Course 3: Capital Budgeting Analysis

... Modified Internal Rate of Return Besides determining the Net Present Value of a project, we can calculate the rate of return earned by the project. This is called the Internal Rate of Return. Internal Rate of Return (IRR) is one of the most popular economic criteria for evaluating capital projects s ...

... Modified Internal Rate of Return Besides determining the Net Present Value of a project, we can calculate the rate of return earned by the project. This is called the Internal Rate of Return. Internal Rate of Return (IRR) is one of the most popular economic criteria for evaluating capital projects s ...

Discovery Fund - Wells Fargo Funds

... Performance attribution and sector returns are calculated using the Brinson-Fachler attribution model. As such, performance attribution calculations may differ from the fund’s actual investment results. Definition of terms: Alpha measures the difference between a fund’s actual returns and its expect ...

... Performance attribution and sector returns are calculated using the Brinson-Fachler attribution model. As such, performance attribution calculations may differ from the fund’s actual investment results. Definition of terms: Alpha measures the difference between a fund’s actual returns and its expect ...

Lecture Presentation to accompany Investment

... Portfolio Management • What is the relationship between covariance and correlation? • What is the formula for the standard deviation for a portfolio of risky assets and how does it differ from the standard deviation of an individual risky asset? • Given the formula for the standard deviation of a po ...

... Portfolio Management • What is the relationship between covariance and correlation? • What is the formula for the standard deviation for a portfolio of risky assets and how does it differ from the standard deviation of an individual risky asset? • Given the formula for the standard deviation of a po ...

Stable Value Fund

... held by the fund are not guaranteed by the U.S. government, Vanguard, the trustee, or your retirement plan. The fund will seek to invest with a diversified selection of contract issuers. A stable value fund is designed as a low-risk investment but you could still lose money by investing in it. The p ...

... held by the fund are not guaranteed by the U.S. government, Vanguard, the trustee, or your retirement plan. The fund will seek to invest with a diversified selection of contract issuers. A stable value fund is designed as a low-risk investment but you could still lose money by investing in it. The p ...

Standard Deviation and Sharpe Ratio

... the investment, and 95 percent of the time within two standard deviations. For example, for a portfolio with a mean annual return of 10 percent and a standard deviation of two percent, you would expect the return to be between eight and 12 percent about 68 percent of the time, and between six and 14 ...

... the investment, and 95 percent of the time within two standard deviations. For example, for a portfolio with a mean annual return of 10 percent and a standard deviation of two percent, you would expect the return to be between eight and 12 percent about 68 percent of the time, and between six and 14 ...

Required return Answer: c Diff: M

... has been saving for her retirement ever since their 25th birthday. On their 25th birthday, she made a $5,000 contribution to her retirement account. Every year thereafter on their birthday, she has added another $5,000 to the account. Her plan is to continue contributing $5,000 every year on their b ...

... has been saving for her retirement ever since their 25th birthday. On their 25th birthday, she made a $5,000 contribution to her retirement account. Every year thereafter on their birthday, she has added another $5,000 to the account. Her plan is to continue contributing $5,000 every year on their b ...

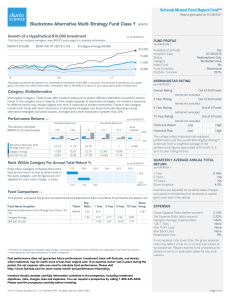

Blackstone Alternative Multi-Strategy Fund Class Y BXMYX

... Blackstone Alternative Multi-Strategy Fund Class Y Growth of a Hypothetical $10,000 Investment ...

... Blackstone Alternative Multi-Strategy Fund Class Y Growth of a Hypothetical $10,000 Investment ...

Goldman Sachs Emerging Markets CORE® Equity Portfolio

... Furthermore, this information should not be construed as financial research. It was not prepared in compliance with applicable provisions of law designed to promote the independence of financial analysis and is not subject to a prohibition on trading following the distribution of financial research. Th ...

... Furthermore, this information should not be construed as financial research. It was not prepared in compliance with applicable provisions of law designed to promote the independence of financial analysis and is not subject to a prohibition on trading following the distribution of financial research. Th ...

Does Fundamental and Technical Analysis Reduce Investment Risk

... in which the portfolios form based on past trading volume, make performance assessment meaningful. Kuo and Fan (2004) mention that based on the fundamental difference, the growth stock is not entirely trial value stock’s fundament analysis. Therefore, Kuo and Fan improve the value stock scoring syst ...

... in which the portfolios form based on past trading volume, make performance assessment meaningful. Kuo and Fan (2004) mention that based on the fundamental difference, the growth stock is not entirely trial value stock’s fundament analysis. Therefore, Kuo and Fan improve the value stock scoring syst ...

what stock market returns to expect for the future?

... number of different indicators, such as earnings, dividends, and gross domestic product (GDP). Some critics argue that this high market value, combined with projected slow economic growth, is not consistent with a 7.0 percent return. For example, assuming a 7.0 percent return starting with today’s s ...

... number of different indicators, such as earnings, dividends, and gross domestic product (GDP). Some critics argue that this high market value, combined with projected slow economic growth, is not consistent with a 7.0 percent return. For example, assuming a 7.0 percent return starting with today’s s ...

Chapter 4 "Foreign Exchange Markets and Rates of Return"

... The foreign exchange market (Forex) is not a market like the New York Stock Exchange, where daily trades of stock are conducted in a central location. Instead, the Forex refers to the activities of major international banks that engage in currency trading. These banks act as intermediaries between t ...

... The foreign exchange market (Forex) is not a market like the New York Stock Exchange, where daily trades of stock are conducted in a central location. Instead, the Forex refers to the activities of major international banks that engage in currency trading. These banks act as intermediaries between t ...

Fund Change Notice

... If you are satisfied with how your current investment elections will be modified, as shown previously, no action is required on your part. The Investment Committee has worked carefully to move the future contributions to investment options that it believes have the most similar investment objectives ...

... If you are satisfied with how your current investment elections will be modified, as shown previously, no action is required on your part. The Investment Committee has worked carefully to move the future contributions to investment options that it believes have the most similar investment objectives ...

July 2001 Yochanan Shachmurove*, Uri BenZion**, Paul Klein**, and Joseph Yagil*** *

... It is worthwhile to note that studies concerning profitable trading rules are not restricted only to security prices and currencies. Examples of such studies are, the paper by Blume, Easley and O’hara (1994) mentioned above who studied the role of volume for the U.S., and another study by Antoniou, ...

... It is worthwhile to note that studies concerning profitable trading rules are not restricted only to security prices and currencies. Examples of such studies are, the paper by Blume, Easley and O’hara (1994) mentioned above who studied the role of volume for the U.S., and another study by Antoniou, ...

Monthly Investment Commentary

... hedge-fund strategies was triggered by our concern that stocks and bonds were priced to deliver belowaverage returns and expose investors to above-average risk. In theory, hedge funds could offer an alternative place to hang out, capturing decent returns with less volatility, while waiting for bette ...

... hedge-fund strategies was triggered by our concern that stocks and bonds were priced to deliver belowaverage returns and expose investors to above-average risk. In theory, hedge funds could offer an alternative place to hang out, capturing decent returns with less volatility, while waiting for bette ...