FREE Sample Here - We can offer most test bank and

... 37. Refer to Exhibit 1-5. If next year the real rates all rise by 10% while inflation climbs from 1.5% to 2.5%, what will be the nominal rate of return on each security? a. 1.24% and 1.52% b. 1.35% and 3.52% c. 3.89% and 6.11% d. 3.52% and 3.89% e. 1.17% and 6.11% ANS: C The computations for the new ...

... 37. Refer to Exhibit 1-5. If next year the real rates all rise by 10% while inflation climbs from 1.5% to 2.5%, what will be the nominal rate of return on each security? a. 1.24% and 1.52% b. 1.35% and 3.52% c. 3.89% and 6.11% d. 3.52% and 3.89% e. 1.17% and 6.11% ANS: C The computations for the new ...

the evaluation of active manager returns in a non

... returns are normally distributed and (2) investors should only be concerned with mean and variance (the first and second moments of a return distribution). The pioneering portfolio evaluation techniques of Sharpe (1966), Jensen (1968, 1969) and Treynor (1965) are all firmly grounded in MPT theory an ...

... returns are normally distributed and (2) investors should only be concerned with mean and variance (the first and second moments of a return distribution). The pioneering portfolio evaluation techniques of Sharpe (1966), Jensen (1968, 1969) and Treynor (1965) are all firmly grounded in MPT theory an ...

Mutual Funds Sharekhan`s Top Equity Fund Picks

... investment advice or investment information. The information in this report has not been prepared taking into account specific investment objectives, financial situations and needs of any particular investor, and therefore may not be suitable for you. You should verify all scheme related information ...

... investment advice or investment information. The information in this report has not been prepared taking into account specific investment objectives, financial situations and needs of any particular investor, and therefore may not be suitable for you. You should verify all scheme related information ...

Five Myths of Active Portfolio Management

... superior returns, and expected return will be driven down to the second-best manager’s expected return. At that point, investors will be indifferent between investing with either manager, so funds will flow to both managers until their expected returns are driven down to the third-best manager. This ...

... superior returns, and expected return will be driven down to the second-best manager’s expected return. At that point, investors will be indifferent between investing with either manager, so funds will flow to both managers until their expected returns are driven down to the third-best manager. This ...

Zephyr Analytics API - Informa Investment Solutions

... Value at Risk (VaR) Cornish Fisher Not Volatility Normalized Value at Risk (VaR) Cornish Fisher Volatility Normalized Value at Risk (VaR) Historical Not Volatility Normalized Value at Risk (VaR) Historical Volatility Normalized Variance Worst N Quarter Return Worst One Year Return Zephyr K-Ratio ...

... Value at Risk (VaR) Cornish Fisher Not Volatility Normalized Value at Risk (VaR) Cornish Fisher Volatility Normalized Value at Risk (VaR) Historical Not Volatility Normalized Value at Risk (VaR) Historical Volatility Normalized Variance Worst N Quarter Return Worst One Year Return Zephyr K-Ratio ...

Trading Is Hazardous to Your Wealth: The Common Stock

... where Pdcls and Pdclb are the reported closing prices from the Center for Research in Security Prices ~CRSP! daily stock return files on the day of a sale and purchase, respectively, and Pdss and Pdbb are the actual sale price and purchase price from our account database.5 Our estimate of the bid-as ...

... where Pdcls and Pdclb are the reported closing prices from the Center for Research in Security Prices ~CRSP! daily stock return files on the day of a sale and purchase, respectively, and Pdss and Pdbb are the actual sale price and purchase price from our account database.5 Our estimate of the bid-as ...

Investing - Madeira City Schools

... Investor services and newsletters, such as ValueLine or Morningstar and financial calculators ...

... Investor services and newsletters, such as ValueLine or Morningstar and financial calculators ...

