Valuation - Ohio University College of Business

... This is a site of the Edinburgh Business School. I have also included one in Appendix 1. So if you wanted to find the present value of $100, in one year, 10% interest, you go to the 10% column, go to row 1 (for one year) and you find the value .909. You multiply that number times the future value yo ...

... This is a site of the Edinburgh Business School. I have also included one in Appendix 1. So if you wanted to find the present value of $100, in one year, 10% interest, you go to the 10% column, go to row 1 (for one year) and you find the value .909. You multiply that number times the future value yo ...

APPENDIX D

... While this recently published conclusion as to the imprecision of equity cost estimates produced by CAPM-type models does not negate the risk/return basis of asset pricing, it does definitely call for a more accurate measure other than beta (or other risk indicators) with which asset returns can be ...

... While this recently published conclusion as to the imprecision of equity cost estimates produced by CAPM-type models does not negate the risk/return basis of asset pricing, it does definitely call for a more accurate measure other than beta (or other risk indicators) with which asset returns can be ...

Long Run Stock Returns: Evidence from Belgium 1838-2008

... only consider common stocks trade on the spot market, for several reasons. The spot market had a wider coverage because stocks listed on the forward market had to be listed on the spot market, but not vice versa. Furthermore, before 1871 there was no forward market reported at all, between 1871 and ...

... only consider common stocks trade on the spot market, for several reasons. The spot market had a wider coverage because stocks listed on the forward market had to be listed on the spot market, but not vice versa. Furthermore, before 1871 there was no forward market reported at all, between 1871 and ...

Table of Contents - Maryland Public Service Commission

... Starting with the 1999 stock price, which is known to ...

... Starting with the 1999 stock price, which is known to ...

2016 Projection Assumption Guidelines

... An important facet of the financial planner’s work is to make a variety of projections (retirement needs and retirement income, insurance needs, children’s education funding needs, etc.). In making projections, financial planners are bound by method, rather than results. The purpose of this document ...

... An important facet of the financial planner’s work is to make a variety of projections (retirement needs and retirement income, insurance needs, children’s education funding needs, etc.). In making projections, financial planners are bound by method, rather than results. The purpose of this document ...

Risk and Return

... must lie on the security market line, so must the market portfolio. Let E(RM) denote the expected return on the market portfolio. ...

... must lie on the security market line, so must the market portfolio. Let E(RM) denote the expected return on the market portfolio. ...

Risk and Return for Farmland Today

... • Farmland has moved close to 1 to 1 with the CPI. • However, the relationship is more complex than this model suggests, therefore we broke inflation into expected and unexpected components ...

... • Farmland has moved close to 1 to 1 with the CPI. • However, the relationship is more complex than this model suggests, therefore we broke inflation into expected and unexpected components ...

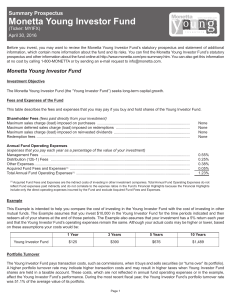

Monetta Young Investor Fund

... The Young Investor Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-exempt, tax-advantaged, or tax-deferred arrangement, such as a 401(k) plan, 529 plan or IRA. Distributions on investments made through such accounts may ...

... The Young Investor Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-exempt, tax-advantaged, or tax-deferred arrangement, such as a 401(k) plan, 529 plan or IRA. Distributions on investments made through such accounts may ...

1. Introduction - Academic Web Pages

... We study a class of competitive pure exchange economies for which the equilibrium growth rate process on consumption and equilibrium asset returns are stationary. Attention is restricted to economies for which the elasticity of substitution for the composite consumption good between the year t and y ...

... We study a class of competitive pure exchange economies for which the equilibrium growth rate process on consumption and equilibrium asset returns are stationary. Attention is restricted to economies for which the elasticity of substitution for the composite consumption good between the year t and y ...

Grant Samuel Epoch Global Equity Shareholder Yield

... through 5/04 is for Epoch’s investment team and accounts while at Steinberg Priest & Sloane Capital Management, LLC. For the period 7/94 through 3/01 Bill Priest managed the accounts while at Credit Suisse Asset Management and was the only individual responsible for selecting the securities to buy a ...

... through 5/04 is for Epoch’s investment team and accounts while at Steinberg Priest & Sloane Capital Management, LLC. For the period 7/94 through 3/01 Bill Priest managed the accounts while at Credit Suisse Asset Management and was the only individual responsible for selecting the securities to buy a ...

chapter 11 part 2 savings class notes

... income on a steady basis. When referring to mutual funds, the terms "fixedincome," "bond," and "income" are synonymous. These terms denote funds that invest primarily in government and corporate debt. While fund holdings may appreciate in value, the primary objective of these funds is to provide a s ...

... income on a steady basis. When referring to mutual funds, the terms "fixedincome," "bond," and "income" are synonymous. These terms denote funds that invest primarily in government and corporate debt. While fund holdings may appreciate in value, the primary objective of these funds is to provide a s ...

CI Money Market Fund - Mutual Fund Search

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total including changes in unit value and reinvestment of all distributi ...

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total including changes in unit value and reinvestment of all distributi ...

Capital Asset Pricing Model

... assumption may be relaxed with more complicated versions of the model The market portfolio consists of all assets in all markets, where each asset is weighted by its market capitalization. This assumes no preference between markets and assets for individual investors, and that investors choose asset ...

... assumption may be relaxed with more complicated versions of the model The market portfolio consists of all assets in all markets, where each asset is weighted by its market capitalization. This assumes no preference between markets and assets for individual investors, and that investors choose asset ...

press release

... (2) Please see the press release of October 29, 2012 noting TFG’s acquisition of Polygon Management L.P. and certain of its affiliates. (3) The intrinsic value of the options will be calculated as the excess of (x) the closing price of the shares as of the final trading day in the relevant period ov ...

... (2) Please see the press release of October 29, 2012 noting TFG’s acquisition of Polygon Management L.P. and certain of its affiliates. (3) The intrinsic value of the options will be calculated as the excess of (x) the closing price of the shares as of the final trading day in the relevant period ov ...