fiscal and monetary policy

... Low interest rate means more money to loan = more money in circulation High interest rate = less money to loan, less money in circulation Between 1990-2008, from 7% to 0.75% Borrowing from the Fed can signal problems with the bank, last resort ...

... Low interest rate means more money to loan = more money in circulation High interest rate = less money to loan, less money in circulation Between 1990-2008, from 7% to 0.75% Borrowing from the Fed can signal problems with the bank, last resort ...

Sample quiz 5

... increase in the real money supply will: a. Lower the interest rate b. Raise the interest rate c. Have no effect on the interest rate ...

... increase in the real money supply will: a. Lower the interest rate b. Raise the interest rate c. Have no effect on the interest rate ...

Negative Rates: Not Needed, Not Helpful

... holding deposits at the central bank a -10-basis-point interest penalty, which was expanded in March 2016 to a -40 basis point penalty. The BoJ followed the lead of the ECB in late January 2016, charging a -10-basis-point penalty on certain classes of deposits held at the central ...

... holding deposits at the central bank a -10-basis-point interest penalty, which was expanded in March 2016 to a -40 basis point penalty. The BoJ followed the lead of the ECB in late January 2016, charging a -10-basis-point penalty on certain classes of deposits held at the central ...

Obj. 5 Vocabulary

... 10. Saving - Accumulation of excess funds by intentionally spending less than you earn 11. Savings - Portion of income not spent on consumption 12. Time value of money - Money available at the present time (today) is worth more than the same amount if received in the future 13. Certificate of deposi ...

... 10. Saving - Accumulation of excess funds by intentionally spending less than you earn 11. Savings - Portion of income not spent on consumption 12. Time value of money - Money available at the present time (today) is worth more than the same amount if received in the future 13. Certificate of deposi ...

Heading 1 - Royal London Asset Management

... to raise official rates by 25 basis points (bp) while four prefer no change, the weighted-average vote is +14 bp (five-ninths of 25). If it is assumed that votes are either for no change or a move of 25 bp – reasonable under "normal" economic and financial conditions – then the model forecasts an ac ...

... to raise official rates by 25 basis points (bp) while four prefer no change, the weighted-average vote is +14 bp (five-ninths of 25). If it is assumed that votes are either for no change or a move of 25 bp – reasonable under "normal" economic and financial conditions – then the model forecasts an ac ...

"quantitative" easing. Like lowering interest rates, QE is supposed to

... struck, big central banks like the Fed and the Bank of England slashed their overnight interest-rates to boost the economy. But even cutting the rate as far as it could go, to almost zero, failed to spark recovery. Central banks therefore began experimenting with other tools to encourage banks to pu ...

... struck, big central banks like the Fed and the Bank of England slashed their overnight interest-rates to boost the economy. But even cutting the rate as far as it could go, to almost zero, failed to spark recovery. Central banks therefore began experimenting with other tools to encourage banks to pu ...

QUESTIONS FOR DISCUSSION

... Why do banks want to maintain as little excess reserves as possible? Under what circumstances might banks desire to hold excess reserves? (Hint: see Figure 14.3.) Excess reserves represent unused lending power. The opportunity cost of excess reserves can be high. Banks are in the business of making ...

... Why do banks want to maintain as little excess reserves as possible? Under what circumstances might banks desire to hold excess reserves? (Hint: see Figure 14.3.) Excess reserves represent unused lending power. The opportunity cost of excess reserves can be high. Banks are in the business of making ...

PDF Download

... not accomplished much yet. Financial conditions have not eased. The decline in interest rates has been fully offset by a weaker stock market and a strengthening dollar. Our Goldman Sachs Financial Conditions index is tighter now than it was at the beginning of the year before the Fed starting cuttin ...

... not accomplished much yet. Financial conditions have not eased. The decline in interest rates has been fully offset by a weaker stock market and a strengthening dollar. Our Goldman Sachs Financial Conditions index is tighter now than it was at the beginning of the year before the Fed starting cuttin ...

The Role of the Interest Rate Channel of

... for setting the reserve requirements for banking institutions and shares the responsibility with the Reserve Banks for discount rate policy. ...

... for setting the reserve requirements for banking institutions and shares the responsibility with the Reserve Banks for discount rate policy. ...

Chapter 1

... real wage is equal to the marginal productivity of labor, while the nominal wage is determined by monetary factors. ...

... real wage is equal to the marginal productivity of labor, while the nominal wage is determined by monetary factors. ...

http://socrates

... money supply and placing upward pressure on interest rates. (the federal funds rate) End Result: Higher interest rates encourage consumers to spend less money causing aggregate demand to fall which leads to a lower GDP and less employment. Short Term versus Long Term Interest Rates: Open market oper ...

... money supply and placing upward pressure on interest rates. (the federal funds rate) End Result: Higher interest rates encourage consumers to spend less money causing aggregate demand to fall which leads to a lower GDP and less employment. Short Term versus Long Term Interest Rates: Open market oper ...

