Tightest Credit Market in 16 Years Rejects Bernanke`s Bid

... James Bregenzer, a 31-year-old marketing strategist in Chicago, was rejected for a mortgage in May after successfully financing two previous home purchases. The hitch this time: his monthly payment would have been $100 more than the lender was willing to approve. Bregenzer is in good company. Standa ...

... James Bregenzer, a 31-year-old marketing strategist in Chicago, was rejected for a mortgage in May after successfully financing two previous home purchases. The hitch this time: his monthly payment would have been $100 more than the lender was willing to approve. Bregenzer is in good company. Standa ...

ECON 104---Financial Crisis What is the nature of the current crisis

... 4.8.2.People who figured that the real estate market was just gonna go up, up, up forever. If the real estate market goes up, up, up forever, then nobody ever defaults and the credit default swap is just equal to the value of the periodic payments that it comes with. 4.9. A final unfortunateness: ba ...

... 4.8.2.People who figured that the real estate market was just gonna go up, up, up forever. If the real estate market goes up, up, up forever, then nobody ever defaults and the credit default swap is just equal to the value of the periodic payments that it comes with. 4.9. A final unfortunateness: ba ...

Unauthorised - ACT Legislation Register

... The proposed loan credit facility is consistent to what has been published in the 2008-09 Budget and 2008-09 LDA Statement of Intent. ...

... The proposed loan credit facility is consistent to what has been published in the 2008-09 Budget and 2008-09 LDA Statement of Intent. ...

Personal Finance - Carl Junction Schools

... 5d. Differentiate among various types of electronic banking services. ...

... 5d. Differentiate among various types of electronic banking services. ...

Business Department Course Choices

... Grades 10-12 1 credit • Understand your rights, obligations, and responsibilities under the law • Civil and criminal procedures, contracts and employment, consumer protection, mock-trail procedures, and personal law • Presentations from DEA and FBI agents, lawyers, judges, field trip to Chester Coun ...

... Grades 10-12 1 credit • Understand your rights, obligations, and responsibilities under the law • Civil and criminal procedures, contracts and employment, consumer protection, mock-trail procedures, and personal law • Presentations from DEA and FBI agents, lawyers, judges, field trip to Chester Coun ...

Economic Stabilization Act of 2008

... receiving a few questions on the extenders and found out we neglected to send this. Its real name is the Emergency Economic Stabilization Act of 2008 (Public Law 110343). You will also find references to this Act as the Energy Improvement and Extension Act of 2008 and the Tax Extenders and Alternati ...

... receiving a few questions on the extenders and found out we neglected to send this. Its real name is the Emergency Economic Stabilization Act of 2008 (Public Law 110343). You will also find references to this Act as the Energy Improvement and Extension Act of 2008 and the Tax Extenders and Alternati ...

Use of Deposit Agents - CU-2016-01

... Thank you for providing information on your credit union's use of deposit agents. The purpose of this letter is to provide additional information to credit unions and to clarify several points related to deposit agents. Nominee accounts/form ...

... Thank you for providing information on your credit union's use of deposit agents. The purpose of this letter is to provide additional information to credit unions and to clarify several points related to deposit agents. Nominee accounts/form ...

Electronic Payment Systems

... To attract people to his site, Fred offers rebates. Each time a customer buys from him, 1% of the purchase price is credited to a special account in the customer’s name. Once the amount reaches $10, customers can request that amount in cash, use the amount to buy more items from Fred, or simply cont ...

... To attract people to his site, Fred offers rebates. Each time a customer buys from him, 1% of the purchase price is credited to a special account in the customer’s name. Once the amount reaches $10, customers can request that amount in cash, use the amount to buy more items from Fred, or simply cont ...

