Powerpoint - Blakeley LLP

... An SP cannot have its members agree to refuse credit requested by the customer, even where the customer is delinquent and may be liquidating its assets The decision to extend credit is with each SP member, and they must act independently ...

... An SP cannot have its members agree to refuse credit requested by the customer, even where the customer is delinquent and may be liquidating its assets The decision to extend credit is with each SP member, and they must act independently ...

March

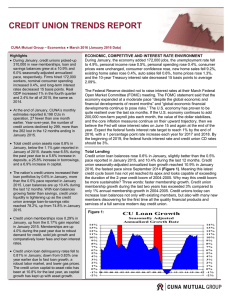

... only 1% annual membership growth in 2004-2005. Credit unions today can increase loan balances not only with existing members, but also with many new members discovering for the first time all the quality financial products and services of a full service modern day credit union. Figure 1: ...

... only 1% annual membership growth in 2004-2005. Credit unions today can increase loan balances not only with existing members, but also with many new members discovering for the first time all the quality financial products and services of a full service modern day credit union. Figure 1: ...

Products, services, customers, geography

... you money if you leave an item with them, such as jewelry, firearms, cameras or electronic devices. Usually, the shop must keep your item for 30 days. Within that time, you must repay the loan. If you don’t, the pawned item belongs to the store, and it is put up for sale. Loans from the pawnshop are ...

... you money if you leave an item with them, such as jewelry, firearms, cameras or electronic devices. Usually, the shop must keep your item for 30 days. Within that time, you must repay the loan. If you don’t, the pawned item belongs to the store, and it is put up for sale. Loans from the pawnshop are ...

Audit Committee

... Matrix organization / One of largest Risk Management in the SG Group (330FTE). SG RISQ ...

... Matrix organization / One of largest Risk Management in the SG Group (330FTE). SG RISQ ...

New Consumer Compensation Rights

... of the price, with the level of discount applicable depending on the seriousness of the prohibited practice. This is to be determined by reference to matters including the impact on the consumer, the behaviour of the trader and the passage of time. Finally, a consumer may also claim damages in respe ...

... of the price, with the level of discount applicable depending on the seriousness of the prohibited practice. This is to be determined by reference to matters including the impact on the consumer, the behaviour of the trader and the passage of time. Finally, a consumer may also claim damages in respe ...

Discover

... June 2007 officially spun off from Morgan Stanley July 1, 2007 DFS Added To S&P 500 July 2, 2007 DFS Debuts On NYSE Sept. 25 2007 DFS Profit Falls in the 3rd quarter ER due to higher marketing and interest expenses • Dec. 3 2007 DFS to take big charge for UK card business in its 4th quarter ER (abou ...

... June 2007 officially spun off from Morgan Stanley July 1, 2007 DFS Added To S&P 500 July 2, 2007 DFS Debuts On NYSE Sept. 25 2007 DFS Profit Falls in the 3rd quarter ER due to higher marketing and interest expenses • Dec. 3 2007 DFS to take big charge for UK card business in its 4th quarter ER (abou ...

An introduction to pricing methods for credit derivatives

... could mimic the loss that A suffers on a bond issue by C to A). The premium payments are quoted in annualized percentage x ∗ of the notional value of the reference asset. This rate x ∗ is called the CDS spread. ...

... could mimic the loss that A suffers on a bond issue by C to A). The premium payments are quoted in annualized percentage x ∗ of the notional value of the reference asset. This rate x ∗ is called the CDS spread. ...

General Financial Literacy

... 4.2.5 Calculate how long it takes to repay debt by making minimum payments on installment loans and revolving accounts. 4.2.6 Locate and use online calculators to determine how principal and interest aggregate ...

... 4.2.5 Calculate how long it takes to repay debt by making minimum payments on installment loans and revolving accounts. 4.2.6 Locate and use online calculators to determine how principal and interest aggregate ...

What is double entry accounting and how does it analyze business

... Demonstrate an understanding of the fundamental accounting equation. Classify items as assets, liabilities, or owner’s equity. Explain the double-entry system of accounting and apply debit and credit rules when analyzing business transactions. ...

