* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Close Tactical Select Passive Growth X Acc

International investment agreement wikipedia , lookup

Investment banking wikipedia , lookup

Private equity wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Private money investing wikipedia , lookup

Socially responsible investing wikipedia , lookup

Mutual fund wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Private equity secondary market wikipedia , lookup

Hedge (finance) wikipedia , lookup

Early history of private equity wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

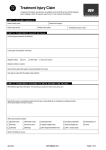

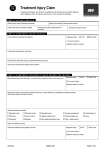

Factsheet as at : June 12, 2017 Close Tactical Select Passive Growth X Acc Fund objective Past performance overview fund vs. sector The investment objective of the Close Tactical Select Passive Growth Fund is to generate capital growth. Detailed fund information Unit name Close Tactical Select Passive Growth X Acc FE Crown rating Morningstar Analyst Rating FE Risk Score Sector 76 IA Flexible Investment Launch date Fund size Price and charges Mid price (as at 09-Jun-2017) Jun 12 17-Oct-2011 (as at 09-Jun-2017) Primary asset class Performance % 70.0 65.0 60.0 55.0 50.0 45.0 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 -5.0 Apr 13 Sep Feb 14 Jul Dec May 15 Oct Mar 16 Aug Jan 17 IA Flexible Investment [61.7%] £ 12.0m 08/06/2012 - 09/06/2017 Powered by data from FE Mixed Asset Cumulative performance (%) 1m 3m 6m 1y 3ys 5ys Close Tactical Select Passive Growth X Acc +1.8 +2.0 +8.8 +22.7 +31.7 +68.0 IA Flexible Investment +2.1 +2.5 +8.9 +20.1 +27.6 +61.7 GBX 276.70 Initial charge 0.00% Annual charge 0.30% Investment Minimum initial Minimum additional Dividend policy Nov Close Tactical Select Passive Growth X Acc [68.0%] £1,000 £250 Price total return performance figures are calculated on a bid price to bid price basis (mid to mid where applicable) with gross income (dividends) reinvested. Performance figures are shown in selected currency. Apr 01, Oct 01 (Final) Codes Citicode SEDOL GOXP B7SG1Y9 Discrete calendar year performance Performance % 18.0 Management information Fund manager Weixu Yan Start date 26-Oct-2015 10 Exchange Square, Address Primrose Street, London 087 0606 6402 (Dealing) Tel 020 7426 4707 (Fax Number) 020 7426 4000 (Main Number) Website www.closebrothersam.com Email [email protected] 16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0 2016 2015 2014 Close Tactical Select Passive Growth X Acc IA Flexible Investment 2013 2012 Powered by data from FE Discrete performance (%) YTD 2016 2015 2014 2013 2012 Close Tactical Select Passive Growth X Acc +6.8 +16.4 +1.8 +7.0 +14.7 +9.3 IA Flexible Investment +7.0 +13.8 +2.0 +4.9 +14.5 +10.1 Price total return performance figures are calculated on a bid price to bid price basis (mid to mid where applicable) with gross income (dividends) reinvested. Performance figures are shown in selected currency. Source: FE You should not use past performance as a suggestion of future performance. It should not be the main or sole reason for making an investment decision. The value of investments and any income from them can fall as well as rise. You may not get back the amount you invested. Tax concessions are not guaranteed their value will depend on individual circumstances and may change in the future. Fund performance data is based on a (bid to bid) basis and doesn’t take into account fees and expenses which are specific to individual plans. Details are available on request. Close Tactical Select Passive Growth X Acc Asset allocation Key Rank % of Fund (30.04.2017) Asset class A B C D E F 1 2 3 4 5 6 American Equity UK Equities Europe ex UK Equities Asia Pacific ex Japan Equities Alternative Assets Japanese Equities 30.6 23.4 16.0 11.8 5.0 4.9 G 7 Global Corporate Fixed Interest 3.2 H I 8 9 Global Fixed Interest Money Market 2.8 2.3 Regional breakdown Key A B C D E F G Rank 1 2 3 4 5 6 7 % of Fund (30.04.2017) Region Americas UK Europe ex UK Asia Pacific ex Japan Not Specified Japan Money Market 30.6 23.4 16.0 11.8 11.0 4.9 2.3 Sector breakdown No Breakdown Data available Top ten holdings % of Fund (30.04.2017) Rank Holding 1 2 3 4 5 6 7 8 9 10 UBS ETF MSCI EMU HDG GBP AMUNDI ETF MSCI EMERGING MARKETS B GBX ISHARES CORE FTSE 100 UCITS ETF HSBC FTSE 250 INDEX C ACC VANGUARD US EQUITY INDEX A PWRSHR S&P500 HI DVD LOW HSBC PACIFIC INDEX C ACC UBS ETF MSCI EMU TRN A-AC DB X-TRACKERS DJ EURO STOXX 50 ETF 1C ACC FIRST TRUST US EQUITY INCOME UCITS ETF A 7.0 6.9 6.6 6.1 5.5 4.8 4.8 4.7 4.3 4.0 © Trustnet Limited 2017 FE Trustnet is a free website devoted exclusively to research, and does not offer any transactional facilities to its users, or offer any advice on investments.The Institute of Company Secretaries and Administrators (ICSA) Registrars Group has issued an official warning to investors to beware of fraudulent use of authorised firms’ logos and trademarks by illegitimate and illegal trading operations or ‘boiler rooms’. Data supplied in conjunction with Thomson Financial Limited, London Stock Exchange Plc, StructuredRetailProducts.com and ManorPark.com, All Rights Reserved. Please read our Disclaimer and Privacy Policy.