* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download RHB Growth And Income Focus Trust

Business valuation wikipedia , lookup

Land banking wikipedia , lookup

Securitization wikipedia , lookup

Beta (finance) wikipedia , lookup

Stock trader wikipedia , lookup

Stock valuation wikipedia , lookup

Private equity wikipedia , lookup

Syndicated loan wikipedia , lookup

Financial economics wikipedia , lookup

Early history of private equity wikipedia , lookup

Private equity secondary market wikipedia , lookup

Fund governance wikipedia , lookup

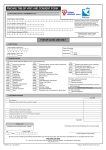

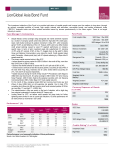

FUND FACTSHEET – FEBRUARY 2017 All data expressed as at 31 January 2017 unless otherwise stated RHB GROWTH AND INCOME FOCUS TRUST This Fund aims to achieve maximum total returns through a combination of long term growth of capital and current income. INVESTOR PROFILE INVESTMENT STRATEGY This Fund is suitable for Investors who: • seek long term capital appreciation through investments in high growth potential small cap securities whilst requiring the flexibility of a conservative portfolio of fixed income securities in order to capitalise and adapt to prevailing market conditions; and • are willing to accept slightly higher risk in their investments than that normally associated with a general balanced fund in order to achieve long term capital growth and income. • 30% - 70% of NAV: Investments in securities of companies with market capitalization of not more than RM750 million (“small cap securities”). • 30% - 70% of NAV: Investments in fixed income securities, money market instruments, cash and deposits with financial institutions. FUND PERFORMANCE ANALYSIS FUND DETAILS Performance Chart Since Launch* Investment Manager Trustee Fund Category Fund Type Cumulative Performance (%)* 1 Month Fund 3.63 Benchmark 2.77 Launch Date Unit NAV Fund Size (million) Units In Circulation (million) Financial Year End MER (as at 31 Dec 2016) Min. Initial Investment Min. Additional Investment Benchmark 3 Months -1.21 1.36 6 Months -9.78 3.88 YTD 3.63 2.77 3 Years 13.53 21.73 5 Years 56.28 51.54 Since Launch 307.32 72.93 2015 22.73 12.80 2014 2.38 8.09 2013 25.10 21.51 Sales Charge 1 Year -3.49 3.53 Fund Benchmark Calendar Year Performance (%)* 2016 Fund -11.62 Benchmark -1.96 Redemption Charge Annual Management Fee Annual Trustee Fee Distribution Policy 2012 14.18 4.68 *For the purpose of computing the annual management fee and annual trustee fee, the NAV of the Fund is exclusive of the management fee and trustee fee for the relevant day. FUND PORTFOLIO ANALYSIS FUND STATISTICS Country Allocation* Trading / Services 33.35% Unquoted Bonds Malaysia 22.13% Consumer Products 76.76% Thailand Cash 9.54% 10% 20% Since Launch 0.9179 0.3795 4.52% 16.41% 0% 12 Months 0.4897 0.4217 Source: Lipper IM Indonesia Cash Historical NAV (RM) 1 Month High 0.4391 Low 0.4228 9.18% 18.58% Industrial Products 07 January 2005 RM0.4391 RM100.62 229.14 31 December 1.69% RM200.00 Any amount 50% FBM Fledgling Index + 50% 12-month FD rate by Maybank Berhad Up to 5.26% of investment amount None 1.50% p.a. of NAV* Up to 0.07% p.a. of NAV* Annually, if any *The implementation of GST will be effective from 1 April 2015 at the rate of 6% and the fees or charges payable is exclusive of GST. Source: Lipper IM Sector Allocation* RHB Asset Management Sdn. Bhd. HSBC (Malaysia) Trustee Bhd Equity (Small Cap) / Bond Fund High Growth and Income Fund 30% Top Holdings (%)* BANGKOK AVIATION FUEL SER PLC-FOR PIE INDUSTRIAL BHD BRIGHT FOCUS BHD 2.5% (24/01/2030) UNITED U-LI CORPORATION SLP RESOURCES BHD *As percentage of NAV RHB Asset Management Sdn Bhd (174588-x) 40% 9.54% 0% 9.18 7.16 6.71 6.63 6.60 50% 100% Historical Distributions (Last 5 Years) (Net) Distribution Yield (%) (sen) 16 Dec 2016 16 Dec 2015 2.0500 4.27 16 Dec 2014 2.7800 6.05 27 Dec 2013 7.8075 15.58 31 Dec 2012 7.4560 15.99 Source: RHB Asset Management Sdn. Bhd. Head Office: Level 8, Tower 2 & 3, RHB Centre, 50400 Kuala Lumpur General Line: 603-9205 8000 FUND FACTSHEET – FEBRUARY 2017 All data expressed as at 31 January 2017 unless otherwise stated RHB GROWTH AND INCOME FOCUS TRUST This Fund aims to achieve maximum total returns through a combination of long term growth of capital and current income. MANAGER'S COMMENTS LOCAL MARKET SUMMARY FBMKLCI increased by +29.81 points in the month of January 2017, to close at 1671.54 points from 1641.73 points in December 2016, an increase of +1.82% on the month-onmonth (mom) and year-to-date (ytd) basis. The positive performance of the benchmark index was due to better market sentiments from the rising commodity prices and increasing foreign inflows. Crude Palm Oil (CPO) spot price increased by +3.17% mom in January 2017 to close at RM3300.00/tonne, similarly for ytd basis. The CPO price strengthened this month due to