* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Managing Interest Rate Risk: Duration GAP and Economic

Security interest wikipedia , lookup

Investment fund wikipedia , lookup

Internal rate of return wikipedia , lookup

United States housing bubble wikipedia , lookup

Pensions crisis wikipedia , lookup

Private equity secondary market wikipedia , lookup

Global saving glut wikipedia , lookup

Stock selection criterion wikipedia , lookup

Quantitative easing wikipedia , lookup

Credit rationing wikipedia , lookup

Interest rate swap wikipedia , lookup

Credit card interest wikipedia , lookup

Securitization wikipedia , lookup

Financial economics wikipedia , lookup

Financialization wikipedia , lookup

Interbank lending market wikipedia , lookup

Greeks (finance) wikipedia , lookup

Business valuation wikipedia , lookup

Fixed-income attribution wikipedia , lookup

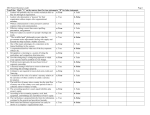

Prof. Dr. Rainer Stachuletz Banking Academy of Vietnam Based upon: Bank Management, 6th edition. Timothy W. Koch and S. Scott MacDonald Managing Interest Rate Risk: Duration GAP and Economic Value of Equity Chapter 6 Prof. Dr. Rainer Stachuletz – Banking Academy of Vietnam - Hanoi Measuring Interest Rate Risk with Duration GAP Economic Value of Equity Analysis Focuses on changes in stockholders’ equity given potential changes in interest rates Duration GAP Analysis Compares the price sensitivity of a bank’s total assets with the price sensitivity of its total liabilities to assess the impact of potential changes in interest rates on stockholders’ equity. Recall from Chapter 4 Duration is a measure of the effective maturity of a security. Duration incorporates the timing and size of a security’s cash flows. Duration measures how price sensitive a security is to changes in interest rates. The greater (shorter) the duration, the greater (lesser) the price sensitivity. Duration and Price Volatility Duration as an Elasticity Measure Duration versus Maturity Consider the cash flows for these two securities over the following time line 0 5 10 15 20 01 900 5 10 15 $1,000 20 $100 Duration versus Maturity The maturity of both is 20 years Maturity does not account for the differences in timing of the cash flows What is the effective maturity of both? The effective maturity of the first security is: (1,000/1,000) x 1 = 20 years The effective maturity of the second security is: [(900/1,000) x 1]+[(100/1,000) x 20] = 2.9 years Duration is similar, however, it uses a weighted average of the present values of the cash flows Duration versus Maturity Duration is an approximate measure of the price elasticity of demand % Change in Quantity Demanded Price Elasticity of Demand % Change in Price Duration versus Maturity The longer the duration, the larger the change in price for a given change in interest rates. P Duration - P i (1 i) i P - Duration P (1 i) Measuring Duration Duration is a weighted average of the time until the expected cash flows from a security will be received, relative to the security’s price Macaulay’s k Duration n CFt (t) CFt (t) t t (1 + r) (1 + r) t =1 D = t=k1 CFt Price of the Security t t =1 (1 + r) Measuring Duration Example What is the duration of a bond with a $1,000 face value, 10% annual coupon payments, 3 years to maturity and a 12% YTM? The bond’s price is $951.96. 100 1 100 2 100 3 1,000 3 + + + 1 2 3 2,597.6 (1.12) (1.12) (1.12) (1.12) 3 D = 2.73 years 3 100 1000 951.96 + t (1.12) 3 t =1 (1.12) Measuring Duration Example What is the duration of a bond with a $1,000 face value, 10% coupon, 3 years to maturity but the YTM is 5%?The bond’s price is $1,136.16. 100 * 1 100 * 2 100 * 3 1,000 * 3 + + + 1 2 3 3,127.31 (1.05) (1.05) (1.05) (1.05) 3 D = 2.75 years 1136.16 1,136.16 Measuring Duration Example What is the duration of a bond with a $1,000 face value, 10% coupon, 3 years to maturity but the YTM is 20%?The bond’s price is $789.35. 