CMHC Newcomer

... 5% down payment for the purchase price (or lending value) portion ≤ $500,000. 10% down payment for the purchase price (or lending value) portion > $500,000. Maximum purchase price or as-improved property value must be below $1,000,000. At least one borrower (or guarantor) must have a minimum credit ...

... 5% down payment for the purchase price (or lending value) portion ≤ $500,000. 10% down payment for the purchase price (or lending value) portion > $500,000. Maximum purchase price or as-improved property value must be below $1,000,000. At least one borrower (or guarantor) must have a minimum credit ...

Understanding Your Credit Report

... a smart idea to check your credit history at least once a year. Three major credit-reporting agencies operate in the United States: · Experian: (888) 397-3742 · Equifax: (800) 685-1111 · Trans Union: (800) 916-8800 Each of these agencies features slightly different information, so to obtain the most ...

... a smart idea to check your credit history at least once a year. Three major credit-reporting agencies operate in the United States: · Experian: (888) 397-3742 · Equifax: (800) 685-1111 · Trans Union: (800) 916-8800 Each of these agencies features slightly different information, so to obtain the most ...

Alternative ways of SME financing and a credit risk appropriate

... WAYS OF SMEs FINANCING Loans from banks and financing via business (trade receivables) Financing via banking loans, not as one company loan, but as a credit for the group companies bounded by mutual guarantees. Typical representative of this approach is European Association of Mutual Guarantee Soci ...

... WAYS OF SMEs FINANCING Loans from banks and financing via business (trade receivables) Financing via banking loans, not as one company loan, but as a credit for the group companies bounded by mutual guarantees. Typical representative of this approach is European Association of Mutual Guarantee Soci ...

Synopsis - The Cordova Tutorial

... the American credit industry, and highlights the importance of both knowledge and behavior when it comes to managing money. Chapter 2. Saving Emphasizes the importance of saving and explains the three reasons to save: emergencies, large purchases, and wealth building. Chapter 3. Budgeting ...

... the American credit industry, and highlights the importance of both knowledge and behavior when it comes to managing money. Chapter 2. Saving Emphasizes the importance of saving and explains the three reasons to save: emergencies, large purchases, and wealth building. Chapter 3. Budgeting ...

Presentation on Unsecured Personal Loan (UPL) Market

... - Predominantly unsecured lending banks growth - Success of business models - Large banks lost market share following crash - Business plans for growth in UPL ...

... - Predominantly unsecured lending banks growth - Success of business models - Large banks lost market share following crash - Business plans for growth in UPL ...

Forum for the Free Flow of Information Organizational Launch Meeting

... Without payment information, lenders face three problems: ...

... Without payment information, lenders face three problems: ...

Word

... the second year (-0.7 %), even though the fall was not that deep as in 2011 (-1.9 %). It is most likely not only the effect of rational behaviour of households with a will not to indebt themselves further this way, but also the stricter assessment of the solvency of clients on the side of banks. Low ...

... the second year (-0.7 %), even though the fall was not that deep as in 2011 (-1.9 %). It is most likely not only the effect of rational behaviour of households with a will not to indebt themselves further this way, but also the stricter assessment of the solvency of clients on the side of banks. Low ...

**** 1

... ①The equity fund of KODIT shall be built up with resources falling under the followings: 1.Contributions from the government; 2.Contributions from financial institutions; 3.Contributions from enterprises; ③Financial institutions shall make contributions to KODIT such amount by the rate as prescribed ...

... ①The equity fund of KODIT shall be built up with resources falling under the followings: 1.Contributions from the government; 2.Contributions from financial institutions; 3.Contributions from enterprises; ③Financial institutions shall make contributions to KODIT such amount by the rate as prescribed ...

Presentation Title

... Scores based solely on information in consumer credit reports maintained at the credit reporting agencies (Experian, TransUnion & Equifax) • The higher the score, the lower the risk ...

... Scores based solely on information in consumer credit reports maintained at the credit reporting agencies (Experian, TransUnion & Equifax) • The higher the score, the lower the risk ...

