Engineering Economy

... Interest is paid when a person or organization borrows money (obtains a loan) and repays a larger amount. Interest is earned when a person or organization saves, invests, or lends money and obtains a return of a larger amount. Interest = end amount - original amount ...

... Interest is paid when a person or organization borrows money (obtains a loan) and repays a larger amount. Interest is earned when a person or organization saves, invests, or lends money and obtains a return of a larger amount. Interest = end amount - original amount ...

Portfolio Optimisation - Hearthstone Investments

... than for UK equities and Gilts (0.11 vs. equities’ 0.30 and Gilts’ 0.14). Although it could be expected that property would prove less volatile than the equity market, it is perhaps surprising that it appears to be less “risky” than the Gilts market. This, of course, reflects the fact that if Gilts ...

... than for UK equities and Gilts (0.11 vs. equities’ 0.30 and Gilts’ 0.14). Although it could be expected that property would prove less volatile than the equity market, it is perhaps surprising that it appears to be less “risky” than the Gilts market. This, of course, reflects the fact that if Gilts ...

Examples of Level II exam item set questions

... Sherman has earned a reputation for consistently outperforming the market. Over the long run, his mutual funds have outperformed their respective market benchmarks by a wide margin. For the past 12 months the funds have slightly underperformed the benchmarks. Some clients have noticed that Sherman’s ...

... Sherman has earned a reputation for consistently outperforming the market. Over the long run, his mutual funds have outperformed their respective market benchmarks by a wide margin. For the past 12 months the funds have slightly underperformed the benchmarks. Some clients have noticed that Sherman’s ...

IFSL Brunsdon Investment Funds brochure

... With a mandate to target a return in excess of long-term equities, there will be a higher level of market participation than is usually seen in institutional mandates. The Adventurous mandate's asset allocation will therefore have a reduced core of diversified assets with an added allocation of a ba ...

... With a mandate to target a return in excess of long-term equities, there will be a higher level of market participation than is usually seen in institutional mandates. The Adventurous mandate's asset allocation will therefore have a reduced core of diversified assets with an added allocation of a ba ...

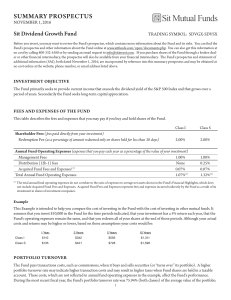

Baird Core Intermediate Municipal Bond Fund Summary Prospectus

... The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual ...

... The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual ...

The Month of the Year Effect on Dhaka Stock Exchange

... and year of the month, range from visual inspection of value and equally-weighted market returns [11, 12] to OLS regressions [13, 14, 15, 16], to GARCH models [17, 18, 19, 20], to general linear procedures such as ANOVA [21, 16], nonparametric tests [21] to cross sectional risk and autocorrelation [ ...

... and year of the month, range from visual inspection of value and equally-weighted market returns [11, 12] to OLS regressions [13, 14, 15, 16], to GARCH models [17, 18, 19, 20], to general linear procedures such as ANOVA [21, 16], nonparametric tests [21] to cross sectional risk and autocorrelation [ ...

Unconstrained Investing: Unleash Your Bonds

... can vary widely and there is no market-based benchmark against which to compare performance. This makes comparisons of manager returns difficult and an assessment of risk and return subjective. So what is an appropriate benchmark for an unconstrained strategy? The unfortunate answer is, “It depends. ...

... can vary widely and there is no market-based benchmark against which to compare performance. This makes comparisons of manager returns difficult and an assessment of risk and return subjective. So what is an appropriate benchmark for an unconstrained strategy? The unfortunate answer is, “It depends. ...

master-ppt-embed-class8

... depreciation on a straight-line basis. Currently, variable costs are $360,000 at 60% of capacity ($1,800,000 × 20%). If Quigley purchases energy equal to an additional 30% of capacity, it can be assumed that the increase in total variable costs will be half of the variable costs for 60% of capacity, ...

... depreciation on a straight-line basis. Currently, variable costs are $360,000 at 60% of capacity ($1,800,000 × 20%). If Quigley purchases energy equal to an additional 30% of capacity, it can be assumed that the increase in total variable costs will be half of the variable costs for 60% of capacity, ...

Forward Rate Contract - Western Australian Treasury Corporation

... = the continuously compounded foreign interest rate (dependent on the method of quotation) . This is equal to ln(1 + 0.083) or 0.079735 ...

... = the continuously compounded foreign interest rate (dependent on the method of quotation) . This is equal to ln(1 + 0.083) or 0.079735 ...

University of Louisville Endowment Fund Statement of Investment

... converted must be listed on the New York Stock Exchange (NYSE), the American Stock Exchange (AMEX), or the National Association of Securities Dealers Automated Quote System (NASDAQ), or, for foreign securities, equivalent exchanges in their country of domicile. Any other securities or investment veh ...

... converted must be listed on the New York Stock Exchange (NYSE), the American Stock Exchange (AMEX), or the National Association of Securities Dealers Automated Quote System (NASDAQ), or, for foreign securities, equivalent exchanges in their country of domicile. Any other securities or investment veh ...

Over/Under-Reaction of Stock Markets

... Test riskiness of the strategy and about whether the profits are due to overreaction or underreaction Are higher than average unconditional returns either because of their risk or for other reasons such as differential tax exposures? Significant negative returns of the zero-cost portfolio in the mon ...

... Test riskiness of the strategy and about whether the profits are due to overreaction or underreaction Are higher than average unconditional returns either because of their risk or for other reasons such as differential tax exposures? Significant negative returns of the zero-cost portfolio in the mon ...

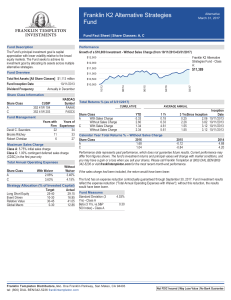

Franklin K2 Alternative Strategies Fund Fact Sheet

... Reference Benchmark: S&P 500 Index. The S&P 500 Index is solely utilized as a reference benchmark to illustrate difference in behavior between U.S. equity markets and the fund. However, the S&P 500 Index is not fully reflective of the risk profile of the fund, which is not limited to investing solel ...

... Reference Benchmark: S&P 500 Index. The S&P 500 Index is solely utilized as a reference benchmark to illustrate difference in behavior between U.S. equity markets and the fund. However, the S&P 500 Index is not fully reflective of the risk profile of the fund, which is not limited to investing solel ...

document - TradingFloor.com

... The portfolio is not hedged to offset movements in the currency markets. If an investor wants to reduce the impact on returns from currency fluctuations they should hedge all currency exposure to the account’s currency denomination on a monthly basis using the currency exposure pie chart that can be ...

... The portfolio is not hedged to offset movements in the currency markets. If an investor wants to reduce the impact on returns from currency fluctuations they should hedge all currency exposure to the account’s currency denomination on a monthly basis using the currency exposure pie chart that can be ...