DollarsDirect - Treasury.gov.au

... i. The Proposed Caps on Establishment Fees are Detrimental to Consumers and the Australian Public and would result in depriving consumers access to legitimate and responsible credit options and encourage illegal lending activities. 1. A 20% establishment fee with monthly fees that can be a maximum o ...

... i. The Proposed Caps on Establishment Fees are Detrimental to Consumers and the Australian Public and would result in depriving consumers access to legitimate and responsible credit options and encourage illegal lending activities. 1. A 20% establishment fee with monthly fees that can be a maximum o ...

Reformatted from November 9, 2007 Federal Register p

... Sec. 681.2 Duties regarding the detection, prevention, and mitigation of identity theft. (a) Scope. This section applies to financial institutions and creditors that are subject to administrative enforcement of the FCRA by the Federal Trade Commission pursuant to 15 U.S.C. 1681s(a)(1). (b) Definitio ...

... Sec. 681.2 Duties regarding the detection, prevention, and mitigation of identity theft. (a) Scope. This section applies to financial institutions and creditors that are subject to administrative enforcement of the FCRA by the Federal Trade Commission pursuant to 15 U.S.C. 1681s(a)(1). (b) Definitio ...

The Credit Market Model with Three Parameters

... function h. It will have exactly the same impact on the credit market as in the case of adverse selection [6]. For this reason we have poor client and leave the inferior function h1. In fact, A should lie outside the curve but still outside the gray zone. In terms of moral hazard interpretation, by ...

... function h. It will have exactly the same impact on the credit market as in the case of adverse selection [6]. For this reason we have poor client and leave the inferior function h1. In fact, A should lie outside the curve but still outside the gray zone. In terms of moral hazard interpretation, by ...

Shopping for Credit

... She receives her credit card bill with a $20 minimum payment. Whitney has many options for paying back the $200 as long as she makes the minimum payment. ...

... She receives her credit card bill with a $20 minimum payment. Whitney has many options for paying back the $200 as long as she makes the minimum payment. ...

Privacy Policy - Georgia Power Valdosta FCU

... Approved by: Board of Directors General Policy Statement: The Georgia Power Valdosta Federal Credit Union recognizes its responsibility to protect the privacy of member nonpublic personal information. The purpose of this policy is to set forth the guidelines under which such information may be share ...

... Approved by: Board of Directors General Policy Statement: The Georgia Power Valdosta Federal Credit Union recognizes its responsibility to protect the privacy of member nonpublic personal information. The purpose of this policy is to set forth the guidelines under which such information may be share ...

chapter - three concept and significance of cd ratio

... inclusion of education loan in the same category distorts the RBI’s stipulation and has reduced the size of credit as per place of utilization which has real power to affect the situations. Thus, the process of accepting deposit and granting them in the form of credit is best productive utilization ...

... inclusion of education loan in the same category distorts the RBI’s stipulation and has reduced the size of credit as per place of utilization which has real power to affect the situations. Thus, the process of accepting deposit and granting them in the form of credit is best productive utilization ...

Credit Risk – Introduction

... 2. A bankruptcy filing or legal receivership by the debt issuer or obligor that will likely cause a miss or delay in future contractually-obligated debt service payments; 3. A distressed exchange whereby 1) an obligor offers creditors a new or restructured debt, or a new package of securities, cash ...

... 2. A bankruptcy filing or legal receivership by the debt issuer or obligor that will likely cause a miss or delay in future contractually-obligated debt service payments; 3. A distressed exchange whereby 1) an obligor offers creditors a new or restructured debt, or a new package of securities, cash ...

Credit Risk - Amazon Web Services

... Analytical Recommendation Engine automatically produce every night potential lists, based on data mining models, for every relevant product and service sold by the bank Within these potential lists, all the company’s customers are scored from 1 to 100 by their likelihood to accept targeted marketi ...

... Analytical Recommendation Engine automatically produce every night potential lists, based on data mining models, for every relevant product and service sold by the bank Within these potential lists, all the company’s customers are scored from 1 to 100 by their likelihood to accept targeted marketi ...

