File

... Different Types of Credit Credit card: a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services, based on the cardholder's promise to the card issuer (usually a bank) to pay them for the amounts so paid plus ...

... Different Types of Credit Credit card: a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services, based on the cardholder's promise to the card issuer (usually a bank) to pay them for the amounts so paid plus ...

Unit 1 Essential Questions

... investment? Why is it important to diversify your investments? How are liquidity and diversification related? How do you know which type of investment is best for you? In what ways does the stock market impact the personal wealth of an individual and a business? Why diversify within a portfolio? Inv ...

... investment? Why is it important to diversify your investments? How are liquidity and diversification related? How do you know which type of investment is best for you? In what ways does the stock market impact the personal wealth of an individual and a business? Why diversify within a portfolio? Inv ...

All You Need to Know about the Credit Crunch

... take on more debt themselves and have little money to lend, and so these effects have spread around the world. Some firms, like Northern Rock, have been too dependent on this source of finance and have suffered as a result. There is quite some debate about whether the blame lies with consumers for p ...

... take on more debt themselves and have little money to lend, and so these effects have spread around the world. Some firms, like Northern Rock, have been too dependent on this source of finance and have suffered as a result. There is quite some debate about whether the blame lies with consumers for p ...

A1 Advanced products for managing the bank`s balance sheet

... 5. Creating and managing the pool. 6. Conduit structures and short term assets. 7. Application to auto loans, credit cards, trade receivables. 8. Issues relating to over-collateralisation and ratings. Afternoon: The concept of credit derivatives: 1. Pressure on regulatory capital within internationa ...

... 5. Creating and managing the pool. 6. Conduit structures and short term assets. 7. Application to auto loans, credit cards, trade receivables. 8. Issues relating to over-collateralisation and ratings. Afternoon: The concept of credit derivatives: 1. Pressure on regulatory capital within internationa ...

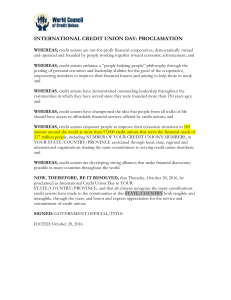

resolution - World Council of Credit Unions

... communities in which they have served since they were founded more than 150 years ago; and WHEREAS, credit unions have championed the idea that people from all walks of life should have access to affordable financial services offered by credit unions; and WHEREAS, credit unions empower people to imp ...

... communities in which they have served since they were founded more than 150 years ago; and WHEREAS, credit unions have championed the idea that people from all walks of life should have access to affordable financial services offered by credit unions; and WHEREAS, credit unions empower people to imp ...

credit_test_review_powerpoint

... What is the numerical value applied to your credit report by a consumer credit bureau that rate an individual’s creditworthiness for lenders? ...

... What is the numerical value applied to your credit report by a consumer credit bureau that rate an individual’s creditworthiness for lenders? ...

Hooked on Credit Cards Draft

... Credit card companies often entice students with low interest rates, then they jack up the rates later. A student may not think about the cost of interest. That new stereo or back-to-school wardrobe can get pretty expensive at 17.9% interest if it’s compounded over several months. Would you have bou ...

... Credit card companies often entice students with low interest rates, then they jack up the rates later. A student may not think about the cost of interest. That new stereo or back-to-school wardrobe can get pretty expensive at 17.9% interest if it’s compounded over several months. Would you have bou ...

The characteristics of the capital market

... • Stable, conservative and concentrated • Tight supervision, and stability-related limitations • International standards––risk management, control, corporate governance, capital (Basel 2) ...

... • Stable, conservative and concentrated • Tight supervision, and stability-related limitations • International standards––risk management, control, corporate governance, capital (Basel 2) ...

credit evaluation from the corporate practitioners

... the seminar would pay particular attention to the practical aspects of Credit Management. Who Should Attend This seminar is designed for all levels of credit staff as well as corporate CFOs who are interested to acquire credit evaluation skills, to improve credit decision-making and to mitigate agai ...

... the seminar would pay particular attention to the practical aspects of Credit Management. Who Should Attend This seminar is designed for all levels of credit staff as well as corporate CFOs who are interested to acquire credit evaluation skills, to improve credit decision-making and to mitigate agai ...

Bureau Of Consumer Financial Protection

... Our organizations also regularly hear from consumers regarding the other markets proposed in the Advance Notice: Markets identified in this Notice for possible inclusion are: debt collection, consumer credit and related activities, money transmitting, check cashing and related activities, prepaid ca ...

... Our organizations also regularly hear from consumers regarding the other markets proposed in the Advance Notice: Markets identified in this Notice for possible inclusion are: debt collection, consumer credit and related activities, money transmitting, check cashing and related activities, prepaid ca ...

Chapter 29

... receives a loan • creditor--a person who sells on credit or makes a loan • depends on trust; creditor believes the debtor will pay back later ...

... receives a loan • creditor--a person who sells on credit or makes a loan • depends on trust; creditor believes the debtor will pay back later ...

(I) What happens to loan performance?

... A more comprehensive reporting system (TeraNet – similar to proposed D&B model for Australia) reduces the probability of delinquencies (60+ days) by 34.1% for the mean loan. ...

... A more comprehensive reporting system (TeraNet – similar to proposed D&B model for Australia) reduces the probability of delinquencies (60+ days) by 34.1% for the mean loan. ...

At US Bank, we`re passionate about helping customers and the

... At U.S. Bank, we're passionate about helping customers and the communities where we live and work. The fifth-largest bank in the United States, we’re one of the country's most respected, innovative and successful financial institutions. U.S. Bank is an equal opportunity employer committed to creatin ...

... At U.S. Bank, we're passionate about helping customers and the communities where we live and work. The fifth-largest bank in the United States, we’re one of the country's most respected, innovative and successful financial institutions. U.S. Bank is an equal opportunity employer committed to creatin ...

credit report authorization and privacy disclosure form

... Authorization is further granted to the credit reporting agency to use a copy of this form to obtain any information the credit reporting agency deems necessary to complete my credit report. In addition, in connection with determining my ability to obtain a loan; I authorize ___ ...

... Authorization is further granted to the credit reporting agency to use a copy of this form to obtain any information the credit reporting agency deems necessary to complete my credit report. In addition, in connection with determining my ability to obtain a loan; I authorize ___ ...

Word Wall Words

... credit-The supplying of money, goods, or services at present in exchange for the promise of future payment. creditor- The business or organization that extends the credit. finance charge- The total cost of using credit, including interest and any fees. credit score- A numerical rating, based on cred ...

... credit-The supplying of money, goods, or services at present in exchange for the promise of future payment. creditor- The business or organization that extends the credit. finance charge- The total cost of using credit, including interest and any fees. credit score- A numerical rating, based on cred ...