* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Company: Arab Bank Group Date: Oct 12, 2011 Stock Code on: ASE

Federal takeover of Fannie Mae and Freddie Mac wikipedia , lookup

Syndicated loan wikipedia , lookup

United States housing bubble wikipedia , lookup

Stock selection criterion wikipedia , lookup

Financial economics wikipedia , lookup

Securitization wikipedia , lookup

Credit bureau wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Great Recession in Russia wikipedia , lookup

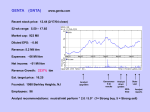

Al-Hekma for Financial Services Tel +962 6 5654046/47/48 Fax: +962 6 5654049 Company: Arab Bank Group Date: Oct 12, 2011 Stock Code on: ASE: ARBK.AM Bloomberg: ARBK.JR Current Price: 7.49 No. of Shares 550,203,143 Market Capitalization In JOD 4,401 million In USD 6,208 million EPS (ttm): P/E (ttm) 0.42 16.8 P/E(ttm)-(PS)* 20.1 Ownership Structure Local Companies 21.0% Individuals 21.8% Foreign Companies 41.5% Individuals 15.7% Share Liquidity Free Float 45% Closely Held 55% Av. Daily Value 61,027,424 (3 months) Av. Daily Volume 7,254,270 (3 months) 2011 Mid Year Update Outlook 2011 is expected to be another difficult year for ARBK. The unrest in several regional countries were ARBK operates, is expected to result in lower business activities and a hike in non-performing loans (NPL). Although as of mid-2011 no such impact was reflected on the Group’s profitability or asset quality. Most likely however, ARBK will be compelled before year end to build further credit provisions in order to protect its credit ratings. Credit provisions for 2011 is expected to range between $450-$500 million, which will bring projected net income to$ 320-$350 million, a marginal improvement of 4%-14% from last year, but still 39%-44% lower than the 2009 level of $576 million. Significant exposure in the region. The group’s collected exposure to countries such as Egypt, Tunisia, Libya, Yemen, Syria, Lebanon, Palestine, Algeria and Sudan is around 34% of total assets in 2010. ARBK total Net loan exposure at mid-year is at $21.8 bn, 68% of which is in large corporates. As of 2010, the Group’s credit exposure to Arab Countries excluding Jordan is at 64% of gross loans, with the largest regional concentrations are in its wholesale banking operations in Bahrain, (covering Kuwait, Saudi Arabia and Oman), UAE and Egypt. Noting that net credit exposure as of 2010 at its subsidiaries in Syria, Tunisia & Libya (ARBK portion) is at $1.6 bn. However credit exposure at its branches in Egypt & Yemen is unavailable and is estimated at around $ 1.0-1.3 bn. Noting that historically, ARBK is known for its conservative credit policy, whereby extension in traditionally riskier areas in the region has regularly been collateralized overseas, which is expected to partially mitigate the risk, especially in places like Yemen. ARBK’s Credit Exposure to Subsidiaries in Risky Countries in the Region as of 2010 Country Syria Tunisia Libya % Ownership ARBK Portion 49% Estimate of ARBK’s Credit Exposure to some Countries in the Region UAE $ 1.8-2.0 billion $1.09 billion Lebanon $ 0.9-1.1 billion 64.24% $0.24 billion Egypt $ 0.8-$ 1.0 billion 19% $ 0.28 billion Palestine $1.0-$1.2 Billion Yemen $0.2-0.3 billion Bahrain $ 1.8-2.0 billion *Pertaining to Shareholders Private & Confidential Page 1 Al-Hekma for Financial Services Tel +962 6 5654046/47/48 Fax: +962 6 5654049 European Subsidiary is back on track. Europe Arab Bank (EAB), which suffered significant losses since establishment, as a result of credit problems, is now fully provisioned for, and is reported by Fitch to be “marginally profitable” as of mid-2011. Non Performing Loans (NPL) improves to 6.3% of gross loans as of Mid-Year. NPL loans dropped to $ 1,6 bn (including interest in suspense) at midyear as compared to $ 1,7 bn at year end 2010. On the other hand, Loan Loss Provision (LLP) stayed at nearly same level of $ 1.1 bn, bringing credit coverage ratio as of mid year to acceptable levels of 67% and 79% when interest in suspense is excluded. NPL Ratios 2008 2009 2010 Mid 2011 CP/NPL 67.5% 43.4% 60.8% 67.4% CP/(NPL-IIS) 92.4% 50.2% 68.9% 78.6% De-consolidation of Libyan Subsidiary as of mid-year. The drop in total assets of the Group as of mid-year, and the downward re-stating of the total assets by $5.8 bn as of yearend 2010, is a result of the