* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Purchasing Power Parity

Reserve currency wikipedia , lookup

Currency War of 2009–11 wikipedia , lookup

International monetary systems wikipedia , lookup

Bretton Woods system wikipedia , lookup

Currency war wikipedia , lookup

Foreign exchange market wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

Fixed exchange-rate system wikipedia , lookup

Tuesdays 6:10-9:00 p.m.

Commerce 260306

Wednesdays 9:10 a.m.-12 noon

Commerce 260508

Handout #6

International Parity Conditions

Purchasing Power Parity

Yee-Tien “Ted” Fu

Course web pages:

http://finance2010.pageout.net

ID: California2010 Password: bluesky

ID: Oregon2010

Password: greenland

Corporate finance web pages:

http://finance2010.pageout.net

ID: Washington2010

Password: bluesky

ID: Virginia2010 Password: greenland

4-2

Reading Assignments for This Week

Scan

Read

Chaps 3-5

Pages

Luenberger

Chap

Pages

Solnik

Chap

Pages

Levich

Blanchard

Chap 18

Pages

Openness in Goods and Financial Markets

Wooldridge

Chap 4

Pages

Multiple Regression Analysis: Inference

4-3

World Interest Rates Table

Major Central Banks Overview

Next Meeting

Last Change

Current

Interest Rate

Bank of

Canada

Jul 15 2008

Apr 22 2008

3%

Bank of

England

Jul 10 2008

Apr 10 2008

5%

Bank of Japan

Jul 15 2008

Feb 21 2007

0.5%

European

Central Bank

Aug 07 2008

Jul 03 2008

4.25%

Federal

Reserve

Aug 05 2008

Apr 30 2008

2%

Swiss National

Bank

Sep 18 2008

Sep 13 2007

2.75%

The Reserve

Bank of

Australia

Aug 05 2008

Mar 04 2008

7.25%

Central Bank

http://www.fxstreet.com/fundamental/interest-rates-table/

4-4

How do you like the 8 months Liquid CD with a minimum

required balance of $10,000 and a ceiling of $500,000?

CERTIFICATES OF DEPOSIT AS OF JULY 7, 2008

Minimum

Annual

Interest

Term

Balance* Percentage Yield*

Rate

5 years

$5,000+

5.00%

4.88%

4 years

$5,000+

4.25%

4.16%

3 years

$5,000+

3.50%

3.44%

2 years

$5,000+

3.40%

3.34%

18 months

$5,000+

3.75%

3.68%

12 months

$5,000+

2.75%

2.71%

9 months Special $5,000+

3.50%

3.44%

8 month Liquid

$10,000+

3.25%

3.20%

6 months

$5,000+

2.65%

2.62%

3 months

$5,000+

2.60%

2.57%

30 day Special*

$25,000+

2.50%

2.47%

*The 30-day CD has a minimum opening balance of $25,000.

*The 8 Month Liquid CD Maintains a minimum balance of $10,000,

and a maximum opening balance of $500,000.

4-5

http://finance.mapsofworld.com/financial-market/world-inflation.html

http://inflationdata.com/inflation/Inflation_Rate/InternationalSites.asp

4-6

Exchange Rates Table

http://www.x-rates.com/

4-7

July 2007

http://www.eco

nomist.com/ma

rkets/bigmac/

4-8

June 24, 2008

4-9

Feb 04, 2009

4-10

International Parity Relations Linear Approximation

where Spot Rate S are in indirect quote (FC/DC or FC/$)

Forward Rate

Unbiased

FRU Property

Purchasing Power

Parity (relative

PPP

version)

FIE

Uncovered Interest Parity

or Fisher International

Effect

Solnik 2.1

IRP

Interest Rate

Parity

4-11

It takes three to five years to see a significant

(+)(-)valuation to be cut in half.

Source: Page 129 of Levich 2E

4-12

Foreign Exchange Markets

International Parity Conditions

Purchasing Power Parity

MS&E 247S International Investments

Yee-Tien (Ted) Fu

“Under the skin of any international economist

lies a deep-seated belief in some variant of

the PPP theory of the exchange rate.”

- Dornbusch and Krugman (1976)

4-14

Parity Conditions

• Parity or equilibrium conditions can be thought

of as international financial “benchmarks” or

“break-even values”.

¤ They are the defining points where the decisionmaker in a private enterprise is indifferent

between the two strategies summarized by the

two halves of the parity relation.

¤ Such decisions include :

– to borrow in one currency or another?

– to locate a plant in one country or another?

– to measure exposure to currency risks using one

formula or another?

4-15

Parity Conditions

• Parity conditions are the most intriguing when

they are false. Why is this so?

¤ Because the parity conditions rely heavily on

arbitrage, a violation of parity often implies that

a direct or indirect profit opportunity (or cost

advantage) is available to the decision-maker.

¤ These times present the greatest opportunities

but not necessarily the greatest risks.

¤ So, the decision-maker should be most

interested in knowing the direction and duration

of such departures from parity.

4-16

Analysis of Parity Conditions

For each parity condition :

Step 1: Assume a perfect capital market setting.

- no transaction costs

- no taxes

- complete certainty

Step 2: Relax the key assumptions underlying

the parity condition.

Step 3: Review the empirical evidence under the

parity condition.

We will begin with purchasing power parity (PPP) by

developing its theory and reviewing the empirical

evidence related to it.

4-17

Purchasing Power Parity

• When goods become expensive in one

•

country (relatively high inflation rate), exports

decrease and imports increase due to

arbitrage across the goods markets. So, the

demand for foreign currencies increases and

the domestic currency value is depressed.

The result is that currencies will fluctuate

until the relative purchasing power of each

country is the same, that is, reaches parity.

4-18

Purchasing Power Parity

• The theory of purchasing power parity (PPP)

•

focuses on this inflation - exchange rate

relationship.

The absolute form is the “Law of One Price”.

It suggests that similar products in different

countries should be equally priced when

measured in the same currency.

• The relative form of PPP accounts for market

imperfections like transportation costs,

tariffs, and quotas.

4-19

Absolute PPP

The Law of One Price is the principle that in a

perfect capital market setting, homogeneous

goods will sell for the same price in two

markets, taking into account the exchange rate.

Example:

If the price of wheat is $4.50/bushel in the US

and the $/£ exchange rate (S) is $1.50/£,

then the price of wheat in the UK should be

$4.50/bushel / $1.50/£ = 3.00£/bushel.

4-20

Absolute PPP

The price of a market basket of U.S. goods

equals the price of a market basket of U.K.

goods when multiplied by the exchange rate:

PUS, t = S$/£, t x PUK, t

Driving Force: Arbitrage in goods

PUS = PUK x Spot

4-21

Relative PPP

The percentage change in the exchange rate

equals the percentage change in U.S. goods

prices less the percentage change in foreign

goods prices.

