* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

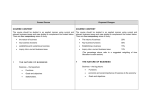

Download chapter 2 estimating discount rates

Syndicated loan wikipedia , lookup

Moral hazard wikipedia , lookup

Securitization wikipedia , lookup

Household debt wikipedia , lookup

Present value wikipedia , lookup

Investment fund wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Stock valuation wikipedia , lookup

Government debt wikipedia , lookup

Private equity wikipedia , lookup

Interest rate wikipedia , lookup

Investment management wikipedia , lookup

Private equity secondary market wikipedia , lookup

Financialization wikipedia , lookup

Early history of private equity wikipedia , lookup

Lattice model (finance) wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Financial economics wikipedia , lookup

Beta (finance) wikipedia , lookup

Systemic risk wikipedia , lookup