulatory authority including the Securities and Futures Commission in Hong Kong. Accordingly, save where an exemption is available under the relevant law, this document shall not be issued, circulated, distributed, directed at, or made available to, the public in Hong Kong. This document may be distributed only (i) to persons who are “institutional investors” under section 304 of the Securities and Futures Act, (the “SFA”), or (ii) to persons who are “accredited investors” or “relevant persons” under section 305 of the SFA, and such distribution is in accordance with the conditions specified in section 305 of the SFA. This publication is disseminated in Australia by Morgan Stanley Investment Management (Australia) Pty Limited ACN: 122040037, A.F.S.L. No. 314182, which accept responsibility for its contents. This publication, and any access to it, is intended only for “wholesale clients” within the meaning of the Australian Corporations Act. This communication is only intended for and will be only distributed to persons resident in jurisdictions where such distribution or availability would not be contrary to local laws or regulations. This document has been prepared by Morgan Stanley Investment Management Limited solely for informational purposes and does not seek to make any recommendation to buy or sell any particular security or to adopt any specific investment strategy. MSIM has not authorized financial intermediaries to use and to distribute this document, unless such use and distribution is made in accordance with applicable law and regulation. Additionally, financial intermediaries are required to satisfy themselves that the information in this document is suitable for any person to whom they provide this document in view of that person’s circumstances and purpose. MSIM shall not be liable for, and accepts no liability for, the use or misuse of this document by any such financial intermediary. If such a person considers an investment she/he should always ensure that she/he has satisfied herself/himself that she/he has been properly advised by that financial intermediary about the suitability of an investment. The material contained herein has not been based on a consideration of any individual client circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision. Except as otherwise indicated herein, the views and opinions expressed herein are those of Morgan Stanley Investment Management, are based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date hereof. This communication is a marketing communication. It is not a product of Morgan Stanley’s Research Department and should not be regarded as a research recommendation. The information contained herein has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto. All information contained herein is proprietary and is protected under copyright law. Risk Considerations Past performance is not a guarantee of future performance. The value of the investments and the income from them can go down as well as up and an investor may not get back the amount invested. There can be no assurance that the strategy will achieve its investment objectives. Investments may be in a variety of currencies and therefore changes in rates of exchange between currencies may cause the value of investments to decrease or increase. Furthermore, the value of investments may be adversely affected by fluctuations in exchange rates between the investor’s reference currency and the base currency of the investments. For investments in emerging markets, the volatility and risk to your capital may be greater due to potential price volatility, political and/or economic risks. Debt securities may not be rated by a recognized rating agency. High yield fixed income securities are considered speculative, involve greater risk of default and tend to be more volatile than investment grade fixed income securities. Securities of small capitalization companies: these securities involve greater risk and the markets for such securities may be more volatile and less liquid. Strategies that specialize in a particular region or market sector are more risky than those which hold a very broad spread of investments. Where strategy concentration is in one sector it is subject to greater risk and volatility than strategies that are more diversified and its value may be more substantially affected by economic events in a particular industry. Investments in derivative instruments carry certain inherent risks such as the risk of counter party default and before investing you should ensure you fully understand these risks. Use of leverage may also magnify losses as well as gains to the extent that leverage is employed. www.morganstanley.com/im © 2015 Morgan Stanley EMEA CRC 1068070 exp 30/04/2016 LN-1