Driving Force: Arbitrage in goods

%Δ Spot = %Δ PUS - %Δ PUK

4-22

Relative PPP

Assume that the following hold only with K:

a

b

PUS, t+1 = K x S$/£, t+1 x PUK, t+1

PUS, t = K x S$/£, t x PUK, t

(4.3a)

(4.3b)

(1 + pUS) = (1 + s) x (1 + pUK )

= 1 + s + pUK + s x pUK

(4.4)

where p = P t+1 - P t , s = S t+1 - S t

Pt

St

(% change)

Rearranging terms, we have:

pUS = s + pUK + s x pUK

4-23

Relative PPP

Example:

If UK prices rose by 20% (from 100 to 120),

and the US$ depreciated by 10% (from $1.50

to $1.65), then US prices need to rise by 32%

(from 100 to 132) to maintain the relative PPP.

That is, pUS = 10% + 20% + 10% X 20% = 32%

4-24

Relative PPP

Assuming small % changes in prices and

exchange rates, we can ignore the crossproduct term (s x pUK) :

s = pUS - pUK

% exchange

% change in _ % change in

rate change = US prices

UK prices

i.e.

%Δ Spot = %Δ PUS - %Δ PUK

4-25

Relative PPP

What if we are interested in the level of the

exchange rate that satisfies PPP?

• PPP spot rate is the spot rate that

reestablishes PPP relative to some base

period, or the exchange rate that would just

offset the relative inflation between a pair of

countries since the base period.

4-26

Relative PPP

PUS, t+1 = K x S$/£, t+1 x PUK, t+1

PUS, t = K x S$/£, t x PUK, t

4.3a

4.3b

(4.3a)

(4.3b)

S$/£, t+1

PUS, t+1 / PUK, t+1

S$/£, t =

PUS, t / PUK, t

SPPP, t+1 = S$/£, t

or SPPP, t+1 = S$/£, t

PUS, t+1 / PUK, t+1

PUS, t / PUK, t

(4.7a)

PUS, t+1 / PUS, t

PUK, t+1 / PUK, t

(4.7b)

4-27

Relative PPP

Example:

Assume that the nominal exchange rate in the

base period was $1.50 and that the prices of US

goods had risen by 8%, while the prices of UK

goods had risen by 4%.

The PPP spot rate is $1.50/£ X 1.08/1.04

= $1.5577/£

A nominal exchange rate of $1.5577/£ would reestablish PPP in comparison with the base period.

Nominal exchange rates > $1.5577/£

represent £ "overvaluation" ($ undervaluation).

4-28

Relative PPP

Note that purchasing power conditions

do not imply anything about causal

linkages between prices and exchanges

rates or vice versa.

Both prices AND exchange rates are jointly

determined by other variables in the economy.

A nation's money supply policy, tax (fiscal)

policy, or commercial (tariff) policy may affect

BOTH domestic prices and the exchange

rates.

4-29

Relative PPP - Another Derivation

• When inflation occurs and PPP holds, the

exchange rate will adjust to maintain the parity:

Pf (1 + If ) (1 + ef ) = Ph (1 + Ih )

where Ph = price index of goods in the home country

Pf = price index of goods in the foreign country

Ih = inflation rate in the home country

If = inflation rate in the foreign country

ef = % change in the foreign currency’s value

• Since Ph = Pf , solving for ef gives:

ef = (1 + Ih ) _ 1

(1 + If )

Madura

4-30

Relative PPP - Another Derivation

• The relationship can be simplified as follows:

ef ≈

_

Ih

If

This formula is appropriate only when the inflation

differential is small.

Old Data, Old Data, Old Data

Example:

Suppose that the inflation rate in U.S. is 9%, while

U.K.’s rate is 5%. Then PPP suggests that the

exchange rate should appreciate by about 4%.

U.S. will import more, while U.K. will import less, until

the exchange rate has risen by about 4%. At this

point, U.K. goods will cost 5+4=9% more to U.S.

consumers, while U.S. goods will cost 9-4=5% more

to U.K. consumers.

Madura

4-31

Graphic Analysis of Purchasing Power Parity

Inflation Rate Differential (%)

home inflation rate - foreign inflation rate

4

PPP line

2

-3

-1

1

-2

-4

Madura

3

%Δ in the

foreign

currency

spot rate

4-32

Graphic Analysis of Purchasing Power Parity

Inflation Rate Differential (%)

home inflation rate - foreign inflation rate

4

PPP line

Increased

purchasing

power of

2

foreign

goods

-3

-1

1

-2

-4

Madura

3

Decreased

purchasing

power of

foreign

goods

%Δ in the

foreign

currency

spot rate

4-33

Purchasing Power Parity

• If the actual inflation differential and exchange

•

rate % change for two or more countries

deviate significantly from the PPP line over

time, then PPP does not hold.

A statistical test can be developed by applying

regression analysis to the historical exchange

rates and inflation differentials:

ef = a0 + a1 { (1+Ih)/(1+If) - 1 } + μ

The appropriate t-tests are then applied to a0

and a1, whose hypothesized values are 0 and

1 respectively.

Madura

4-34

Purchasing Power Parity

• PPP may not occur consistently due to:

the existence of other influential factors like

differentials in income levels and risk, as well

as government controls; and

¤ the lack of substitutes for traded goods.

A limitation in testing PPP is that the results

may vary according to the base period used.

PPP can also be tested by assessing a “real”

exchange rate over time. If this rate reverts to

some mean level over time, this would

suggest that it is constant in the long run.

¤

•

•

Madura

4-35

The Real Exchange Rate

• For a country which relies heavily on trade to

•

maintain living standards, it is arguable that

the exchange rate that is important is not the

rate at which the country’s currency

exchanges for another, but the rate at which

the country’s goods exchange in

international trade.

One such calculation of this is the real

exchange rate, which relates the effective

exchange rate to the price of domestic goods

relative to the price of foreign goods.

International Business Economics: Piggott and Cook

4-36

The Effective Exchange Rate

• Since a currency varies against other currencies, it

sometimes makes little sense to refer to one

particular bilateral rate intended to represent the

foreign exchange value of that currency.

• What is needed is some kind of average foreign

currency value, of, say, the pound or Deutsche mark

against several other currencies, and indeed this is

what is currently computed for all major currencies.

• These “average exchange rates” are termed effective

exchange rates and are calculated as an index.