100 * 1 100 * 2 100 * 3 1,000 * 3 + + + 1 2 3 2,131.95 (1.20) (1.20) (1.20) (1.20) 3 D = 2.68 years 789.35 789.35 Measuring Duration Example What is the duration of a zero coupon bond with a $1,000 face value, 3 years to maturity but the YTM is 12%? 1,000 * 3 2,135.34 (1.12) 3 D = 3 years 1,000 711.78 (1.12) 3 By definition, the duration of a zero coupon bond is equal to its maturity Duration and Modified Duration The greater the duration, the greater the price sensitivity Modified Duration gives an estimate of price volatility: Macaulay' s Duration Modified Duration (1 i) P - Modified Duration i P Effective Duration Effective Duration Used to estimate a security’s price sensitivity when the security contains embedded options. Compares a security’s estimated price in a falling and rising rate environment. Effective Duration Pi- - Pi Effective Duration P0 (i - i ) Where: Pi- = Price if rates fall Pi+ = Price if rates rise P0 = Initial (current) price i+ = Initial market rate plus the increase in rate i- = Initial market rate minus the decrease in rate Effective Duration Example Consider a 3-year, 9.4 percent semiannual coupon bond selling for $10,000 par to yield 9.4 percent to maturity. Macaulay’s Duration for the option-free version of this bond is 5.36 semiannual periods, or 2.68 years. The Modified Duration of this bond is 5.12 semiannual periods or 2.56 years. Effective Duration Example Assume, instead, that the bond is callable at par in the near-term . If rates fall, the price will not rise much above the par value since it will likely be called If rates rise, the bond is unlikely to be called and the price will fall Effective Duration Example If rates rise 30 basis points to 5% semiannually, the price will fall to $9,847.72. If rates fall 30 basis points to 4.4% semiannually, the price will remain at par $10,000 - $9,847.72 Effective Duration 2.54 $10,000( 0.05 - 0.044) Duration GAP Duration GAP Model Focuses on either managing the market value of stockholders’ equity The bank can protect EITHER the market value of equity or net interest income, but not both Duration GAP analysis emphasizes the impact on equity Duration GAP Duration GAP Analysis Compares the duration of a bank’s assets with the duration of the bank’s liabilities and examines how the economic value stockholders’ equity will change when interest rates change. Two Types of Interest Rate Risk Reinvestment Rate Risk Changes in interest rates will change the bank’s cost of funds as well as the return on invested assets Price Risk Changes in interest rates will change the market values of the bank’s assets and liabilities Reinvestment Rate Risk If interest rates change, the bank will have to reinvest the cash flows from assets or refinance rolled-over liabilities at a different interest rate in the future An increase in rates increases a bank’s return on assets but also increases the bank’s cost of funds Price Risk If interest rates change, the value of assets and liabilities also change. The longer the duration, the larger the change in value for a given change in interest rates Duration GAP considers the impact of changing rates on the market value of equity Reinvestment Rate Risk and Price Risk Reinvestment Rate Risk If interest rates rise (fall), the yield from the reinvestment of the cash flows rises (falls) and the holding period return (HPR) increases (decreases). Price risk If interest rates rise (fall), the price falls (rises). Thus, if you sell the security prior to maturity, the HPR falls (rises). Reinvestment Rate Risk and Price Risk Increases in interest rates will increase the HPR from a higher reinvestment rate but reduce the HPR from capital losses if the security is sold prior to maturity. Decreases in interest rates will decrease the HPR from a lower reinvestment rate but increase the HPR from capital gains if the security is sold prior to maturity. Reinvestment Rate Risk and Price Risk An immunized