Understanding Debt - UConn Financial Aid

... exists, typically after 30 days Credit Limit based on credit rating, FICO score Debit Card: Connected with a bank account. Comes directly out of the account balance. Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

... exists, typically after 30 days Credit Limit based on credit rating, FICO score Debit Card: Connected with a bank account. Comes directly out of the account balance. Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

Understanding Debt - UConn Financial Aid

... exists, typically after 30 days Credit Limit based on credit rating, FICO score Debit Card: Connected with a bank account. Comes directly out of the account balance. Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

... exists, typically after 30 days Credit Limit based on credit rating, FICO score Debit Card: Connected with a bank account. Comes directly out of the account balance. Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

BMC Case History - Mobiloil

... About CUMarketingCenter.com CUMarketingCenter.com is a web-based platform that fully automates the creation of print ads, direct mail, e-mail campaigns, statement stuffers, product- and service-specific brochures, posters, flyers, digital signs and more. Credit unions can customize each marketing pi ...

... About CUMarketingCenter.com CUMarketingCenter.com is a web-based platform that fully automates the creation of print ads, direct mail, e-mail campaigns, statement stuffers, product- and service-specific brochures, posters, flyers, digital signs and more. Credit unions can customize each marketing pi ...

The Benefits of Reporting Positive Payment Data in Latin America

... delinquency rate of 3.78%. o Colombia’s observed delinquency rate of 27.49% in files (but 3.6% for loans--Bankscope). However, this difference may very well be an artifact of the system of reporting rather than of consumer behavior. o Approximately two-thirds of data furnishers in Costa Rica do not ...

... delinquency rate of 3.78%. o Colombia’s observed delinquency rate of 27.49% in files (but 3.6% for loans--Bankscope). However, this difference may very well be an artifact of the system of reporting rather than of consumer behavior. o Approximately two-thirds of data furnishers in Costa Rica do not ...

CHAPTER 16, CREDIT IN AMERICA CREDIT

... CREDIT- Privilege of buying something now, with the agreement to pay for it later, or borrowing money with the promise to pay it back later. The need for credit arose when the country grew from a bartering and trading society to a currency exchange. Americans began to be dependent on one another. So ...

... CREDIT- Privilege of buying something now, with the agreement to pay for it later, or borrowing money with the promise to pay it back later. The need for credit arose when the country grew from a bartering and trading society to a currency exchange. Americans began to be dependent on one another. So ...

Credit: The Promise to Pay

... pay off a loan if minimum payments are paid. Protects potential credit consumers under the age of 21, who must have a cosigner with a means to repay debt of the consumer. ...

... pay off a loan if minimum payments are paid. Protects potential credit consumers under the age of 21, who must have a cosigner with a means to repay debt of the consumer. ...

1 - CGC

... Korea Credit Guarantee Fund Act Article 6 ①The equity fund of KODIT shall be built up with resources falling under the followings: 1.Contributions from the government; 2.Contributions from financial institutions; 3.Contributions from enterprises; ③Financial institutions shall make contributions to K ...

... Korea Credit Guarantee Fund Act Article 6 ①The equity fund of KODIT shall be built up with resources falling under the followings: 1.Contributions from the government; 2.Contributions from financial institutions; 3.Contributions from enterprises; ③Financial institutions shall make contributions to K ...

Money ≈ credit

... > Credit line of EUR 10,000, but only if the total exposure of Widgets does not exceed EUR 50,000 > The credit is free for 30 days, after which a 5% pro-rata interest applies > The credit must be cleared within 90 days, or settled in EUR fiat at that time > Radu also accepts credit conversion to the ...

... > Credit line of EUR 10,000, but only if the total exposure of Widgets does not exceed EUR 50,000 > The credit is free for 30 days, after which a 5% pro-rata interest applies > The credit must be cleared within 90 days, or settled in EUR fiat at that time > Radu also accepts credit conversion to the ...

Company: Arab Bank Group Date: Oct 12, 2011 Stock Code on: ASE

... P/E: Price/Earnings Ratio is calculated as Market Price Per Share / ttm Earnings Per Share, ttm is trailing twelve months) P/E Price Annualized is calculated based on the current Market Price over annualized earnings P/BV: Price/Book Value Ratio is calculated as (Market Price Per Share / Book Value ...

