Assume that you recently graduated with a major in

... The standard deviation gets smaller as more stocks are combined in the portfolio, while rp (the portfolio’s return) remains constant. Thus, by adding stocks to your portfolio, which initially started as a 1-stock portfolio, risk has been reduced. In the real world, stocks are positively correlated w ...

... The standard deviation gets smaller as more stocks are combined in the portfolio, while rp (the portfolio’s return) remains constant. Thus, by adding stocks to your portfolio, which initially started as a 1-stock portfolio, risk has been reduced. In the real world, stocks are positively correlated w ...

chapter 17

... equity. The zero-risk, zero-investment portfolio is formed by borrowing: (0.465 × $1,000,000) = $465,000 and selling short $535,000 of Debt Galore’s common stock. The proceeds of these transactions would then be used to purchase $1,000,000 of Debt Zero common stock. The net cost is zero. Interest on ...

... equity. The zero-risk, zero-investment portfolio is formed by borrowing: (0.465 × $1,000,000) = $465,000 and selling short $535,000 of Debt Galore’s common stock. The proceeds of these transactions would then be used to purchase $1,000,000 of Debt Zero common stock. The net cost is zero. Interest on ...

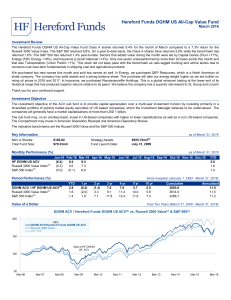

Modeling the Active versus Passive Debate

... The active versus passive investment argument is not going to be resolved by a contest. But can it be resolved by research? I think so, and here’s my attempt: On February 1st, Cassandra picks up the Wall Street Journal outside her door and discovers that it is the paper for March 1st, one month in t ...

... The active versus passive investment argument is not going to be resolved by a contest. But can it be resolved by research? I think so, and here’s my attempt: On February 1st, Cassandra picks up the Wall Street Journal outside her door and discovers that it is the paper for March 1st, one month in t ...

Government Obligations Fund (TR Shares)

... aided by actions taken by the US Federal Reserve. The central bank in June raised the target funds range another 25 basis points—the third increase in six months—and signaled it expects to make one more move, as well as initiate the first phases of a balance-sheet reduction plan, before year-end. Wh ...

... aided by actions taken by the US Federal Reserve. The central bank in June raised the target funds range another 25 basis points—the third increase in six months—and signaled it expects to make one more move, as well as initiate the first phases of a balance-sheet reduction plan, before year-end. Wh ...

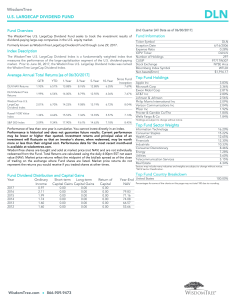

WisdomTree LargeCap Dividend Fund

... Performance of less than one year is cumulative. You cannot invest directly in an index. Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor ...

... Performance of less than one year is cumulative. You cannot invest directly in an index. Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor ...

CIMB-Principal ASEAN Total Return Fund

... with temporary defensive positions and risk of investing in emerging markets. You can obtain a copy of the Fund Prospectus from the head office of CIMB-Principal Asset Management Berhad or from any of our approved distributors. Product Highlight Sheet ("PHS") is available and that investors have the ...

... with temporary defensive positions and risk of investing in emerging markets. You can obtain a copy of the Fund Prospectus from the head office of CIMB-Principal Asset Management Berhad or from any of our approved distributors. Product Highlight Sheet ("PHS") is available and that investors have the ...

During August 2012, company produced and sold 3000 boxes of

... Discounted payback period = 2 + (916,041/1,014,430) = 2 + 0·9 = 2·9 years (c) Discuss your findings in each section of (b) above and advise whether the investment proposal is financially acceptable. The investment proposal has a positive net present value (NPV) of $366,722 and is therefore financial ...

... Discounted payback period = 2 + (916,041/1,014,430) = 2 + 0·9 = 2·9 years (c) Discuss your findings in each section of (b) above and advise whether the investment proposal is financially acceptable. The investment proposal has a positive net present value (NPV) of $366,722 and is therefore financial ...

Sanlam Investment Management Value Fund Class A1

... annual or quarterly reports, can be obtained from the Manager, free of charge. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in the port ...

... annual or quarterly reports, can be obtained from the Manager, free of charge. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. Collective investments are calculated on a net asset value basis, which is the total market value of all assets in the port ...

non-discretionary portfolio - Alternative Capital Partners

... This portfolio provides an investment strategy that emphasizes capital growth over the medium and long term. The portfolio takes advantage of investment opportunities in alternative asset classes as well as more volatile traditional asset classes. These assets classes provide opportunities for reali ...

... This portfolio provides an investment strategy that emphasizes capital growth over the medium and long term. The portfolio takes advantage of investment opportunities in alternative asset classes as well as more volatile traditional asset classes. These assets classes provide opportunities for reali ...

Global Timber Investing: Benchmarking Returns with Land and

... When Harald Orneberg sold his private equity fund, ORN Capital, to British insurance giant Aviva in 2006, he became an indentured servant of sorts. As part of the deal, Orneberg was contracted to work for Aviva for a year, which turned out to be the longest year of his life. "Working for a large com ...

... When Harald Orneberg sold his private equity fund, ORN Capital, to British insurance giant Aviva in 2006, he became an indentured servant of sorts. As part of the deal, Orneberg was contracted to work for Aviva for a year, which turned out to be the longest year of his life. "Working for a large com ...

Risk and Return Analysis

... As shown in the last section, the total risk of a portfolio is obtained through weighting and adding the risks of the individual investments in the portfolio. The same is true for the expected return of a portfolio, only this relationship is linear as opposed to the risk relationship displayed above ...

... As shown in the last section, the total risk of a portfolio is obtained through weighting and adding the risks of the individual investments in the portfolio. The same is true for the expected return of a portfolio, only this relationship is linear as opposed to the risk relationship displayed above ...

CAPM and APT - BYU Marriott School

... Based on the previous assumptions: • All investors will hold the same portfolio for risky assets – the market portfolio (M) • The market portfolio (M) contains all securities and the proportion of each security is its market value as a percentage of total market value • The risk premium on the mar ...

... Based on the previous assumptions: • All investors will hold the same portfolio for risky assets – the market portfolio (M) • The market portfolio (M) contains all securities and the proportion of each security is its market value as a percentage of total market value • The risk premium on the mar ...

Click to download DSM US LCG JUNE 2010

... substantial and includes weak global economic growth, sovereign default risk in the developed world, disintegration of the European Monetary Union, and geopolitical turmoil in the Middle-East as well as on the Korean peninsula. Two conflicting forces are at work. Short and long term interest rates h ...

... substantial and includes weak global economic growth, sovereign default risk in the developed world, disintegration of the European Monetary Union, and geopolitical turmoil in the Middle-East as well as on the Korean peninsula. Two conflicting forces are at work. Short and long term interest rates h ...