Going Into Debt $$$

... Credit Rating – rating of the risk involved in lending money to a specific person or business Credit Score – numerical value placed on a person’s creditworthiness – 850 is the highest score Capacity to Pay – looks at income, debt & employment Character – person’s reputation as a reliable and trustwo ...

... Credit Rating – rating of the risk involved in lending money to a specific person or business Credit Score – numerical value placed on a person’s creditworthiness – 850 is the highest score Capacity to Pay – looks at income, debt & employment Character – person’s reputation as a reliable and trustwo ...

Frequently Asked Questions on the Current Expected Credit Losses

... accounting for available-for-sale debt securities and purchased credit deteriorated assets. Although there are differences between CECL and current U.S. generally accepted accounting principles (GAAP), the agencies expect the new standard to be scalable to institutions of all sizes, meaning that the ...

... accounting for available-for-sale debt securities and purchased credit deteriorated assets. Although there are differences between CECL and current U.S. generally accepted accounting principles (GAAP), the agencies expect the new standard to be scalable to institutions of all sizes, meaning that the ...

air, water, and noise pollution

... Fair Credit Reporting Act (“FCRA”): Permits consumer credit reporting agencies to issue credit reports only under certain circumstances, requires creditors to inform the consumer if credit has been denied because of information on the consumer’s credit report, and provides the consumer with mechanis ...

... Fair Credit Reporting Act (“FCRA”): Permits consumer credit reporting agencies to issue credit reports only under certain circumstances, requires creditors to inform the consumer if credit has been denied because of information on the consumer’s credit report, and provides the consumer with mechanis ...

the 2016 economic summit conference schedule

... Schenk unlike any other has the most concise way to deliver real time information on industry changing economic landscape and what that means to future credit union financial performance. Mike’s research and documented studies have proven after time to be just the information credit union leaders ne ...

... Schenk unlike any other has the most concise way to deliver real time information on industry changing economic landscape and what that means to future credit union financial performance. Mike’s research and documented studies have proven after time to be just the information credit union leaders ne ...

PDF

... credit associations. In others, both banks and specialized institutions provide credit. Some countries have established state credit institutions. Some of these are outside the field which private institutions would regard as creditworthy; others supplement the often limited supply of credit from ot ...

... credit associations. In others, both banks and specialized institutions provide credit. Some countries have established state credit institutions. Some of these are outside the field which private institutions would regard as creditworthy; others supplement the often limited supply of credit from ot ...

Presentation - Quality on Statistics 2010

... financial stability credit risk and (in some cases) economic analysis statistical use is generally not part of the main purposes, although some statistics are compiled, mainly for internal purposes and quality checking; very limited use for ECB ...

... financial stability credit risk and (in some cases) economic analysis statistical use is generally not part of the main purposes, although some statistics are compiled, mainly for internal purposes and quality checking; very limited use for ECB ...

Improving National Statistical Systems

... • More detail on the types of instruments that are held • More detail on the institutions that are issuing those instruments • Information on new issues and retirements of debt, as well as net flows • Better ability to track this information across countries ...

... • More detail on the types of instruments that are held • More detail on the institutions that are issuing those instruments • Information on new issues and retirements of debt, as well as net flows • Better ability to track this information across countries ...

Law for Business

... Building Credit 5. Check Your Progress Federal law requires credit reporting firms to provide consumers free credit reports (1 per year per bureau) A modest fee is typically required to receive an actual credit score http://www.annualcreditreport.com is sponsored by the three largest credit reportin ...

... Building Credit 5. Check Your Progress Federal law requires credit reporting firms to provide consumers free credit reports (1 per year per bureau) A modest fee is typically required to receive an actual credit score http://www.annualcreditreport.com is sponsored by the three largest credit reportin ...

Purchasing Performing Accounts

... will not take a “liquidate first” approach to their account. Partnering with a non-bank financial services company, who are not constrained by strict OSFI or OCC directives, can yield improved experience for the Customer. Customer Experience Example A senior executive of a major credit card issuer ...

... will not take a “liquidate first” approach to their account. Partnering with a non-bank financial services company, who are not constrained by strict OSFI or OCC directives, can yield improved experience for the Customer. Customer Experience Example A senior executive of a major credit card issuer ...

Impact of Macroprudential Policy Measures on Economic Dynamics: Simulation Using

... Some comments by David Hargreaves, RBNZ ...

... Some comments by David Hargreaves, RBNZ ...

Canadian Fixed Income 2017 Outlook

... Canadian economic growth disappointed for much of 2016 as the desired rotation to investment and exports failed to materialize as expected, even with the help of a weaker Canadian dollar. However, growth did manage to improve over the course of the year, although at the time of writing, the economy ...

... Canadian economic growth disappointed for much of 2016 as the desired rotation to investment and exports failed to materialize as expected, even with the help of a weaker Canadian dollar. However, growth did manage to improve over the course of the year, although at the time of writing, the economy ...

Graeme Oram Presentation[1]

... Tooled up by every available course but no progress into work Biggest barrier - £000s of doorstep and other high-cost credit Debt had created an insurmountable array of issues Local advice services weren’t helping Five Lamps recognised a massive gap in the financial services marketplace …… and our c ...