... P/E: Price/Earnings Ratio is calculated as Market Price Per Share / ttm Earnings Per Share, ttm is trailing twelve months) P/E Price Annualized is calculated based on the current Market Price over annualized earnings P/BV: Price/Book Value Ratio is calculated as (Market Price Per Share / Book Value ...

FBLA PERSONAL FINANCE Competency - FBLA-PBL

... Describe the advantages and disadvantages of bankruptcy. Compare the terms and rates of mortgage agreements. Demonstrate awareness of consumer protection and information (identify theft, phishing, scams, etc.). Complete credit forms and loan applications. Compare the costs of a purchase if paid with ...

... Describe the advantages and disadvantages of bankruptcy. Compare the terms and rates of mortgage agreements. Demonstrate awareness of consumer protection and information (identify theft, phishing, scams, etc.). Complete credit forms and loan applications. Compare the costs of a purchase if paid with ...

Several states have passed legislation allowing residents to place a

... When a file is temporarily unlocked, you may need to provide further authorization from the consumer in order to pull a credit file. Equifax requires a four-character PIN. TransUnion issues an eight-character access code beginning with the letters "TU". Experian uses a PIN up to 15 characters long. ...

... When a file is temporarily unlocked, you may need to provide further authorization from the consumer in order to pull a credit file. Equifax requires a four-character PIN. TransUnion issues an eight-character access code beginning with the letters "TU". Experian uses a PIN up to 15 characters long. ...

Rapid Expansion of Credit in South Eastern Europe

... 2. Composition of credit growth • Much faster growth of credit to households than to enterprises • Negative correlation: R (household, enterprise credit growth) = -0.75 ...

... 2. Composition of credit growth • Much faster growth of credit to households than to enterprises • Negative correlation: R (household, enterprise credit growth) = -0.75 ...

presentation

... After the difficult 2009-2010 period, the Romanian consumer credit market is progressively recovering : o In terms of volumes – but this will need time o In terms of credit risk : we believe the non performing loans will reach the peak in 2012, followed by a better trend starting with 2013 The r ...

... After the difficult 2009-2010 period, the Romanian consumer credit market is progressively recovering : o In terms of volumes – but this will need time o In terms of credit risk : we believe the non performing loans will reach the peak in 2012, followed by a better trend starting with 2013 The r ...

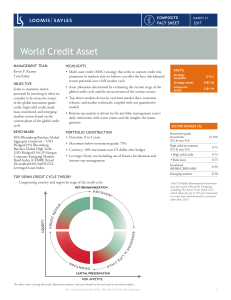

World Credit Asset

... The World Credit Asset Composite includes all discretionary accounts with market values greater than $75 million managed by Loomis Sayles that seek to maximize risk-adjusted returns by allocating across the credit spectrum based on macro analysis of economic regimes and the global credit cycle. Acce ...

... The World Credit Asset Composite includes all discretionary accounts with market values greater than $75 million managed by Loomis Sayles that seek to maximize risk-adjusted returns by allocating across the credit spectrum based on macro analysis of economic regimes and the global credit cycle. Acce ...

Subject: Economics with Financial Literacy

... money held today by discounting the future value based on the rate of interest. Down payments on a loan give borrowers an equity stake in the transaction which reduces not only the principal being borrowed ...

... money held today by discounting the future value based on the rate of interest. Down payments on a loan give borrowers an equity stake in the transaction which reduces not only the principal being borrowed ...

Liquidity Now!

... share prices to increase both business investment and consumer spending; and by freeing up spendable cash for homeowners with adjustable-rate mortgages. A reduction of the federal funds rate would not be a bailout for individual borrowers and lenders who are suffering from their past mistakes. Any s ...

... share prices to increase both business investment and consumer spending; and by freeing up spendable cash for homeowners with adjustable-rate mortgages. A reduction of the federal funds rate would not be a bailout for individual borrowers and lenders who are suffering from their past mistakes. Any s ...