PNC Large Cap Value Fund

... 1 Net operating expenses reflect contractual waivers and expense reimbursements that continue through the end of September 2017. For more information on fee waivers or expense reimbursements please see the expense table in the prospectus. If the waivers or reimbursements were not in effect the Fund’ ...

... 1 Net operating expenses reflect contractual waivers and expense reimbursements that continue through the end of September 2017. For more information on fee waivers or expense reimbursements please see the expense table in the prospectus. If the waivers or reimbursements were not in effect the Fund’ ...

Optimising Risk-adjusted Returns

... For the untrained eye the ensuing topic might appear highly theoretical, academic and even intimidating, yet it contains a very powerful message of how index investing can fit into an overall investment strategy, which I shall endeavor to convey in the simplest terms possible. The active manager inv ...

... For the untrained eye the ensuing topic might appear highly theoretical, academic and even intimidating, yet it contains a very powerful message of how index investing can fit into an overall investment strategy, which I shall endeavor to convey in the simplest terms possible. The active manager inv ...

Franklin U.S. Dollar Liquid Reserve Fund - A (acc) USD

... Given the variety of investment options available today, we suggest investors seek guidance from a Financial Adviser. This document is intended to be of general interest only and does not constitute legal or tax advice nor is it an offer for shares or invitation to apply for shares of the Franklin T ...

... Given the variety of investment options available today, we suggest investors seek guidance from a Financial Adviser. This document is intended to be of general interest only and does not constitute legal or tax advice nor is it an offer for shares or invitation to apply for shares of the Franklin T ...

THE SEARCH FOR HIGHER RETURNS

... involving duration, sector and credit decisions. With this paper, we hope to have provided a framework for day-to-day investor strategy discussions to explore one or more ways to improve return potential. For example, when presented with an investment with seemingly attractive return potential, it h ...

... involving duration, sector and credit decisions. With this paper, we hope to have provided a framework for day-to-day investor strategy discussions to explore one or more ways to improve return potential. For example, when presented with an investment with seemingly attractive return potential, it h ...

The Cash Flow Quadrant

... ages. The accumulation figure reflects continued investment at the same rate over 35 years at a 10% nominal rate of return compounded monthly and does not take into consideration taxes or other factors, which would lower results. This example uses a constant rate of return, unlike actual investments ...

... ages. The accumulation figure reflects continued investment at the same rate over 35 years at a 10% nominal rate of return compounded monthly and does not take into consideration taxes or other factors, which would lower results. This example uses a constant rate of return, unlike actual investments ...

Group investment fund return

... file an IR 6 estate and trust return. If the fund receives both Category A and Category B income, an IR 4 company return must be filed. It is not necessary to separate Category A and Category B income on the IR 4 return. Include overseas income and overseas tax paid in the appropriate boxes when com ...

... file an IR 6 estate and trust return. If the fund receives both Category A and Category B income, an IR 4 company return must be filed. It is not necessary to separate Category A and Category B income on the IR 4 return. Include overseas income and overseas tax paid in the appropriate boxes when com ...

Delaware Investments Global Value Fund - fund

... guide to future performance and does not guarantee future results. The value of investments and any income will fluctuate and investors may not get back the full amount invested. Current tax levels and relief may change. Depending on individual circumstances, this may affect investment returns. Wher ...

... guide to future performance and does not guarantee future results. The value of investments and any income will fluctuate and investors may not get back the full amount invested. Current tax levels and relief may change. Depending on individual circumstances, this may affect investment returns. Wher ...

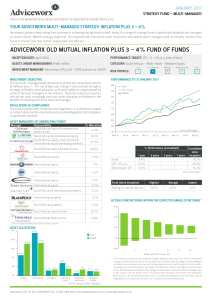

adviceworx old mutual inflation plus 3

... • This fund holds assets in foreign countries and therefore it may have risks regarding liquidity, the repatriation of funds, political and macro-economic situations, foreign exchange, tax, settlement, and the availability of information. • A fund of fund is a portfolio that invests in other funds ...

... • This fund holds assets in foreign countries and therefore it may have risks regarding liquidity, the repatriation of funds, political and macro-economic situations, foreign exchange, tax, settlement, and the availability of information. • A fund of fund is a portfolio that invests in other funds ...

FUSION Income | US Dollar - Capital International Group

... own investment decisions. A composite benchmark has been used from inception until December 2011 and from that point a more r epresentative private client index, based on real performance numbers provided by participating investment managers, has been used. This document has been prepared for inform ...

... own investment decisions. A composite benchmark has been used from inception until December 2011 and from that point a more r epresentative private client index, based on real performance numbers provided by participating investment managers, has been used. This document has been prepared for inform ...

Ch. 10

... • APT applies to well diversified portfolios and not necessarily to individual stocks • With APT it is possible for some individual stocks to be mispriced - not lie on the SML • APT is more general in that it gets to an expected return and beta relationship without the assumption of the market portf ...

... • APT applies to well diversified portfolios and not necessarily to individual stocks • With APT it is possible for some individual stocks to be mispriced - not lie on the SML • APT is more general in that it gets to an expected return and beta relationship without the assumption of the market portf ...

RBC Microcap Value Fund - RBC Global Asset Management

... investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. For performance data current to the most recent m ...

... investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. For performance data current to the most recent m ...

CHAPTER 6 Risk, Return, and the Capital Asset Pricing Model 1

... No. Rational investors will minimize risk by holding portfolios. They bear only market risk, so prices and returns reflect this lower risk. The one-stock investor bears higher (stand-alone) risk, so the return is less than that required by the risk. ...

... No. Rational investors will minimize risk by holding portfolios. They bear only market risk, so prices and returns reflect this lower risk. The one-stock investor bears higher (stand-alone) risk, so the return is less than that required by the risk. ...

6 - Holy Family University

... entire economy such as a change in interest rates or GDP or a financial crisis such as occurred in 2007and 2008. • If a well diversified portfolio has no unsystematic risk then any risk that remains must be systematic. • That is, the variation in returns of a well diversified portfolio must be due t ...

... entire economy such as a change in interest rates or GDP or a financial crisis such as occurred in 2007and 2008. • If a well diversified portfolio has no unsystematic risk then any risk that remains must be systematic. • That is, the variation in returns of a well diversified portfolio must be due t ...