security or portfolio is one in which the gain from the higher reinvestment rate is just offset by the capital loss. For an individual security, immunization occurs when an investor’s holding period equals the duration of the security. Steps in Duration GAP Analysis Forecast interest rates. Estimate the market values of bank assets, liabilities and stockholders’ equity. Estimate the weighted average duration of assets and the weighted average duration of liabilities. Incorporate the effects of both on- and offbalance sheet items. These estimates are used to calculate duration gap. Forecasts changes in the market value of stockholders’ equity across different interest rate environments. Weighted Average Duration of Bank Assets Weighted Average Duration of Bank Assets (DA) n DA w iDai Where i wi = Market value of asset i divided by the market value of all bank assets Dai = Macaulay’s duration of asset i n = number of different bank assets Weighted Average Duration of Bank Liabilities Weighted Average Duration of Bank Liabilities (DL) m DL z jDlj Where j zj = Market value of liability j divided by the market value of all bank liabilities Dlj= Macaulay’s duration of liability j m = number of different bank liabilities Duration GAP and Economic Value of Equity Let MVA and MVL equal the market values of assets and liabilities, respectively. If: ΔEVE ΔMVA ΔMVL and Duration GAP DGAP DA - (MVL/MVA)D L Then: y ΔEVE - DGAP MVA (1 y) where y = the general level of interest rates Duration GAP and Economic Value of Equity To protect the economic value of equity against any change when rates change , the bank could set the duration gap to zero: y ΔEVE - DGAP MVA (1 y) Hypothetical Bank Balance Sheet 1 Assets Cash Earning assets 3-yr Commercial loan 6-yr Treasury bond 84 1 Total Earning Assets Non-cash earning(1 assets .12)1 Total assets D Liabilities Interest bearing liabs. 1-yr Time deposit 3-yr Certificate of deposit Tot. Int Bearing Liabs. Tot. non-int. bearing Total liabilities Total equity Total liabs & equity Par $1,000 % Coup Years Mat. $100 $ $ 700 12.00% 3 $ 200 8.00% 6 84 2 84 3 $ 900 2 $ (1-.12) (1.12)3 $ 1,000 700 $ 620 $ 300 $ 920 $ $ 920 $ 80 $ 1,000 YTM Market Value 5.00% 7.00% 1 3 Dur. 100 12.00% $ 700 8.00% $ 200 700 3 11.11% $ 900 (1.12)3 $ 10.00% $ 1,000 2.69 4.99 5.00% $ 620 7.00% $ 300 5.65% $ 920 $ 5.65% $ 920 $ 80 $ 1,000 1.00 2.81 2.88 1.59 Calculating DGAP DA ($700/$1000)*2.69 + ($200/$1000)*4.99 = 2.88 DL ($620/$920)*1.00 + ($300/$920)*2.81 = 1.59 DGAP 2.88 - (920/1000)*1.59 = 1.42 years What does this tell us? The average duration of assets is greater than the average duration of liabilities; thus asset values change by more than liability values. 1 percent increase in all rates. 1 Par $1,000 % Coup Years Mat. YTM Market Value Assets Cash $ 100 $ Earning assets 3-yr Commercial loan $ 700 12.00% 3 13.00% $ 6-yr Treasury bond $ 200 8.00% 6 9.00% $ Total Earning Assets $ 900 12.13% $ 3 84 700 $ Non-cash earning assets $ PV t t 1 Total assets $ 1,000 10.88%3 $ 1.13 1.13 Liabilities Interest bearing liabs. 1-yr Time deposit 3-yr Certificate of deposit Tot. Int Bearing Liabs. Tot. non-int. bearing Total liabilities Total equity Total liabs & equity $ 620 $ 300 $ 920 $ $ 920 $ 80 $ 1,000 5.00% 7.00% 1 3 6.00% $ 8.00% $ 6.64% $ $ 6.64% $ $ $ Dur. 100 683 191 875 975 2.69 4.97 614 292 906 906 68 975 1.00 2.81 2.86 1.58 Calculating DGAP DA ($683/$974)*2.68 + ($191/$974)*4.97 = 2.86 DA ($614/$906)*1.00 + ($292/$906)*2.80 = 1.58 DGAP 2.86 - ($906/$974) * 1.58 = 1.36 years What does 1.36 mean? The average duration of assets is greater than the average duration of liabilities, thus asset values change by more than liability values. Change in the Market Value of Equity y ΔEVE - DGAP[ ]MVA (1 y) In this case: .01 ΔEVE - 1.42[ ]$1,000 $12.91 1.10 Positive and Negative Duration GAPs Positive DGAP Indicates that assets are more price sensitive than liabilities, on average. Thus, when