International Business Economics: Piggott and Cook

4-37

The Effective Exchange Rate

Effective exchange rates (1991=100)

Sterling

US$

DM

81.2

130.6

107.4

1985

89.8

113.9

99.5

1986

96.0

97.9

105.2

1987

100.1

95.8

103.8

1988

102.8

95.1

100.6

1989

100.4

99.1

101.0

1990

100.0

100.0

100.0

1991

103.8

96.5

98.6

1992

100.7

107.9

88.4

1993

89.2

100.1

109.7

1994

85.4

101.0

116.8

1995

115.0

87.3

107.6

1996

International Business Economics: Piggott and Cook

Yen

68.3

89.9

97.5

106.5

99.9

91.8

100.0

105.4

126.6

136.3

143.9

125.5

4-38

The Effective Exchange Rate

• The effective exchange rate is an index of the

weighted-average foreign exchange value of

a currency against a basket of other

currencies.

¤ This index summarizes in one number the

value of the currency against a number of

other currencies.

• The weights are usually based on a country’s

trade against its trading partners.

Extra-Man

4-39

The Effective Exchange Rate

Example

Suppose the U.S. only trades with Japan and Germany.

Year 1 yen 100/$ index 100

Year 2 yen 105/$ index 105

Year 3 yen 110/$ index 110

DM 1.50/$ index 100

DM 1.65/$ index 110

DM 1.65/$ index 110

Total U.S. trade = $1000 billion

with Japan

$ 600 billion weight: 60%

with Germany

$ 400 billion weight: 40%

Effective exchange rate for the $:

Extra-Man

Year 1: 100

Year 2: 107

Year 3: 110

4-40

Openness in Goods and Financial Markets

Opening the Economy to International Transactions

Two dimensions of openness:

1. Openness in Goods Markets

2. Openness in Financial Markets

4-41

Openness in Goods Markets

4-42

Openness in Goods Markets

Observations of U.S. Exports and Imports

• Exports and imports in the U.S. were 5% of GDP in

•

•

1960, are 12% (11.2% exports, 13% imports) of GDP

today.

Decline in exports and imports from 1929-1936 was

due in large part to the Smoot-Hawley Act of 1930,

which led to sharp increases in tariffs with the hope

of increasing the demand for domestic goods,

thereby helping the U.S. economy recover from the

Great Depression.

Large trade surpluses occurred in the 1940s, while

large trade deficits occurred in the 1980s.

4-43

Openness in Goods Markets

Measuring the Degree of Openness

• Volume of Trade: Ratio of exports or imports to

•

GDP (U.S. = 12%)

Tradable Goods Ratio: Percent of output that

competes in foreign markets

(U.S. = 60%)

4-44

Openness in Goods Markets

A Look Around the World

Country

Export Ratio (%)

United States

12

Japan

10

Germany

23

United Kingdom 29

Country Export Ratio (%)

Switzerland

40

Austria

38

Belgium

73

Luxembourg

91

4-45

Openness in Goods Markets

What Do You Think...

Can exports exceed GDP?

The trick is to realize that exports and imports may be

exports and imports of intermediate goods.

E.g., a country imports intermediate good for $1 billion

and transfers them into final goods using only labor,

which costs $200 million. Assume that there is no profit.

The value of final goods is thus equal to $1,200 million.

Assume that $1 billion worth of goods is exported and the

rest is consumed in the country. Recall that GDP is value

added in the economy ($200 million here), so that the ratio

of exports to GDP is equal to 5.

4-46

Openness in Goods Markets

The Choice Between Domestic and Foreign Goods

Real Exchange Rates: Price of foreign goods in terms of

domestic goods

Nominal Exchange Rates: The relative prices of

currencies

4-47

Openness in Goods Markets

The Choice Between Domestic and Foreign Goods

Nominal Exchange Rates: Two Views

1.

The price of domestic currency in terms of foreign

currency.

2.

The price of foreign currency in terms of domestic

currency.

For Example:

December 1998: Nominal exchange between U.S. dollar

and German Deutschemark (DM)

$ in terms of DM: 1$ = 1.67 DM

DM in terms of $s: 1DM = 0.60 $

4-48

Openness in Goods Markets

The Choice Between Domestic and Foreign Goods

Nominal Exchange Rates--Choosing a Definition:

Nominal exchange rates (E): price of foreign

currency in terms of

domestic currency

For Example:

E between the U.S. (domestic) and Germany (foreign)

is the price of DM in terms of $

E = .60 (December 1998)

4-49

Openness in Goods Markets

The Choice Between Domestic and Foreign Goods

Measuring Changes in the Nominal Exchange Rate (E)

• Appreciation of domestic currency corresponds to

a decrease in E

• Depreciation of domestic currency corresponds to

an increase in E

4-50

Openness in Goods Markets

The Nominal Exchange Rate, Appreciation, &

Depreciation: Germany and the United States*

Nominal Exchange Rate, E (Price of DM in terms of dollars)

Appreciation of the dollar

Price of dollars in DM increases

Equivalently:

Price of DM in dollars decreases

Equivalently:

Exchange rate decreases: E↓

Depreciation of the dollar

Price of dollars in DM decreases

*Note that E is in the

Equivalently:

form of “American

Price of DM in dollars increases

Quote” or “Direct

Quote” here.

Equivalently:

Exchange rate increases: E↑

4-51

4-52

Openness in Goods Markets

The Nominal Exchange Rate between the DM and the Dollar

1978 - 1998

A sharp dollar appreciation

in the first half of the 1980s

was followed by an equally

sharp dollar depreciation in

the second half of the

1980s.

4-53

Openness in Goods Markets

The Choice Between Domestic and Foreign Goods

Observations on E between U.S. and Germany:

1.

The trend increase in E

1975 DM = 40 cents

1998 DM = 60 cents

2.

The large fluctuations in E

Early 1980s the value of DM dropped 57 cents

to 30 cents

Late 1980s the value of DM rose to 60 cents

4-54

Openness in Goods Markets

The Choice Between Domestic and Foreign Goods

Question:

Does a decrease in E of U.S. $s for DMs necessarily

mean U.S. citizens can buy more German goods with

their dollars?

Hint: What is the inflation rate in Germany?

4-55

Openness in Goods Markets

The Choice Between Domestic and Foreign Goods

Calculating Real Exchange Rates

The price of one German good (Mercedes SL) in terms of

one U.S. Good (Cadillac Seville)

1.

Convert the price of the Mercedes from DM to $s

PDM = 100,000

DM = .60$s

P$s = 100,000 x .60 = $60,000

2.

