* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

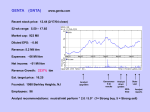

Download Gilead Sciences (7-03

Survey

Document related concepts

Transcript

Ticker: GILD Sector: Healthcare Industry: Biotechnology Own: 800 shares Buffet Evaluation: $56.51 Recommendation: Buy Pricing Closing Price $52.17 (07/01/08) 52-wk High $56.95 (06/05/08) 52-wk Low $35.22 (08/29/07) Market Data Market Cap $47.93B Total assets $5.87B Trading vol. 7.68M (10 Day avg) 6.69M (3 month avg) Valuation EPS P/E PEG Div Yield $1.76(ttm) 29.44 (ttm) 1.10 N/A Profitability & Effectiveness (ttm) ROA 32.43% ROE 59.66% Gross Margin 81.23% Oper. Margin 50.95% Profit Margin 38.21% Brian Stieren Gilead Sciences Gilead Sciences, Inc., a biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics for the treatment of life-threatening infectious diseases. Its products include Truvada, Viread, Atripla, and Emtriva for the treatment of human immunodeficiency virus infection in adults; Hepsera, an oral formulation for the treatment of chronic hepatitis B; AmBisome, amphotericin B liposome injection to treat serious invasive fungal infections; Flolan, an injected medication for the long-term intravenous treatment of primary pulmonary hypertension and pulmonary hypertension; and Vistide, an antiviral medication for the treatment of cytomegalovirus retinitis in patients with acquired immunodeficiency syndrome (AIDS). The company also offers Tamiflu, an oral antiviral for the treatment and prevention of influenza A and B; Macugen, an intravitreal injection for the treatment of neovascular agerelated macular degeneration; Letairis, an endothelin receptor antagonist for the treatment of pulmonary arterial hypertension in patients with WHO Class II or III symptoms; and Cicletanine, which is being evaluated for the treatment of pulmonary arterial hypertension. Gilead Sciences has operations in North America, Europe, and Australia. The company has research collaborations with Abbott Laboratories, Inc.; Novartis Institutes for BioMedical Research, Inc.; Novartis Vaccines and Diagnostics, Inc.; Genelabs Technologies, Inc.; Achillion Pharmaceuticals, Inc.; Japan Tobacco, Inc.; Parion Sciences, Inc.; LG Life Sciences, Ltd.; and University of Texas System. It also has commercial collaborations with Astellas Pharma, Inc.; Emory University; F. Hoffmann-La Roche, Ltd.; Pfizer, Inc.; Dainippon Sumitomo Pharma Co., Ltd.; OSI Pharmaceuticals, Inc.; GlaxoSmithKline, Inc.; Japan Tobacco, Inc.; and Bristol-Myers Squibb Company. The company was founded in 1987 and is headquartered in Foster City, California. DIRECT COMPETITOR COMPARISON GILD BMY GSK Industry RHHBY.PK Market Cap: 48.01B 41.15B 120.03B N/A 113.71M Employees: 2,979 42,000 103,483 N/A 60 22.30% 20.00% 1.70% N/A 25.10% 4.46B 20.21B 45.47B N/A 14.20M 81.23% 68.95% 76.77% N/A 97.33% 2.33B 5.23B 17.41B N/A -23.09M 50.95% 21.61% 33.66% N/A -251.42% Net Income (ttm): 1.70B 2.03B 9.98B N/A -17.05M EPS (ttm): 1.765 1.077 3.63 N/A -0.54 P/E (ttm): 29.49 19.30 12.50 N/A 22.14 1.1 1.11 2.81 1.8 1.06 10.79 2.01 2.55 N/A 8.86 Qtrly Rev Growth (yoy): Revenue (ttm): Gross Margin (ttm): EBITDA (ttm): Oper Margins (ttm): PEG (5 yr expected): P/S (ttm): Opportunities: 2 Approximately 1.2 million Americans are living with HIV and half are not being treated. Half a million people world wide are treating HIV with one of Gilead’s products which generated revenues of 3 billion in 2007. Hepsera is the leading antiviral to treat Hepatitis B, there are more than 400 million infected world wide. Terminology Clinical trials are conducted in phases. The trials at each phase have a different purpose and help scientists answer different questions: In Phase I trials, researchers test an experimental drug or treatment in a small group of people (20-80) for the first time to evaluate its safety, determine a safe dosage range, and identify side effects. In Phase II trials, the experimental study drug or treatment is given to a larger group of people (100-300) to see if it is effective and to further evaluate its safety. In Phase III trials, the experimental study drug or treatment is given to large groups of people (1,000-3,000) to confirm its effectiveness, monitor side effects, compare it to commonly used treatments, and collect information that will allow the experimental drug or treatment to be used safely. In Phase IV trials, post marketing studies delineate additional information including the drug's risks, benefits, and optimal use. News June 13, 2008 Gilead announces data from a Phase III study of Aztreonam Lysine for Inhalation in Patients with Cystic Fibrosis. June 2, 2008 U.S. Patent Office confirms second of four Viread Patents. May 29, 2008 Data from a Phase III study of Letairis for Pulmonary Arterial Hypertension. May 20, 2008 U.S. Patent Office confirms first of four Viread Patents. May 1, 2008 Gilead initiates a Phase IV study of Letairis. April 25, 2008 The European Union Approves Viread to treat Chronic Hepatitis B. April 24, 