discrimination in the small-business credit market

... Although not much previous research has examined discrimination in small-business credit markets, there has been an active debate on the question of whether banks discriminate against minority applicants for mortgages. In an in uential study in that area, researchers at the Federal Reserve Bank of ...

... Although not much previous research has examined discrimination in small-business credit markets, there has been an active debate on the question of whether banks discriminate against minority applicants for mortgages. In an in uential study in that area, researchers at the Federal Reserve Bank of ...

re-prioritizing priority sector lending in india

... norms being mandated on domestic as well as foreign banks. Data show that four decades later, the effect of priority sector lending on growth has varied across sectors. On the other hand, the costs incurred by scheduled commercial banks (SCBs) in lending credit to priority sectors, specifically agri ...

... norms being mandated on domestic as well as foreign banks. Data show that four decades later, the effect of priority sector lending on growth has varied across sectors. On the other hand, the costs incurred by scheduled commercial banks (SCBs) in lending credit to priority sectors, specifically agri ...

COLLEGE STUDENTS AND CREDIT CARD USE: THE EFFECT OF

... allowing interest rates to become quite high under certain conditions. Consumers that fail to pay their balance in full at the end of each pay cycle offer the greatest potential for profit, as the average credit card interest rate on cards that do not offer some form or reward or rebate is around 14 ...

... allowing interest rates to become quite high under certain conditions. Consumers that fail to pay their balance in full at the end of each pay cycle offer the greatest potential for profit, as the average credit card interest rate on cards that do not offer some form or reward or rebate is around 14 ...

Research Centre for International Economics Working Paper: 2013046

... information asymmetries and agency problems between borrowers and lenders increase with tax evasion, which in turn affects banks’ lending decisions and requires banks to monitor firms more intensively (Lin et al. (2011)). The higher costs are passed along to borrowers in the form of reduced credit a ...

... information asymmetries and agency problems between borrowers and lenders increase with tax evasion, which in turn affects banks’ lending decisions and requires banks to monitor firms more intensively (Lin et al. (2011)). The higher costs are passed along to borrowers in the form of reduced credit a ...

A Causal Framework for Credit Default Theory

... obligations so that delinquency rates and therefore default rates are substantially less than what one would expect. Indeed lenders of unsecured loans seek to obtain substantial gains from charging high interest rates on outstanding balances after the minimum payment obligations have been made. The ...

... obligations so that delinquency rates and therefore default rates are substantially less than what one would expect. Indeed lenders of unsecured loans seek to obtain substantial gains from charging high interest rates on outstanding balances after the minimum payment obligations have been made. The ...

Money Management

... The Higher Education Student Assistance Authority (HESAA) is committed to excellence in education and helping you develop the life skills you need for your financial well-being. Real Money 101 was created especially for New Jersey students in cooperation with licensed credit counseling agencies and ...

... The Higher Education Student Assistance Authority (HESAA) is committed to excellence in education and helping you develop the life skills you need for your financial well-being. Real Money 101 was created especially for New Jersey students in cooperation with licensed credit counseling agencies and ...

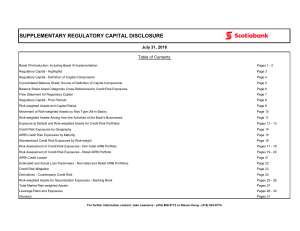

supplementary regulatory capital disclosure

... increases the level of risk-weighted assets for significant investments and deferred tax amounts due to temporary timing differences under defined thresholds, exposures to large or unregulated financial institutions meeting specific criteria, exposures to centralized counterparties and exposures tha ...

... increases the level of risk-weighted assets for significant investments and deferred tax amounts due to temporary timing differences under defined thresholds, exposures to large or unregulated financial institutions meeting specific criteria, exposures to centralized counterparties and exposures tha ...

chapter 10

... Topic: Borrowers and the Demand for Loans 10) If an individual borrows $100, and pays back $100 after a year to settle his loan, it implies that the rate of interest is: A) 0 %. B) 1%. C) 10%. D) 100%. Answer: A Difficulty: Medium AACSB: Application of Knowledge Topic: Borrowers and the Demand for L ...