... Tooled up by every available course but no progress into work Biggest barrier - £000s of doorstep and other high-cost credit Debt had created an insurmountable array of issues Local advice services weren’t helping Five Lamps recognised a massive gap in the financial services marketplace …… and our c ...

Job Description

... Implement and align credit policies and procedures for Malaysia in consultation with Regional Credit Control Manager and GM. Liaise with Sales Managers on credit control/customer issues; as well as with Customer Services, Sales Operation and Accounts receivables. ...

... Implement and align credit policies and procedures for Malaysia in consultation with Regional Credit Control Manager and GM. Liaise with Sales Managers on credit control/customer issues; as well as with Customer Services, Sales Operation and Accounts receivables. ...

UK consumer credit

... (a) The Bank’s effective interest rate series are currently compiled using data from up to 19 UK MFIs. Data are non seasonally adjusted. (b) Effective rates are sterling-only monthly averages. (c) Income from cross-selling of payment protection insurance (PPI) substantially offset low margins on per ...

... (a) The Bank’s effective interest rate series are currently compiled using data from up to 19 UK MFIs. Data are non seasonally adjusted. (b) Effective rates are sterling-only monthly averages. (c) Income from cross-selling of payment protection insurance (PPI) substantially offset low margins on per ...

Realize Higher Returns from Income-Producing Credit

... credit card portfolio. “Although profitability for the large credit card banks has risen and fallen over the years, credit card earnings have been almost always higher than returns on all commercial bank activities.Earning patterns for 2013 were consistent with historical experience: For all commerc ...

... credit card portfolio. “Although profitability for the large credit card banks has risen and fallen over the years, credit card earnings have been almost always higher than returns on all commercial bank activities.Earning patterns for 2013 were consistent with historical experience: For all commerc ...

Our History Sierra Credit Corporation was founded in 2004 in the

... financial backing, and the idea of Sierra Credit was born. What began as a one desk, shared computer operation with literally one account, soon grew and Sierra Credit needed to move from the dealership into its own office. Still wanting to be close to the community which had given the Rosso family s ...

... financial backing, and the idea of Sierra Credit was born. What began as a one desk, shared computer operation with literally one account, soon grew and Sierra Credit needed to move from the dealership into its own office. Still wanting to be close to the community which had given the Rosso family s ...

Buying or Leasing a Car and Your Credit Score

... secure the best available mortgage rate, said Claudia Mott, a certified financial planner with Epona Financial Solutions in Basking Ridge. She said whether you choose to lease a new car or take out a loan to finance it, the result on your credit score will be about the same. "Both are considered to ...

... secure the best available mortgage rate, said Claudia Mott, a certified financial planner with Epona Financial Solutions in Basking Ridge. She said whether you choose to lease a new car or take out a loan to finance it, the result on your credit score will be about the same. "Both are considered to ...

Comments on Tang and Wu`s Trade Credit Bank Credit

... • But Asian financial crisis of 1997-98? – (Taiwan mildly affected) – Sample of firms here starts in 1995! – Can add third (regional) crisis at cost of some firms ...

... • But Asian financial crisis of 1997-98? – (Taiwan mildly affected) – Sample of firms here starts in 1995! – Can add third (regional) crisis at cost of some firms ...

Member Service Representative ProMedica Federal Credit Union

... MSR Position Summary: The primary functions of an MSR are to process member deposits, withdraws, loan and credit card payments, issue cashier’s checks, money orders, and cash advances. MSR’s must balance each day’s transactions and verify cash and check totals. MSR’s also assist members with questio ...

... MSR Position Summary: The primary functions of an MSR are to process member deposits, withdraws, loan and credit card payments, issue cashier’s checks, money orders, and cash advances. MSR’s must balance each day’s transactions and verify cash and check totals. MSR’s also assist members with questio ...

Biggest Player

... Corporate and Government Rating Services - Provides credit analysis services for corporates, project finances, public financings and financial service ...

... Corporate and Government Rating Services - Provides credit analysis services for corporates, project finances, public financings and financial service ...

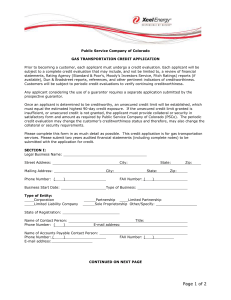

Contact - Xcel Energy - Web site maintenance

... Once an applicant is determined to be creditworthy, an unsecured credit limit will be established, which must equal the estimated highest 90-day credit exposure. If the unsecured credit limit granted is insufficient, or unsecured credit is not granted, the applicant must provide collateral or securi ...

... Once an applicant is determined to be creditworthy, an unsecured credit limit will be established, which must equal the estimated highest 90-day credit exposure. If the unsecured credit limit granted is insufficient, or unsecured credit is not granted, the applicant must provide collateral or securi ...

![Graeme Oram Presentation[1]](http://s1.studyres.com/store/data/021314501_1-3cb04f79840be6ebc60c4382080f818a-300x300.png)