de-consolidation of Wahda Bank (19% ownership). The decision to de-consolidate was on the basis that the Group is unable to manage & control its subsidiary following the unrest in Libya. ARBK share to remain under pressure, price may not rise in the short run. Global and regional environments are not in favor of ARBK. The financial crises in Europe and it’s still unquantifiable repercussions on the global banking industry and the unrest in several countries where ARBK operates in the Middle East is making ARBK share unappealing for investors. The expected hike in NPLs and the resultant shortfall in credit provisions mean that ARBK share will continue to be under pressure this year and probably next year, until credit coverage is back to its historical levels of 80%-90%. Once this is behind ARBK, ARBK share will start to quickly appreciate, especially that when credit provisions are excluded, ARBK’s net income can easily exceed $600 million Price of share still higher than its peers. When compared to its peers, ARBK’s current P/E of 16.8 and expected future P/E of 16.6x-18.2x are still higher than average regional peer of 13.5x and are also high when compared with most banks at ASE. However P/BV continues to be attractive. Moreover ARBK is expected to maintain its low dividend distribution level of 20%, which will bring dividend yield to 2.25%. Price of share is expected to continue to be under pressure and is not expected to rise in the short run. Uncontrollable predicaments. Until the U.S litigations against ARBK are fully settled, the amount of damages which ARBK may incur and the sufficiency of the provisions remain unclear. Also the dimension of the negative impact of the regional disturbances on ARBK is hard to predict. Financial Performance Overview $ Million Net Income Net Income Pertaining to Shareholders Total Assets Net Credit Facilities Customer Deposits EPS Dividends per Share Dividends Yield P/E (x) TTM Private & Confidential 2009 2010 Q2-2011 576 528 50,525 22,026 31,472 0.99 25% 2% 16.38 308 251 51,097 22,490 32,110 0.47 20% 2% 25.15 327 319 46,215 * 21,780* 27,931* 0.60 19.7 Page 2 Al-Hekma for Financial Services Tel +962 6 5654046/47/48 Fax: +962 6 5654049 P/E (x) TTM Pertaining to shareholders P/B 17.31 1.16 30.9 1.01 21.7 0.81 Credit coverage=(LLP/(NPL –IIS) * ARBK’s subsidiary in Libya (Wehda Bank) figures were de-consolidated from the Group. Arab Bank Group (USD) National Bank of Kuwait (USD) National Bank of Qatar (USD) Arab National Bank (USD) 11.81 4.19 38.07 7.84 776 1,182 1,075 2,266 46,214 49,502 71,173 29,071 7,773 7,925 10,356 4,304 Net Credit Facilities 21,780 28,426 40,642 18,419 Customer Deposits 27,931 23,472 52,995 22,533 319 530 488 186 Credit Provisions 1,063 NA NA 597 Non-Performing Loans 1,576 NA NA 551 67% NA NA 92% 0.6 1.34 0.86 0.22 PE 20.34 14.99 14.6 13.4 PB 1.18 2.14 3.76 1.65 H1 - 2011 ( in million USD) Price Capital Total Assets Equity Net Income Credit Coverage EPS Private & Confidential Page 3 Al-Hekma for Financial Services Tel +962 6 5654046/47/48 Fax: +962 6 5654049 DEFENITIONS P/E: Price/Earnings Ratio is calculated as Market Price Per Share / ttm Earnings Per Share, ttm is trailing twelve months) P/E Price Annualized is calculated based on the current Market Price over annualized earnings P/BV: Price/Book Value Ratio is calculated as (Market Price Per Share / Book Value of the Company), where the book value of the company is calculated as (Owner's Equity / Outstanding Shares), and Market Price Per Share is the current market price. Y: The Yield is calculated as percent of cash dividend/market price. DISCLAIMER Al Hekma for Financial Services obtains information from sources it believes to be reliable, but do not warrant its accuracy or fitness for a particular purpose and disclaim for themselves and their information providers all liability arising from the use. The information in this publication is provided in good faith and maybe displayed for personal purposes only. Al Hekma for Financial Services is not liable for any loss resulting from any action taken or reliance made by any person on any information or material provided by it. . You should seek independent information and advice from relevant sources before acting or relying on any information provided by Al Hekma You rely on this information at your own risk Private & Confidential Page 4