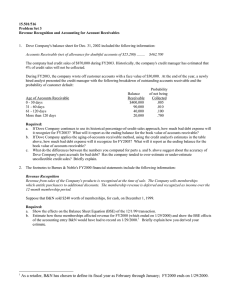

15.501/516 Problem Set 3 Revenue Recognition and Accounting for Account Receivables

... above, how much bad debt expense will it recognize for FY2003? What will it report as the ending balance for the book value of accounts receivable? c. What do the differences between the numbers you computed for parts a. and b. above suggest about the accuracy of Dove Company's past accruals for bad ...

... above, how much bad debt expense will it recognize for FY2003? What will it report as the ending balance for the book value of accounts receivable? c. What do the differences between the numbers you computed for parts a. and b. above suggest about the accuracy of Dove Company's past accruals for bad ...

Shopaholic Credit Case Study - socialsciences dadeschools net

... 3) Obtain a bank credit card (Visa/MasterCard) and pay it off 4) Obtain a retail credit card (Department store card) and pay it off 5) At college, pay utility bills and rent on time B. The function of a credit bureau is: 1) To provide creditors with your bill paying/credit record C. What are some of ...

... 3) Obtain a bank credit card (Visa/MasterCard) and pay it off 4) Obtain a retail credit card (Department store card) and pay it off 5) At college, pay utility bills and rent on time B. The function of a credit bureau is: 1) To provide creditors with your bill paying/credit record C. What are some of ...

June 2006 - Many Nations

... affordable and culturally appropriate group benefits, including pension.” There was a clear need for the services provided by Many Nations and the new company grew rapidly. ...

... affordable and culturally appropriate group benefits, including pension.” There was a clear need for the services provided by Many Nations and the new company grew rapidly. ...

Credit Corp - Treasury.gov.au

... inclusion. We maintain the most successful hardship program in the industry with a current portfolio of $1.1 billion of defaulted consumer credit obligations, restructured into sustainable repayment arrangements across 140,000 individual customer accounts. In our consumer lending business we provide ...

... inclusion. We maintain the most successful hardship program in the industry with a current portfolio of $1.1 billion of defaulted consumer credit obligations, restructured into sustainable repayment arrangements across 140,000 individual customer accounts. In our consumer lending business we provide ...

ConsumerMan Video for LifeSmarts 3: YOUR CREDIT REPORT

... When you open a bank account, apply for a credit card, get a student loan, pay your credit card bills on time or make late car payment that information is reported to credit bureaus and added to your file. This information is then sold to various companies that want to know about you; if are you fin ...

... When you open a bank account, apply for a credit card, get a student loan, pay your credit card bills on time or make late car payment that information is reported to credit bureaus and added to your file. This information is then sold to various companies that want to know about you; if are you fin ...

CAMPUS POLICY

... The chancellor of the University of Colorado at Colorado Springs shall be the chief academic and administrative officer responsible to the president for the conduct of affairs of the Colorado Springs campus in accordance with the policies of the Board of Regents. The chancellor shall have such other ...

... The chancellor of the University of Colorado at Colorado Springs shall be the chief academic and administrative officer responsible to the president for the conduct of affairs of the Colorado Springs campus in accordance with the policies of the Board of Regents. The chancellor shall have such other ...

EBCC - Arrangements for gas and electricity supply and gas

... against any risk of credit default and the subsequent sanctions. Other members felt it is the provisions within NETA that have led to an over-secured position, rather than participants’ behaviour. However Members agreed that an uneconomic level of security for each individual User in respect of gas ...

... against any risk of credit default and the subsequent sanctions. Other members felt it is the provisions within NETA that have led to an over-secured position, rather than participants’ behaviour. However Members agreed that an uneconomic level of security for each individual User in respect of gas ...

personal statement - Bath Savings Institution

... Home Phone:___________________ Work Phone:___________________ ...

... Home Phone:___________________ Work Phone:___________________ ...