Compute the ratio of the $ price of the Mercedes to the

Cadillac (Cadillac price = $40,000)

Real exchange rate between U.S. & Germany =

$60,000

= 1 .5

$40,000

4-56

Openness in Goods Markets

The Choice Between Domestic and Foreign Goods

Expanding the Real Exchange Rate Calculation to the

Entire Economic System

If:

P = U.S. GDP Deflator

P* = German GDP Deflator

E = DM-dollar nominal exchange rate

Then: Price of German goods in US$ = EP*

Real exchange rate (ε ) = EP*

P

NOTE:

Real exchange rates (ε ) are index numbers and

measure only relative change.

4-57

Openness in Goods Markets

The Choice Between Domestic and Foreign Goods

The Construction of the Real Exchange Rate

Price of German

goods in DM

P*

Price of German

goods in dollars

EP*

Price of U.S.

goods in dollars

P

Real exchange

rate

ε = EP*

P

4-58

Openness in Goods Markets

The Real Exchange Rate and Real

Appreciation and Real Depreciation*

Real Exchange Rate, ε (Price of German goods in terms of U.S. goods)

Real Appreciation

Price of U.S. goods in terms of German goods increases

Equivalently:

Price of German goods in terms of U.S. goods decreases

Equivalently:

Real exchange rate decreases: ε ↓

Real Depreciation

Price of U.S. goods in terms of German goods decreases

Equivalently:

Price of German goods in terms of U.S. goods increases

Equivalently:

Real exchange rate decreases: ε ↑

*From the view of United States looking at Germany

4-59

4-60

Openness in Goods Markets

The Choice Between Domestic and Foreign Goods

Real and Nominal Exchange Rates

Between Germany and the U.S., 1975-1998

4-61

Openness in Goods Markets

The Choice Between Domestic and Foreign Goods

The Real and Nominal Exchange Rates Between Germany

and the U.S. 1975-1998

Observations:

•

The real 1998 exchange 0.60 was the same as 1975.

P * remained unchanged.

E and P both rose, so

∈= E

•

P

Movements in ε are driven primarily by change in E

4-62

Openness in Goods Markets

The Choice Between Domestic and Foreign Goods

The Country Composition of U.S. Merchandise Trade, 1998

Countries

Canada

Western Europe

Japan

Mexico

Asia*

OPEC**

Others

Total

Exports to

Imports from

$ BillionsPercent $ BillionsPercent

156

159

57

78

126

15

80

671

23

24

8

12

19

2

11

100

177

193

121

95

247

19

67

919

*Not including Japan.

**OPEC: Organization of Petroleum Exporting Countries.

19

21

13

11

27

2

7

100

4-63

Openness in Goods Markets

The Choice Between Domestic and Foreign Goods

Country Composition of U.S. Merchandise Trade, 1998

Observations:

• Canada and Western Europe account for 40-47%

of U.S. trade.

• Large trade deficit with Japan:

Exports to = $57 Billion

Imports from = $121 Billion

4-64

Openness in Goods Markets

The Choice Between Domestic and Foreign Goods

Real Multilateral Exchange Rates

• The real exchange rate when considering many

countries

• Calculate by using each country’s share of

trade as the weight for that country

4-65

Openness in Goods Markets

The Choice Between Domestic and Foreign Goods

The U.S. Effective Real Exchange Rate

1975 - 1998

The multilateral real U.S.

exchange rate is also

called the U.S. tradeweighted real exchange

rate, and the U.S.

effective real exchange

rate.

4-66

The Real Exchange Rate

Real magnitudes are constructed from nominal

magnitudes by adjusting for the appropriate

price levels (P) or inflation rates.

nominal income

Real income =

$ per market basket

$55,000/year

=

$250/market basket

= 220 market baskets/year in 1990

(define this as 100)

So, real income is measured in terms of real

goods and services.

4-67

The Real Exchange Rate

In 1991, nominal income rises by 10%

(to $60,500) while the price of a market basket

rises by 8% (to $270).

To express real income in 1991 as an index:

index (1991) = real income (1991)

real income (1990)

= (60,500/270)

220

= 1.0185

Real income has increased by 1.85%.

4-68

The Real Exchange Rate

The nominal exchange rate (e.g., S=$0.60/DM)

measures the rate of exchange between the

currencies of two countries.

Currency traders quote nominal exchange rates.

The real exchange rate is calculated by

correcting the nominal exchange rate for the

price levels in two countries.

4-69

The Real Exchange Rate

Assuming the case that absolute purchasing

power parity holds:

($600 Price/USgood)

$0.60/DM =

(DM 1000 Price/GermanGood)

LHS = 1 = US good / German good

RHS

In other words, when PPP holds, identical US

goods and German goods exchange for each

other on a one-for-one basis; and the

real exchange rate is constant.

4-70

The Real Exchange Rate

Spot (Real, t) = Spot (Nominal, t)

Spot (PPP, t)

If real exchange rate index = $0.60/DM / $0.50/DM

= 1.2

=> DM is "overvalued" on a PPP basis,

since DM 1 exchanges for $0.60 > PPP spot exchange

$0.50 or 1.0 German good can be exchanged for 1.2

US goods

and sellers of German goods have lost

competitiveness.

4-71

Evidence: The Law of One Price

• One test of the Law of One Price is the Big Mac index,

which has been published annually in The Economist

since 1986.

http://www.economist.com/markets/Bigmac/Index.cfm

• The Big Mac index (burgernomics) was devised as a

•

•

light-hearted guide to whether currencies are at their

“correct” level, based on PPP – the notion that a

dollar should buy the same amount in all countries.

Thus in the long run, the exchange rate between two

countries should move towards the rate that

equalizes the prices of an identical basket of goods

and services in each country.

In other words, a dollar should buy the same amount

everywhere.

The Economist

4-72

Evidence: The Law of One Price

¤

¤

¤

Our “basket” is a McDonalds’ Big Mac, which is

produced and consumed in 120 countries

around the world.

The Big Mac PPP is the exchange rate that

would leave hamburgers costing the same in

America as abroad.

Comparing actual exchange rates with PPPs

signals whether a currency is under- or overvalued.

The Economist

4-73

Evidence: The Law of One Price

• The result of the 2000 survey suggested that the

•

average price of a Big Mac in the U.S. was $2.51, but

was as little as $1.19 in Malaysia, and as much as

$3.58 in Israel.

Hence the Israeli shekel is the most overvalued

currency (by 43%), while the Malaysian ringgit is the

most undervalued (by 53%).

The Economist

4-74

Big Mac foreign-currency price

PPP rate =

US($) price

(of the

US$)

The Economist

convert into dollars at the spot rate

25/04/00

4-75

25/04/00

The Economist

4-76

The first column of the table shows local-currency prices

of a Big Mac, while the second converts them into

dollars. The third column calculates PPPs.

