* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Chapter 9 Sources of Capital

Survey

Document related concepts

Transcript

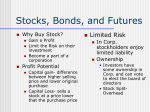

SECTION 3 Stocks, Bonds, and Futures Essential Question: Explain why and how people invest in stocks and how stock prices are determined; compare and contrast bonds to stocks; define what a future is and when people often invest in futures. 1 SECTION 3 Stocks, Bonds, and Futures Why and how people invest in stocks: to gain profit to limit the risk on their investments to become a part owner of a corporation How to invest in stock: buy from a broker/ Online sites are e-brokers buy from an investment bank 2 SECTION 3 Stocks, Bonds, and Futures What is the Dow Jones: 3 The Dow Jones is an index (an average of 30 companies stock prices) The 30 companies are in different industries, but represent the U.S. Economy When the Dow is increasing, it is inferred that the U.S. economy is doing well; when it decreases, it suggests that the economy is declining. SECTION 3 Stocks, Bonds, and Futures Factors that influence stock prices: corporate finances- sales, revenue, profits, losses, lawsuits, government fines investor expectations- difficult to predict external forces, such as changes in the economy or international events 4 SECTION 3 Stocks, Bonds, and Futures Factors that influence stock prices: Bull Market- This term refers to an overall gain in the stock market. While not all stock values are rising, in GENERAL stock values are increasing- this can drive people to invest in stock and continue the trend. Bear Market- This term refers to an overall loss in value of stocks on the stock market. 5 SECTION 3 Stocks, Bonds, and Futures Corporate and government bonds offer lower interest than stock dividends offer less risk than stock Corporate bond offered by companies, even if company declares bankrupcy, bond holders can attempt to get repaid Govt. Bond lower interest, but most secure 6 SECTION 3 Stocks, Bonds, and Futures Futures A future is purchasing a unit of a commodity (oil, gold, etc.) based on the current price, but not getting the item until a “future” time The hope is that by the time you receive the commodity, the value will have increased and you will sell it for a profit This is not guaranteed, sometimes the value decreases and you lose money. Investing in futures can require specialized knowledge and can be difficult. 7 SECTION 3 Stocks, Bonds, and Futures Futures Futures in certain commodities like oil or gold are seen as being safe investments (demand always for these) When the stock market declines, people will often sell stocks and put their money into futures or other “safe” investments to prevent themselves from losing money. 8