Lecture Presentation to accompany Investment

... • Event studies – Stock split studies show that splits do not result in abnormal gains after the split announcement, but before – Initial public offerings seems to be underpriced by almost 18%, but that varies over time, and the price is adjusted within one day after the offering • Suppose you had b ...

... • Event studies – Stock split studies show that splits do not result in abnormal gains after the split announcement, but before – Initial public offerings seems to be underpriced by almost 18%, but that varies over time, and the price is adjusted within one day after the offering • Suppose you had b ...

The Growing Role of Alternative Investments

... are invested and their higher investment management fees. The increased level of interest in both real estate and infrastructure has created supply and demand imbalances for these assets. As a result, the biggest challenge for new investors is getting committed money invested in a timely manner. A m ...

... are invested and their higher investment management fees. The increased level of interest in both real estate and infrastructure has created supply and demand imbalances for these assets. As a result, the biggest challenge for new investors is getting committed money invested in a timely manner. A m ...

A Different Way to Invest

... Performance data shown represents past performance. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, ma ...

... Performance data shown represents past performance. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, ma ...

Ross Template

... or value of a bond changes: – if the required rate of return increases, the price of the bond will decrease – if the required rate of return decreases, the price of the bond will increase McGraw-Hill/Irwin ...

... or value of a bond changes: – if the required rate of return increases, the price of the bond will decrease – if the required rate of return decreases, the price of the bond will increase McGraw-Hill/Irwin ...

Franklin Growth Fund Fact Sheet - Franklin Templeton Investments

... contains this and other information, talk to your financial advisor, call us at (800) DIAL BEN/342-5236 or visit franklintempleton.com. Please carefully read a prospectus before you invest or send money. Information is historical and may not reflect current or future portfolio characteristics. All p ...

... contains this and other information, talk to your financial advisor, call us at (800) DIAL BEN/342-5236 or visit franklintempleton.com. Please carefully read a prospectus before you invest or send money. Information is historical and may not reflect current or future portfolio characteristics. All p ...

Access the Investor Brochure

... 1. In the unlikely circumstance that CION does not qualify as a Regulated Investment Company, it would subject CION to federal income taxes on all of its income, resulting in a material adverse effect on its financial performance. 2. The weekly determination of our public offering price does not r ...

... 1. In the unlikely circumstance that CION does not qualify as a Regulated Investment Company, it would subject CION to federal income taxes on all of its income, resulting in a material adverse effect on its financial performance. 2. The weekly determination of our public offering price does not r ...

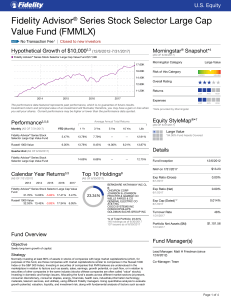

Fidelity Advisor® Series Stock Selector Large Cap Value Fund

... prospectus (before waivers or reimbursements). This ratio also includes Acquired Fund Fees and Expenses, which are expenses indirectly incurred by a fund through its ownership of shares in other investment companies. If the investment option is not a mutual fund, the expense ratio may be calculated ...

... prospectus (before waivers or reimbursements). This ratio also includes Acquired Fund Fees and Expenses, which are expenses indirectly incurred by a fund through its ownership of shares in other investment companies. If the investment option is not a mutual fund, the expense ratio may be calculated ...

Risk

... deviation, which is the risk of the security has decreased substantially, while returns have generally increased. We believe this is a positive trend for the investor because over the past 10 years investors have been able to generate relatively better returns for a lower risk. Expected Return and R ...

... deviation, which is the risk of the security has decreased substantially, while returns have generally increased. We believe this is a positive trend for the investor because over the past 10 years investors have been able to generate relatively better returns for a lower risk. Expected Return and R ...

asset value guarantees under equity-based products

... Under current equity-based p r o d u c t s offered b y life insurance companies in the United States, the contractholder generally assumes the full i n v e s t m e n t risk and has no g u a r a n t e e as to the asset value of his c o n t r a c t a t a n y point in time. I t is both reasonable and a ...

