chapter 26: managing client portfolios

... This result can also be obtained by computing these returns for each of the individual holdings, weighting each result by the portfolio percentage and then adding to derive a total portfolio result. From the data available, it is not possible to determine specifically the inherent degree of portfoli ...

... This result can also be obtained by computing these returns for each of the individual holdings, weighting each result by the portfolio percentage and then adding to derive a total portfolio result. From the data available, it is not possible to determine specifically the inherent degree of portfoli ...

Chapter 3

... • The dollar today could be invested in a bank and earn interest so that it is worth more than a dollar tomorrow. • This relationship between interest and time is called the time value of money. ...

... • The dollar today could be invested in a bank and earn interest so that it is worth more than a dollar tomorrow. • This relationship between interest and time is called the time value of money. ...

FTA Morningstar 90 10 FS 3-31-17_Layout 1

... among asset classes based on long-term expectations for returns, risk, and correlation. Morningstar Investment Management implements its proprietary research to determine the optimal weightings of each asset class to maximize return and reduce risk. Morningstar Investment Management employs a statis ...

... among asset classes based on long-term expectations for returns, risk, and correlation. Morningstar Investment Management implements its proprietary research to determine the optimal weightings of each asset class to maximize return and reduce risk. Morningstar Investment Management employs a statis ...

Invesco Comstock Fund fact sheet: Inst`l ret shares

... The Russell 1000® Value Index is an unmanaged index considered representative of large-cap value stocks. The Russell 1000 Value Index is a trademark/service mark of the Frank Russell Co. Russell® is a trademark of the Frank Russell Co. An investment cannot be made directly in an index. 12-month forw ...

... The Russell 1000® Value Index is an unmanaged index considered representative of large-cap value stocks. The Russell 1000 Value Index is a trademark/service mark of the Frank Russell Co. Russell® is a trademark of the Frank Russell Co. An investment cannot be made directly in an index. 12-month forw ...

Affin Hwang Select AUD Income Fund_RM Class

... Fund is not an indicative of its future performance. Prices and distribution payable, if any, can go down as well as up. A Product Highlights Sheet ("PHS") is available for the Fund and investors have the right to request for a copy of it. The Replacement Prospectus ("RP") dated 22 September 2014 ha ...

... Fund is not an indicative of its future performance. Prices and distribution payable, if any, can go down as well as up. A Product Highlights Sheet ("PHS") is available for the Fund and investors have the right to request for a copy of it. The Replacement Prospectus ("RP") dated 22 September 2014 ha ...

CHAPTER 5 Risk and Rates of Return

... individual investment Define and measure the riskiness of an individual investment Compare the historical relationship between risk and rates of return in the capital markets Explain how diversifying investments affect the riskiness and expected rate of return of a portfolio or combination of assets ...

... individual investment Define and measure the riskiness of an individual investment Compare the historical relationship between risk and rates of return in the capital markets Explain how diversifying investments affect the riskiness and expected rate of return of a portfolio or combination of assets ...

a new perspective

... actual property is only a consideration if you plan on disposing of it. This paper proposes that a person can use this same reasoning to train their brain to look at the stock market in a similar fashion. This would allow a person to mentally ignore the ups and downs of the stock market. After all, ...

... actual property is only a consideration if you plan on disposing of it. This paper proposes that a person can use this same reasoning to train their brain to look at the stock market in a similar fashion. This would allow a person to mentally ignore the ups and downs of the stock market. After all, ...

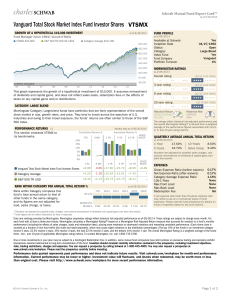

Vanguard Total Stock Market Index Fund Investor Shares

... transactions deemed detrimental to long-term shareholders of the fund. Investors should consider carefully information contained in the prospectus, including investment objectives, risks, trading restrictions, charges and expenses. You can request a prospectus by calling Schwab at 1-800-435-4000. Yo ...

... transactions deemed detrimental to long-term shareholders of the fund. Investors should consider carefully information contained in the prospectus, including investment objectives, risks, trading restrictions, charges and expenses. You can request a prospectus by calling Schwab at 1-800-435-4000. Yo ...

Equity Income and Dividend Growth Strategies

... bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the U.S. government. Diversification does not guarantee a profit nor protect against loss. Dividends ...

... bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the U.S. government. Diversification does not guarantee a profit nor protect against loss. Dividends ...

Fund Manager Sector Minimum Investment Fund Size

... investment may go down as well as up and past performance is not a guide to future performance. Fluctua�ons or movements in the exchange rates may cause the value of underlying interna�onal investments to go up or down. CIS are traded at ruling prices and can engage in borrowing and script lending. ...

... investment may go down as well as up and past performance is not a guide to future performance. Fluctua�ons or movements in the exchange rates may cause the value of underlying interna�onal investments to go up or down. CIS are traded at ruling prices and can engage in borrowing and script lending. ...

Monte Carlo Simulation

... spending, to inflation, and more. When all of these complexities need to be considered, Monte Carlo simulation can be quite useful. The process starts with a set of assumptions about the estimated mean, standard deviation, and correlations for a set of asset classes or investments. These assumptions ...

... spending, to inflation, and more. When all of these complexities need to be considered, Monte Carlo simulation can be quite useful. The process starts with a set of assumptions about the estimated mean, standard deviation, and correlations for a set of asset classes or investments. These assumptions ...

solutions to the November 2005 Course FM/2 Examination 1

... options stochastically (general concept of a Black-Scholes option pricing model), or the Black-Scholes option pricing formula. The formula can actually be used to derive a hedge ratio in hedging stock position with options and vice versa. So this answer does describe the technique used by Alex to a ...

... options stochastically (general concept of a Black-Scholes option pricing model), or the Black-Scholes option pricing formula. The formula can actually be used to derive a hedge ratio in hedging stock position with options and vice versa. So this answer does describe the technique used by Alex to a ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... as measured by the Personal Consumption Expenditures Deflator. There are serious differences between the two series, especially in 1974 and 1979; but as the correlation coefficient of .977 reported at the bottom of Table 3.1 indicates, they are highly positively correlated. The first column in Table ...

... as measured by the Personal Consumption Expenditures Deflator. There are serious differences between the two series, especially in 1974 and 1979; but as the correlation coefficient of .977 reported at the bottom of Table 3.1 indicates, they are highly positively correlated. The first column in Table ...