2017-01-0130-SBIMF_Blue Chip Leaflet Dec A5

... business models, high visibility and reach and good recognition. In essence, they can help you steadily achieve your long-term investing goals. SBI Blue Chip Fund invests predominantly in such blue chip companies and hence, is a must-have scheme for every portfolio. The focus of the fund is on gener ...

... business models, high visibility and reach and good recognition. In essence, they can help you steadily achieve your long-term investing goals. SBI Blue Chip Fund invests predominantly in such blue chip companies and hence, is a must-have scheme for every portfolio. The focus of the fund is on gener ...

Homework 10 solution

... 4. Impact of Interest Rates. How are the interest rate, the required rate of return on a stock, and the valuation of a stock related? ANSWER: Given a choice of risk-free Treasury securities or stocks, stocks should be purchased only if they are appropriately priced to reflect a sufficiently high exp ...

... 4. Impact of Interest Rates. How are the interest rate, the required rate of return on a stock, and the valuation of a stock related? ANSWER: Given a choice of risk-free Treasury securities or stocks, stocks should be purchased only if they are appropriately priced to reflect a sufficiently high exp ...

how the p/e ratio can really help you

... ratio based on the estimated growth of EPS over the next 3-5 years, as explained a little later by an example. Cash earnings per share (CEPS) Some analysts recommend the use of cash earning per share (CEPS), i.e. earnings before charging depreciation, whereas the EPS is after charging depreciation. ...

... ratio based on the estimated growth of EPS over the next 3-5 years, as explained a little later by an example. Cash earnings per share (CEPS) Some analysts recommend the use of cash earning per share (CEPS), i.e. earnings before charging depreciation, whereas the EPS is after charging depreciation. ...

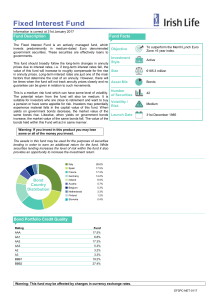

Fixed Interest Fund - Irish Life Corporate Business

... in annuity prices. Long-term interest rates are just one of the main factors that determine the cost of an annuity. However, there will be times when the fund will not track annuity prices closely and no Asset Mix guarantee can be given in relation to such movements. This is a medium risk fund which ...

... in annuity prices. Long-term interest rates are just one of the main factors that determine the cost of an annuity. However, there will be times when the fund will not track annuity prices closely and no Asset Mix guarantee can be given in relation to such movements. This is a medium risk fund which ...

North Carolina Large Cap Value Fund

... recordkeeping and communications fee that is not reflected in performance. Due to rounding, the Total Estimated Expense may appear overestimated even though it is not. Prior to 1/1/2016, your Plan invested in units of an insurance company separate account established on 3/6/2009. The North Carolina ...

... recordkeeping and communications fee that is not reflected in performance. Due to rounding, the Total Estimated Expense may appear overestimated even though it is not. Prior to 1/1/2016, your Plan invested in units of an insurance company separate account established on 3/6/2009. The North Carolina ...

Greenfield Seitz Capital Management, LLC

... As of March 2009, accounts are removed on a monthly basis from the composite when assets fall below 30% of the minimum. Prior to March 2009, the minimum was 50%. Dispersion is only shown on annual periods. Calculation Methodology: Valuations and returns are computed and stated in U.S. dollars, and i ...

... As of March 2009, accounts are removed on a monthly basis from the composite when assets fall below 30% of the minimum. Prior to March 2009, the minimum was 50%. Dispersion is only shown on annual periods. Calculation Methodology: Valuations and returns are computed and stated in U.S. dollars, and i ...

ACCA F9 S16 Notes

... company and calculate the current cost. If the company has traded debt, we can do this by using the valuation theory (from Chapter 15) backwards! We know the current market value and the future receipts and can therefore calculate the investors’ required rate of return. There is one additional probl ...

... company and calculate the current cost. If the company has traded debt, we can do this by using the valuation theory (from Chapter 15) backwards! We know the current market value and the future receipts and can therefore calculate the investors’ required rate of return. There is one additional probl ...

Understanding Volatility/Standard Deviation within investment funds.

... Terms and conditions apply. Where relevant life assurance tax applies. This presentation is of a general nature and should not be relied upon without taking appropriate professional advice. The content is for information purposes only and does not constitute an offer or recommendation to invest in t ...

... Terms and conditions apply. Where relevant life assurance tax applies. This presentation is of a general nature and should not be relied upon without taking appropriate professional advice. The content is for information purposes only and does not constitute an offer or recommendation to invest in t ...

Lecture No30

... Project risk—the possibility that an investment project will not meet our minimum requirements for acceptability and success. Our real task is not to try to find “risk-free” projects—they don’t exist in real life. The challenge is to decide what level of risk we are willing to assume and then, havin ...