2008 Data from two The Phase III studies evaluating Viread for the treatment of chronic Hepatitis B. 3 October 22, 2007 Gilead announces that they will repurchase $3 billion of their shares. November 17, 2006 Gilead purchased Myogen Inc. for $2.42 billion. Buffett Evaluations I used a beta of 0.585 which is a average of Rueters and Yahoo! and 3.983, the ten year T-Bill, for the risk free rate. Risks: Competition in healthcare can be brutal. If another company develops the cure for HIV, Gilead could easily be put out of business. Developing new medicines are expensive. Medicines that are denied by the government in Phase III studies drastically affect the price of the stock price. Recommendations: The stock price is hugely affected by the phases new medicines have been approved for. In the recent past a solid base of innovative medicines have already been approved and are being used; income from these medicines will continue to come in at lower costs. Growth has been steady and it seems that it will continue in the future. Balance Sheet 4 View: Annual Data | Quarterly Data All numbers in thousands 31-Dec-07 31-Dec-06 968,086 203,892 947,660 599,966 308,688 816,007 120,844 905,347 564,145 22,863 707,913 1,615,972 480,964 216,903 70,456 Total Current Assets Long Term Investments Property Plant and Equipment Goodwill Intangible Assets Accumulated Amortization Other Assets Deferred Long Term Asset Charges 3,028,292 1,550,444 447,696 290,742 220,183 297,359 2,429,206 452,715 361,299 317,743 222,479 302,539 3,092,208 242,568 333,582 29,400 66,893 Total Assets 5,834,716 4,085,981 3,764,651 705,242 286 30,747 727,752 18,747 17,777 376,779 60,206 18,353 Total Current Liabilities Long Term Debt Other Liabilities Deferred Long Term Liability Charges Minority Interest Negative Goodwill 736,275 1,300,000 136,836 61,316 140,299 - 764,276 1,300,000 91,847 61,049 53,091 - 455,338 240,650 32,725 8,160 - Total Liabilities 2,374,726 2,270,263 736,873 - - - PERIOD ENDING Assets Current Assets Cash And Cash Equivalents Short Term Investments Net Receivables Inventory Other Current Assets Liabilities Current Liabilities Accounts Payable Short/Current Long Term Debt Other Current Liabilities Stockholders' Equity Misc Stocks Options Warrants Redeemable Preferred Stock Preferred Stock 31-Dec-05 5 Common Stock Retained Earnings Treasury Stock Capital Surplus Other Stockholder Equity 932 249,080 3,214,341 (4,363) 461 (891,363) 2,704,399 2,221 460 809,642 2,206,228 11,448 Total Stockholder Equity 3,459,990 1,815,718 3,027,778 $3,169,248 $1,497,975 $2,694,196 Net Tangible Assets Income Statement View: Annual Data | Quarterly Data All numbers in thousands Total Revenue Cost of Revenue 31-Dec-07 4,230,045 768,771 31-Dec-06 31-Dec-05 3,026,139 2,028,400 433,320 260,326 Gross Profit 3,461,274 2,592,819 1,768,074 PERIOD ENDING Operating Expenses Research Development Selling General and Administrative Non Recurring Others Total Operating Expenses Operating Income or Loss Income from Continuing Operations Total Other Income/Expenses Net Earnings Before Interest And Taxes Interest Expense Income Before Tax Income Tax Expense 591,026 705,741 - 383,861 573,660 2,394,051 - 277,724 379,248 - - - - 2,164,507 (758,753) 1,111,102 109,823 2,283,438 13,100 2,270,338 655,040 134,642 47,137 (617,845) 1,162,234 20,362 442 (638,207) 1,161,792 551,750 347,878 6 Minority Interest Net Income From Continuing Ops Non-recurring Events Discontinued Operations Extraordinary Items Effect Of Accounting Changes Other Items Net Income Preferred Stock And Other Adjustments Net Income Applicable To Common Shares 9,108 1,615,298 - 1,615,298 $1,615,298 6,266 (1,189,957) - (1,189,957) - 3,995 813,914 - 813,914 - ($1,189,957) $813,914 Cash Flow View: Annual Data | Quarterly Data PERIOD ENDING Net Income All numbers in thousands 31-Dec-07 31-Dec-06 31-Dec-05 1,615,298 (1,189,957) 813,914 Operating Activities, Cash Flows Provided By or Used In Depreciation 51,279 47,284 Adjustments To Net Income 334,886 2,585,879 Changes In Accounts Receivables (138,034) (184,370) 35,777 126,210 13,753 7 Changes In Liabilities Changes In Inventories Changes In Other Operating Activities Total Cash Flow From Operating Activities 189,077 (34,619) (252,489) 1,765,398 298,379 162,889 (358,184) (81,923) 19,028 (355,540) 1,218,059 715,080 Investing Activities, Cash Flows Provided By or Used In Capital Expenditures (78,648) (105,208) (47,951) Investments (1,177,376) 1,102,046 (643,965) Other Cashflows from Investing Activities (46,443) (2,736,172) Total Cash Flows From Investing Activities (1,302,467) (1,739,334) (691,916) Financing Activities, Cash Flows Provided By or Used In Dividends Paid Sale Purchase of Stock (244,116) Net Borrowings (99,459) Other Cash Flows from Financing Activities 76,276 (141,556) 695,558 95,259 143,283 298,613 - Total Cash Flows From Financing Activities Effect Of Exchange Rate Changes 649,261 (19,892) 441,896 (38,056) Change In Cash and Cash Equivalents (267,299) (43,553) $152,079 $108,094 $427,004 8