The Euro: Past and Future

... the gold standard This ended dollar convertibility and the fixed gold exchange rate of $35/ounce Motivated the European Economic Community to create a monetary system not dependant on the US dollar. ...

... the gold standard This ended dollar convertibility and the fixed gold exchange rate of $35/ounce Motivated the European Economic Community to create a monetary system not dependant on the US dollar. ...

Fiscal Policy:

... • The government spends more money because consumers cannot – keep companies running and workers employed. ...

... • The government spends more money because consumers cannot – keep companies running and workers employed. ...

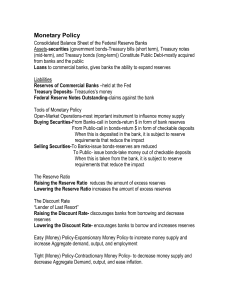

Monetary Policy

... – Influences both the nominal and real interest rate – To affect a nominal interest rate does some kind of open market operation to change it – By changing the quantity of money that the Fed achieves its target for the Federal Funds rate – The expected inflation rate does not change every time the F ...

... – Influences both the nominal and real interest rate – To affect a nominal interest rate does some kind of open market operation to change it – By changing the quantity of money that the Fed achieves its target for the Federal Funds rate – The expected inflation rate does not change every time the F ...

Higher Interest Rates and the National Debt

... To be clear, the culprit here is failed fiscal policy, not our monetary policy and the Federal Reserve. Congresses and presidents of both parties, over many years, have avoided making hard choices about our budget and failed to put it on a long-run, sustainable path. In recent years, many have said ...

... To be clear, the culprit here is failed fiscal policy, not our monetary policy and the Federal Reserve. Congresses and presidents of both parties, over many years, have avoided making hard choices about our budget and failed to put it on a long-run, sustainable path. In recent years, many have said ...

How do we mea sure economic activity

... T-Bill- the yield on short term U.S. Government debt obligations (13-week) Treasury Bond Rate- the yield on long term U.S. Government debt obligations (up to 30 years) ...

... T-Bill- the yield on short term U.S. Government debt obligations (13-week) Treasury Bond Rate- the yield on long term U.S. Government debt obligations (up to 30 years) ...

module 28 review

... 4. Which of the following is true regarding short-term and long-term interest rates? a. Short-term interest rates are always above long-term interest rates. b. Short-term interest rates are always below long-term interest rates. c. Short-term interest rates are always equal to long-term interest rat ...

... 4. Which of the following is true regarding short-term and long-term interest rates? a. Short-term interest rates are always above long-term interest rates. b. Short-term interest rates are always below long-term interest rates. c. Short-term interest rates are always equal to long-term interest rat ...

Why Are Interest Rates Still Low

... more because spreads have increased due to the need for additional loan loss reserves and increased risk premiums than because of an increase in the underlying cost of funds. Obviously, the federal reserve has been increasing the money supply and holding down the discount and fed funds rates to stim ...

... more because spreads have increased due to the need for additional loan loss reserves and increased risk premiums than because of an increase in the underlying cost of funds. Obviously, the federal reserve has been increasing the money supply and holding down the discount and fed funds rates to stim ...

Monetary Policy

... Money market affects→ Investment Demand→Affects Equilibrium GDP The multiplier is in effect when changes in investment result in a change in AD Strengths of Monetary Policy Speed and flexibility (even on a daily basis with actions of the FOMC) Isolation from political pressure (works more subtly, mo ...

... Money market affects→ Investment Demand→Affects Equilibrium GDP The multiplier is in effect when changes in investment result in a change in AD Strengths of Monetary Policy Speed and flexibility (even on a daily basis with actions of the FOMC) Isolation from political pressure (works more subtly, mo ...

Determinants of Interest Rates

... • Liquidity—ease and speed an asset can be turned into cash—relative to alternative assets ...

... • Liquidity—ease and speed an asset can be turned into cash—relative to alternative assets ...

Multiple Choice: Circle the answer the best completes each question

... 25. One necessary characteristic of money is that it must be unlimited in supply. 26. Commercial banks like Wells Fargo and Washington Mutual make a profit by loaning money. 27. Money is anything that is accepted for payment for goods and services. 28. Using a contractionary fiscal policy results in ...

... 25. One necessary characteristic of money is that it must be unlimited in supply. 26. Commercial banks like Wells Fargo and Washington Mutual make a profit by loaning money. 27. Money is anything that is accepted for payment for goods and services. 28. Using a contractionary fiscal policy results in ...

Chapter 9

... The investment demand curve is an array of potential investment projects in descending order of their expected rates of return. The curve sloped downward reflecting an inverse relationship between the real interest rate (“price”) and the quantity of investment demanded. ...

... The investment demand curve is an array of potential investment projects in descending order of their expected rates of return. The curve sloped downward reflecting an inverse relationship between the real interest rate (“price”) and the quantity of investment demanded. ...

Ch 18 Milton Friedman

... • Transitory changes in income do not affect consumption spending, only permanent changes do • This implies a small marginal propensity to consume and, therefore, a small multiplier. • This makes Keynesian fiscal policy ineffective ...

... • Transitory changes in income do not affect consumption spending, only permanent changes do • This implies a small marginal propensity to consume and, therefore, a small multiplier. • This makes Keynesian fiscal policy ineffective ...

Interest rate

An interest rate is the rate at which interest is paid by borrowers (debtors) for the use of money that they borrow from lenders (creditors). Specifically, the interest rate is a percentage of principal paid a certain number of times per period for all periods during the total term of the loan or credit. Interest rates are normally expressed as a percentage of the principal for a period of one year, sometimes they are expressed for different periods such as a month or a day. Different interest rates exist parallelly for the same or comparable time periods, depending on the default probability of the borrower, the residual term, the payback currency, and many more determinants of a loan or credit. For example, a company borrows capital from a bank to buy new assets for its business, and in return the lender receives rights on the new assets as collateral and interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower.Interest-rate targets are a vital tool of monetary policy and are taken into account when dealing with variables like investment, inflation, and unemployment. The central banks of countries generally tend to reduce interest rates when they wish to increase investment and consumption in the country's economy. However, a low interest rate as a macro-economic policy can be risky and may lead to the creation of an economic bubble, in which large amounts of investments are poured into the real-estate market and stock market. In developed economies, interest-rate adjustments are thus made to keep inflation within a target range for the health of economic activities or cap the interest rate concurrently with economic growth to safeguard economic momentum.