interest rates rise (fall), assets will fall proportionately more (less) in value than liabilities and EVE will fall (rise) accordingly. Negative DGAP Indicates that weighted liabilities are more price sensitive than weighted assets. Thus, when interest rates rise (fall), assets will fall proportionately less (more) in value that liabilities and the EVE will rise (fall). DGAP Summary DGAP Summary Positive Positive Change in Interest Rates Increase Decrease Decrease > Decrease → Decrease Increase > Increase → Increase Negative Negative Increase Decrease Decrease < Decrease → Increase Increase < Increase → Decrease Zero Zero Increase Decrease Decrease = Decrease → Increase = Increase → DGAP Assets Liabilities Equity None None An Immunized Portfolio To immunize the EVE from rate changes in the example, the bank would need to: decrease the asset duration by 1.42 years or increase the duration of liabilities by 1.54 years DA / ( MVA/MVL) = 1.42 / ($920 / $1,000) = 1.54 years Immunized Portfolio 1 Par Years $1,000 % Coup Mat. Assets Cash $ 100 Earning assets 3-yr Commercial loan $ 700 6-yr Treasury bond $ 200 Total Earning Assets $ 900 Non-cash earning assets$ Total assets $ 1,000 Liabilities Interest bearing liabs. 1-yr Time deposit $ 340 3-yr Certificate of deposit$ 300 6-yr Zero-coupon CD* $ 444 Tot. Int Bearing Liabs. $ 1,084 Tot. non-int. bearing $ Total liabilities $ 1,084 Total equity $ 80 YTM Market Value $ 12.00% 8.00% 5.00% 7.00% 0.00% 3 6 1 3 6 100 12.00% $ 700 8.00% $ 200 11.11% $ 900 $ 10.00% $ 1,000 5.00% 7.00% 8.00% 6.57% $ $ $ $ $ 6.57% $ $ DGAP = 2.88 – 0.92 (3.11) ≈ 0 Dur. 340 300 280 920 920 80 2.69 4.99 2.88 1.00 2.81 6.00 3.11 Immunized Portfolio with a 1% increase in rates 1 Par $1,000 Assets Cash $ 100.0 Earning assets 3-yr Commercial loan $ 700.0 6-yr Treasury bond $ 200.0 Total Earning Assets $ 900.0 Non-cash earning assets$ Total assets $ 1,000.0 Liabilities Interest bearing liabs. 1-yr Time deposit $ 340.0 3-yr Certificate of deposit$ 300.0 6-yr Zero-coupon CD* $ 444.3 Tot. Int Bearing Liabs. $ 1,084.3 Tot. non-int. bearing $ Total liabilities $ 1,084.3 Total equity $ 80.0 Years % Coup Mat. YTM Market Value Dur. $ 100.0 12.00% 8.00% 5.00% 7.00% 0.00% 3 6 1 3 6 13.00% $ 683.5 9.00% $ 191.0 12.13% $ 874.5 $ 10.88% $ 974.5 6.00% 8.00% 9.00% 7.54% $ 336.8 $ 292.3 $ 264.9 $ 894.0 $ 7.54% $ 894.0 $ 80.5 2.69 4.97 2.86 1.00 2.81 6.00 3.07 Immunized Portfolio with a 1% increase in rates EVE changed by only $0.5 with the immunized portfolio versus $25.0 when the portfolio was not immunized. Stabilizing the Book Value of Net Interest Income This can be done for a 1-year time horizon, with the appropriate duration gap measure DGAP* MVRSA(1- DRSA) - MVRSL(1- DRSL) where: MVRSA = cumulative market value of RSAs MVRSL = cumulative market value of RSLs DRSA = composite duration of RSAs for the given time horizon Equal to the sum of the products of each asset’s duration with the relative share of its total asset market value DRSL = composite duration of RSLs for the given time horizon Equal to the sum of the products of each liability’s duration with the relative share of its total liability market value. Stabilizing the Book Value of Net Interest Income If DGAP* is positive, the bank’s net interest income will decrease when interest rates decrease, and increase when rates increase. If DGAP* is negative, the relationship is reversed. Only when DGAP* equals zero is interest rate risk eliminated. Banks can use duration analysis to stabilize a number of different variables reflecting bank performance. Economic Value of Equity Sensitivity Analysis Effectively involves the same steps as earnings sensitivity analysis. In EVE analysis, however, the bank focuses on: The relative durations of assets and liabilities How much the durations change in different interest rate environments What happens to the economic value of equity across different rate environments