PPI Final Report: Main Text

... Competition between PPI providers ........................................................................ 100 ...

... Competition between PPI providers ........................................................................ 100 ...

Audit Technique Guide IRC §42, Low-Income Housing Credit

... renting any market-rate units to tenants who are not income-qualified. 4. General Public Use – The rental units must be available for use by the general public and rented in a manner consistent with housing policy governing nondiscrimination. A determination that the taxpayer violated the Fair Housi ...

... renting any market-rate units to tenants who are not income-qualified. 4. General Public Use – The rental units must be available for use by the general public and rented in a manner consistent with housing policy governing nondiscrimination. A determination that the taxpayer violated the Fair Housi ...

Joint Report to Congress: Economic Growth and Regulatory

... Section 2222 of the Economic Growth and Regulatory Paperwork Reduction Act of 1996 (EGRPRA) 2 requires that, not less than once every 10 years, the Federal Financial Institutions Examination Council (FFIEC) and the Board of Governors of the Federal Reserve System (Board), the Office of the Comptroll ...

... Section 2222 of the Economic Growth and Regulatory Paperwork Reduction Act of 1996 (EGRPRA) 2 requires that, not less than once every 10 years, the Federal Financial Institutions Examination Council (FFIEC) and the Board of Governors of the Federal Reserve System (Board), the Office of the Comptroll ...

EQUIFAX INC - Investor Relations Solutions

... Online Consumer Information Solutions (OCIS). OCIS products are derived from multiple large and comprehensive databases of consumer information that we maintain about individual consumers, including credit history, current credit status, payment history and consumer address information. Our clients ...

... Online Consumer Information Solutions (OCIS). OCIS products are derived from multiple large and comprehensive databases of consumer information that we maintain about individual consumers, including credit history, current credit status, payment history and consumer address information. Our clients ...

Credit Where it Counts: The Community Reinvestment Act and its

... been accompanied by “predatory” or abusive lending practices targeted at minorities, the elderly, and other segments of the population. Congress has enacted a wide range of federal laws and subsidy programs that affect the provision of credit.8 This Article focuses on perhaps the most controversial ...

... been accompanied by “predatory” or abusive lending practices targeted at minorities, the elderly, and other segments of the population. Congress has enacted a wide range of federal laws and subsidy programs that affect the provision of credit.8 This Article focuses on perhaps the most controversial ...

Amendments to the Capital Framework for Securitisation Exposures

... sets out Pillar 2 requirements for the identification, measurement, monitoring and control of IRRBB, and disclosure requirements under prescribed interest rate shock scenarios. The draft amendments to the Notice are in Annex 1. ...

... sets out Pillar 2 requirements for the identification, measurement, monitoring and control of IRRBB, and disclosure requirements under prescribed interest rate shock scenarios. The draft amendments to the Notice are in Annex 1. ...

EQUIFAX INC

... Online Information Solutions. Online Information Solutions’ products are derived from multiple large and comprehensive databases of consumer and commercial information that we maintain about individual consumers and businesses, including credit history, current credit status, payment history and ad ...

... Online Information Solutions. Online Information Solutions’ products are derived from multiple large and comprehensive databases of consumer and commercial information that we maintain about individual consumers and businesses, including credit history, current credit status, payment history and ad ...

Credit Suisse AGM analysis and voting recommendations

... For the long-term incentive plan, specific performance targets are disclosed, as well as the ...

... For the long-term incentive plan, specific performance targets are disclosed, as well as the ...

Economic and financial statistics - Australian Prudential Regulation

... requirements administered on behalf of the ABS and the RBA by APRA in its role as national statistical agency for the financial sector. The collection focuses on the Australian (domestic) operations and activities of ADIs and RFCs. Data provided in the EFS collection are key inputs to important macr ...

... requirements administered on behalf of the ABS and the RBA by APRA in its role as national statistical agency for the financial sector. The collection focuses on the Australian (domestic) operations and activities of ADIs and RFCs. Data provided in the EFS collection are key inputs to important macr ...

Non-rating revenue and conflicts of interest

... perform rating services, usually charging according to a standardized price list; second, agencies perform a variety of non-rating services (we use the term “consulting services” interchangeably). One example of consulting services is “ratings assessment services”, which encompass pre-rating analyse ...

... perform rating services, usually charging according to a standardized price list; second, agencies perform a variety of non-rating services (we use the term “consulting services” interchangeably). One example of consulting services is “ratings assessment services”, which encompass pre-rating analyse ...

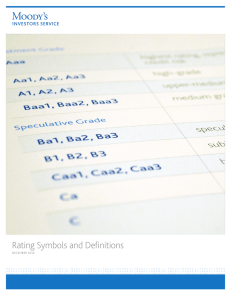

Rating Symbols and Definitions

... institutions, structured finance vehicles, project finance vehicles, and public sector entities. Long-term ratings are assigned to issuers or obligations with an original maturity of one year or more and reflect both on the likelihood of a default on contractually promised payments and the expected ...

... institutions, structured finance vehicles, project finance vehicles, and public sector entities. Long-term ratings are assigned to issuers or obligations with an original maturity of one year or more and reflect both on the likelihood of a default on contractually promised payments and the expected ...

What is financial exclusion - European Commission

... Table 4 Levels of financial exclusion in individual EU 25 countries............................... 20 Table 5 Levels of financial exclusion in individual EU countries.................................... 22 Table 6 Levels of revolving credit and savings exclusion...................................... ...

... Table 4 Levels of financial exclusion in individual EU 25 countries............................... 20 Table 5 Levels of financial exclusion in individual EU countries.................................... 22 Table 6 Levels of revolving credit and savings exclusion...................................... ...