... Demonstrate an understanding of the fundamental accounting equation. Classify items as assets, liabilities, or owner’s equity. Explain the double-entry system of accounting and apply debit and credit rules when analyzing business transactions. ...

Applied Consumer Lending

... how to grow relationships so that members keep coming back for loans and other business. This course will equip you to: ...

... how to grow relationships so that members keep coming back for loans and other business. This course will equip you to: ...

English

... “The reason that credit cooperatives are subjected to various kinds of regulation, including by the Act on Financial Business by Cooperatives, is that in addition to the fact that it is anticipated that they will collect deposits from a large number of unspecified people, making it necessary to prot ...

... “The reason that credit cooperatives are subjected to various kinds of regulation, including by the Act on Financial Business by Cooperatives, is that in addition to the fact that it is anticipated that they will collect deposits from a large number of unspecified people, making it necessary to prot ...

Modeling and Forecasting Customer Behavior for Revolving Credit

... words, the borrower is under no obligation to actually take out a loan at any particular time, but may take part or all of the funds at any time over a period of several years. This agreement is common in situations in which a business must pay obligations but its operating cashflow varies, for e.g. ...

... words, the borrower is under no obligation to actually take out a loan at any particular time, but may take part or all of the funds at any time over a period of several years. This agreement is common in situations in which a business must pay obligations but its operating cashflow varies, for e.g. ...

Nicolas Magud Carmen M Reinhart Esteban R Vesperoni 24

... Capital-inflow bonanzas have become more frequent after restrictions to international movements were relaxed worldwide over the last decades.1 Capital flows to emerging economies can finance investment and foster economic growth. However, inflows may also induce sharp monetary and credit expansions, ...

... Capital-inflow bonanzas have become more frequent after restrictions to international movements were relaxed worldwide over the last decades.1 Capital flows to emerging economies can finance investment and foster economic growth. However, inflows may also induce sharp monetary and credit expansions, ...

Trade Credit Insurance

... In answering this question here are some questions to consider: Have you ever experienced credit losses, especially with buyers overseas? Do you regularly sell to new customers and markets? Are you concerned about the credit or country risk associated with growing your customer base overseas? ...

... In answering this question here are some questions to consider: Have you ever experienced credit losses, especially with buyers overseas? Do you regularly sell to new customers and markets? Are you concerned about the credit or country risk associated with growing your customer base overseas? ...

Credit Market Frictions and the Productivity Slowdown

... Literature on the consequences of firm-level distortions for aggregate performance (e.g. Hsieh and Klenow, 2009) Large number of frictions → ‘black box’ We want to isolate financial frictions ...

... Literature on the consequences of firm-level distortions for aggregate performance (e.g. Hsieh and Klenow, 2009) Large number of frictions → ‘black box’ We want to isolate financial frictions ...

February 9, 2017 150/2017-SAE/GAE 2 Itaú Unibanco Holding

... In response to the Official Letter from Corporate Monitoring Department - BM&FBOVESPA in relation to the report published in the newspaper Valor Econômico on February 9, 2017, Itaú Unibanco Holding S.A. (“Itaú Unibanco” or “Company”) wishes to clarify that: On February 07, 2017, at 5:13 p.m., the Co ...

... In response to the Official Letter from Corporate Monitoring Department - BM&FBOVESPA in relation to the report published in the newspaper Valor Econômico on February 9, 2017, Itaú Unibanco Holding S.A. (“Itaú Unibanco” or “Company”) wishes to clarify that: On February 07, 2017, at 5:13 p.m., the Co ...

This PDF is a selection from an out-of-print volume from... of Economic Research Volume Title: Consumer Instalment Credit and Economic Fluctuations

... the types of credit we are examining, although much of the present analysis is applicable to charge account credit too. Consumer real estate credit conforms with the adopted definition in all respects except its long period of repayment.1 Home mortgage financing has been excluded from the present se ...

