* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Finance 419

Syndicated loan wikipedia , lookup

Present value wikipedia , lookup

Investment fund wikipedia , lookup

Internal rate of return wikipedia , lookup

Modified Dietz method wikipedia , lookup

Debt settlement wikipedia , lookup

Investment management wikipedia , lookup

Debt collection wikipedia , lookup

Securitization wikipedia , lookup

Financialization wikipedia , lookup

Debtors Anonymous wikipedia , lookup

History of private equity and venture capital wikipedia , lookup

First Report on the Public Credit wikipedia , lookup

Debt bondage wikipedia , lookup

Financial economics wikipedia , lookup

Stock selection criterion wikipedia , lookup

Systemic risk wikipedia , lookup

Household debt wikipedia , lookup

Private equity wikipedia , lookup

Early history of private equity wikipedia , lookup

Private equity secondary market wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Business valuation wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

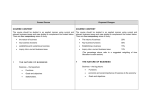

FIN 40153: Advanced Corporate Finance THE WEIGHTED AVERAGE COST OF CAPITAL (BASED ON RWJ CHAPTER 13) The Cost of Capital and Valuation Debt and Equity A company can get cash for investment by retaining earnings or selling either debt or equity. Does it make any difference how the firm raises money? What is the proper discount rate when the firm uses both debt and equity? How do we perform capital budgeting/valuation when the project has different risk and/or capital structure than the firm as a whole? Setting the stage Cash Flows Debt Assets Produce Cash Flows That Create Value Equity The firm’s assets are a portfolio of the debt and equity. Debt and equity just divide up the cash flows (value) of the firm. The Weighted Average Cost Of Capital (WACC) • When a firm has both debt and equity in its capital structure, the most frequent recommendation is to base the project discount rate on the weighted average cost of capital (WACC): E D WACC rE rD (1 TC ) ED ED • where – E is the market value of the firm’s stock – D is the market value of the firm’s debt – rE is the required rate of return on the firm’s stock – rD is the required before tax rate of return on the firm’s debt – TC is the firm’s marginal tax rate Why Is There A Tax Adjustment For Debt? Consider a firm that has earnings before interest and taxes each period of $1000. Under scenario A, the firm is all equity financed; under scenario B, the firm has issued debt with a face value of $1000 and a coupon rate of 10%. The firm has a 40% marginal tax rate. Why Is There A Tax Adjustment For Debt? A EBIT Interest $1000 $0 ______ EBT $1000 Tax (40%) $(400) ______ Net Inc $600 B $1000 $(100) ______ $900 $(360) ______ $540 In A, the firm can distribute a total of $600 to stakeholders. In B, the firm can distribute $100+$540=$640 to stakeholders. The tax shield from debt gives the firm $40 more to distribute. This tax shield lowers the effective interest payment on debt to $60=$100(1-0.4) or 6% coupon rate. Calculation of the cost of debt (RDebt) The before tax cost of debt can be calculated as the yield to maturity (YTM) on the firm’s existing debt. Much debt is not publicly traded, so you do not have the current price to compute the YTM. YTM is basically the IRR of the debt. Can also be determined using the current interest rates applicable to bonds of companies with comparable financial structure and bond ratings. Wall Street Journal Moody’s The after tax cost of debt is the before tax cost of debt multiplied by (1-Tc), where Tc is the firm’s effective marginal tax rate. Bond Ratings and Bond Yields So on 3/1/2006 10 year AAA bonds pay 68 basis points higher than 10 year than Treasuries, 4.59% + 0.68% = 5.27% High Yield Bond Quotes For Intelsat if the face a corporate tax rate of 35% their after tax cost of debt would be 9.467(1 – 0.35) = 6.154% Calculation of the cost of equity (rEquity) The cost of equity can be calculated using the Security Market Line (SML) from the CAPM. rE= Rf+ b (E[RM]- Rf) Three inputs are required Firm Beta Risk free rate Market risk premium Applying the CAPM (i) An estimate of the risk free interest rate. Practitioners tend to favor the current yield on longer-term treasury bonds but adjust according to projects maturity. Remember to adjust the market risk premium accordingly. (ii) An estimate of the market risk premium, E(Rm rf), the extra return investors expect to earn from holding the market instead of the risk-free bond. The theory calls for a forward looking measure (expected) Expectations are not observable. Generally use a historically estimated value. (iii) An estimate of beta. Is the project or a surrogate for it traded in financial markets? If so, gather data and run an OLS regression. How To Obtain Beta. Estimate beta from a regression equation. In practice, generally use last five years of monthly data. Some companies publish beta estimates on a regular basis: Value Line Merrill Lynch Beta Book Internet Finance Websites What if the company is not publicly traded? Find a comparable company that is traded. Use accounting data (ROE) instead of stock returns Reason it out. Microsoft Return Versus S&P 500 RMicrosoft RS&P Estimating Microsoft’s Beta Regression Results of Microsoft Return on S&P 500 Return 20012004 SUMMARY OUTPUT Regression Statistics Multiple R 0.598458926 R Square 