Top of Form Week 4: Internal Control, Cash and Receivables

... Bad Debts can be accounted for using either of two methods: direct write-off method or the allowance method. The direct write-off method is entered as an increase to bad debt expense account and a decrease to accounts receivable. This is done only after it is certain that the company cannot collect ...

... Bad Debts can be accounted for using either of two methods: direct write-off method or the allowance method. The direct write-off method is entered as an increase to bad debt expense account and a decrease to accounts receivable. This is done only after it is certain that the company cannot collect ...

CHAPTER 7

... 1. The schedule of creditors was understated by $800 due to error in addition. 2. The balance of a debtor was left out of the schedule of debtors in error, $36. 3. The total of the accounts payable column in the cash payments journal is overstated by $300 because of an addition error. 4. $160 owed b ...

... 1. The schedule of creditors was understated by $800 due to error in addition. 2. The balance of a debtor was left out of the schedule of debtors in error, $36. 3. The total of the accounts payable column in the cash payments journal is overstated by $300 because of an addition error. 4. $160 owed b ...

Credit Rating and Short-Term Debt Financing: Empirical

... creditworthiness can reduce the debt costs by receiving discount on debt costs through early repayment of trade credits.3 There exist other streams of previous studies on trade credit. Garcia-Appendini(2011) finds that suppliers of intermediate goods have better skills in certifying creditworthiness ...

... creditworthiness can reduce the debt costs by receiving discount on debt costs through early repayment of trade credits.3 There exist other streams of previous studies on trade credit. Garcia-Appendini(2011) finds that suppliers of intermediate goods have better skills in certifying creditworthiness ...

building the case for social investment in credit unions

... Automated Lending Decisions (ALD) product have benefited from faster credit approvals or rejections, along with improved quality of the credit decisions and instant automatic loan disbursal. Additionally, the new online banking platform will also provide members with online access to their financial ...

... Automated Lending Decisions (ALD) product have benefited from faster credit approvals or rejections, along with improved quality of the credit decisions and instant automatic loan disbursal. Additionally, the new online banking platform will also provide members with online access to their financial ...

The price impact of rating announcements

... information released prior to the rating change. Steiner and Heinke (2001) examine the international bond market and find that there are significant price ...

... information released prior to the rating change. Steiner and Heinke (2001) examine the international bond market and find that there are significant price ...

Market conditions, default risk and credit spreads

... for credit spread dynamics and for the effect of the interaction between macroeconomic conditions and industry or firm-level characteristics. First, it indicates that credit spreads should decrease with the current firm-specific growth rate and increase with the volatility of cash flows. Secondly, the c ...

... for credit spread dynamics and for the effect of the interaction between macroeconomic conditions and industry or firm-level characteristics. First, it indicates that credit spreads should decrease with the current firm-specific growth rate and increase with the volatility of cash flows. Secondly, the c ...

and Accounts Receivable Methods Percent of

... Installment Accounts Receivable Amounts owed by customers from credit sales for which payment is required in periodic amounts over an extended time period. The customer is usually ...

... Installment Accounts Receivable Amounts owed by customers from credit sales for which payment is required in periodic amounts over an extended time period. The customer is usually ...

Personal Finance 2015-2016 CSS Page 1 of 10 Instructional Area

... a. Explain factors that affect whether a person will be granted a loan (e.g., character, capacity, collateral). b. Discuss factors to consider in selecting a loan to obtain. c. Describe how APR impacts choice of loans. d. Identify documentation that must be supplied when obtaining a loan. e. Identif ...

... a. Explain factors that affect whether a person will be granted a loan (e.g., character, capacity, collateral). b. Discuss factors to consider in selecting a loan to obtain. c. Describe how APR impacts choice of loans. d. Identify documentation that must be supplied when obtaining a loan. e. Identif ...

Parameter Uncertainty and the Credit Risk of Collateralized Debt

... systems of correlated normal latent credit factors. Copula-based models have become popular over the last decade both because they are computationally tractable, and because they can be derived from the structural corporate debt valuation framework of Merton (1974). Today, normal copula models are u ...