Embedded Options Embedded options sharply influence the estimated volatility in EVE Prepayments that exceed (fall short of) that expected will shorten (lengthen) duration. A bond being called will shorten duration. A deposit that is withdrawn early will shorten duration. A deposit that is not withdrawn as expected will lengthen duration. Assets First Savings Bank Economic Value of Equity Market Value/Duration Report as of 12/31/04 Most Likely Rate Scenario-Base Strategy Book Value Market Value Book Yield Duration* $ 100,000 $ 25,000 $ 170,000 $ 55,000 $ 250,000 $ 100,000 $ 25,000 $ 725,000 $ (15,000) $ 710,000 $ $ $ $ $ $ $ $ $ $ 102,000 25,500 170,850 54,725 245,000 100,500 25,000 723,575 11,250 712,325 9.00% 8.75% 7.50% 6.90% 7.60% 8.00% 14.00% 8.03% 0.00% 8.03% 1.1 0.5 6.0 1.9 1.0 2.6 8.0 2.5 Loans Prime Based Ln Equity Credit Lines Fixed Rate > I yr Var Rate Mtg 1 Yr 30-Year Mortgage Consumer Ln Credit Card Total Loans Loan Loss Reserve Net Loans Investments Eurodollars CMO Fix Rate US Treasury Total Investments $ $ $ $ 80,000 $ 35,000 $ 75,000 $ 190,000 $ 80,000 34,825 74,813 189,638 5.50% 6.25% 5.80% 5.76% 0.1 2.0 1.8 1.1 Fed Funds Sold Cash & Due From Non-int Rel Assets Total Assets $ $ $ $ 25,000 $ 15,000 $ 60,000 $ 100,000 $ 25,000 15,000 60,000 100,000 5.25% 0.00% 0.00% 6.93% 6.5 8.0 2.6 First Savings Bank Economic Value of Equity Liabilities Market Value/Duration Report as of 12/31/04 Most Likely Rate Scenario-Base Strategy Book Value Market Value Book Yield Duration* MMDA Retail CDs Savings NOW DDA Personal Comm'l DDA Total Deposits TT&L L-T Notes Fixed Fed Funds Purch NIR Liabilities Total Liabilities $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 232,800 400,000 33,600 38,800 52,250 58,200 815,650 25,000 50,250 28,500 919,400 Equity Total Liab & Equity $ 65,000 $ $ 1,000,000 $ 82,563 1,001,963 Deposits $ $ Off Balance Sheet lnt Rate Swaps Adjusted Equity $ 240,000 400,000 35,000 40,000 55,000 60,000 830,000 25,000 50,000 30,000 935,000 - $ 1,250 65,000 $ 83,813 2.25% 5.40% 4.00% 2.00% 5.00% 8.00% 5.25% 1.1 1.9 1.9 8.0 4.8 1.6 5.9 8.0 2.0 9.9 2.6 6.00% Notional 2.8 50,000 7.9 Duration Gap for First Savings Bank EVE Market Value of Assets $1,001,963 Duration of Assets 2.6 years Market Value of Liabilities $919,400 Duration of Liabilities 2.0 years Duration Gap for First Savings Bank EVE Duration Gap 2.6 – ($919,400/$1,001,963)*2.0 = 0.765 years = Example: A 1% increase in rates would reduce EVE by $7.2 million = 0.765 (0.01 / 1.0693) * $1,001,963 Recall that the average rate on assets is 6.93% Change in EVE (millions of dollars) Sensitivity of EVE versus Most Likely (Zero Shock) Interest Rate Scenario 20.0 10.0 13.6 8.8 8.2 2 (10.0) ALCO Guideline Board Limit (20.0) (8.2) (20.4) (30.0) (36.6) (40.0) -300 -200 -100 0 +100 +200 +300 Shocks to Current Rates Sensitivity of Economic Value of Equity measures the change in the economic value of the corporation’s equity under various changes in interest rates. Rate changes are instantaneous changes from current rates. The change in economic value of equity is derived from the difference between changes in the market value of assets and changes in the market value of liabilities. Effective “Duration” of Equity By definition, duration measures the percentage change in market value for a given change in interest rates Thus, a bank’s duration of equity measures the percentage change in EVE that will occur with a 1 percent change in rates: Effective duration of equity 9.9 yrs. = $8,200 / $82,563 Asset/Liability Sensitivity and DGAP Funding GAP and Duration GAP are NOT directly comparable Funding GAP examines various “time buckets” while Duration GAP represents the entire balance sheet. Generally, if a bank is liability (asset) sensitive in the sense that net interest income falls (rises) when rates rise and vice versa, it will likely have a positive (negative) DGAP suggesting that assets are more price sensitive