... Project risk—the possibility that an investment project will not meet our minimum requirements for acceptability and success. Our real task is not to try to find “risk-free” projects—they don’t exist in real life. The challenge is to decide what level of risk we are willing to assume and then, havin ...

Average Performance of Bonds Based on Monthly Interest

... were defined as the top 20% of all 1,055 months. Neutral rates were defined as the middle 60%, and falling rates as the bottom 20%. Returns during the different periods are calculated by averaging the monthly returns and annualizing the monthly average. For example, in the rising-interest-rates peri ...

... were defined as the top 20% of all 1,055 months. Neutral rates were defined as the middle 60%, and falling rates as the bottom 20%. Returns during the different periods are calculated by averaging the monthly returns and annualizing the monthly average. For example, in the rising-interest-rates peri ...

Investment Fund Overview

... Seeks to track the performance of a benchmark index that measures the investment return of stocks of companies located in developed and emerging markets around the world. The fund employs a “passive management” – or indexing-investment approach designed to track the performance of the FTSE All-World ...

... Seeks to track the performance of a benchmark index that measures the investment return of stocks of companies located in developed and emerging markets around the world. The fund employs a “passive management” – or indexing-investment approach designed to track the performance of the FTSE All-World ...

Navigating Interest Rate Cycles with the Laddered Bond Portfolio

... U.S. tax-exempt bond market. Qualifying bonds must have at least one year remaining term to maturity, a fixed coupon schedule, and an investment grade rating (based on average of Moody’s, S&P, and Fitch). The performance of any index is not indicative of the performance of any particular investment. ...

... U.S. tax-exempt bond market. Qualifying bonds must have at least one year remaining term to maturity, a fixed coupon schedule, and an investment grade rating (based on average of Moody’s, S&P, and Fitch). The performance of any index is not indicative of the performance of any particular investment. ...

Meet Dave - Allegis Financial Partners

... 5. Hypothetical Franklin Income Fund ending portfolio value for the period 1/1/70–12/31/15 assumes a $50,000 initial investment on 1/1/70, Class A with current maximum sales charge withdrawals made at the end of each applicable year, and the reinvestment of all dividends and capital gains at net ass ...

... 5. Hypothetical Franklin Income Fund ending portfolio value for the period 1/1/70–12/31/15 assumes a $50,000 initial investment on 1/1/70, Class A with current maximum sales charge withdrawals made at the end of each applicable year, and the reinvestment of all dividends and capital gains at net ass ...

foundation market-based investment funds

... The Dow and S&P logged their best quarterly gain in almost 14 years. The Nasdaq posted its best quarterly performance since 1991. The Dow Jones Industrial Average Index jumped 8.1% for the first quarter. The S&P 500 Index ended the quarter with a 12% surge. Nasdaq Composite finished the quarter with ...

... The Dow and S&P logged their best quarterly gain in almost 14 years. The Nasdaq posted its best quarterly performance since 1991. The Dow Jones Industrial Average Index jumped 8.1% for the first quarter. The S&P 500 Index ended the quarter with a 12% surge. Nasdaq Composite finished the quarter with ...

Solution 1:

... investor will have purchased the bond at discount and will be receiving the coupon payments over the life of the bond Question No: 17 ( Marks: 1 ) - Please choose one Which of the following is a characteristic of a coupon bond? ► Pays interest on a regular basis (typically every six months) ► Does n ...

... investor will have purchased the bond at discount and will be receiving the coupon payments over the life of the bond Question No: 17 ( Marks: 1 ) - Please choose one Which of the following is a characteristic of a coupon bond? ► Pays interest on a regular basis (typically every six months) ► Does n ...

Large Cap Value Select UMA Hancock Horizon

... Past performance is no guarantee of future results. Actual individual account results may differ from the performance shown in this profile. There is no guarantee that this investment strategy will work under all market conditions. Do not use this profile as the sole basis for your investment decisi ...

... Past performance is no guarantee of future results. Actual individual account results may differ from the performance shown in this profile. There is no guarantee that this investment strategy will work under all market conditions. Do not use this profile as the sole basis for your investment decisi ...

MetWest Total Return Bond Fund

... BLOOMBERG is a trademark and service mark of Bloomberg Finance L.P. BARCLAYS is a trademark and service mark of Barclays Bank Plc, used under license. Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) or Bloomberg’s licensors own all proprietary rights in the BLOOMBERG BARCLAYS I ...

... BLOOMBERG is a trademark and service mark of Bloomberg Finance L.P. BARCLAYS is a trademark and service mark of Barclays Bank Plc, used under license. Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) or Bloomberg’s licensors own all proprietary rights in the BLOOMBERG BARCLAYS I ...