Big Mac PPP rate

=

(of the US$)

foreign currency price

US($) price

Big Mac PPP rate

(of the foreign =

currency)

US($) price

foreign currency price

spot rate

– Big Mac PPP rate

Under (-) / Over (+)

(of foreign currency) (of the foreign currency)

x 100

valuation against =

Big Mac PPP rate

the dollar, %

(of the foreign currency)

4-77

Evidence: The Law of One Price

Example 1. Canada

Purchasing power of C$2.85

= Purchasing power of $2.51

= a Big Mac

Hence Big Mac PPP implies 1 C$ = $ (2.51/2.85)

However from the market spot rate, 1 C$ = $ (1/1.47)

(-)/(+) valuation against $, % (based on Big Mac PPP)

(1/1.47) - (2.51/2.85)

(1/1.47)

=

= (2.51/2.85) - 1

(2.51/2.85)

= - 22.8%

4-78

Evidence: The Law of One Price

Example 2. Denmark

Purchasing power of 24.75 DKr

= Purchasing power of $2.51

= a Big Mac

Hence Big Mac PPP implies 1 DKr = $ (2.51/24.75)

However from the market spot rate, 1 DKr = $ (1/8.04)

(-)/(+) valuation against $, % (based on Big Mac PPP)

(1/8.04) - (2.51/24.75)

(1/8.04)

=

= (2.51/24.75) - 1

(2.51/24.75)

= + 22.6%

4-79

17/04/01

4-80

17/04/01

4-81

The average price of a Big Mac in the U.S. is $2.54

(including sales tax). In Japan, Big Mac scoffers have to

pay ¥294, or $2.38 at current exchange rates. Dividing the

yen price by the dollar price gives a Big Mac PPP of ¥116.

Comparing that with this week’s rate of ¥124 implies that

the yen is 6% undervalued.

(1/124 - 1/116)/(1/116) = -0.0645 = -6%

The cheapest Big Macs are found in China, Malaysia, the

Philippines and South Africa, and all cost less than

$1.20 – these countries have the most undervalued

currencies, by more than 50%.

The most expensive Big Macs are found in Britain,

Denmark and Switzerland – they have the most

overvalued currencies. Sterling, for example is 12%

overvalued against the dollar – less than two years ago,

it was overvalued by 26%.

4-82

Overall, the dollar has never looked so overvalued during

15 years of burgernomics. In the mid 1990s the dollar was

cheap against most currencies; now it looks dear against

all but three. The most undervalued of the rich-world

currencies are the Australian and New Zealand dollars,

which are both 40-45% below McParity. They need to

ketchup.

All the emerging-market currencies are undervalued

against the dollar on a Big Mac PPP basis. That, in turn,

means that a currency such as Argentina’s peso, which is

undervalued only a tad against the dollar, is massively

overvalued compared with other currencies, such as the

Brazilian real and virtually all of the East Asian

currencies.

4-83

25/04/02

4-84

25/04/02

4-85

The average American price has fallen slightly over the

past year, to $2.49. The cheapest Big Mac is in Argentina

(78 cents), after its massive devaluation; the most

expensive ($3.81) is in Switzerland. By this measure, the

Argentine peso is the most undervalued currency and the

Swiss franc the most overvalued.

The euro is only 5% undervalued relative to its Big Mac

PPP, far less than many economists claim. The euro area

may have a single currency, but the price of a Big Mac

varies from euro2.15 in Greece to euro2.95 in France.

However, that range has narrowed from a year ago.

The Australian dollar is the most undervalued rich-world

currency, 35% below McParity. No wonder the Australian

economy was so strong last year. Sterling, by contrast, is

one of the few currencies that is overvalued against the

dollar, by 16%; it is 21% too strong against the euro.

4-86

Overall, the dollar looks overvalued. Over half the

emerging-market currencies are more than 30%

undervalued. That implies that any currency close to

McParity (eg, the Argentine peso last year, or the

Mexican peso today) will be overvalued against other

emerging-market rivals.

Adjustment back towards PPP does not always come

through a shift in exchange rates. It can also come

about through price changes. In 1995 the yen was 100%

overvalued. It has since fallen by 35%; but the price of a

Japanese burger has also dropped by one-third.

In the early 1990s the Big Mac index repeatedly

signalled that the dollar was undervalued, yet it

continued to slide for several years until it flipped

around. Our latest figures suggest that, sooner or later,

the mighty dollar will tumble...

4-87

Apr 24th 2003

4-88

4-89

4-90

4-91

Evidence: The Law of One Price

• Some find the Big Mac index hard to swallow. Not

•

•

•

only does the PPP theory hold only for the very long

run, but hamburgers are a flawed measure of PPP.

Local prices may be distorted by trade barriers on

beef, sales taxes, local competition and changes in

the cost of non-traded inputs such as rents.

But despite its flaws, the Big Mac index produces

PPP estimates close to those derived by more

sophisticated methods.

A currency can deviate from PPP for long periods,

but several studies have found that the Big Mac PPP

is a useful predictor of future movements – “betting

on the most undervalued of the main currencies each

year is a profitable strategy.”

The Economist

4-92

Evidence: The Law of One Price

¤

¤

¤

Indeed, the Big Mac has had several forecasting

successes.

When the euro was launched at the start of 1999,

most forecasters predicted that it would rise against

the dollar. But the euro has instead tumbled – exactly

as the Big Mac index had signaled. At the start of

1999, euro burgers were much dearer than American

ones, suggesting that the euro had started off

significantly overvalued.

One of the best-known hedge funds, Soros Fund

Management, admitted that it chewed over the sell

signal given by the Big Mac index when the euro was

launched, but then decided to ignore it. The euro

tumbled, and Soros was cheesed off.

The Economist

4-93

Year 2000

2.51/2.56 = 0.98

(0.93-0.98)/0.98 = -5%

€ is undervalued by 5%

Year 2001

2.54/2.57 = 0.99

(0.88-0.99)/0.99 = -11%

€ is undervalued by 11%

The average price today in the 12 euro countries is

euro2.57, or $2.27 at current exchange rates. The

euro’s Big Mac PPP against the dollar is

euro1=$0.99, which shows that it has now undershot

McParity by 11%. That, in turn, implies that sterling

is 26% overvalued against the euro.

Please update the Big Mac Index at

http://www.economist.com/PrinterFriendly.cfm?Story_ID=2708584

(also appear in this week’s reading list).

4-94

July 2007

4-95

July 2007

*

*

4-96

July 2007

4-97

The price of a burger depends

heavily on local inputs such as rent

and wages, which are not easily

arbitraged across borders and tend

to be lower in poorer countries. For

this reason PPP is a better guide to

currency misalignments between

countries at a similar stage of

development.