0.358153086 Adjusted R Square 0.34708676 Standard Error 0.099420174 Observations 60 ANOVA df Regression Residual Total Intercept X Variable 1 1 58 59 SS 0.319900025 0.573293522 0.893193547 MS 0.319900025 0.009884371 Coefficients Standard Error t Stat -0.000268979 0.012848137 -0.020935275 1.563925441 0.274905499 5.688956548 This is Microsoft’s Beta F Significance F 32.36422661 4.41249E-07 P-value 0.983369144 4.41249E-07 Lower 95% Upper 95% Lower 95.0% Upper 95.0% -0.025987299 0.025449341 -0.025987299 0.025449341 1.013642709 2.114208173 1.013642709 2.114208173 What Determines Beta? Beta is a measure of sensitivity to the market. Companies with cyclical cash flows will tend to have higher betas. Higher operating leverage implies higher betas. operating leverage is the ratio of fixed costs to variable costs. Higher financial leverage also means higher equity beta. The Market Risk Premium The market risk premium measures the additional return that an investor needs to hold risky assets (i.e. stocks) rather than riskfree assets (treasuries). The Market Risk Premium is defined as: [E[R M ] R F ] Ideally, the MRP would be based on expectations of investors about the future. However, expectations are not observable. We can observe what has actually happened based on historical data. The Market Risk Premium (Excess Returns) Excess Returns The difference between the average return for an investment and the average return for a risk-free asset The extra return earned for holding a risky investment For U.S. data from 1928 to 2007 The Market Risk Premium Recall that the standard deviation of returns on the S&P 500 is approximately 20% per year. If we use data from 1928-2007 we have 80 years of data. The standard error of the risk premium estimate is about 0.20/sqrt(80)=0.022 This implies that our estimate of the risk premium is not very precise. The 95% confidence interval is: 0.078 ± 2 x 0.022 The risk premium is between 3.3% and 12.2% Note that these calculations assume that the process generating stock returns is stationary over time. What if it is not? The Market Risk Premium [E[R M ] R F ] Should we use a longer sample? Some researchers have now been able to get U.S. stock return data back to the early 1800s. See for example “Stocks for the Long Run” by Jeremy Siegel http://www.wharton.edu/research/1998.html Also, do we want to create our sample estimate using only data from U.S. markets? The U.S. “won” the major wars, avoided communism or other major social upheaval. Could the U.S. market outcomes reflect what was expected, plus a “bonus” for doing so well? Lets look at some data from “A Century of Global Stock Market Returns” provided by William Goetzmann, Yale University. Fig.1. Real Returns on Global Stock Markets 6 Percent Sorted by Years of Existence: 1921-1996 5 The US is clearly not typical 4 Czechoslovakia • 3 Hungary US Sweden Switzerland Israel Uruguay Canada Norway Chile* UK Mexico Denmark Finland Germany* Netherlands Ireland Austria Australia France 2 1 0 Brazil -1 Pakistan -2 Italy New Zealand Portugal* South Africa Venezuela India Belgium Japan* Spain Egypt -3 -4 Poland Philippines Colombia Argentina* -5 Peru* Greece -6 0 20 40 60 80 Years of Existence since 1921 (* indicates a long-term break) 100 Country Risk Premiums How do estimates of the market risk premium change? If we add additional years to the sample using the Siegel data it suggests a risk premium relative to short-term treasuries of perhaps 6% per year (compared to 7.78%). The Goetzmann data suggest that the average U.S. stock return exceeds average world returns by about 2% per year. These findings suggest estimates of: 6.0% relative to short-term treasuries. 4.5% relative to long-term treasuries . Finally, might the risk premium change over time -- higher at some points, lower at others? If the risk premium is not stationary then using a longer sample will not provide an accurate estimate of current expectations. But using only recent data increases the estimation error. Betas and Leverage • We noted earlier that the beta of a portfolio is the average of the component betas. Also, we can think of the firm’s assets as a portfolio of the debt and equity claims. From these insights it follows that: E D b Assets b Equity b Debt ED ED • Where E is the market value of the stock (equity) and D is the market value of debt (borrowings). Risk of Debt and Equity Assets Produce Cash Flows That Create Value (Asset Beta) Cash Flows Debt (Debt Beta) Equity (Equity Beta) The firm’s assets are a portfolio of the debt and equity. Debt and equity just divide up the cash flows (value) of the firm. Beta and Leverage This formula can be used to find the asset beta given the equity and debt betas or to find the equity beta, given the asset and debt betas. Rearranging the formula gives: D b Equity b Assets ( b Assets b Debt ) E Note that the equity beta increases as leverage (D/E) increases. It is often assumed that the debt has a zero beta (a big simplification). Then: b Assets E b Equity E D b Equity b Assets 1 D E Beta and Leverage This formula can be used to find the asset beta given the equity and debt betas or to find the equity beta, given the asset and debt betas. For firms with risky debt (i.e., below investment grade), in practice it is often assumed that the debt beta is 0.25 to 0.30. b Equity b Assets b Assets D ( b Assets b Debt ) E E D b Equity b Debt E D E D Adjusting