Credit Risk - G-Stat

... Analytical Recommendation Engine automatically produce every night potential lists, based on data mining models, for every relevant product and service sold by the bank Within these potential lists, all the company’s customers are scored from 1 to 100 by their likelihood to accept targeted marketi ...

... Analytical Recommendation Engine automatically produce every night potential lists, based on data mining models, for every relevant product and service sold by the bank Within these potential lists, all the company’s customers are scored from 1 to 100 by their likelihood to accept targeted marketi ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... when monetary policy lowers the short end of the yield curve. The answer follows from discounting the payment stream with (hypothetical) state prices that reflect the steeper yield curve. More generally, once positions are viewed as payment streams, the risk in a position can often be parsimoniously ...

... when monetary policy lowers the short end of the yield curve. The answer follows from discounting the payment stream with (hypothetical) state prices that reflect the steeper yield curve. More generally, once positions are viewed as payment streams, the risk in a position can often be parsimoniously ...

44)

... 1) Which of the following records the payment of the current month's rent bill for a business? A) debit to cash and a credit to rent expense B) debit to rent expense and a credit to cash C) debit to rent expense and a credit to accounts payable D) debit to accounts payable and a credit to cash 2) Re ...

... 1) Which of the following records the payment of the current month's rent bill for a business? A) debit to cash and a credit to rent expense B) debit to rent expense and a credit to cash C) debit to rent expense and a credit to accounts payable D) debit to accounts payable and a credit to cash 2) Re ...

FCA staff - The Farm Credit Council

... institutions Developed conditions that may apply to requests approved by the FCA Board Cannot purchase a bond unless issuer determined bond is a security under Federal securities law The institution cannot purchase the bond unless it can be and is recorded as an investment under GAAP Bond of ...

... institutions Developed conditions that may apply to requests approved by the FCA Board Cannot purchase a bond unless issuer determined bond is a security under Federal securities law The institution cannot purchase the bond unless it can be and is recorded as an investment under GAAP Bond of ...

Slide 1

... instrument to fulfil goals of government economic policy. • Its principal function is assistance to entrepreneurs, to obtain credit necessary for investments or to restructure the enterprise. • The Lithuanian Rural Credit Guarantee Fund was chosen as an instrument for business development in rural a ...

... instrument to fulfil goals of government economic policy. • Its principal function is assistance to entrepreneurs, to obtain credit necessary for investments or to restructure the enterprise. • The Lithuanian Rural Credit Guarantee Fund was chosen as an instrument for business development in rural a ...

PFF EOC 2010 ppt with answers

... A. The cardholder will pay higher interest rates on other forms of credit B. The cardholder will develop a positive credit history C. The cardholder will develop a negative credit history D. There are no benefits for the B cardholder ...

... A. The cardholder will pay higher interest rates on other forms of credit B. The cardholder will develop a positive credit history C. The cardholder will develop a negative credit history D. There are no benefits for the B cardholder ...

Credit

... There is a contract or agreement Lists the repayment terms: number of payments, payment amount, cost of credit May require down-payment or trade-in; the balance repaid in equal weekly or monthly payments over a period of time Seller holds title to the merchandise until completion of ...

... There is a contract or agreement Lists the repayment terms: number of payments, payment amount, cost of credit May require down-payment or trade-in; the balance repaid in equal weekly or monthly payments over a period of time Seller holds title to the merchandise until completion of ...

Credit Default Swaps and the synthetic CDO

... o Collateralised Debt Obligations (CDOs) are a major asset class in the securitisation and credit derivatives markets. o CDOs provide banks and portfolio managers with a mechanism to outsource risk and optimise economic and regulatory capital management. For investors they are a tool by which to div ...

... o Collateralised Debt Obligations (CDOs) are a major asset class in the securitisation and credit derivatives markets. o CDOs provide banks and portfolio managers with a mechanism to outsource risk and optimise economic and regulatory capital management. For investors they are a tool by which to div ...

EACRA letter to OECD on HLP_LTI april 2013

... Use ratings in parallel to internal benchmark: A common sense compromise between the exclusive relying on external ratings and, on the opposite, the deletion of any reference to external ratings is advocating their use in parallel with the own internal evaluations performed by the investors. Such ap ...