4-98

The most overvalued currencies are found

on the rich fringes of the European Union:

in Iceland, Norway and Switzerland.

Indeed, nearly all rich-world currencies are

expensive compared with the dollar. The

exception is the yen, undervalued by 33%.

This anomaly seems to justify fears that

speculative carry trades, where funds

from low-interest countries such as Japan

are used to buy high-yield currencies,

have pushed the yen too low. But broader

measures of PPP suggest the yen is close

to fair value.

4-99

Carry Trade: borrow money at a cheaper rate

than you can earn on an investment elsewhere

2007

The biggest risk is generally that the exchange rate moves

against you – the higher-interest rate currency rapidly

devalues, reducing the value of your assets relative to your

borrowing. That's why these trades are often described as

“picking up nickels in front of a steamroller”

4-100

2008

http://www.centralbankrates.com/

4-101

2009

http://www.centralbankrates.com/

4-102

Japan’s low Interest Rate

The savings rates of Japanese

households have been among the

highest in the world, and high savings

rates push down the interest rate.

In addition, Japanese investment was

low in 2002 because of the weak

economy at that time. Low investment

also reduced real interest rates.

http://www.worthpublishers.com/ballpreview/casestudy1.PDF

4-103

About the CFA Program

• The Chartered Financial Analyst (CFA) Program is a

•

•

•

globally recognized standard for measuring the

competence and integrity of financial analysts.

Its curriculum develops and reinforces a fundamental

knowledge of investment principles.

Three levels of examination measure a candidate’s

ability to apply these principles at a professional level.

The CFA exam is administered annually in more than 70

nations worldwide.

• http://www.aimr.org/cfaprogram/

4-104

CFA (level III, 1997)

a. Explain the following three concepts of

purchasing power parity (PPP):

i. The law of one price.

ii. Absolute PPP.

iii. Relative PPP.

b. Evaluate the usefulness of relative PPP in

predicting movements in foreign exchange

rates on a:

i. Short-term basis (e.g., three months).

ii. Long-term basis (e.g., six years).

4-105

CFA (level III, 1997)

i. The law of one price is that, assuming competitive markets

and no transportation costs or tariffs, the same goods

should have the same real prices in all countries after

converting prices to a common currency.

ii. Absolute PPP, focusing on baskets of goods and services,

states that the same basket of goods should have the same

price in all countries after conversion to a common currency.

Under absolute PPP, the equilibrium exchange rate

between two currencies would be the rate that equalizes the

prices of a basket of goods between the two countries. This

rate would correspond to the ratio of average price levels in

the countries. Absolute PPP assumes no impediments to

trade and identical price indexes that do not create

measurement problems.

4-106

CFA (level III, 1997)

iii. Relative PPP holds that exchange rate movements reflect

differences in price changes (inflation rates) between

countries. A country with a relatively high inflation rate will

experience a proportionate depreciation of its currency’s

value vis-à-vis a country with a lower rate of inflation.

Movements in currencies provide a means for maintaining

equivalent purchasing power levels among currencies in

the presence of differing inflation rates.

Relative PPP assumes prices adjust quickly and price

indexes properly measure inflation rates. Because relative

PPP focuses on changes and not absolute levels, relative

PPP is more likely to be satisfied than the law of one price

or absolute PPP.

4-107

CFA (level III, 1997)

i. Short-term basis (e.g., three months). Relative PPP is not

consistently useful in the short run because: (1)

Relationships between month-to-month movements in

market exchange rates and PPP are not consistently strong,

according to empirical research. Deviations between the

rates can persist for extended periods; (2) exchange rates

fluctuate minute by minute because they are set in the

financial markets. Price levels, in contrast, are sticky and

adjust slowly; and, (3) many other factors can influence

exchange rate movements rather than just inflation.

ii. Long-term basis (e.g., six years). Research suggests that

over the long term a tendency exists for market and PPP

rates to move together, with market rates eventually moving

toward levels implied by PPP.

4-108

CFA (level III, 1998)

Even though the investment community generally

believes that country M’s recent budget deficit

reduction is “credible, sustainable, and large,”

analysts disagree about how it will affect country M’s

foreign exchange rate. Juan DaSilva, CFA, states

“the reduced budget deficit will lower interest rates,

which will immediately weaken country M’s foreign

exchange rate.”

a. Discuss the direct (short-term) effects of a

reduction in country M’s budget deficit on:

i. Demand for loanable funds.

ii. Nominal interest rates.

iii. Exchange rates.

4-109

CFA (level III, 1998)

b. Helga Wu, CFA, states, “Country M’s foreign

exchange rate will strengthen over time as a

result of changes in expectations in the private

sector in country M.” Support Wu’s position that

country M’s foreign exchange rate will strengthen

because of the changes a budget deficit

reduction will cause in:

i. Expected inflation rates.

ii.Expected rates on return on domestic

securities.

4-110

CFA (level III, 1998)

i. Demand for loanable funds. The immediate effect of

reducing the budget deficit is to reduce the demand for

loanable funds because the government needs to borrow

less to bridge the gap between spending and taxes.

ii. Nominal interest rates. The reduced public sector demand

for loanable funds has the direct effect of lowering nominal

interest rates because lower demand leads to lower cost of

borrowing.

iii. Exchange rates. The direct effect of the budget deficit

reduction is a depreciation of the domestic currency and the

exchange rate. As investors sell lower yielding country M

securities to buy the securities of other countries, country

M’s currency will come under pressure and country M’s

currency will depreciate.

4-111

CFA (level III, 1998)

i. Expected inflation rates. In the case of a credible,

sustainable, and large reduction in the budget deficit,

reduced inflationary expectations are likely because the

central bank is less likely to monetize the debt by printing

money. Purchasing power parity and international Fisher

relationships suggest that a currency should strengthen

against other currencies when expected inflation

declines.

ii. Expected rates on return on domestic securities. A

reduction in government spending would tend to shift

resources into private sector investments, where

productivity is higher. The effect would be to increase the

expected return on domestic securities.

4-112

CFA (level III, 1996)

The HFS Trustees have decided to invest in

international equity markets and have hired Jacob

Hind, a specialist manager, to implement this

decision. He has recommended that an unhedged

equities position be taken in Japan, providing the

following comment and data to support his views:

“Appreciation of a foreign currency increases

the returns to a U.S. dollar investor. Since

appreciation of the yen from 100¥/$ to 98 ¥/$

is expected, the Japanese stock position

should not be hedged.”

4-113

CFA (level III, 1996)

Market Rates and Hind’s Expectations

Spot rate (direct quote)

Hind’s 12-month currency forecast

1-year Eurocurrency rate (% per annum)

Hind’s 1-year inflation forecast (% per annum)

U.S.