... Topic: Borrowers and the Demand for Loans 10) If an individual borrows $100, and pays back $100 after a year to settle his loan, it implies that the rate of interest is: A) 0 %. B) 1%. C) 10%. D) 100%. Answer: A Difficulty: Medium AACSB: Application of Knowledge Topic: Borrowers and the Demand for L ...

More Credit with Fewer Crises - weforum.org

... picture, though, there were pockets of overheating. Clear warning signs of credit excess in countries such as Ireland, Spain and Greece were largely ignored as borrowing continued to rise beyond sustainable levels. At the same time, other segments were credit-starved, including China’s retail segmen ...

... picture, though, there were pockets of overheating. Clear warning signs of credit excess in countries such as Ireland, Spain and Greece were largely ignored as borrowing continued to rise beyond sustainable levels. At the same time, other segments were credit-starved, including China’s retail segmen ...

Credit market disequilibrium in Greece (2003 - ECB

... assumption of deterministic demand and supply adopted in previous empirical studies seems to have been made mainly in order to facilitate the econometric estimation rather than being grounded on solid economic reasoning. However, the Bayesian approach adopted here enables us to estimate the model wh ...

... assumption of deterministic demand and supply adopted in previous empirical studies seems to have been made mainly in order to facilitate the econometric estimation rather than being grounded on solid economic reasoning. However, the Bayesian approach adopted here enables us to estimate the model wh ...

The Market for Corporate Control and the Cost of Debt

... We use the di¤erences-in-di¤erences approach to gauge the e¤ect of the BC laws. Specifically, we compare the change in credit spread around the time a BC law was passed (say, year t) for …rms a¤ected by the law to the change in credit spread for …rms una¤ected by the law. Our sample consists of 3,9 ...

... We use the di¤erences-in-di¤erences approach to gauge the e¤ect of the BC laws. Specifically, we compare the change in credit spread around the time a BC law was passed (say, year t) for …rms a¤ected by the law to the change in credit spread for …rms una¤ected by the law. Our sample consists of 3,9 ...

ESG integration in high yield portfolios

... respectively, within one month of the event.9 Regarding the remaining two pillars of ESG, a number of studies have explored environmental and social factors and their relationship with corporate credit, and this growing body of academic work lends further credence to the notion that ESG factors and ...

... respectively, within one month of the event.9 Regarding the remaining two pillars of ESG, a number of studies have explored environmental and social factors and their relationship with corporate credit, and this growing body of academic work lends further credence to the notion that ESG factors and ...

General Principles for Credit Reporting

... national standards for credit reporting systems’ policy and oversight. The Principles for credit reporting are deliberately expressed in a general way to ensure that they can be useful in all countries and that they will be durable. These Principles are not intended for use as a blueprint for the de ...

... national standards for credit reporting systems’ policy and oversight. The Principles for credit reporting are deliberately expressed in a general way to ensure that they can be useful in all countries and that they will be durable. These Principles are not intended for use as a blueprint for the de ...

Appendix III: Credit Growth OLS Regression, Summary Statistics

... and researchers to review the dynamics of credit extension and the impact of the country’s consumer credit legislation, the NCA. This case study contains what may be the first empirical analysis of the impact of the NCA on South Africa’s credit markets; it is composed of four main parts This paper p ...

... and researchers to review the dynamics of credit extension and the impact of the country’s consumer credit legislation, the NCA. This case study contains what may be the first empirical analysis of the impact of the NCA on South Africa’s credit markets; it is composed of four main parts This paper p ...

Chapter 7: Quantitative vs. Credit Easing

... In contrast, the Federal Reserve’s credit easing approach focuses on the mix of loans and securities that it holds and on how this composition of assets affects credit conditions for households and businesses. This difference does not reflect any doctrinal disagreement with the Japanese approach, bu ...

... In contrast, the Federal Reserve’s credit easing approach focuses on the mix of loans and securities that it holds and on how this composition of assets affects credit conditions for households and businesses. This difference does not reflect any doctrinal disagreement with the Japanese approach, bu ...

Problems and Reforms in Mortgage

... have surfaced (e.g., knowingly issuing inaccurate ratings) proving that CRAs are unreliable in this regulatory capacity. However, these problems cannot be addressed by punishing individual CRAs. Instead, policymakers must address the incentives – or lack thereof – within the industry generally. As t ...

