* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 16 PPP

Beta (finance) wikipedia , lookup

Federal takeover of Fannie Mae and Freddie Mac wikipedia , lookup

Securitization wikipedia , lookup

Greeks (finance) wikipedia , lookup

Land banking wikipedia , lookup

Investment management wikipedia , lookup

Financial economics wikipedia , lookup

Financialization wikipedia , lookup

Investment fund wikipedia , lookup

Present value wikipedia , lookup

Interest rate wikipedia , lookup

Business valuation wikipedia , lookup

Short (finance) wikipedia , lookup

Securities fraud wikipedia , lookup

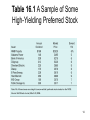

Web Chapter 16 Investing in Preferred Stocks 1 Preferred Stocks and Convertible Securities • Learning Goals 1. Describe the basic features of preferred stock, including sources of value and exposure to risk. 2. Discuss the rights and claims of preferred stockholders, and note some of the popular issue characteristics often found with these securities. 3. Understand the various measures of investment worth, and identify several investment strategies that can be used with preferred stocks. 2 Characteristics of Preferred Stocks • Hybrid security with characteristics of stocks and bonds • Preferred stockholders have a prior claim (ahead of common) on the income and assets of the issuing company • Dividends are a fixed amount—a fixed dollar amount or a percentage of the stock’s par value • Investment quality is rated like bonds 3 Advantages of Preferred Stock • Dividend income is highly predictable • Dividends yields are similar to yields on high credit quality bonds • Generally safe investments with good track record of paying dividends • Easy to purchase due to low unit cost 4 Disadvantages of Preferred Stock • Many preferred stock dividends do not qualify for the new preferential tax rate of 15% • If inflation and interest rates rise, the value of the preferred stock drops • If inflation and interest rates drop, the value rises • Investors don’t participate in the capital gains that common stockholders receive • Preferred stock does not have the safety of a bond, because dividends can be “passed” 5 Valuing Preferred Stock • Value is a function of the dividend yield provided. • Value moves inversely to interest rates, similar to a bond. • The lower the investment quality, the higher the yield. • Risk exposure of preferred stocks includes: – Business risk – Interest rate risk Price of a preferred stock Annual dividend income Prevailing market yield 6 Issue Characteristics of Preferred Stock • Conversion feature: allows holder to convert to a specified number of shares of a company’s common stock • Adjustable rate/floating rate: the dividend rate changes with the market interest rate rather than letting the value of the stock drop • Preference (prior preferred): type of preferred that has seniority over other preferred to receive dividends and claims on assets 7 Issue Characteristics of Preferred Stock (cont’d) • Cumulative provision: all past unpaid dividends must be paid before common stock dividends are paid • In arrears: past dividends that remain unpaid and are an unfulfilled obligation of the company • Noncumulative provision: company is excused from paying all past unpaid dividends 8 Key Measures of Preferred Stock • Dividend Yield Dividend yield Annual dividend income Current market price of the preferred stock • Book Value • Agency Ratings • Fixed Charge Coverage Fixed charge coverage Earnings before interest and taxes (EBIT) Preferred dividends Interest expense 0.65 9 Investment Strategies Using Preferred Stock • Two Major Strategies – Going after higher levels of current income – Seeking capital gains when market rates are falling • Looking for High Yields – – – – Used by long-term investors High current income is primary objective Certainty of income and safety are important Yields typically lower than comparably rated bonds 10 Investment Strategies Using Preferred Stock (cont’d) • Trading on Interest Rate Swings – Investors buy on interest rate declines – Short-term strategy – Capital gains are the primary objective • Speculating on Turnarounds – Look for stocks with speculative ratings and dividends in arrears that are about to undergo a substantial turnaround – Speculative and highly risky – Returns “capped” at price of other investment-grade preferred stocks 11 Figure 16.1 Price Pattern of Preferred Turnaround Candidate 12 Chapter 16 Review • Learning Goals 1. Describe the basic features of preferred stock, including sources of value and exposure to risk. 2. Discuss the rights and claims of preferred stockholders, and note some of the popular issue characteristics often found with these securities. 3. Understand the various measures of investment worth, and identify several investment strategies that can be used with preferred stocks. 13 Table 16.1 A Sample of Some High-Yielding Preferred Stock 14