than liabilities, on average. Strengths and Weaknesses: DGAP and EVESensitivity Analysis Strengths Duration analysis provides a comprehensive measure of interest rate risk Duration measures are additive This allows for the matching of total assets with total liabilities rather than the matching of individual accounts Duration analysis takes a longer term view than static gap analysis Strengths and Weaknesses: DGAP and EVESensitivity Analysis Weaknesses It is difficult to compute duration accurately “Correct” duration analysis requires that each future cash flow be discounted by a distinct discount rate A bank must continuously monitor and adjust the duration of its portfolio It is difficult to estimate the duration on assets and liabilities that do not earn or pay interest Duration measures are highly subjective Speculating on Duration GAP It is difficult to actively vary GAP or DGAP and consistently win Interest rates forecasts are frequently wrong Even if rates change as predicted, banks have limited flexibility in vary GAP and DGAP and must often sacrifice yield to do so Gap and DGAP Management Strategies Example Cash flows from investing $1,000 either in a 2-year security yielding 6 percent or two consecutive 1-year securities, with the current 1-year yield equal to 5.5 percent. 0 1 2 Two-Year Security $60 0 $60 1 2 One-Year Security & then another One-Year Security $55 ? Gap and DGAP Management Strategies Example It is not known today what a 1-year security will yield in one year. For the two consecutive 1-year securities to generate the same $120 in interest, ignoring compounding, the 1-year security must yield 6.5% one year from the present. This break-even rate is a 1-year forward rate, one year from the present: 6% + 6% = 5.5% + x so x must = 6.5% Gap and DGAP Management Strategies Example By investing in the 1-year security, a depositor is betting that the 1-year interest rate in one year will be greater than 6.5% By issuing the 2-year security, the bank is betting that the 1-year interest rate in one year will be greater than 6.5% Yield Curve Strategy When the U.S. economy hits its peak, the yield curve typically inverts, with short-term rates exceeding long-term rates. Only twice since WWII has a recession not followed an inverted yield curve As the economy contracts, the Federal Reserve typically increases the money supply, which causes the rates to fall and the yield curve to return to its “normal” shape. Yield Curve Strategy To take advantage of this trend, when the yield curve inverts, banks could: Buy long-term non-callable securities Prices will rise as rates fall Make fixed-rate non-callable loans Borrowers are locked into higher rates Price deposits on a floating-rate basis Lengthen the duration of assets relative to the duration of liabilities Interest Rates and the Business Cycle The general level of interest rates and the shape of the yield curve appear to follow the U.S. business cycle. Peak In expansionary Short-TermRates stages rates rise until they reach a peak as the Federal Reserve Long-TermRates tightens credit availability. )t n e c r e P ( s e t a Contraction R t Expansion s In contractionary e rstages rates fall until e tthey reach a trough n Iwhen the U.S. Expansion The inverted yield curve has predicted the last five recessions DATE WHEN 1-YEAR RATE LENGTH OF TIME UNTIL FIRST EXCEEDS 10-YEAR RATE START OF NEXT RECESSION Trough economy falls into recession. Time Apr. ’68 Mar. ’73 Sept. ’78 Sept. ’80 Feb. ’89 Dec. ’00 20 months (Dec. ’69) 8 months (Nov. ’73) 16 months (Jan. ’80) 10 months (July ’81) 17 months (July ’90) 15 months (March ’01) Bank Management, 6th edition. Timothy W. Koch and S. Scott MacDonald Copyright © 2006 by South-Western, a division of Thomson Learning Managing Interest Rate Risk: Duration GAP and Economic Value of Equity Chapter 6 Prof. Dr. Rainer Stachuletz edited and updated the PowerPoint slides for this edition.