... have surfaced (e.g., knowingly issuing inaccurate ratings) proving that CRAs are unreliable in this regulatory capacity. However, these problems cannot be addressed by punishing individual CRAs. Instead, policymakers must address the incentives – or lack thereof – within the industry generally. As t ...

Accounting I Lesson Plan - Terry Wilhelmi`s Home Page

... * Assets taken out of a business for the personal use of the owner are known as withdrawals, and are considered to be part of the owner’s equity taken out of a business. Therefore, withdrawals decrease owner’s equity. * Withdrawals could be recorded as decreases directly in the owner’s capital accou ...

... * Assets taken out of a business for the personal use of the owner are known as withdrawals, and are considered to be part of the owner’s equity taken out of a business. Therefore, withdrawals decrease owner’s equity. * Withdrawals could be recorded as decreases directly in the owner’s capital accou ...

"Sarbanes-Oxley" For Credit Rating Agencies?

... RMBS are a type of collateralized debt obligation (“CDO”), meaning that they may be offered and sold under Rule 144A of the Federal Securities Act of 1933.11 Such instruments escape the strict marketing and sales restrictions of Section 5 of the Securities Act to which typical publicly offered secur ...

... RMBS are a type of collateralized debt obligation (“CDO”), meaning that they may be offered and sold under Rule 144A of the Federal Securities Act of 1933.11 Such instruments escape the strict marketing and sales restrictions of Section 5 of the Securities Act to which typical publicly offered secur ...

1. Recognizing accounts receivable. 2. Valuing accounts receivable

... • The required balance in the allowance account is determined by applying the percentage to the accounts receivable balance at the end of the current period. • The amount of the adjusting entry to record expected bad debt losses for the current period is the difference between the required balance a ...

... • The required balance in the allowance account is determined by applying the percentage to the accounts receivable balance at the end of the current period. • The amount of the adjusting entry to record expected bad debt losses for the current period is the difference between the required balance a ...

NORMAL BALANCE

... helps in the recording process 2 Define debits and credits and explain how they are used to record business transactions 3 Identify the basic steps in the recording process 4 Explain what a journal is and how it helps in the recording process ...

... helps in the recording process 2 Define debits and credits and explain how they are used to record business transactions 3 Identify the basic steps in the recording process 4 Explain what a journal is and how it helps in the recording process ...

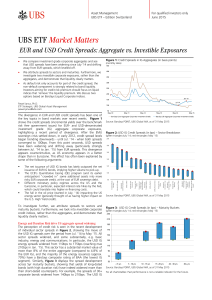

Market Matters EUR and USD Credit Spreads

... performance is not a reliable indicator of future results. The performance shown does not take account of any commissions and costs charged when subscribing to and redeeming units. Commissions and costs have a negative impact on performance. If the currency of a financial product or financial servic ...

... performance is not a reliable indicator of future results. The performance shown does not take account of any commissions and costs charged when subscribing to and redeeming units. Commissions and costs have a negative impact on performance. If the currency of a financial product or financial servic ...

How and Why Credit Rating Agencies are not Like Other Gatekeepers

... reason is that the most successful credit rating agencies have benefited from an oligopoly market structure that is reinforced by regulations that depend exclusively on credit ratings issued by Nationally Recognized Statistical Rating Organizations (NRSROs).7 These regulatory benefits – which I call ...

... reason is that the most successful credit rating agencies have benefited from an oligopoly market structure that is reinforced by regulations that depend exclusively on credit ratings issued by Nationally Recognized Statistical Rating Organizations (NRSROs).7 These regulatory benefits – which I call ...

chapter 1 overview of the research thesis

... of reimbursement principal and interest. Lending activity in general and lending for businesses in particular carry a number of characteristics such as trust property the borrower will repay principal and interest on term loan used for the right purposes, as reimbursement for funds, is just the fina ...

... of reimbursement principal and interest. Lending activity in general and lending for businesses in particular carry a number of characteristics such as trust property the borrower will repay principal and interest on term loan used for the right purposes, as reimbursement for funds, is just the fina ...