* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Fund Facts

Pensions crisis wikipedia , lookup

Beta (finance) wikipedia , lookup

Business valuation wikipedia , lookup

Internal rate of return wikipedia , lookup

Rate of return wikipedia , lookup

Present value wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Land banking wikipedia , lookup

Financialization wikipedia , lookup

Stock selection criterion wikipedia , lookup

Financial economics wikipedia , lookup

Negative gearing wikipedia , lookup

Interest rate wikipedia , lookup

Modified Dietz method wikipedia , lookup

Fixed-income attribution wikipedia , lookup

Global saving glut wikipedia , lookup

Corporate finance wikipedia , lookup

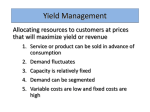

Improving income in a low interest rate environment A focus on commercial property John Kelly Head of Client Investment Page 1 What we will cover • Current interest rates and expectations - improving cash returns • Opportunities and risks of other investments – a maturing cycle – valuations • Commercial property – return characteristics – costs and liquidity Page 2 Latest expectation for interest rates Consensus expectations for Base Rate 5 Implied Rate 10.10.2014 Implied Rate 05.08.2014 Implied Rate 20.06.2014 4 3 2 1 0 2014 2014 2015 2015 2016 2016 Source: Bloomberg / CCLA as at 10.10.2014, 05.08.2014 and 20.06.2014 Page 3 2017 2017 2018 2018 2019 Interest rates will be slow to rise because: • Inflation is not a threat • Debt levels are still high • Strong sterling is a concern • Government policy will continue to drag on activity Page 4 Improving cash returns • By lending longer • Term rates are not attractive: – one year 0.5% – three years 1.1% – five years 1.6% CPI 1.2% • Reduce opportunity and flexibility, increase risk Page 5 Improving cash returns II • By reducing credit quality • The asymmetry of risk for cash investors • Bail-ins – a particular threat to the sector Page 6 Asset classes other than cash UK fixed interest, 10 year gilt yield 12 10 8 6 4 2 0 01/03/92 01/03/94 Source: Bloomberg (10.09.2014) Page 7 01/03/96 01/03/98 01/03/00 01/03/02 01/03/04 01/03/06 01/03/08 01/03/10 01/03/12 01/03/14 Asset classes other than cash II Equities, 10 year returns to 30 September 2014 +160.0% +140.0% +120.0% +100.0% +80.0% +60.0% +40.0% +20.0% +0.0% -20.0% 30/09/2004 30/09/2006 UK Equities +120.22% Cash +26.13% 30/09/2008 30/09/2010 Global Equities +141.91% Inflation +37.14% 30/09/2012 30/09/2014 UK Government Bonds +71.95% UK Commercial Property +76.92% Sources: Bloomberg, IPD: FTSE All-Share Total Return Index, FTSE All-World Total Return Index, FTSE UK Govt All-Stocks Total Return Index, IPD Monthly Total Return Index*, 7 Day LIBID, Retail Price Index* (*lagged a month to give a contemporaneous picture). Page 8 Asset classes other than cash III Commercial property • An inefficient asset class • Predictable income, based on contract • Valuations compressed by recession • Occupier markets just starting to recover Page 9 Long term characteristics are the most important Property investment returns since 1970 % 30 20 10 0 1971 1974 1977 1980 1983 1986 1989 1992 1995 1998 2001 2004 -10 -20 -30 Source: CCLA and IPD Page 10 Income return* Capital growth* *Past performance is no guarantee of future returns 2007 2010 2013 Dec-03 Mar-04 Jun-04 Sep-04 Dec-04 Mar-05 Jun-05 Sep-05 Dec-05 Mar-06 Jun-06 Sep-06 Dec-06 Mar-07 Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Jun-12 Sep-12 Dec-12 Mar13 Jun-13 Sep-13 Dec-13 Property: prime vs secondary Low Yield Source: IPD Page 11 High Yield 200.0 190.0 180.0 170.0 160.0 150.0 140.0 130.0 120.0 110.0 100.0 Current conditions: a building recovery • Economic and financial climate helps not hinders • Activity levels higher, valuations recovering • A gradual thaw in occupier markets? – void rates still high – rents improving in some areas • We expect positive returns for the medium term Page 12 Short term trends are positive Source: Investment Property Databank Page 13 How to invest: • Funds are the lower risk choice • Diversification reduces risk, improves income certainty • Costs and liquidity are important factors Page 14 LAPF Property Fund Fund performance – total returns (NAV) basis % longer term returns to 30 June 2014 • Unique accounting advantages 17.8 18.0 15.2 16.0 14.0 • Strong independent governance 12.4 12.0 9.3 10.0 8.0 6.0 • Attractive income 8.9 6.6 5.0 4.0 • Excellent performance 4.0 2.0 0.0 10 yrs pa* LAPF 5 yrs pa* 3 yrs pa* 1 yr pa* Other Balanced Property Funds Index Source: CCLA and IPD – Annualised past performance is no guarantee of future returns. NAV basis is after the deduction of all expenses Page 15 Property portfolio • Top quality office/lab facility in Cambridge let to AstraZeneca • Current yield 6.1% • Expected yield of 7.2% on renewal Page 16 Building 310, Cambridge Property portfolio • Distribution warehouse let to Royal Mail • Yield 7.8% Page 17 Royal Mail North West Regional Distribution Centre, Winwick Quay, Warrington Property portfolio • Well located and popular distribution facility let to DHL • Bought for £9 million on a 9% yield • Current value £13.5 million, 6% yield Page 18 3310 Hunter Boulevard, Magna Park, Lutterworth, Leicestershire Property portfolio 22/23 Gentleman’s Walk, Norwich • Prime retail shop in dominant regional location • Refurbished and new trading floor opened • Achieved highest rent in Norwich since financial crisis Page 19 Property portfolio 292 St Vincent Street, Glasgow • Current value £2.7m and initial yield 10.0% • Income secured by extending lease to February 2019 • Prime Glasgow office street • Significant office development opposite will further enhance the location Page 20 Regulatory information and risk warning We do not represent that this information, including any third party information, is accurate or complete and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. The services described are provided by CCLA Fund Managers Limited (CCLA), a firm authorised and regulated by the Financial Conduct Authority. This document is issued for information purposes only and is not a solicitation to buy or sell any investment. Nothing in the document should be deemed to constitute the provision of financial, investment or other professional advice. Past performance is not an indication of future performance. Values of investments, and any income derived from them, may fall as well as rise and you may not get back the amount you invested. Exchange rate changes may have an adverse effect on the value, price or income of investments. The levels and bases of, and relief from, taxation may change. You should obtain tax advice where appropriate before proceeding with any investment. Investments in higher yielding bonds issued by borrowers with lower credit ratings may result in a greater risk of default and have a negative impact on income and capital value. Income payments may constitute a return of capital in whole or in part. Income may be achieved by foregoing future capital growth. There may be additional risks associated with investment in emerging and developing markets. Where reference is made to COIF Funds CCLA Fund Managers Limited is the appointed Manager and these may be Unregulated Collective Investment Schemes. The Funds may deal infrequently and may limit redemption. Share values may reflect fluctuations in property and share prices. Fund charges may be applied to capital which may result in capital erosion. Any forward-looking statements are based upon our current opinions, expectations and projections. We undertake no obligation to update or revise these. Actual results could differ materially from those anticipated. Page 21 Senator House, 85 Queen Victoria Street, London EC4V 4ET www.ccla.co.uk Page 22