The Interplay Between Student Loans and Credit Cards: Implications for Default ∗

... the interaction between different bankruptcy arrangements induces significant trade-offs in default incentives in the two markets. Understanding these trade-offs is particularly important in the light of the recent trends in borrowing and default behavior. Data show that young U.S. households have t ...

... the interaction between different bankruptcy arrangements induces significant trade-offs in default incentives in the two markets. Understanding these trade-offs is particularly important in the light of the recent trends in borrowing and default behavior. Data show that young U.S. households have t ...

Margin Credit and Stock Return Predictability

... returns? There are no significant regulatory hurdles to open a margin account and the data provided by the NYSE and FINRA is aggregate for all investors with long positions in margin accounts. Reported margin debt is the result of all long positions taken by any investor. While investor level demogr ...

... returns? There are no significant regulatory hurdles to open a margin account and the data provided by the NYSE and FINRA is aggregate for all investors with long positions in margin accounts. Reported margin debt is the result of all long positions taken by any investor. While investor level demogr ...

Explaining Credit Default Swap Spreads with Equity Volatility and

... popular instrument in the rapidly growing credit derivatives markets, as a direct measure of credit default spreads. Compared with corporate bond spreads, which were widely used in previous studies in testing structural models, CDS spreads have two important advantages. First, CDS spread is a relati ...

... popular instrument in the rapidly growing credit derivatives markets, as a direct measure of credit default spreads. Compared with corporate bond spreads, which were widely used in previous studies in testing structural models, CDS spreads have two important advantages. First, CDS spread is a relati ...

Advertising guide - Promote general financing and No Interest if

... This Advertising Guide describes Wells Fargo’s requirements for advertising our financing program and replaces any prior editions of this document. At Wells Fargo, we want to help our customers succeed financially We’re committed to making financial services available to everyone on a fair and consi ...

... This Advertising Guide describes Wells Fargo’s requirements for advertising our financing program and replaces any prior editions of this document. At Wells Fargo, we want to help our customers succeed financially We’re committed to making financial services available to everyone on a fair and consi ...

Did the recent financial crisis affect credibility of credit rating agencies?

... Rating agencies have been gaining power since John moody published its first rating. Where Moody’s started with rating solely the creditworthiness of railroad bonds, nowadays heads of states attach great importance to ratings assigned to their countries creditworthiness. A decrease in creditworthine ...

... Rating agencies have been gaining power since John moody published its first rating. Where Moody’s started with rating solely the creditworthiness of railroad bonds, nowadays heads of states attach great importance to ratings assigned to their countries creditworthiness. A decrease in creditworthine ...

Pillar 3 Disclosures Quantitative Disclosures As at 31

... taken for accounts defaulting during the year and includes write-offs during the year. The two measures of losses are hence not directly comparable and it is not appropriate to use Actual Loss data to assess the performance of internal rating process or to undertake comparative trend analysis. ...

... taken for accounts defaulting during the year and includes write-offs during the year. The two measures of losses are hence not directly comparable and it is not appropriate to use Actual Loss data to assess the performance of internal rating process or to undertake comparative trend analysis. ...

View PDF - CiteSeerX

... rationed” farmers who voluntarily withdraw from the credit market because the terms of the best available contract in the second best world imply excessive risk. These farmers, with a relatively high collateral wealth to liquidity ratio “choose” to undertake low return projects even though they cou ...

... rationed” farmers who voluntarily withdraw from the credit market because the terms of the best available contract in the second best world imply excessive risk. These farmers, with a relatively high collateral wealth to liquidity ratio “choose” to undertake low return projects even though they cou ...

Group-Based Financial Institutions for the Rural

... t is not difficult to fathom why the simplest form of financial service can make a significant difference to a poor family. Many of the world’s poor are microentrepreneurs— farmers, shopkeepers, weavers, small commodity producers, traders, and the like. Like other businesspeople, they require access ...

... t is not difficult to fathom why the simplest form of financial service can make a significant difference to a poor family. Many of the world’s poor are microentrepreneurs— farmers, shopkeepers, weavers, small commodity producers, traders, and the like. Like other businesspeople, they require access ...

Unresolved Issues in Modeling Credit Risky Assets

... In Section 4 we consider some of the problems that can arise in the pricing of single name credit default swap instruments. We first consider how calibration can affect pricing and hedging. We start by considering a digital credit default swap. The great advantage of a digital is that the payoff if ...

... In Section 4 we consider some of the problems that can arise in the pricing of single name credit default swap instruments. We first consider how calibration can affect pricing and hedging. We start by considering a digital credit default swap. The great advantage of a digital is that the payoff if ...

Differential Access to Capital from Financial Institutions by Minority

... This suggests that controlling for credit risk, there is no causal impact of access to capital between Hispanic-owned and White-owned firms. Lumping Hispanic-owned with African-American owned firms as minority-owned firms is therefore not optimal. Fifth, our results are robust to three different ca ...

... This suggests that controlling for credit risk, there is no causal impact of access to capital between Hispanic-owned and White-owned firms. Lumping Hispanic-owned with African-American owned firms as minority-owned firms is therefore not optimal. Fifth, our results are robust to three different ca ...

Credit Ratings and The Cross

... per month, only slightly lower than the 1.16% raw return. The characteristic-adjusted payoff earned by the C1 − C9 portfolio is 0.51% per month, slightly higher than the 0.47% unadjusted payoff. The monthly C1 − C10 characteristic-adjusted return is significant at 0.87% during expansions and 1.18% in ...

... per month, only slightly lower than the 1.16% raw return. The characteristic-adjusted payoff earned by the C1 − C9 portfolio is 0.51% per month, slightly higher than the 0.47% unadjusted payoff. The monthly C1 − C10 characteristic-adjusted return is significant at 0.87% during expansions and 1.18% in ...