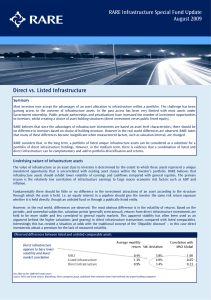

Listed vs Unlisted rgc - RARE Infrastructure Limited

... Lack of liquidity in an investment can cause problems when trying to sell. However it can also cause problems when trying to buy, especially if there are a small number of potential assets and a large number of willing buyers. When this is combined with a lack of alternative investments, prices can ...

... Lack of liquidity in an investment can cause problems when trying to sell. However it can also cause problems when trying to buy, especially if there are a small number of potential assets and a large number of willing buyers. When this is combined with a lack of alternative investments, prices can ...

Think Again. - Cambria Investment Management

... Although SYLD offers a healthy dividend at 1.63%, it’s obviously near the bottom of this group. But remember, we’ve engineered SYLD to reflect total cash distributions to investors from dividends and buybacks. When management rewards investors with buybacks, we wouldn’t see that value-transfer refle ...

... Although SYLD offers a healthy dividend at 1.63%, it’s obviously near the bottom of this group. But remember, we’ve engineered SYLD to reflect total cash distributions to investors from dividends and buybacks. When management rewards investors with buybacks, we wouldn’t see that value-transfer refle ...

Capital Market Review - Allegheny Financial Group

... and expansionary fiscal policy. Credit spreads narrowed during the quarter. The Federal Reserve decided to raise rates at their December meeting, the first and only rate increase of 2016 and a far cry from the Federal Reserve’s projection of four rate increases at this time last year. Rates across t ...

... and expansionary fiscal policy. Credit spreads narrowed during the quarter. The Federal Reserve decided to raise rates at their December meeting, the first and only rate increase of 2016 and a far cry from the Federal Reserve’s projection of four rate increases at this time last year. Rates across t ...

A Two-Period International Investment Model Setting Up the The

... • By being able to lend, export, and import, the small country’s consumers to achieve the combination of period 1 and 2 consumption levels that lie on a higher indifference curve than the best closed-economy consumption point A. • Notice that for the small country to take advantage of international ...

... • By being able to lend, export, and import, the small country’s consumers to achieve the combination of period 1 and 2 consumption levels that lie on a higher indifference curve than the best closed-economy consumption point A. • Notice that for the small country to take advantage of international ...

1 - Member and Committee Information

... Over the past 10 years the average fund has increased allocation to bonds and alternatives considerably at the expense of equities. In contrast, the Teesside Fund has shifted its allocation in the opposite direction, increasing the allocation in equities by 14% over the past 10 years at the expense ...

... Over the past 10 years the average fund has increased allocation to bonds and alternatives considerably at the expense of equities. In contrast, the Teesside Fund has shifted its allocation in the opposite direction, increasing the allocation in equities by 14% over the past 10 years at the expense ...

Portfolio Funding Profile

... The Impact of Withdrawal Rates on Portfolio Longevity in Extended Down Markets and Average Markets ...

... The Impact of Withdrawal Rates on Portfolio Longevity in Extended Down Markets and Average Markets ...

making the case

... obvious risks. Dispose of each with a short statement of the countermeasure should they occur. Then be prepared to field the questions from management regarding the risks not listed in your business case. ...

... obvious risks. Dispose of each with a short statement of the countermeasure should they occur. Then be prepared to field the questions from management regarding the risks not listed in your business case. ...

MFS MERIDIAN ® FUNDS ― GLOBAL - fund

... Currency Risk: Changes in currency rates can significantly affect the value of your investment. Derivatives Risk: Derivatives can be highly volatile and can involve leverage. Gains or losses from derivatives can be substantially greater than the derivatives’ original cost. Other Risks The rating doe ...

... Currency Risk: Changes in currency rates can significantly affect the value of your investment. Derivatives Risk: Derivatives can be highly volatile and can involve leverage. Gains or losses from derivatives can be substantially greater than the derivatives’ original cost. Other Risks The rating doe ...