... Use ratings in parallel to internal benchmark: A common sense compromise between the exclusive relying on external ratings and, on the opposite, the deletion of any reference to external ratings is advocating their use in parallel with the own internal evaluations performed by the investors. Such ap ...

Chapter 8 Section 2 and 3 Notes

... Consider that even if you are not asked to repay the debt, your liability for this loan may keep you from getting other credit. Before you pledge property to secure the loan, understand that you could lose the property you pledge if the borrower defaults. Check your state law. Some states have ...

... Consider that even if you are not asked to repay the debt, your liability for this loan may keep you from getting other credit. Before you pledge property to secure the loan, understand that you could lose the property you pledge if the borrower defaults. Check your state law. Some states have ...

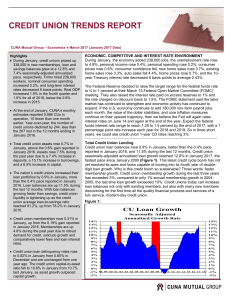

credit union trends report

... has exceeded 3%, compared to only 1% annual membership growth in 20042005, the last time loan growth exceeded 10%. Credit unions today can increase loan balances not only with existing members, but also with many new members discovering for the first time all the quality financial products and servi ...

... has exceeded 3%, compared to only 1% annual membership growth in 20042005, the last time loan growth exceeded 10%. Credit unions today can increase loan balances not only with existing members, but also with many new members discovering for the first time all the quality financial products and servi ...

The Great Recession: Lessons from Microeconomic Data

... aggregate datasets. We show that contrary to the predictions of a productivity-based credit expansion hypothesis, zip codes that see the largest increase in home purchase mortgage originations from 2002 to 2005 experienced relative declines in income. In fact, the evidence is even more extreme. We i ...

... aggregate datasets. We show that contrary to the predictions of a productivity-based credit expansion hypothesis, zip codes that see the largest increase in home purchase mortgage originations from 2002 to 2005 experienced relative declines in income. In fact, the evidence is even more extreme. We i ...

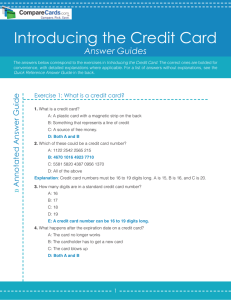

Introduction to Credit Card Answer Guide | CompareCards.com

... Exercise 3: Do credit cards have fees? 1. B: Annual percentage rate 2. D: Continue to the next section for the Quick Reference Answer Guide. 3. D: When you withdraw money from an ATM 4. C: $96 5. D: $50 ...

... Exercise 3: Do credit cards have fees? 1. B: Annual percentage rate 2. D: Continue to the next section for the Quick Reference Answer Guide. 3. D: When you withdraw money from an ATM 4. C: $96 5. D: $50 ...

Curriculum Introduction and Lesson Correlation Section

... saving money can improve financial well-being. ...

... saving money can improve financial well-being. ...

Microcredit: Conceptual Aspects Asymmetry of Information

... case of non-compliance possibly including subjective collective punishments, such as symbolic loss of capital within the community, and even physical aggressions and other types of social sanctions. Another key to success in this type of scheme, as shown by Ghatak (1999), is that joint liability cre ...

... case of non-compliance possibly including subjective collective punishments, such as symbolic loss of capital within the community, and even physical aggressions and other types of social sanctions. Another key to success in this type of scheme, as shown by Ghatak (1999), is that joint liability cre ...

Credit Cards Can Build Business for Community

... services. When an anticipated service, such as a credit card, is not offered, the potential customer relationship is incomplete, and the institution’s customer base is more vulnerable to competitive churn. Ron Shevlin, a senior analyst at Aite Group, asserts, “Branded credit cards offer a compelling ...

... services. When an anticipated service, such as a credit card, is not offered, the potential customer relationship is incomplete, and the institution’s customer base is more vulnerable to competitive churn. Ron Shevlin, a senior analyst at Aite Group, asserts, “Branded credit cards offer a compelling ...