lower output expectations. Brent Crude Oil price declined by -1.97% mom in January 2017 to close at USD55.70/barrel, while on the ytd basis, it increased by the same percentage. The rising U.S. crude supplies do affect short term sentiments, but price still supported by the agreement between OPEC and Non-OPEC to cut supplies for the next six months. The Malaysia Ringgit appreciated by +1.27% mom to reach RM4.4300/USD from RM4.4870/USD in December 2016. The Ringgit strength could be due to better sentiments from the rising commodities prices. MARKET OUTLOOK AND STRATEGY The steady improvement in the U.S. economy will led to expectations for gradual hike in U.S. interest rate, but not in a disorderly manner than will disrupt the stability of the U.S. economy and also global growth. Developed nations will engage more in fiscal spending to complement accommodative monetary policy to support their economy. Asia remains the attractive investment destination, given the higher GDP growth and earnings prospects. Domestically, economic fundamentals remain intact and resilient, supported by the rising commodity prices and domestic demands, while fiscal and monetary policies remain accommodative. The encouraging fiscal and monetary policies, will also help corporates to grow their earnings going forward. The stabilisation of the Ringgit, rising commodity prices and continuous roll-out of infrastructure projects will also improve consumer sentiments and private consumptions. The bottoming of corporate earnings downgrade, inexpensive valuations, end of foreign investor capitulation and solid corporate fundamentals will continue to be the positive catalysts for the equity market. In terms of strategy, stock selections have become more important in the current volatile market. We will continue to focus in value investing, which encompass of value and growth approach. The factors that we look for in companies includes long term earnings generation visibility, derived from its unique product offerings, new capacity and market expansions, besides of their strong balance sheet and cashflows, which will benefit the fund in the longer term. DISCLAIMER: Based on the fund’s portfolio returns as at 15 January 2017, the Volatility Factor (VF) for this fund is 13.4 and is classified as “Very High”. (source: Lipper) “Very High” includes funds with VF that are more than 10.6 (source: Lipper). The VF means there is a possibility for the fund in generating an upside return or downside return around this VF. The Volatility Class (VC) is assigned by Lipper based on quintile ranks of VF for qualified funds. VF is subject to monthly revision and VC will be revised every six months. The fund’s portfolio may have changed since this date and there is no guarantee that the fund will continue to have the same VF or VC in the future. Presently, only funds launched in the market for at least 36 months will display the VF and its VC. The VC referred to was dated 31 December 2016 which is calculated once every six months and is valid until its next calculation date, i.e. 30 June 2017. A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the Fund is available and investors have the right to request for a PHS. Investors are advised to obtain, read and understand the PHS and the contents of the Master Prospectus dated 3 August 2016 and its supplementary(ies) (if any) (“the Master Prospectus”) before investing. The Master Prospectus has been registered with the Securities Commission Malaysia who takes no responsibility for its contents. Amongst others, investors should consider the fees and charges involved. Investors should also note that the price of units and distributions payable, if any, may go down as well as up. Where a distribution is declared, investors are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from cum-distribution NAV to ex-distribution NAV. Any issue of units to which the Master Prospectus relates will only be made on receipt of a form of application referred to in the Master Prospectus. For more details, please call 1-800-88-3175 for a copy of the PHS and the Master Prospectus or collect one from any of our branches or authorised distributors. The Manager wishes to highlight the specific risks for the Fund are liquidity of underlying investments, interest rate risk, credit / default risk, inflation / purchasing power risk, equity investment risks such as market risk and particular security risk. These risks and other general risks are elaborated in the Master Prospectus. This factsheet is prepared for information purposes only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. Past performance is not necessarily a guide to future performance. Returns may vary from year to year. RHB Asset Management Sdn Bhd (174588-x) Head Office: Level 8, Tower 2 & 3, RHB Centre, 50400 Kuala Lumpur General Line: 603-9205 8000