beta for different capital structures Example: Gamma airlines’ equity beta is observed to be 1.31. It’s equity is worth 25.0 million while its debt is worth 15.0 million. What is the beta of the underlying assets assuming a debt beta of zero? b Assets 25 1.31 0.819 25 15 Note: The asset beta is always less than or equal to the equity beta. Points to Note Regarding Beta and Leverage If the firm uses no debt (D=0) the equity beta and the asset beta are equal. If the firm uses debt, the equity beta is increased relative to the asset beta: b Equity D b Assets 1 E implies: (1) equity holders will require a higher rate of return, (2) when comparable firms are used to estimate beta, allowances for differing capital structures will be required. How to use the set of tools developed here to select discount rates for capital budgeting. The cost of capital for each project should reflect the systematic risk of that project and the capital structure of the firm (or division) taking the project. So, Select a publicly traded company that is comparable in terms of the risk of the underlying business (i.e., the asset beta). Obtain the unlevered (asset) beta of the comparable. Obtain the corresponding project equity beta for your firm, reflecting your firm’s capital structure. Obtain the cost of equity and cost of debt for this project reflecting your firm’s capital structure. Calculate the WACC for the project and perform NPV analysis based on the expected cash flows with no leverage. EXAMPLE The Story For BK Industries Remember BK Industries has been producing publishing equipment for some time now and the CEO believes that he has stumbled upon a valuable product innovation that embeds new features in text editing systems. BK’s cost advantages and vast skill in marketing mean it would be difficult for competitors to undertake such a project. BK Industries Incremental Cash Flows Suppose that BK forecasts the following cash flows from operating a text editing business ($ millions). Year 0 Year 1 Year 2 Year 3 Year 4 Year5 -26.00 3.98 5.42 6.69 5.99 22.46 BK Industries Net Present Value (NPV) BK has estimated its company cost of capital to be 10%. What is the NPV of the text editing business? NPV (@ r=10%) = -26.00 + 3.98/(1.10) + 5.42/(1.10)2 + 6.69/(1.10)3 + 5.99/(1.10)4 + 22.46/(1.10)5 = $5.159 Million The NPV is greater than zero, so BK should proceed with the project. Example: BK Industries Revisited Suppose that BK Industries is a conglomerate company with operations in a number of other products lines with no text editing business. Also suppose BK’s current equity beta is 1.0. BK has and will maintain a debt/equity ratio of 1.0. Can we use the company cost of capital to value the text editing project? Latec Inc. is a firm that makes only text editing systems. Latec’s equity beta is 1.35. Latec has a debt to equity ratio of 0.75. Delevered Betas with debt/equity ratios • The formulas for obtaining asset betas from equity betas and vice versa provided earlier required dollars values for debt (D) and equity (E). What if you are only given the leverage ratio, L = D/E? The formulas are restated as: 1 b Assets b Equity 1 L b Equity b Assets (1 L) Delever Latec’s Beta to obtain the Beta of text-editing assets: • Latec has L =0.75and an equity beta of 1.35. b Assets 1 1.35 0.77 1 0.75 Relever the asset Beta to reflect BK’s capital structure: Recalling that BK will keep its debt/equity ratio equal to one, we can get: b Equity 0.77 1 1 1.54 This is the beta for a BK equity position in a text editing asset. Why is this equity beta greater than Latec’s? BK Industries, Cont. Assume that the risk free rate is 8% and that BK’s cost of debt is also 8%. The market risk premium is 7% and the marginal tax rate is 45%. The required return on BK’s equity is: requity RF b (E[RM ] RF ) 8% 1.54 7% 18.78% The weighted average cost of capital for the text editing venture (using the fact that D/E = 1 here) is: E D WACC rE rD (1 TC ) ED ED 1 1 = 18.78% 8%(1 0.45) 11.59% 1+1 1 +1 Finally, we can evaluate the NPV of the text editing venture using the WACC that reflects the risk associated with this particular business. The NPV of the text editing project is -$21,329 Notice that the selected discount rate of 11.59% reflects: The risk (beta) of text editing businesses, not BK’s existing businesses. BK’s capital structure, not that of the surrogate firm. COMPANY COST OF CAPITAL AND PROJECT COST OF CAPITAL Required return Security market line showing required return on project Risky Project Safe Project Company cost of capital Average beta of firm's assets Project beta Some Common Errors to Avoid Using book value weights in the WACC. The weights should be based on market values The weights should reflect the firm’s target capital structure. Using incorrect leverage ratios for levering and unlevering betas and computing WACC. D/E versus D/(D+E). Know which one you are using. Some Common Errors to Avoid Subtracting the current risk-free rate from the historical average market return to get the market-risk-premium. The MRP estimate should be based on the difference between the historical average of the market return and the historical average return on the risk-free bond. The current risk-free rate is used for the standalone Rf if the SML equation. E[R i ] R F b i [E[R M ] R F ] Current-Value Historical difference between return on the market and return on the risk-free bond