... systems of correlated normal latent credit factors. Copula-based models have become popular over the last decade both because they are computationally tractable, and because they can be derived from the structural corporate debt valuation framework of Merton (1974). Today, normal copula models are u ...

Financial globalization or great financial expansion

... interaction of each trend with financial vulnerabilities, in determining whether these have been significant antecedents of banking crises. Exploring these two narratives is important not only ...

... interaction of each trend with financial vulnerabilities, in determining whether these have been significant antecedents of banking crises. Exploring these two narratives is important not only ...

Why Do SMEs Use Informal Credit? A Comparison between Countries

... informal credit, e.g., family/friends, moneylenders, rotating savings and credit organisations (ROSCAs), loan sharks, indigenous savings and credit clubs, informal credit unions, and savings collectors. However, some of the common characteristics of these sources are their primary dependence on rela ...

... informal credit, e.g., family/friends, moneylenders, rotating savings and credit organisations (ROSCAs), loan sharks, indigenous savings and credit clubs, informal credit unions, and savings collectors. However, some of the common characteristics of these sources are their primary dependence on rela ...

Rating Agencies - Financial Policy Forum

... publication contained operating and financial statistics for the major railroad companies, and provided an independent source of information on the business conditions of these corporate borrowers. John Moody took the process another step forward in 1909 by issuing the first credit ratings in the Un ...

... publication contained operating and financial statistics for the major railroad companies, and provided an independent source of information on the business conditions of these corporate borrowers. John Moody took the process another step forward in 1909 by issuing the first credit ratings in the Un ...

332 - Consumer credit and payment cards (PDF: 1010.6 Kb)

... lators. Policymakers have focused on the level of interchange fees, paid by the acquiring bank to the issuing bank (see below for more details). Following discussions with the European Commission, Mastercard has recently agreed to reduce interchange fees on cross-border European card transactions. ...

... lators. Policymakers have focused on the level of interchange fees, paid by the acquiring bank to the issuing bank (see below for more details). Following discussions with the European Commission, Mastercard has recently agreed to reduce interchange fees on cross-border European card transactions. ...

The countercyclical capital buffer in Spain: an

... we explore the performance of indicators of real estate property prices, external imbalances and private sector debt sustainability – including various transformations of the indicators when needed. In line with previous literature, we find that a broad but manageable set of indicators may help to i ...

... we explore the performance of indicators of real estate property prices, external imbalances and private sector debt sustainability – including various transformations of the indicators when needed. In line with previous literature, we find that a broad but manageable set of indicators may help to i ...

New Community Reinvestment Act regulation

... forth by the agencies, enough experience has been gained to form some initial impressions about its effects on such matters as on compliance costs and performance assessments. To see how well cost and assessment objectives have been met, the Federal Reserve Bank of Kansas City surveyed by telephone ...

... forth by the agencies, enough experience has been gained to form some initial impressions about its effects on such matters as on compliance costs and performance assessments. To see how well cost and assessment objectives have been met, the Federal Reserve Bank of Kansas City surveyed by telephone ...

Institutional Ownership and Credit Spreads: An Information

... equity side also tend to have lower cost of debt capital. For example, Ashbaugh, Collins, and LaFond (2006) and Bhojraj and Sengupta (BS, 2003) find the higher the total institutional equity ownership (IO), the better credit ratings and narrower credit spreads. They attribute these findings to stron ...

... equity side also tend to have lower cost of debt capital. For example, Ashbaugh, Collins, and LaFond (2006) and Bhojraj and Sengupta (BS, 2003) find the higher the total institutional equity ownership (IO), the better credit ratings and narrower credit spreads. They attribute these findings to stron ...

Euro Corporate Bonds Risk Factors∗

... with associated (possibly state-dependent) intensity process and, as such, whether or not an issuer actually defaults is an unpredictable event. Several works deal with the empirical estimation of the structural models. Among others, Eom, Helwege, and Huang (2003) empirically test five structural mo ...

... with associated (possibly state-dependent) intensity process and, as such, whether or not an issuer actually defaults is an unpredictable event. Several works deal with the empirical estimation of the structural models. Among others, Eom, Helwege, and Huang (2003) empirically test five structural mo ...

