Videos-UK-US-India Economy-August 2016 File

... What is key driver of India’s economic growth? There has been a _________ slump in o___________ prices Explain why lower o__________ prices benefit the economy?? (Post Video Discussion: Not answered in video) ...

... What is key driver of India’s economic growth? There has been a _________ slump in o___________ prices Explain why lower o__________ prices benefit the economy?? (Post Video Discussion: Not answered in video) ...

Retail Trade - ACT Treasury

... The Reserve Bank cited modest inflation outcomes, the moderate pace of domestic economic growth and a mixed global economic outlook as the basis for its decision. The Reserve Bank reiterated that macroprudential measures1 have appeared to ease price pressures in key housing markets, and it was judge ...

... The Reserve Bank cited modest inflation outcomes, the moderate pace of domestic economic growth and a mixed global economic outlook as the basis for its decision. The Reserve Bank reiterated that macroprudential measures1 have appeared to ease price pressures in key housing markets, and it was judge ...

Honduras_en.pdf

... the central bank managed through open market operations. In September, with year-on-year inflation standing at ...

... the central bank managed through open market operations. In September, with year-on-year inflation standing at ...

HW 5.1 AP Macro – Modules 31 and 32 Directions: After reading

... passes a law requiring the central bank to use monetary policy to lower the unemployment rate to 3% and keep it there. How could the central bank achieve this goal in the short run? What would happen in the long run? Illustrate with a diagram 11. The effectiveness of monetary policy depends on how e ...

... passes a law requiring the central bank to use monetary policy to lower the unemployment rate to 3% and keep it there. How could the central bank achieve this goal in the short run? What would happen in the long run? Illustrate with a diagram 11. The effectiveness of monetary policy depends on how e ...

the federal reserve and the money supply

... 3. Banks lend out $80 million; this must return as deposits. 4. Banks lend out $64 million .... Eventual money multiplier is 1 + 0.8 + 0.64 + ... = 5 In general, in economy with no currency, money multiplier is 1/d, where d is reserve/deposit ratio. ...

... 3. Banks lend out $80 million; this must return as deposits. 4. Banks lend out $64 million .... Eventual money multiplier is 1 + 0.8 + 0.64 + ... = 5 In general, in economy with no currency, money multiplier is 1/d, where d is reserve/deposit ratio. ...

Money, Banking and Monetary Policy

... banks that borrow on a short-term (usually overnight) basis The amount of money banks must keep on reserve at the Fed ...

... banks that borrow on a short-term (usually overnight) basis The amount of money banks must keep on reserve at the Fed ...

Answer Key Section 5 and 6 practice test

... C) a perceived peak in an asset index like the Dow Jones Industrial Average X D) an increase in the government deficit 5. Suppose there is news of rising unemployment. Which scenario is most likely? A) Firms invest more in automation; the demand for loanable funds rises; interest rates rise; borrowi ...

... C) a perceived peak in an asset index like the Dow Jones Industrial Average X D) an increase in the government deficit 5. Suppose there is news of rising unemployment. Which scenario is most likely? A) Firms invest more in automation; the demand for loanable funds rises; interest rates rise; borrowi ...

Notes

... over the past 20 years, so the prime rate is no longer very important. - the Fed cannot reliable push mortgage interest rates down 3. Fed impact is asymmetric - by pushing up interest rates a lot (look at the US data for 1979-1981!) the Fed can with certainty make it extraordinarily costly to borrow ...

... over the past 20 years, so the prime rate is no longer very important. - the Fed cannot reliable push mortgage interest rates down 3. Fed impact is asymmetric - by pushing up interest rates a lot (look at the US data for 1979-1981!) the Fed can with certainty make it extraordinarily costly to borrow ...

MONETARY POLICY IN UKRAINE

... communication with little importance for lending activities, stands merely at 10.25%. In our view, this discrepancy is confusing and might contribute to higher inflation expectations. Thus, we suggest bringing the discount rate in line with the rates of overnight loans. ...

... communication with little importance for lending activities, stands merely at 10.25%. In our view, this discrepancy is confusing and might contribute to higher inflation expectations. Thus, we suggest bringing the discount rate in line with the rates of overnight loans. ...

Macroeconomics Key Graphs

... price of old bond must decrease (or no one will want to buy them) When interest rates decrease, price of old bond increase (more people will want to buy them) Bond prices are determined by bond supply and demand. ...

... price of old bond must decrease (or no one will want to buy them) When interest rates decrease, price of old bond increase (more people will want to buy them) Bond prices are determined by bond supply and demand. ...

Document

... According to the quantity equation, the real quantity of money demanded is proportional to real aggregate spending, where the constant of proportionality is one over the velocity of money. ...

... According to the quantity equation, the real quantity of money demanded is proportional to real aggregate spending, where the constant of proportionality is one over the velocity of money. ...

Midterm Exam 2003 Question 1 Discuss two of the following: a

... Using diagrams show graphically the impact of this policy on output and the interest rate. Explain in words how this policy affects output, interest rates, investment and consumption. Setting all variables back to their original levels, calculate the new equilibrium values for Y, i, C and I if the C ...

... Using diagrams show graphically the impact of this policy on output and the interest rate. Explain in words how this policy affects output, interest rates, investment and consumption. Setting all variables back to their original levels, calculate the new equilibrium values for Y, i, C and I if the C ...

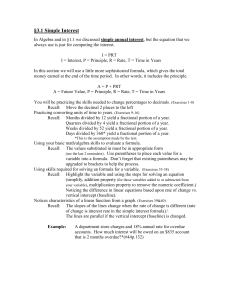

Chapter 3

... of change is interest rate in the simple interest formula).\ The lines are parallel if the vertical intercept (baseline) is changed. Example: ...

... of change is interest rate in the simple interest formula).\ The lines are parallel if the vertical intercept (baseline) is changed. Example: ...

Fall 2007

... Answer the questions below on the answer sheet provided, using a #2 pencil. Each question is worth 3 points; the entire exam is worth 60 points. 1)Ap Suppose total output in the US rises and active fiscal policy is unchanged. The rise in output will a) cause a rise in government consumption and inve ...

... Answer the questions below on the answer sheet provided, using a #2 pencil. Each question is worth 3 points; the entire exam is worth 60 points. 1)Ap Suppose total output in the US rises and active fiscal policy is unchanged. The rise in output will a) cause a rise in government consumption and inve ...

What happens when the Fed buys bonds?

... more money at a lower interest rate, what will happen to the level of spending in the economy? The level of spending in the economy will increase. Consumption will increase Investment Spending will increase ...

... more money at a lower interest rate, what will happen to the level of spending in the economy? The level of spending in the economy will increase. Consumption will increase Investment Spending will increase ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.