* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Private Equity Portfolio Company fees

Private equity wikipedia , lookup

Private money investing wikipedia , lookup

Private equity secondary market wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Special-purpose acquisition company wikipedia , lookup

Dodd–Frank Wall Street Reform and Consumer Protection Act wikipedia , lookup

Investment management wikipedia , lookup

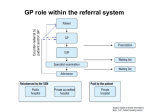

Private Equity Portfolio Company fees Ludovic Phalippou, Chris Rauch, Marc Umber A Private Equity Transaction Board of directors Seat & Control General Partner New York City Repeated interaction future capital commitment Control Appoint Pay standard fees Services Agreement fees & expenses LBO Fund Cayman island Shareholder Executives Portfolio Company (PC) Delaware Cash Pension Funds, Sovereign Wealth Funds, Endowments Contract Time Line LPs sign the Limited Partnership Agreement (LPA): contract on committed capital, management fees, carried interest, and refund rule for transaction and monitoring fees GP sponsors investment #1 in Portfolio Company A LPs receive a fraction of the monitoring and transaction fees GP controls PC-A board Decides on: Executives appointments GP & CEO sign a Services Agreement which specify fees to be paid by CEO to GP 3 Objective Document the content, existence and frequency of these Service Agreements Estimate the amount of transaction and monitoring fees charged Document potential time trends in the occurrence and extent of these fees Document conditional correlations in order to have a first empirical picture on these fees and assess conditions under which these contracts may or may not be optimal, and the main motivation for using them 4 Data source SEC fillings by private equity held companies in the US: IPO-exits: File S1, 144A Companies with publicly traded debt: File 10k, S4 Public to private transactions Filling companies have to disclose ‘related party transactions’ Sample of 1,044 GP investments in 592 LBOs Transactions occurred between 1990 and 2012 Total deal value of $1.1 trillion (2014 dollars) 5 Service Agreements A Service Agreement between PC Executive and GP may be signed when the LBO is ‘closed’ GP ‘will provide the Company from time to time, management, advisory and consulting services’ Four types of cash-transfer items: A one-time transaction fee Annual monitoring fee Post acquisition fees (in connection with recap, acquisitions, spin-offs, dividends etc.) Refund of out-of-pocket expenses (lawyers, accountants; maybe GP internal costs; director fees) 6 Contract characteristics PC fees and expenses are separate transaction fees do not cover cost of executing transactions, monitoring fees do not cover director fees Consistently: No minimum amount/quality of work is required to obtain PC fees In club deals, fees are split in proportion of equity ownership (not based on work done) Contract length is often longer than PC holding period by GPs Termination (usually) triggers the payment of a lump sum amount equal to the present value of the remaining monitoring fees (and sometimes of projected post acquisition fees) Services are not performed; and had a low ex-ante probability of being performed Not binding: can be cancelled/replaced at any time at no cost (if executive/board agrees) Some fiduciary duties are waved. E.g. executives cannot sue for unsatisfactory services Notes: Amount to be paid is entirely decided ex-post LPA and partly decided ex-post acquisition Management fees are ex-ante fees that should cover cost of acquisition and monitoring. Part or all of the PC fees are rebated against management fees Board members of publicly traded companies are a priori restricted to enter such contracts Same person may sign contract for both parties (falls under SEC self dealing rules?) 7 In a nutshell PC fees are partly ex-post discretionary compensation for GPs and partly a dividend to LPs (proportion depends on refund rule) Economic magnitude: $20 billion, equally distributed over past twenty years Represents about 6% of equity invested Average (maximum) refunded amount: 80% 8 Hypothesis I: Optimal contracting • Optimal contracting literature has not studied private equity context, but we could adapt at least four theoretical arguments to support the view that MSAs are solutions to an incomplete dynamic contracting problem: • MSAs enable LPs to reduce GP profit volatility ex ante save on risk compensation (e.g. Holstrom and Milgrom (1990)) • As LPs learn about GPs talent, maybe optimal to start with standard and low compensation and allow GPs to adjust it upward if and when GPs are successful (e.g. Robinson and Sensoy (2013)) • GPs have poor incentives when their carried interest is ‘out-of-the-money’; MSAs can reset their incentives then. Similarly, when a company is in financial distress, it gives incentives for GPs to work hard • MSAs can counteract GPs incentive to invest in bad projects after LPs have committed capital (Axelson, Strömberg, and Weisbach (2009)) • Implications of these ‘optimal’ views: • PC fees should be company and time specific • LPs should not react to the amount of portfolio company fees charged 9 Empirical results I • Fees are unrelated to company characteristics (including volatility of earnings) and do not vary over time with credit/business cycles • Fees are not related to GP past and current performance • Fees are not related to deal performance 10 Hypothesis II: Tunneling • Who lose out? 1. Tax authorities (Polsky (2014)): GPs transfer cash out, call it a fee rather than a dividend because deductible from corporate taxes. GPs share the tax savings with LPs. 2. LP supervisors: GP charge fees to portfolio companies to reduce LP management fees, s.t. LPs report lower than actual expense ratios 3. LPs: cash is withdrawn from investments without consent • Empirical implications as a function of victims: • If tax or supervisor: LP should reward GP. • If LP, LP penalizes GP, and PC fees depend on GP (e.g. patience) • If tax: more PC fees when and where more corp. taxes are being paid 11 Empirical results I • Fees are not related to earnings before tax, are not higher in good times… • Almost all companies pay fees while only half pay corporate taxes • The fraction rebated is often less than one minus marginal corporate tax rate Tax optimization is unlikely to be the prime motive • (preliminary result) Fees are higher when there are more fund of funds among LPs • LPs walked away from GPs that charged most fees when it became public information (post 2009) Only partial support for tunneling LP supervisors • LPs walking away post crisis • Strong GP fixed effect (persistence in fees) • GPs going public distinctively increased fees, and mainly increased monitoring fees (long-term guaranteed fees) • GPs refunding the most charge the least Fees are discretionary; GPs with longer horizons opt to charge less (?) 12 Is this yesterday’s question? • Blackstone earned $327m in 2014, $253m in 2013, and $255m in 2012 of Management and Advisory Fees. Does not look like a dying thing. • This fees were equally high 20 years ago. Even if that was to stop, would be good to know what happened and why it could stay for so long. • At present, move to 100% refund to LPs, but companies would still be charged. • It is a sizeable transfer of capital. Worth knowing about it. • Might also have tax implications, especially in the case of full refund. • 100% is not 100% refund because it is offset only up to the amount of management fees and these may be lower than PC fees, especially late in the fund’s life. 13 Take away Transaction and monitoring fees are controversial Seem high, and GP is supposedly already paid for transacting and monitoring Especially problematic if deal/GP does badly because no longer repeated game Seem to lack compensatory intent Although there is probably a tax consequence, evidence we assemble is not consistent with tax being the main motivation But difficult to rationalize too If it is because of an optimal compensation contract, then how to explain 100% refund? LPs seem to penalize GPs who charge more of these fees, GPs with lower returns seem to charge more etc. But no obvious large-scale tunneling 14