ASSET BUILDING DEPARTMENT Wallet Wise Financial Education

... Wallet Wise is an 8-hour financial education training (four classes, 2 hours each) that introduces the basic concepts of personal finance including goal setting and budgeting, credit and debt management, understanding taxes, and saving and financial services. Wallet Wise participants gain knowledge ...

... Wallet Wise is an 8-hour financial education training (four classes, 2 hours each) that introduces the basic concepts of personal finance including goal setting and budgeting, credit and debt management, understanding taxes, and saving and financial services. Wallet Wise participants gain knowledge ...

HASSLE FREE PAYMENT PLAN AUTOMATIC – CREDIT CARD

... AUTOMATIC – CREDIT CARD – CONTINUOUS PAYMENT AUTHORIZATON FORM My signature below authorizes Traders Insurance Company to initiate charges to my credit card account (information below in this authorization). This authority will remain in effect until I notify you in writing to cancel it in such time ...

... AUTOMATIC – CREDIT CARD – CONTINUOUS PAYMENT AUTHORIZATON FORM My signature below authorizes Traders Insurance Company to initiate charges to my credit card account (information below in this authorization). This authority will remain in effect until I notify you in writing to cancel it in such time ...

Debt crisis hits Europe`s retail credit markets

... 3. Household deleveraging is driven by pre-crisis credit expansion rather than current household debt levels The extent of deleveraging in separate countries is significantly correlated with the country’s credit expansion prior to the financial crisis, but is only weakly linked to current household ...

... 3. Household deleveraging is driven by pre-crisis credit expansion rather than current household debt levels The extent of deleveraging in separate countries is significantly correlated with the country’s credit expansion prior to the financial crisis, but is only weakly linked to current household ...

Cooperative Network 11-16-2009

... Expectation of higher credit losses in many segments Credit spreads likely to tighten from current levels as economy continues to recover but refinancing calendar likely to put floor on ...

... Expectation of higher credit losses in many segments Credit spreads likely to tighten from current levels as economy continues to recover but refinancing calendar likely to put floor on ...

COM SEC(2011)

... repayments can be met. Figures show though that citizens are having increasing difficulties in meeting their debts: in 2008, 16 % of people reported difficulties in paying bills and 10 % of all households reported arrears1. The difficulty in meeting repayments has led to an increase in default rates ...

... repayments can be met. Figures show though that citizens are having increasing difficulties in meeting their debts: in 2008, 16 % of people reported difficulties in paying bills and 10 % of all households reported arrears1. The difficulty in meeting repayments has led to an increase in default rates ...

Data and a lack thereof

... disturbances in the system of financial exchange between households, businesses and financial-service firms. Stability would be evidenced by: ▫ (i) an effective regulatory infrastructure, ▫ (ii) effective financial markets and ▫ (iii) effective and sound financial institutions. ...

... disturbances in the system of financial exchange between households, businesses and financial-service firms. Stability would be evidenced by: ▫ (i) an effective regulatory infrastructure, ▫ (ii) effective financial markets and ▫ (iii) effective and sound financial institutions. ...

Progetto: PROGETTO PER LA CREAZIONE DI UN FONDO DI

... the Italian government and operationally managed by the UN agency UNOPS (United Nations Office for Project Services). After identifying the problem of guarantees and credit availability as one the main obstacles to the activities of small and medium-sized enterprises (SMEs), the City of Modena carri ...

... the Italian government and operationally managed by the UN agency UNOPS (United Nations Office for Project Services). After identifying the problem of guarantees and credit availability as one the main obstacles to the activities of small and medium-sized enterprises (SMEs), the City of Modena carri ...

Cost of borrowing and credit risk management

... market, volatility of the company’s equity price, and the quality (marketability) of the company’s assets. A company should endeavour to research which key areas will most effect its rating and hence the cost of borrowing and be aware that factors such as stock volatility or a decision to buy intang ...

... market, volatility of the company’s equity price, and the quality (marketability) of the company’s assets. A company should endeavour to research which key areas will most effect its rating and hence the cost of borrowing and be aware that factors such as stock volatility or a decision to buy intang ...