Quiz 9

... layers of new regulations on financial institutions b. An expected increase in state and local government spending will help keep the US economy our of recession c. Barbados has joined Venezuela and Cuba in “The Bolivian Alternative” d. Most homeowners in mixed income public housing developments are ...

... layers of new regulations on financial institutions b. An expected increase in state and local government spending will help keep the US economy our of recession c. Barbados has joined Venezuela and Cuba in “The Bolivian Alternative” d. Most homeowners in mixed income public housing developments are ...

Federal Reserve System

... money supply that exceeds increases in its output of goods and services. (demand >supply) • Changes in the money supply can influence overall levels of spending, employment, and prices in the economy by inducing changes in interest rates charged for credit and by affecting the levels of personal and ...

... money supply that exceeds increases in its output of goods and services. (demand >supply) • Changes in the money supply can influence overall levels of spending, employment, and prices in the economy by inducing changes in interest rates charged for credit and by affecting the levels of personal and ...

Knight Time Review- answers Which of the following would be most

... hold less. b. When the interest rate rises, portfolio adjustments are made which increase the holdings of money. In short, as the opportunity cost of money goes up, people hold more. c. When the interest rate falls, portfolio adjustments are made which decrease the holdings of money. In short, as th ...

... hold less. b. When the interest rate rises, portfolio adjustments are made which increase the holdings of money. In short, as the opportunity cost of money goes up, people hold more. c. When the interest rate falls, portfolio adjustments are made which decrease the holdings of money. In short, as th ...

- Bogazici University, Department of Economics

... Q4- Consider a Cobb-Douglas production function with three inputs. K is capital (the number of machines), L is labor (the number of workers), and H is human capital (the number of college degrees among the workers). The production function is Y=K1/3L1/3H1/3 a. Derive an expression for the marginal p ...

... Q4- Consider a Cobb-Douglas production function with three inputs. K is capital (the number of machines), L is labor (the number of workers), and H is human capital (the number of college degrees among the workers). The production function is Y=K1/3L1/3H1/3 a. Derive an expression for the marginal p ...

(G – T) + (X – M)

... Licensed Bank buy US$ from Exchange Fund and sell it to the market for the HK$ arbitrage 持牌銀行 ...

... Licensed Bank buy US$ from Exchange Fund and sell it to the market for the HK$ arbitrage 持牌銀行 ...

File

... a. Using a correctly labeled graph of the loanable funds market, show the effect of the increase in Country A’s budget deficit on the real interest rate. b. Given your answer in (a), what is the effect on business investment in Country A? c. The exchange rate between Country A’s dollar and Country B ...

... a. Using a correctly labeled graph of the loanable funds market, show the effect of the increase in Country A’s budget deficit on the real interest rate. b. Given your answer in (a), what is the effect on business investment in Country A? c. The exchange rate between Country A’s dollar and Country B ...

Targeted review 4 Growth and Decay

... a= r= n= t= A hunter brings 20 rabbits to an island where they have no predators. The rabbits reproduce at a rate of 350% a year. How long will it take for there to be 10,000 rabbits on the island? ...

... a= r= n= t= A hunter brings 20 rabbits to an island where they have no predators. The rabbits reproduce at a rate of 350% a year. How long will it take for there to be 10,000 rabbits on the island? ...

module 31 - Dpatterson

... (a) Assume that banks in Sewell have no excess reserves. What is the effect of the central bank’s action on the amount of customer loans that banks in Sewell can make? (b) Using a correctly labeled graph of the money market, show the effect of the central bank’s action on the nominal interest ra ...

... (a) Assume that banks in Sewell have no excess reserves. What is the effect of the central bank’s action on the amount of customer loans that banks in Sewell can make? (b) Using a correctly labeled graph of the money market, show the effect of the central bank’s action on the nominal interest ra ...

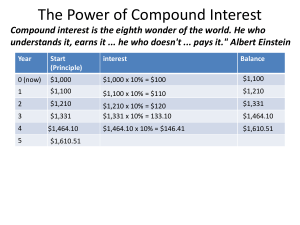

The Power of Compound Interest

... •If your growth slips to 2%, it will double in 36 years. If growth increases to 4%, the economy doubles in 18 years. •Given the speed at which technology develops, shaving years off your growth time could be very important ...

... •If your growth slips to 2%, it will double in 36 years. If growth increases to 4%, the economy doubles in 18 years. •Given the speed at which technology develops, shaving years off your growth time could be very important ...

Brazilian waxing and waning

... borrow more, which encouraged still more spending. Now the virtuous circle is turning vicious. Real wages have been falling since March, compared with a year earlier, mainly because Brazilian workers’ productivity never justified the earlier rises. People are returning to seek work just as there are ...

... borrow more, which encouraged still more spending. Now the virtuous circle is turning vicious. Real wages have been falling since March, compared with a year earlier, mainly because Brazilian workers’ productivity never justified the earlier rises. People are returning to seek work just as there are ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.