Japan

n/a

n/a

6.00

3.00

100

98

0.80

0.50

Assume that the investment horizon is one year

and that there are no costs associated with

currency hedging. State and justify whether Hind’s

recommendation should be followed. Show any

calculations.

4-114

CFA (level III, 1996)

Appreciation of a foreign currency will, indeed, increase

the dollar returns that accrue to a U.S. investor.

However, the amount of the expected appreciation must

be compared with the forward premium or discount on

that currency in order to determine whether hedging

should be undertaken or not.

In the present example to yen is forecast to appreciate

from 100 to 98 (2 percent). However, the forward

premium on the yen as given by the differential in oneyear eurocurrency rates, suggests an appreciation of

over 5 percent:

Forward premium = [(1.06)/(1.008)] -1 = 5.16%

4-115

CFA (level III, 1996)

Thus, the manager’s strategy to leave the yen

unhedged is not appropriate. The manager should

hedge because by doing so, a higher rate of yen

appreciation can be locked in. Given the on-year

eurocurrency rate differentials, the yen position

should be left unhedged only if the yen is forecast

to appreciate to over 95 yen per US dollar.

4-116

Measuring the Cost of Living

•

•

Inflation refers to a situation in which the

economy’s overall price level is rising.

The inflation rate is the percentage change

in the price level from the previous period.

4-117

The GDP Deflator versus the

Consumer Price Index

•

•

Economists and policymakers monitor

both the GDP deflator and the consumer

price index to gauge how quickly prices

are rising.

There are two important differences

between the indexes that can cause

them to diverge.

4-118

The GDP Deflator versus the

Consumer Price Index

•

•

The GDP deflator reflects the prices of

all goods and services produced

domestically, whereas...

…the consumer price index reflects the

prices of all goods and services bought

by consumers.

4-119

The GDP Deflator versus the

Consumer Price Index

•

•

The consumer price index compares the price of a

fixed basket of goods and services to the price of

the basket in the base year (only occasionally

does the BLS change the basket)...

…whereas the GDP deflator compares the price of

currently produced goods and services to the

price of the same goods and services in the base

year.

4-120

Contrasting the CPI and GDP Deflator

Imported

Imported consumer

consumer goods:

goods:

included

included in

in CPI

CPI

excluded

excluded from

from GDP

GDP deflator

deflator

Capital

Capital goods:

goods:

excluded

excluded from

from CPI

CPI

included

included in

in GDP

GDP deflator

deflator (if

(if

produced

produced domestically)

domestically)

The

The basket:

basket:

CPI

CPI uses

uses fixed

fixed basket

basket

GDP

GDP deflator

deflator uses

uses basket

basket of

of

currently

currently produced

produced goods

goods && services

services

This

This matters

matters ifif different

different prices

prices are

are

changing

changing by

by different

different amounts.

amounts.

4-121

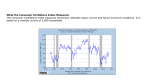

Two Measures of Inflation

15

Percent

15

Percent

per Year

per Year

10

10

5

0

5

0

-5

-5

1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000

1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000

CPI

CPI GDP

GDPdeflator

deflator

4-122

CPI vs. GDP deflator

In each scenario, determine the effects on the

CPI and the GDP deflator.

A. Starbucks raises the price of Frappuccinos.

B. Caterpillar raises the price of the industrial

tractors it manufactures at its Illinois factory.

C. Armani raises the price of the Italian jeans it

sells in the U.S.

4-123

Answers

A. Starbucks raises the price of Frappuccinos.

The CPI and GDP deflator both rise.

B. Caterpillar raises the price of the industrial

tractors it manufactures at its Illinois

factory.

The GDP deflator rises, the CPI does not.

C. Armani raises the price of the Italian jeans it

sells in the U.S.

The CPI rises, the GDP deflator does not.

4-124

MEASURING THE COST OF LIVING

Consumer Price Index

• The consumer price index (CPI) is a measure

of the overall cost of the goods and services

bought by a typical consumer.

• It is used to monitor changes in the cost of

living over time.

• It reports the movement of prices using an

index number.

• When the CPI rises, the typical family has to

spend more dollars to maintain the same

standard of living.

4-125

How the Consumer Price Index Is

Calculated

• Fix the Basket: Determine what goods are

most important to the typical consumer.

Ê The Bureau of Labor Statistics (BLS)

identifies a market basket of goods and

services the typical consumer buys.

Ê The BLS conducts monthly consumer

surveys to determine what they buy and how

much they pay.

• Find the Prices: Find the prices of each of the

goods and services in the basket for each

point in time.

4-126

How the Consumer Price Index Is

Calculated

• Compute the Basket’s Cost: Use the data on

prices to calculate the cost of the basket of

goods and services at different times.

• Choose a Base Year and Compute the Index:

Ê Designate one year as the base year, which is the

benchmark used for comparison.

Ê Compute the index by dividing the price of the basket

in one year by the price in the base year and

multiplying by 100.

4-127

How the Consumer Price Index Is

Calculated

• Compute the inflation rate: The inflation rate

is the percentage change in the price index

from the preceding period.

4-128

Calculating the Consumer Price Index and the

Inflation Rate

•

•

•

•

•

Base Year is 1990

Basket of goods in 1990 cost $1,200

The same basket in 1991 costs $1,236

CPI = ($1,236/$1,200) X 100 = 103

Prices increased 3 percent between 1990 and

1991

4-129

Calculating the Consumer Price Index and the

Inflation Rate: Another Example

•

•

•

•

•

Base Year is 1998.

Basket of goods in 1998 costs $1,200.

The same basket in 2000 costs $1,236.

CPI = ($1,236/$1,200) X 100 = 103.

Prices increased 3 percent between 1998

and 2000.

4-130

What’s in the CPI’s Basket (in year 2000)?

5%

6%

6% 5% 5%

Housing

Food/Beverages

Transportation

40%

17%

16%

Medical Care

Apparel

Recreation

Other

Education and

communication

4-131

What’s in the CPI’s Basket (in year 2004)?

4%

4%

Housing

6%

Transportation

6%

Food & Beverages

42%

6%

Medical care

Recreation

Education and

communication

Apparel

15%

17%

Other

4-132

The Measurement of GDP

GDP is the market value of all

final goods and services

produced within a country in a

given period of time.