1.1. Necessity of the research problem

... Technological and Commercial Joint Stock Bank (Techcombank) in particular. For this reason, credit risk management is a major task of Vietnam Technological and Commercial Joint Stock Bank (Techcombank). However, in addition to contributing greatly to commercial banks, credit is risky. Credit risks o ...

... Technological and Commercial Joint Stock Bank (Techcombank) in particular. For this reason, credit risk management is a major task of Vietnam Technological and Commercial Joint Stock Bank (Techcombank). However, in addition to contributing greatly to commercial banks, credit is risky. Credit risks o ...

Herman J. Bierens - Personal.psu.edu

... conditional variance specification for rebalanced credit spread portfolios is not plausible because of the vanishing memory. For this reason, we adopt an ARCH specification with limited memory. Empirical studies have provided ample evidence that the GARCH type specification is generally insufficient ...

... conditional variance specification for rebalanced credit spread portfolios is not plausible because of the vanishing memory. For this reason, we adopt an ARCH specification with limited memory. Empirical studies have provided ample evidence that the GARCH type specification is generally insufficient ...

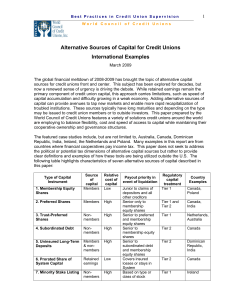

Alternative Sources of Capital for Credit Unions

... to handle unexpected losses by banks, credit unions and other financial institutions. Capital serves as a buffer against such factors as credit, operational and market risks. While regulators define capital requirements and the capital treatment of various financial instruments based upon the laws o ...

... to handle unexpected losses by banks, credit unions and other financial institutions. Capital serves as a buffer against such factors as credit, operational and market risks. While regulators define capital requirements and the capital treatment of various financial instruments based upon the laws o ...

the probability of default under ifrs 9: multi

... and Phase 3: Hedge accounting (for details, see IFRS Foundation, 2015). The phase that will have the greatest impact on business processes and the most important reported characteristics of banking institutions is the impairment methodology phase. The new impairment methodology constitutes a framewo ...

... and Phase 3: Hedge accounting (for details, see IFRS Foundation, 2015). The phase that will have the greatest impact on business processes and the most important reported characteristics of banking institutions is the impairment methodology phase. The new impairment methodology constitutes a framewo ...

NBER WORKING PAPER SERIES AGGREGATE IMPLICATIONS OF CREDIT MARKET IMPERFECTIONS Kiminori Matsuyama

... between seemingly conflicting results across many topics that are ordinarily treated separately or even sometimes viewed as unrelated.2 To this end, I first develop a simple, highly abstract model of credit market imperfections, which is meant to capture all sorts of agency problems that affect cre ...

... between seemingly conflicting results across many topics that are ordinarily treated separately or even sometimes viewed as unrelated.2 To this end, I first develop a simple, highly abstract model of credit market imperfections, which is meant to capture all sorts of agency problems that affect cre ...

The Good, the Bad, and the Ugly: An inquiry into the causes and

... creating a boom and leading to an improvement in borrower net worth. During a boom, with an improved net worth, the agents are now able to finance the Bad projects. The credit is now redirected from the Good to the Bad. This change in the composition of credit and of investment at the peak of the bo ...

... creating a boom and leading to an improvement in borrower net worth. During a boom, with an improved net worth, the agents are now able to finance the Bad projects. The credit is now redirected from the Good to the Bad. This change in the composition of credit and of investment at the peak of the bo ...

The Impact of Sovereign Ratings on Eurozone SMEs Credit Rationing

... credit rationing, where lenders may find it optimal to cut off credit rather than increase loan rates, since the latter may drive off the loan market all but the least creditworthy applicants or elicit riskier behavior from borrowers (Jaffee and Russell, 1976; Stiglitz and Weiss, 1981). The extant e ...

... credit rationing, where lenders may find it optimal to cut off credit rather than increase loan rates, since the latter may drive off the loan market all but the least creditworthy applicants or elicit riskier behavior from borrowers (Jaffee and Russell, 1976; Stiglitz and Weiss, 1981). The extant e ...