First Trust Large Cap Core AlphaDEX® Fund

... *NAV returns are based on the fund’s net asset value which represents the fund’s net assets (assets less liabilities) divided by the fund’s outstanding shares. After Tax Held returns represent return after taxes on distributions. Assumes shares have not been sold. After Tax Sold returns represent th ...

... *NAV returns are based on the fund’s net asset value which represents the fund’s net assets (assets less liabilities) divided by the fund’s outstanding shares. After Tax Held returns represent return after taxes on distributions. Assumes shares have not been sold. After Tax Sold returns represent th ...

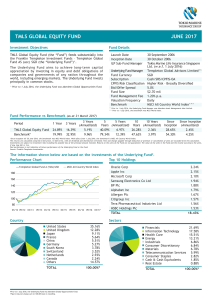

tmls global equity fund june 2017

... *Since inception till 30 June 2016, the benchmark was MSCI World Index. With effect from 1 July 2016, the benchmark is MSCI All Country World Index. The returns are calculated using bid-to-bid prices, in SGD terms, with all dividends and distribution reinvested. Fees and charges payable through dedu ...

... *Since inception till 30 June 2016, the benchmark was MSCI World Index. With effect from 1 July 2016, the benchmark is MSCI All Country World Index. The returns are calculated using bid-to-bid prices, in SGD terms, with all dividends and distribution reinvested. Fees and charges payable through dedu ...

Quarterly Investment Chartbook

... Comerica’s Wealth Management team consists of various divisions of Comerica Bank, affiliates of Comerica Bank including Comerica Bank & Trust, N.A., and subsidiaries of Comerica Bank including World Asset Management, Inc.; Wilson, Kemp & Associates, Inc.; Comerica Securities, Inc.; and Comerica Insu ...

... Comerica’s Wealth Management team consists of various divisions of Comerica Bank, affiliates of Comerica Bank including Comerica Bank & Trust, N.A., and subsidiaries of Comerica Bank including World Asset Management, Inc.; Wilson, Kemp & Associates, Inc.; Comerica Securities, Inc.; and Comerica Insu ...

Treynor Measure

... portfolio with the market by creating a hypothetical portfolio made up of T-bills and the managed portfolio If the risk is lower than the market, leverage is used and the hypothetical portfolio is compared to the market ...

... portfolio with the market by creating a hypothetical portfolio made up of T-bills and the managed portfolio If the risk is lower than the market, leverage is used and the hypothetical portfolio is compared to the market ...

Uncertainty and Consumer Behavior

... lower expected return. If George is not particularly risk averse he may choose fund A even if its return is more variable. 4. What does it mean for consumers to maximize expected utility? Can you think of a case in which a person might not maximize expected utility? To maximize expected utility mean ...

... lower expected return. If George is not particularly risk averse he may choose fund A even if its return is more variable. 4. What does it mean for consumers to maximize expected utility? Can you think of a case in which a person might not maximize expected utility? To maximize expected utility mean ...

Difference of Stock Return Distributions and the Cross

... We investigate the significance of difference of distributions (DD) over time in the cross-sectional pricing of stocks. Our estimate of DD, based upon the Earth Mover’s Distance or the Wasserstein metric, measures the difference of empirical distributions of a firm’s present stock return and those o ...

... We investigate the significance of difference of distributions (DD) over time in the cross-sectional pricing of stocks. Our estimate of DD, based upon the Earth Mover’s Distance or the Wasserstein metric, measures the difference of empirical distributions of a firm’s present stock return and those o ...

Dependence Analysis of the Market Index Using Fuzzy c

... more specifically, the prediction of the return of the market index, which may be a large profit or loss for the investors, has been a challenge for statistics. The purpose is to use such prediction to assist an investor in decision making, altering its behavior biased by optimism or pessimism, with ...

... more specifically, the prediction of the return of the market index, which may be a large profit or loss for the investors, has been a challenge for statistics. The purpose is to use such prediction to assist an investor in decision making, altering its behavior biased by optimism or pessimism, with ...

Sample Investment Policy 2

... In order to meet its needs, the investment strategy of the Long-term Reserve Fund is to emphasize total return; that is, the aggregate return from capital appreciation and dividend and interest income. Specifically, the primary objective in the investment management of the Longterm Reserve Fund shal ...

... In order to meet its needs, the investment strategy of the Long-term Reserve Fund is to emphasize total return; that is, the aggregate return from capital appreciation and dividend and interest income. Specifically, the primary objective in the investment management of the Longterm Reserve Fund shal ...

after-tax returns: methodology for computing

... Once we have the capital gains and dividends for the shadow investment, we can calculate after-tax performance in the same manner that we do for the portfolio. The following sections describe how we compute the shadow benchmark’s capital gains and dividends. The Initial Cost-Basis and Market Value o ...

... Once we have the capital gains and dividends for the shadow investment, we can calculate after-tax performance in the same manner that we do for the portfolio. The following sections describe how we compute the shadow benchmark’s capital gains and dividends. The Initial Cost-Basis and Market Value o ...

Chapter 2

... Risk, Return, and Dominance An investment alternative shows dominance over another if it offers the same expected return for less risk, or if the security has a higher expected return than another security of comparable risk. Equivalent assets should sell for the same price. This is known as th ...

... Risk, Return, and Dominance An investment alternative shows dominance over another if it offers the same expected return for less risk, or if the security has a higher expected return than another security of comparable risk. Equivalent assets should sell for the same price. This is known as th ...

risk margin - Casualty Actuarial Society

... Present value to take into account claim payment and tax deduction timing ...

... Present value to take into account claim payment and tax deduction timing ...