4-133

GDP and Its Components (1998)

Total

(in billions of dollars)

Per Person

(in dollars)

% of Total

Gross domestic product, Y

$8,511

$31,522

100 percent

Consumption, C

5,808

21,511

68

Investment, I

1,367

5,063

16

Government purchases, G

1,487

5,507

18

Net exports, NX

-151

-559

-2

4-134

…some people dispute the validity of GDP as a

measure of well-being. When Senator Robert

Kennedy was running for president in 1968, he gave

a moving critique of such economic measures:

[Gross domestic product] does not allow for the

health of our children, the quality of their education,

or the joy of their play. It does not include the

beauty of our poetry or the strength of our

marriages, the intelligence of our public debate or

the integrity of our government officials. It

measures neither our courage, nor our wisdom, nor

our devotion to our country. It measures

everything, in short, except that which makes life

worthwhile, and it can tell us everything about

America except why we are proud that we are

Americans.

4-135

Real versus Nominal GDP

•

•

Nominal GDP values the production of

goods and services at current prices.

Real GDP values the production of

goods and services at constant prices.

4-136

Real versus Nominal GDP

An accurate view of the economy

requires adjusting nominal to real

GDP by using the GDP deflator.

4-137

GDP Deflator

•

•

The GDP deflator measures the current

level of prices relative to the level of

prices in the base year.

It tells us the rise in nominal GDP that is

attributable to a rise in prices rather than a

rise in the quantities produced.

4-138

GDP Deflator

The GDP deflator is calculated as follows:

Nominal GDP

GDP deflator =

× 100

Real GDP

4-139

Converting Nominal GDP to Real

GDP

Nominal GDP is converted to real

GDP as follows:

(Nominal GDP20xx )

Real GDP20xx =

X 100

(GDP deflator20xx )

4-140

Real and Nominal GDP

Year

Price of

Hot dogs

Quantity of

Hot dogs

Price of

Hamburgers

Quantity of

Hamburgers

2001

$1

100

$2

50

2002

$2

150

$3

100

2003

$3

200

$4

150

4-141

Real and Nominal GDP

Calculating Nominal GDP:

2001

($1 per hot dog x 100 hot dogs) + ($2 per hamburger x 50 hamburgers) = $200

2002

($2 per hot dog x 150 hot dogs) + ($3 per hamburger x 100 hamburgers) = $600

2003

($3 per hot dog x 200 hot dogs) + ($4 per hamburger x 150 hamburgers) = $1200

4-142

Real and Nominal GDP

Calculating Real GDP (base year 2001):

2001

($1 per hot dog x 100 hot dogs) + ($2 per hamburger x 50 hamburgers) = $200

2002

($1 per hot dog x 150 hot dogs) + ($2 per hamburger x 100 hamburgers) = $350

2003

($1 per hot dog x 200 hot dogs) + ($2 per hamburger x 150 hamburgers) = $500

4-143

Real and Nominal GDP

Calculating the GDP Deflator:

2001

($200/$200) x 100 = 100

2002

($600/$350) x 100 = 171

2003

($1200/$500) x 100 = 240

4-144

Inflation Rate Calculation

Calculating the inflation rates with GDP

Deflators

2001

2002

( 171 - 100) / 100 = 71%

2003

( 240 - 171) / 171 = 40%

4-145

Real GDP in the United States

Billions of

1992 Dollars

8,000

(Periods of falling real GDP)

7,000

6,000

5,000

4,000

3,000

1970

1975

1980

1985

1990

1995

2000

4-146

Correcting Variables for Inflation:

Comparing Dollar Figures from Different Times

• Inflation makes it harder to compare dollar

amounts from different times.

• We can use the CPI to adjust figures so that

they can be compared.

4-147

EXAMPLE: The High Price of Gasoline

• Price of a gallon of regular unleaded gas:

$1.42 in March 1981

$2.50 in August 2005

• To compare these figures, we will use the CPI

to express the 1981 gas price in “2005

dollars,”

what gas in 1981 would have cost if the

cost of living were the same then as in 2005.

• Multiply the 1981 gas price by

the ratio of the CPI in 2005 to the CPI in 1981.

4-148

EXAMPLE: The High Price of Gasoline

date

Price of gas

CPI

Gas price in

2005 dollars

3/1981

$1.42/gallon

88.5

$3.15/gallon

8/2005

$2.50/gallon

196.4

$2.50/gallon

• 1981 gas price in 2005 dollars

= $1.42 x 196.4/88.5

= $3.15

• After correcting for inflation, gas was more

expensive in 1981.

4-149

Correcting Variables for Inflation:

Indexation

A dollar amount is indexed for inflation

if it is automatically corrected for inflation

by law or in a contract.

For example, the increase in the CPI

automatically determines

¤

the cost-of-living allowances (COLAs) in

many multi-year labor contracts

¤

the adjustments in Social Security payments

and federal income tax brackets

4-150

Assignment for Chapter 4

Exercises 5, 6, 7.

Question: How to measure inflation "financially"?

Answer: Yields of TIPS "minus" Yields of regular treasury

securities

Note that TIPs are Treasury Inflation Protected

Securities. Investors may purchase TIPs at

http://www.publicdebt.treas.gov/sec/seciis.htm

4-151

5.

Suppose the current spot rate is $ 1.55/£ on the first of January. By

year's end, the US CPI is expected to climb from

144 to 150 and

the UK CPI is expected to climb from 120 to 130. According to PPP,

what is the expected spot rate on December 31?

SOLUTIONS:

SPPP,t+1 = St,$/£ * (CPIt+1,US/CPIt,US)/(CPIt+1,UK/CPIt,UK);

SPPP,Dec = $1.55/£ * (150/144)/(130/120) = $ 1.4904/£

4-152

6.

Consider the following data for the U.S. and Surlandia for the years 1975 - 1980.

1975

1976

1977

1978

1979

1980

Pengo/$

8.5

17.4

28.0

34.0

39.0

39.0

Surlandia CPI

100

312

599

838

1118

1511

U.S. CPI

161.2

170.5

181.5

195.4

217.4

246.8

a.

According to the Purchasing Power Parity Theory, by how much is the Pengo

over- or under-valued at the end of 1980?

b.

On what basis could someone refute your calculation?

SOLUTIONS:

a.

One way to calculate the PPP rate in 1980 is SPPP, 1980 = S1975 * [ PSUR,

1980 / PU.S., 1980] / [ PSUR, 1975 / PU.S., 1975] = 8.5 peso/$ * [1511/246.8]

/ [ 100/161.2] = 83.89 peso/$

[1/39.0 - 1/83.89] / [1/83.89] = 2.15 ===> 2.15 -1 = 1.15 Î peso is 115%

overvalued at 39.00 peso/$

4-153

7.

In the above table of numbers for Surlandia and the US, the

nominal bi-lateral exchange rate at the end of 1980 was

reported as 39.0 Pengos/$. What was the real bi-lateral

exchange rate? Hint:

4-154