... the types of credit we are examining, although much of the present analysis is applicable to charge account credit too. Consumer real estate credit conforms with the adopted definition in all respects except its long period of repayment.1 Home mortgage financing has been excluded from the present se ...

Types and Institutions of Instalment Credit

... the types of credit we are examining, although much of the present analysis is applicable to charge account credit too. Consumer real estate credit conforms with the adopted definition in all respects except its long period of repayment.1 Home mortgage financing has been excluded from the present se ...

... the types of credit we are examining, although much of the present analysis is applicable to charge account credit too. Consumer real estate credit conforms with the adopted definition in all respects except its long period of repayment.1 Home mortgage financing has been excluded from the present se ...

Student Refunds - Montgomery College

... Refunds less than 25.01 are only processed once a month. Refund checks are issued to the student of record, not to the person who paid. Refund checks are mailed to the student address in our records. We do not offer check pick up. Due to the high volume or drops/adds, we do not issue refunds until a ...

... Refunds less than 25.01 are only processed once a month. Refund checks are issued to the student of record, not to the person who paid. Refund checks are mailed to the student address in our records. We do not offer check pick up. Due to the high volume or drops/adds, we do not issue refunds until a ...

Moody`s Credit AssessmentTM Expanding Credit Horizons

... risk of companies that are generally not rated by global credit rating agencies. Moody’s Credit Assessment meets the growing demand for credible and independent fundamental research that assesses the creditworthiness of companies that are generally not rated by global credit rating agencies. Moody’s ...

... risk of companies that are generally not rated by global credit rating agencies. Moody’s Credit Assessment meets the growing demand for credible and independent fundamental research that assesses the creditworthiness of companies that are generally not rated by global credit rating agencies. Moody’s ...

Evaluating Consumer Loans

... hybrid of debit cards in which customers prepay for services to be rendered and receive a card against which purchases are charged Use of phone cards, prepaid cellular, toll tags, subway, etc. are growing ...

... hybrid of debit cards in which customers prepay for services to be rendered and receive a card against which purchases are charged Use of phone cards, prepaid cellular, toll tags, subway, etc. are growing ...

Evaluating Consumer Loans

... hybrid of debit cards in which customers prepay for services to be rendered and receive a card against which purchases are charged Use of phone cards, prepaid cellular, toll tags, subway, etc. are growing ...

... hybrid of debit cards in which customers prepay for services to be rendered and receive a card against which purchases are charged Use of phone cards, prepaid cellular, toll tags, subway, etc. are growing ...

Coastlines - Sunshine Coast Credit Union

... (RRSPs), there is action that must be taken prior to the year end. There are three options available to you and depending on an individual‘s financial situation, a combination of the three options could be selected. 1) Cash in the RRSP – usually not recommended as the total dollar value of the RRSP ...

... (RRSPs), there is action that must be taken prior to the year end. There are three options available to you and depending on an individual‘s financial situation, a combination of the three options could be selected. 1) Cash in the RRSP – usually not recommended as the total dollar value of the RRSP ...

NBER WORKING PAPER SERIES HOUSING, CREDIT MARKETS AND THE BUSINESS CYCLE

... for risky investments, including private equity acquisitions. Loans to support private equity deals that were already in the pipeline could not be syndicated, forcing the commercial banks and investment banks to hold those loans on their own books. Banks are also being forced to honor credit guarant ...

... for risky investments, including private equity acquisitions. Loans to support private equity deals that were already in the pipeline could not be syndicated, forcing the commercial banks and investment banks to hold those loans on their own books. Banks are also being forced to honor credit guarant ...

Personal Financial Literacy

... • Credit card interest rates are expressed as an annual percentage rate (APR) • Low introductory interest rates often last six months to a year. • These temporary rates are then replaced with variable or fixed rates. • The purpose of these rates is to get you to switch to a new credit card. But bewa ...

... • Credit card interest rates are expressed as an annual percentage rate (APR) • Low introductory interest rates often last six months to a year. • These temporary rates are then replaced with variable or fixed rates. • The purpose of these rates is to get you to switch to a new credit card. But bewa ...