... Under current equity-based p r o d u c t s offered b y life insurance companies in the United States, the contractholder generally assumes the full i n v e s t m e n t risk and has no g u a r a n t e e as to the asset value of his c o n t r a c t a t a n y point in time. I t is both reasonable and a ...

Bond Valuation - Duke University

... Optimal investments depend on trading off risk and return » Investors with higher risk tolerance invest more in risky assets » Only risk that can’t be diversified counts If investors can borrow and lend, then everybody holds a combination of two portfolios » The market portfolio of all risky assets ...

... Optimal investments depend on trading off risk and return » Investors with higher risk tolerance invest more in risky assets » Only risk that can’t be diversified counts If investors can borrow and lend, then everybody holds a combination of two portfolios » The market portfolio of all risky assets ...

Summer KiwiSaver Scheme Summer Listed Property

... The ‘manager’s basic fee’ covers management and administration charges paid to us out of the fund for performing our functions as manager. We pay the scheme’s expenses (including fees charged by the Supervisor) out of these amounts. The ‘other management and administration charges’ covers management ...

... The ‘manager’s basic fee’ covers management and administration charges paid to us out of the fund for performing our functions as manager. We pay the scheme’s expenses (including fees charged by the Supervisor) out of these amounts. The ‘other management and administration charges’ covers management ...

Cap Value Fiduciary Services Equity Investment

... Past performance is no guarantee of future results. Actual individual account results may differ from the performance shown in this profile. There is no guarantee that this investment strategy will work under all market conditions. Do not use this profile as the sole basis for your investment decisi ...

... Past performance is no guarantee of future results. Actual individual account results may differ from the performance shown in this profile. There is no guarantee that this investment strategy will work under all market conditions. Do not use this profile as the sole basis for your investment decisi ...

Introduction to Risk, Return and the Opportunity Cost of Capital

... it has the same degree of risk as the market portfolio. What rate should you use to discount this project’s forecasted cash flows? Clearly you should use the currently expected rate of return on the market portfolio. This will be termed market return rm . Assuming that the future will be comparable ...

... it has the same degree of risk as the market portfolio. What rate should you use to discount this project’s forecasted cash flows? Clearly you should use the currently expected rate of return on the market portfolio. This will be termed market return rm . Assuming that the future will be comparable ...

What`s the Significance? Statistical Significance and Expected Returns

... Caution: Technical Discussion to Follow—READ AT YOUR OWN RISK. As the old saying goes, there are three kinds of lies: lies, damned lies, and statistics. It is true data can be tortured with statistical tools that will make it confess to almost anything. On the other hand, the average investor's igno ...

... Caution: Technical Discussion to Follow—READ AT YOUR OWN RISK. As the old saying goes, there are three kinds of lies: lies, damned lies, and statistics. It is true data can be tortured with statistical tools that will make it confess to almost anything. On the other hand, the average investor's igno ...

Industrial Metals as Investment - SummerHaven

... The correlations of largest magnitude are with the Dollar Index (-33%) and industrial production (47%). The high correlation between metals and industrial production is not surprising. Industrial metals, as their name suggests, are used in production and should therefore be expected to be sensitive ...

... The correlations of largest magnitude are with the Dollar Index (-33%) and industrial production (47%). The high correlation between metals and industrial production is not surprising. Industrial metals, as their name suggests, are used in production and should therefore be expected to be sensitive ...

Zvi NBER WORKING PAPER SERIES

... each of four categories of assets for the period 1953 through 1979. The measure of the price level that was used in adjusting these rates of return was the Personal Consumption Expenditures Deflator published by the U.S. Department of Cormuerce. This measure was chosen rather than the Department of ...

... each of four categories of assets for the period 1953 through 1979. The measure of the price level that was used in adjusting these rates of return was the Personal Consumption Expenditures Deflator published by the U.S. Department of Cormuerce. This measure was chosen rather than the Department of ...